Russian Gold Reserves Up 8.5%, Palladium Reserves “Exhausted”

Commodities / Gold and Silver 2013 Jan 28, 2013 - 02:36 PM GMTBy: GoldCore

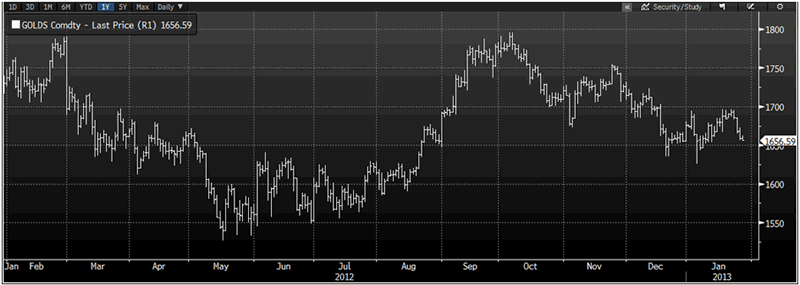

Today’s AM fix was USD 1,656.75, EUR 1,232.43, and GBP 1,052.77 per ounce.

Today’s AM fix was USD 1,656.75, EUR 1,232.43, and GBP 1,052.77 per ounce.

Friday’s AM fix was USD 1,670.25, EUR 1,243.39, and GBP 1,058.93 per ounce.

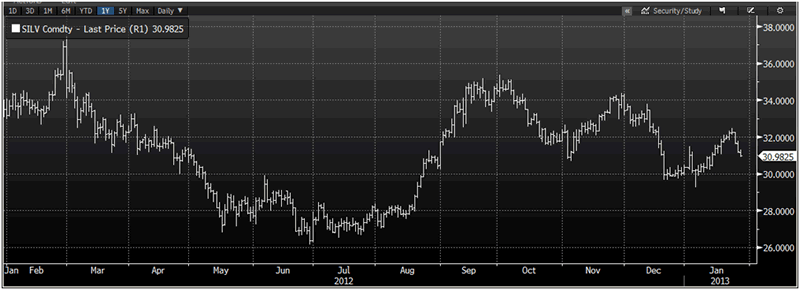

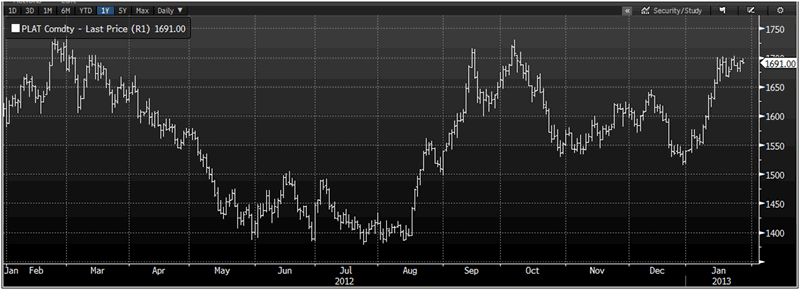

Silver is trading at $30.90/oz, €23.08/oz and £19.74/oz. Platinum is trading at $1,689.00/oz, palladium at $741.00/oz and rhodium at $1,200/oz.

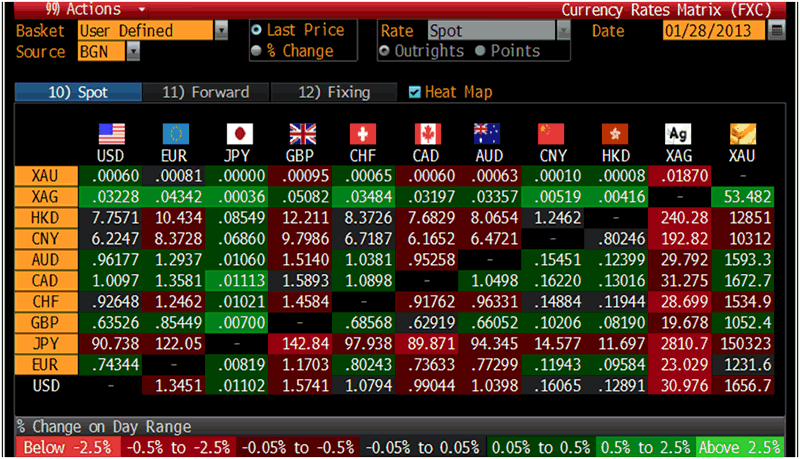

Cross Currency Table – Bloomberg

Gold fell $8.80 or 0.53%% in New York on Friday and closed at $1,658.90/oz. Silver saw an initial gain hitting $31.77 in Asia, but it then slipped to a low of $31.11 in New York and finished with a loss of 1.45%. Gold was down 1.50% on the week, while silver fell a further 2.01%.

