2012 Will be the Gold Stocks Year

Stock-Markets / Stock Markets 2013 Feb 02, 2013 - 01:08 PM GMTBy: Jeff_Clark

Is your precious-metals portfolio ready for 2013? We want to get positioned in the best performers ahead of the industry's next big move to maximize profit while minimizing risk.

Is your precious-metals portfolio ready for 2013? We want to get positioned in the best performers ahead of the industry's next big move to maximize profit while minimizing risk.

Some readers may question if gold stocks really have snapped out of their funk. We could discuss this topic for many pages, but the bottom line for us at Casey Research is simple: if you believe gold and silver prices are going higher, then equity prices will follow.

Precious metals are headed higher for reasons we've outlined before: intractable levels of government debt, reckless deficit spending, and worldwide money printing. GDP growth won't be near strong enough to meet future liabilities, and neither politicians nor the public will agree to austerity measures that will be austere enough. Gold and silver will move higher as the value of currencies declines as governments attempt to pay existing and future obligations.

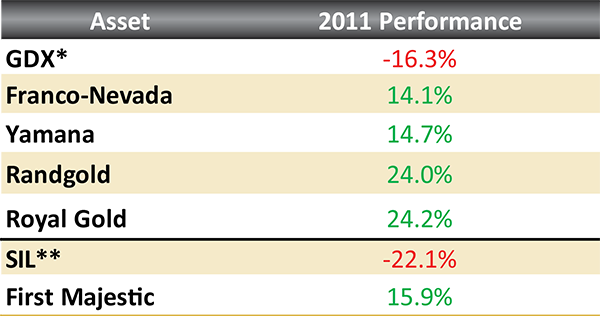

With that in mind, some stocks will certainly do better than others. Recall 2011, when gold continued higher while stocks as a group performed poorly. However, there were still profits to be made…

You can see that while the equity ETFs performed poorly last year, select producers still returned big gains. This is why it pays to be picky.

We won't always be right about which companies will be a given year's trophy, yet there are definitely steps we can take to improve our odds. As 2013 swings into gear and you review your precious-metals portfolio, keep the following in mind…

- Keep share performance in context. Don't sell a stock whose share price has "underperformed" during a period of bearish market sentiment, unless there are also serious operational difficulties that deserve the discount. While some of our picks did poorly last year, I'm convinced we have the best of the best in our portfolio. We'll advise, of course, if we think a company should be sold, but many of our weaker performers simply haven't had their day in the sun yet.

- Don't chase last year's results. Last year's winner is unlikely to also be this year's champ.

- Keep buying physical gold and silver. The metals have advanced every year since 2001 (save silver in '08 and '11), and we fully expect this trend to continue. That means the bullion you buy today should be selling for a higher price by year-end 2013 and entails less risk.

Gold and silver should be viewed as money. We believe serious inflation lies ahead from ongoing currency dilution, making it highly likely we'll someday use precious metals to maintain our standard of living.

Buy now before prices break out of their trading ranges.

- Focus on only the strongest companies. Experienced and proven management, robust production growth, low costs, a strong balance sheet, and operations in low-risk political jurisdictions define a solid company. Owning companies that meet these criteria gives us the best shot at owning a 2013 winner, while mitigating risk.

- Diversify your picks. Don't put all your money in one or two stocks. If you already own several strong gold miners, determine if you need to adjust your portfolio so that the risk – and potential reward – is spread around.

Today it's more important than ever to own the right gold stocks; but between market volatility and increasing political uncertainty in several major gold-mining nations, how can an investor separate the best gold stocks from the rest? You can get started for free right here.

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.