Gold Backed Bonds - An Alternative To European Economic Austerity?

Commodities / Gold and Silver 2013 Jan 25, 2013 - 04:30 PM GMTBy: GoldCore

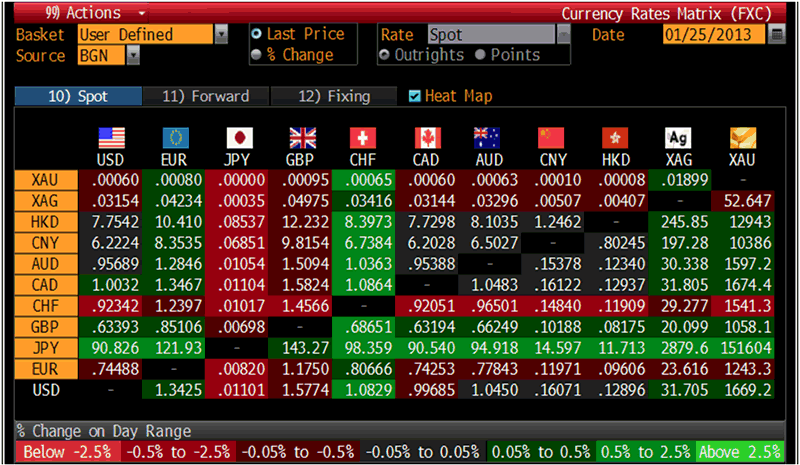

Today’s AM fix was USD 1,670.25, EUR 1,243.39, and GBP 1,058.93 per ounce.

Today’s AM fix was USD 1,670.25, EUR 1,243.39, and GBP 1,058.93 per ounce.

Yesterday’s AM fix was USD 1,677.00, EUR 1,258.06, and GBP 1,059.18 per ounce.

Silver is trading at $31.55/oz, €23.54/oz and £20.04/oz. Platinum is trading at $1,689.00/oz, palladium at $723.00/oz and rhodium at $1,200/oz.

Cross Currency Table – Bloomberg

Gold dropped $17.90 or 1% in New York yesterday and closed at $1,667.70/oz. Silver slipped to a low of $31.60 and finished with a loss of 1.8%. Most traders were at a loss to explain the counter intuitive losses given the bullish backdrop.

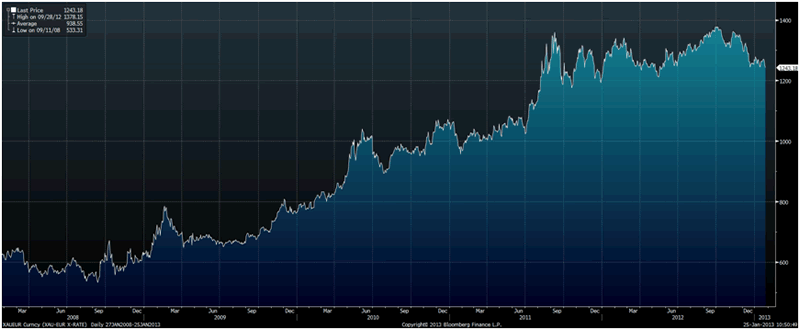

Gold in Euros – 5 Years (Daily) - Bloomberg

Overnight gold bounced back from an almost 2 week low and was again especially strong in yen terms - strengthened by the Bank of Japan’s stance on aggressive monetary easing.

Russia’s Central Bank said it will continue to buy gold bullion as it seeks to diversify its foreign reserves away from paper assets, such as the euro, it views as more risky.

At Davos, George Soros, one of the largest buyers of gold in the world today, warned of currency wars and that “interest rates are going to take a big leap” - probably this year.

Bank of America warned of a “bond crash” comparable to 1994 that would trigger a string of upsets across the world. In 1994, the bond crash bankrupted Orange Country, California, and set off the Tequila Crisis in Mexico.

Today, the world is much more fragile and the increasingly likely bond crash could lead to a Lehman style systemic crisis – but on an even greater scale.

These risks and the recent price drop has fuelled buying interest in physical metal and a minority of smart money gold buyers continue to diversify into allocated gold on the dip .

At 1500 GMT new U.S. new home sales data is released.

Across Europe, economic growth is faltering and in many Eurozone countries, sovereign debt yields are dangerously high and austerity measures are creating much hardship.

The World Gold Council has been exploring ways that Eurozone member states could use their gold reserves to help bring down the cost of borrowing.

