Silver Bars Being Secured By HSBC – Buy $876 Million Worth From Poland

Commodities / Gold and Silver 2013 Jan 23, 2013 - 04:21 PM GMTBy: GoldCore

Today’s AM fix was USD 1,692.25, EUR 1,268.84, and GBP 1,066.19 per ounce.

Today’s AM fix was USD 1,692.25, EUR 1,268.84, and GBP 1,066.19 per ounce.

Yesterday’s AM fix was USD 1,692.50, EUR 1,268.17, and GBP 1,068.36 per ounce.

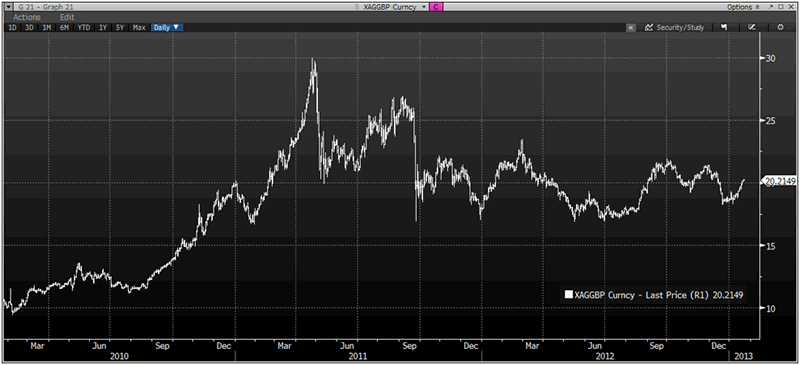

Silver is trading at $32.33/oz, €24.32/oz and £20.46/oz. Platinum is trading at $1,700.50/oz, palladium at $725.00/oz and rhodium at $1,200/oz.

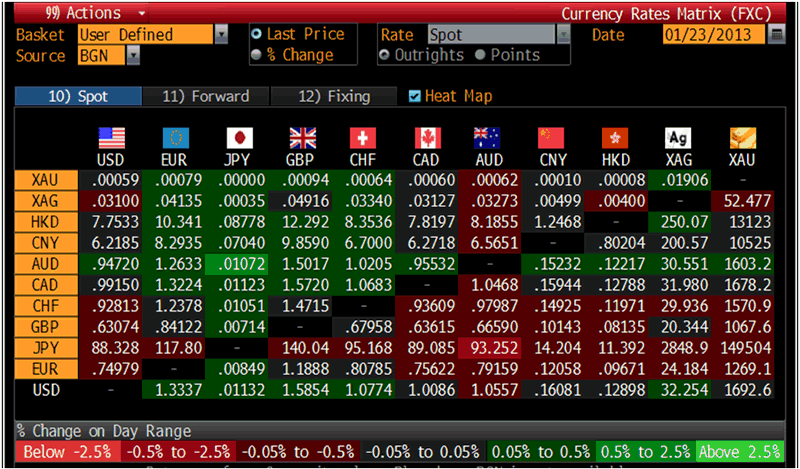

Cross Currency Table – (Bloomberg)

Gold climbed $6.40 or 0.4% in New York yesterday and closed at $1,690.50/oz. Silver slipped to $31.79 in London, but it then climbed to a high of $32.34 in New York and finished with a gain of 1%.

Gold hovered near a 1 month high on Wednesday supported by loose monetary policies of central banks. There are renewed hopes regarding U.S. debt ceiling talks and the U.S. House of Representatives plans to pass a bill on the almost 4 month extension of the borrowing limit.

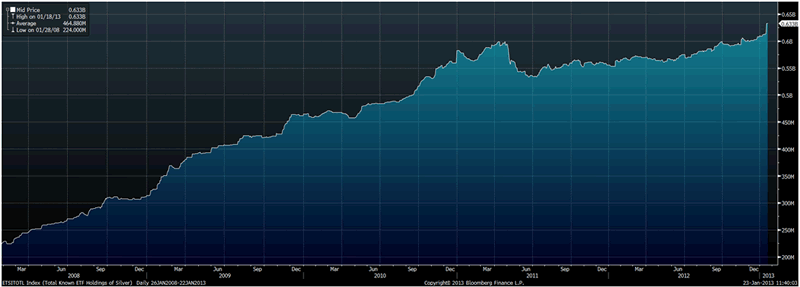

Total Known ETF in Silver, Jan 2008-2013 – (Bloomberg)

Silver has now rallied for 7 days due to the flood of inflows into silver backed ETF’s and investment demand for coins and bars internationally. Analysts polled by Reuters expect silver to rise in 2013.

Holdings of iShares Silver Trust, the world's largest silver ETF, stood at 10,689 tonnes on Jan. 22, up 604.9 tonnes, or nearly 6 percent, from the end of 2012.

By comparison, SPDR Gold Trust, the world's top gold ETF, saw an outflow of nearly 15 tonnes so far this year.

