Read This Before You Buy Oil Stocks

Commodities / Oil Companies Feb 06, 2013 - 08:24 AM GMTBy: GrowthStockWire

"You have to buy the oil stocks," a so-called "expert" proclaimed on CNBC yesterday.

"You have to buy the oil stocks," a so-called "expert" proclaimed on CNBC yesterday.

"They're under-owned, and the price of crude oil is running higher."

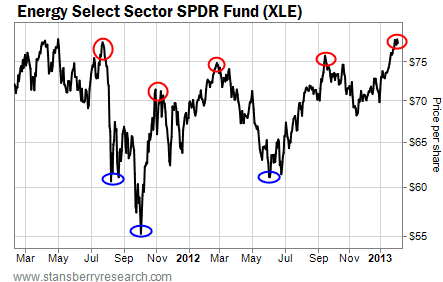

Oil stocks have indeed enjoyed a tremendous rally over the past few weeks. The Energy Select Sector SPDR Fund (XLE) is up more than 10% since the start of 2013. And the fund is just pennies away from making a new multi-year high.

So a lot of folks, including the CNBC expert, are excited about buying oil stocks right now. Of course, this means that a lot of folks, including this expert, have forgotten the simplest rule of how to make money in the stock market...

The simplest rule you need to know about making money in the market is to buy low and sell high.

Oil stocks are "high" right now, and it's a dangerous time to be jumping into the sector. That doesn't mean the sector can't move higher from here. But there's an awful lot of risk to buying oil stocks at multi-year highs. And if history is any sort of a guide, patient investors will get a much better buying opportunity a few months from now.

Let me explain...

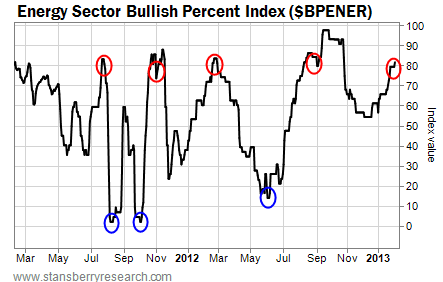

One of the best timing tools for getting in or out of the oil sector is the Energy Sector Bullish Percent Index (BPENER). This is a momentum-based indicator that lets us know when the oil sector is overbought and ripe for a correction – or oversold and a good time to buy.

Take a look at this chart of the BPENER...

As a general rule, oil stocks are overbought when the index rallies above 80 (the red circles on the chart). Oil stocks are oversold when the BPENER drops below 20 (the blue circles). Here's how those overbought and oversold signals have lined up with the XLE...

The BPENER signals didn't always match the exact highs and lows for the oil sector. But each blue circle was always followed eventually by a higher red circle. And each red circle was followed by a lower blue circle... so far.

As you can see on the XLE chart, this year's action is looking a lot like what we saw last year. If that continues to be the case, anyone looking to buy into the oil sector will do better if they wait a few months. Give the BPENER chart a chance to unwind from its current overbought condition... and maybe even drop into oversold territory.

That will give us a low-risk chance to buy into the oil sector.

Best regards and good trading,

Jeff Clark

http://www.growthstockwire.com

The Growth Stock Wire is a free daily e-letter that provides readers with a pre-market briefing on the most profitable opportunities in the global stock, currency, and commodity markets. Written by veteran trader Jeff Clark, and featuring expert guest commentaries, Growth Stock Wire is delivered to your inbox each weekday morning before the markets open.

Customer Service: 1-888-261-2693 – Copyright 2009 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Growth Stock Wire Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.