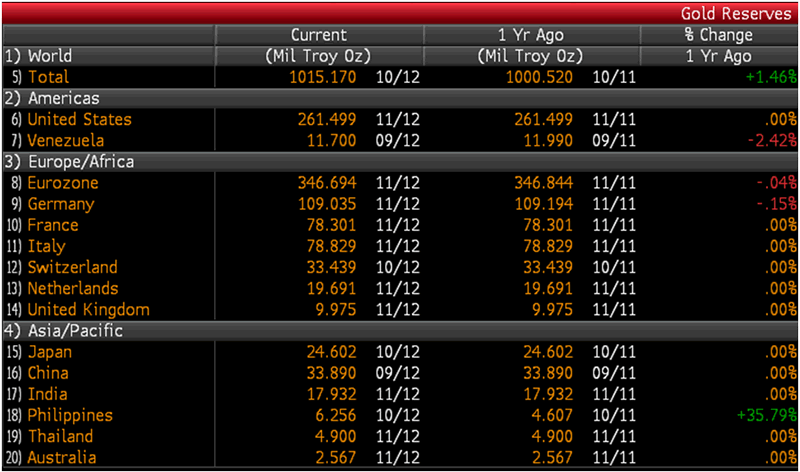

The Eurozone is the largest sovereign holder of gold in the world and has over 10,000 tonnes of gold reserves. The Eurozone, including the ECB, has 10,787.4 tonnes of gold worth over a significant €450 billion. Some of the countries worst affected by the crisis, including Portugal and Italy, own a significant proportion of these assets. Italy alone holds nearly 2,000 tonnes of gold.

The Eurozone as a whole has 32.6% more gold reserves than the U.S. which has 8,133.5 tonnes of gold.

Due to the ongoing global debt crisis and significant systemic and monetary risk, it would be financial and monetary folly of the highest order to sell gold. Indeed, prudent creditor nation central banks are continuing to add to their gold reserves.

Most agree that outright sales of gold are not the answer. Aside from the obvious problem that the outstanding debt level of the struggling European countries far surpasses the value of their gold reserves, existing EU laws prohibit such a move to finance governments, as do the provisions of the Central Bank Gold Agreement, which limits gold sales.

To illustrate this point, the gold holdings of the crisis hit Eurozone countries (Portugal, Spain, Greece, Ireland and Italy) represent only 3.3% of the combined outstanding debt of their central governments.

A one-time sale of all of their gold reserves would probably not cover even one year’s worth of their debt service costs. This would be akin to an individual selling everything they owned in order to make one month’s mortgage payment.

Click on to watch

However, there may be an alternative to selling gold for desperate cash strapped nations facing vicious austerity. The alternative is to use European gold reserves in a way that will buy time for growth to take hold.

The World Gold Council and leading academics and international think tanks believe that using a portion of a nation's gold reserves to back sovereign debt would lower sovereign debt yields and give some of the Eurozone's most distressed countries time to work on economic reform and recovery.

According to research done by the World Gold Council using the European gold reserves as collateral for new sovereign debt issues would mean that without selling an ounce of gold, Eurozone countries could raise €413 billion. This is over 20% of Italy's and Portugal's two year borrowing requirements.

The move to back sovereign bonds with gold would lower sovereign debt yields, without increasing inflation, which would help to calm markets. This should give European countries some vital breathing space to work on economic reform and recovery.

Some citizens would be concerned that there may be a risk that the sovereign nations who pledge their gold as collateral could ultimately end up losing their gold reserves to the ECB, or whoever the collateral of the gold reserves are pledged to, in the event of a default.

Unlike currency debasement and the printing and electronic creation of money to buy sovereign debt, under schemes such as Draghi's “outright monetary transactions” (OMT), the use of gold as collateral would not create fiscal transfers between Eurozone members, long term inflation or currency devaluation risk.

The proposal shows how gold is being increasingly seen as a safe haven asset and currency.

Indeed, it suggests that those who have suggested returning to some form of gold standard are not as deluded as they have often been portrayed.

Mobilising Europe's gold is a temporary move which the World Gold Council and leading academics believe will help to create a more permanent solution which in time would help the Eurozone extract itself from its debt crisis.

Europe and the world faces an exceptionally challenging period and unconventional policy responses are called for.

A gold-backed bond may offer at least a partial solution to Europe’s woes.

The video 'Leveraging Gold Reserves To Help Lower Eurozone Sovereign Debt Yields' explores why such a measure could offer an alternative to austerity for the Eurozone:

'Leveraging Gold Reserves To Help Lower Eurozone Sovereign Debt Yields'

What's Going To Happen To The Price Of Gold And Silver In 2013?

Join us for a webinar on Jan 30, 2013 at 1300 GMT.

Join two experts - Money Week columnist, Dominc Frisby and GoldCore's Head of Research, Mark O'Byrne for a one hour webinar as they discuss the outlook for gold and silver in 2013.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.