Faber to Shiller: “You Keep Your U.S. Dollars And I’ll Keep My Gold”

Commodities / Gold and Silver 2013 Jan 24, 2013 - 12:36 PM GMTBy: GoldCore

Today’s AM fix was USD 1,677.00, EUR 1,258.06, and GBP 1,059.18 per ounce.

Today’s AM fix was USD 1,677.00, EUR 1,258.06, and GBP 1,059.18 per ounce.

Yesterday’s AM fix was USD 1,692.25, EUR 1,268.84, and GBP 1,066.19 per ounce.

Silver is trading at $31.92/oz, €24.05/oz and £20.26/oz. Platinum is trading at $1,692.75/oz, palladium at $718.00/oz and rhodium at $1,200/oz.

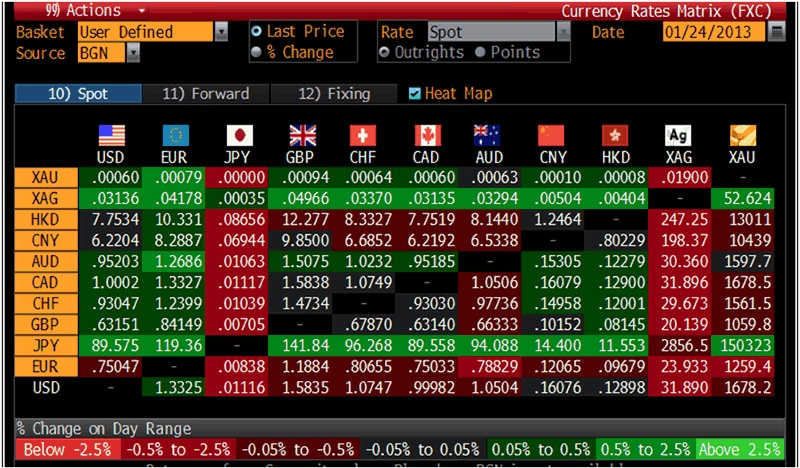

Cross Currency Table – (Bloomberg)

Gold fell $4.90 or 0.29% in New York yesterday and closed at $1,685.60/oz. Silver fell to $32.08 in Asia then rallied to a high of $32.47 in the afternoon in NY trade, but then it dropped off in the last few hours and finished with a gain of just 0.25%.

Gold edged down in most currencies on Thursday, easing off the one month high hit earlier in the week. More speculative players may be taking profits after the recent run from $1,625/oz to over $1,695/oz or 4.3%.

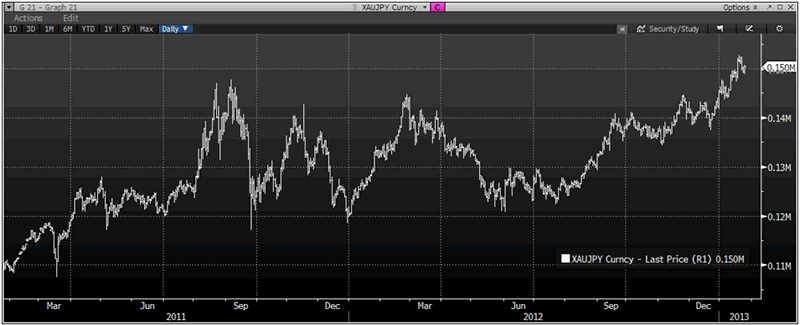

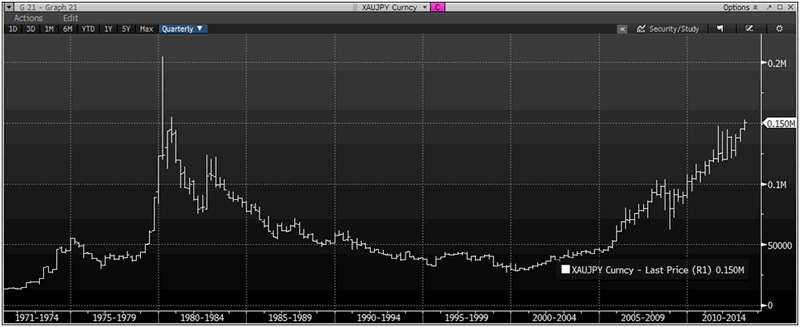

It is noteworthy that while gold is weaker in most currencies today it is again higher in Japanese yen as the yen has fallen sharply on the international markets due to concerns that the yen will be devalued in the coming months.

Gold in yen terms remains near record multiyear highs above 0.150 million yen per ounce. New nominal highs in yen terms above 0.2 million yen per ounce are only a matter of time (see charts).

Bloomberg reported that Credit Suisse says gold holders may have withdrawn gold from the euro zone due to the region’s debt crisis. They noted the Bundesbank comment about capacity becoming available in its own vaults in Germany.

The World Economic Forum is into its second day in Davos, Switzerland, and with the theme of ‘Resilient Dynamism’ it appears a good time to announce or spin positive news in Europe such as a slight growth in consumer morale and confidence.

I’m not sure what Europe the Davos attendees are living on but Ireland, Spain, Portugal and Greece’s ‘recoveries’ are bleak at best.

Spanish youth unemployment has risen again and is now nearly at 60%.

The U.S. House of Representatives passed a Republican led plan to allow the federal government to keep borrowing money through mid-May.

The borrowing and money printing party can continue a little while longer but it would be prudent to prepare for the hangover.

Owning physical gold today is akin to drinking plenty of water and having a few pain killers to hand. When this party ends, those not owning gold are going to suffer one hell of a financial hangover.

XAU/JPY Daily, 2 Years – (Bloomberg)

“Everyone should keep gold in their portfolios” as the precious metal will be able to offer value to investors even in a worst-case scenario, said Marc Faber, the publisher of the Gloom, Boom & Doom report.

“In the worst case scenario, in the systemic failure that I expect, it would still have some value,” Faber, who is also the founder and managing director of Marc Faber Ltd., said today at an event hosted by Evli Bank Oyj in Helsinki.

Faber said his outlook was so bleak that he is “hyper bearish”. He joked that “sometimes I’m so concerned about the world I want to jump out of the window.”

He wisely said that `I advise everyone to have some gold.'

Faber said that he thought there could be a flight out of cash and overvalued bonds and into equities and gold.

In response to a question from Yale University’s Robert Shiller querying the recommendation to hold gold, Faber said: “I’m prepared to make a bet, you keep your U.S. dollars and I’ll keep my gold, we’ll see which one goes to zero first.”

XAU/JPY Quarterly, 1971-2013 – (Bloomberg)

Shiller, who is the co-creator of the S&P/Case-Shiller index of property values, responded "I'm inclined to think gold prices after this crisis might return to a lower level. Given the low yields of the alternatives [ie, bonds], the valuation of the stock market doesn't look so bad."

Faber, whose advice has protected millions of investors in recent years, warned of a global systemic crisis possibly due to massive size of the global derivatives market which is now worth over an incredible $700 trillion.

He warned “when the system goes down,” and only plastic credit cards are left, “maybe then people will realize and go back to some gold-based system.”

What's Going To Happen To The Price Of Gold And Silver In 2013?

Join us for a webinar on Jan 30, 2013 at 1300 GMT.

Join two experts - Money Week columnist, Dominc Frisby and GoldCore's Head of Research, Mark O'Byrne for a one hour webinar as they discuss the outlook for gold and silver in 2013.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.