Gold in USD 2 Years – (Bloomberg)

Gold was slightly lower on Monday, as the poor short term technical picture dimmed bullion’s safe haven appeal.

European banks will repay more than 130 billion euros of crisis loans to the European Central Bank next week, making payments earlier than expected.

European leaders still warned although the single currency has stabilized the crisis in Europe has not abated, noting it will take years to recover and highlighted the mass unemployment on the continent. The euro is now on an eleven month high verses the U.S. dollar.

The U.S. CFTC numbers for the week finished January 22nd show that net long bets were raised for gold and silver.

The Standard & Poor's 500 Index closed above 1,500 for the first time in over 5 years on Friday on strong U.S. earnings reports, including Procter & Gamble's, helped the benchmark extend its rally to 8 days.

Silver in USD, 2 Years – (Bloomberg)

Russia, Kazakhstan and Turkey expanded their gold holdings in December, seeking to diversify their foreign reserves and protect from currency devaluation risk.

Russian gold holdings climbed 2.1% to 957.8 metric tons or 30.793 million ounces, according to data on the International Monetary Fund’s website.

The increase in December takes the increase in Russian gold reserves in 2012 to 8.5%.

The Russian central bank has said that they will continue buying gold. The pace of the purchases may vary, First Deputy Chairman Alexei Ulyukayev told reporters this month.

He denied that there is a 10% target for gold’s share in the reserves according to Bloomberg

Kazakhstan’s gold reserves expanded 1.7 percent to 115.3 tons or 3.707 million ounces last month, and surged 41% over the year, the data showed.

Turkey’s holdings jumped 14.5% to 359.65 tons last month, according to the IMF data. The amount has increased due to it accepting gold in its reserve requirements from commercial banks.

Philippines gold reserves fell 1% in November from October while Mexico’s holdings were down 0.1 percent in December to 4.004 million ounces, according to the IMF.

Iraq cut its gold holdings by a quarter to 29.9 tonnes in November, reversing some of the country's recent efforts to bolster its reserves.

Countries bought 373.9 tons in the first nine months of last year, according to the producer-funded World Gold Council, which said in November that full-year additions for 2012 would probably be at the “bottom end” of a range from 450 to 500 tons. Central banks purchased 456 tons in 2011.

Central bank diversification will continue to give long term support to gold.

Palladium in USD, 2 Years – (Bloomberg)

Tightness in the platinum and palladium markets has begun to see prices move higher.

Palladium reserves in Russia, the world’s largest producer of the metal, are “pretty much exhausted” and sales this year may be only 3 metric tons, according to Johnson Matthey Plc.

Russian inventory sales dropped 68 percent to 250,000 ounces last year from 775,000 ounces in 2011, according to Johnson Matthey.

Shrinking Russian stockpiles at a time when output is falling helped send the metal into the biggest shortage in 12 years.

Output in South Africa, the second-biggest producer, was disrupted by labor disputes and strikes, while lower grades contributed to a decline in Russia.

Palladium for immediate delivery has risen again today and is trading at $741/oz. Palladium, last quarter’s best-performing precious metal, has risen 5.4% this year after advancing 7.5% in 2012.

Palladium supply declined 12% in 2012 to 6.48 million ounces on the South African disruptions.

Platinum in USD, 2 Years – (Bloomberg)

Platinum supply dropped 10% to 5.68 million ounces because of declines in top producer South Africa, coming to less than the 5.84 million ounces forecast in November, according to Johnson Matthey.

Zimbabwe was the only major producing nation to increase output, Duncan said.

Platinum supply probably will be curbed further because of difficulties in South Africa, while auto catalyst demand is expected to stay “flat” this year, before a “much stronger” 2014, according to JM.

What's Going To Happen To The Price Of Gold And Silver In 2013?

Join us for a webinar on Jan 30, 2013 at 1300 GMT.

Join two experts - Money Week columnist, Dominc Frisby and GoldCore's Head of Research, Mark O'Byrne for a one hour webinar as they discuss the outlook for gold and silver in 2013.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.