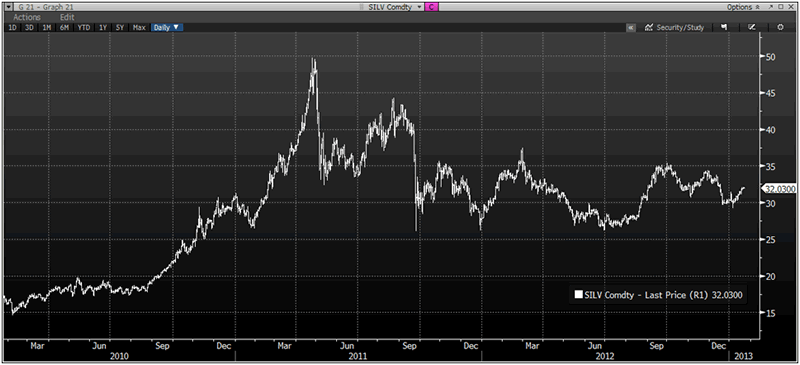

This has helped silver prices rally over 6% so far this year and 4.5% last week alone. The close above $32/oz yesterday was bullish technically and could lead to silver testing the next level of resistance which is at $34/oz.

The U.S. Mint has sold out of 2013 American Eagle silver coins and will resume sales the week of January 28 when the US Mint said inventory would be replenished.

Chinese silver turnover surged to 2,200 tonnes on Friday and analysts say Chinese investor’s interest in silver is continuing to rise as many are looking at silver as a cheaper alternative to gold.

Hence, trading volumes for the precious metal on the SGE soared in 2012.

Silver bullion imports by China remain robust too. Silver imports were 228 metric tons in December, according to data released by the customs agency.

There are also rumours that Apple is experiencing delays in producing the new iMac due to difficulty in sourcing industrial silver in volume in China. More silver than is typically used is utilised in the new 21.5" Apple iMacs.

HSBC Buying KGHM Silver Bars

HSBC has quietly moved into acquiring large amounts of silver bullion.

The bank has secured another deal to buy silver bars from KGHM which brings their total purchases of silver from KGHM alone in the last 12 months to $876 million or PLN 3.65 billion.

KGHM is one of the largest producers of silver in the world and is the second-largest producer of refined silver in the world.

They produce silver bars registered under the brand KGHM HG that are attested to by “Good Delivery” certificates issued by the London Bullion Market Association and the Dubai Multi Commodities Centre.

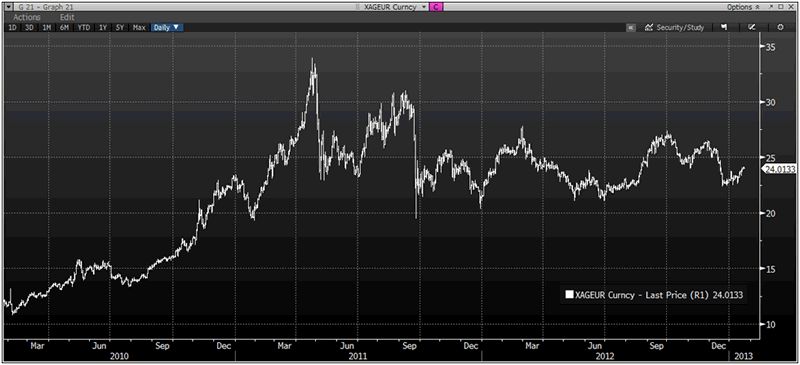

Silver Daily, 2010-1013 – (Bloomberg)

Listed metals producer KGHM signed an estimated PLN 1.67 billion deal on 2013 sales of silver to HSBC, KGHM said in a market filing yesterday.

The deal puts the total value of deals between KGHM and HSBC in the last 12 months to PLN 3.65 billion or $876 million, the filing read.

The Management Board of KGHM announced that on 21 January 2013 a contract was entered into between KGHM and HSBC Bank USA N.A., London Branch for silver sales in 2013.

The estimated value of the contract is PLN 1,672,260,469.66. As a result of entering into this contract, the total estimated value of contracts entered into between KGHM and HSBC Bank USA N.A., London Branch over the last 12 months exceeded 10% of the equity of the Company and amounts to PLN 3,654,120,061.59.

The highest-value contract signed during this period is the above-mentioned contract. The criteria used for describing the contract as significant is that the total estimated value of the contracts exceeds 10% of the equity of KGHM.

KGHM is one of the largest companies in Poland and one of the largest mining & metallurgy companies in the world.

The main customers of Polish silver in recent years have been the United Kingdom, Germany and Belgium. HSBC appears to be one of their main customers now.

Respected and erudite, James Steel, the chief commodity analyst at HSBC Securities (USA) Inc. continues to be bullish on silver and recently said how “silver tends to track gold, except it over performs in a bull market” and how he was “moderately bullish on silver” in 2013.

XAG/GBP Daily, 2010-2013 – (Bloomberg)

XAG/EUR Daily, 2010-2013 – (Bloomberg)

HSBC did not comment on the deal and it only came to light as KGHM is a listed company and had to report the deal which was then picked up in Polish media.

The massive deal could simply be HSBC securing supply for the NYSE listed ETFS Physical Silver as they are the custodian.

Or it could be that senior people in HSBC are concerned about securing supply as they expect robust investment demand to continue and possibly increase resulting in higher prices.

What's Going To Happen To The Price Of Gold And Silver In 2013?

Join us for a webinar on Jan 30, 2013 at 1300 GMT.

Join two experts - Money Week columnist, Dominc Frisby and GoldCore's Head of Research, Mark O'Byrne for a one hour webinar as they discuss the outlook for gold and silver in 2013.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.