Bank of England Gold - The Doubts Remain

Commodities / Gold and Silver 2013 Jan 28, 2013 - 11:01 AM GMTBy: Alasdair_Macleod

Last week I wrote about the mess the Bundesbank has found itself in over its gold bullion. But they are not alone: the Dutch, Austrian, Mexican and now even the Swedish central banks are also coming under public pressure to explain themselves and to repatriate their gold.

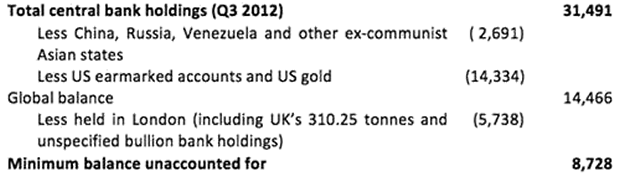

The question that is central to the blind trust placed by central banks in the Bank of England and the Federal Reserve Board is whether or not this trust has been abused. There appear to be no audits; lessees have sold unrecorded gold into the markets; and there is evidence of outright sales using gold swaps and sight accounts (a sight account does not require physical gold to back it). With this in mind we can make a stab at quantifying the deception (if it exists), starting with the table below.

The table assumes that China, Russia and the other Asian states within their sphere of influence hold no gold in London or New York, because their actions are diametrically opposed to attempts to keep a lid on the price. Furthermore, they have very different geopolitical priorities, ruling out any trust-based monetary relationships with the West. Venezuela took her gold back last year. Otherwise it is assumed all central banks operate within the normal central banking framework.

Our objective is to establish whether the 5,738 tonnes of gold held by the Bank of England is reasonable. The figures in the table include the gold custody figures reported by the Bank of England in its last Annual Report, IMF-reported holdings of individual countries and the Federal Reserve Board's International Summary Statistics (Page 3 for earmarked gold). The unknowns are broadly three:

- I can find no evidence of gold sight accounts in New York, but given the physical market is in London this is perhaps not surprising. It is assumed in the table that all the US and earmarked gold actually exists and none is held in London.

- Custody at the Bank of England includes bullion held for both central and bullion banks, and there is no breakdown given. Central bank holdings will therefore be less than the 5,738 tonnes stated.

- We can only make an educated guess at how much central bank bullion is held either in countries of ownership or at other central bank depositories.

To establish the level of central bank reserves held in London we should note disclosures to date. Mexico says she has nearly 95% of her gold in London and only 1% in New York. Austria has 80% of her gold in London. But Holland, echoing Germany (13%) says she has only 18% in the UK.

However, the remaining non-aligned countries that have added to their bullion holdings over the years will have done so in London, and for historical reasons member-nations of the Commonwealth can be expected to have nearly all their gold in London, and for most countries keeping gold reserves in London is safer than in their home capitals.

This suggests that the amount of gold held by the Bank of England should be significantly greater than the 5,738 tonnes declared, particularly when bullion bank deposits within that total are accounted for. And if Austria's 80% in London is anything to go by, despite the obvious convenience of the rival Zurich market on her doorstep, the custody figure should be closer to 11,500 tonnes.

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2013 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.