Chaos Theory Market Fractals - Nadeem Walayat's Real Secrets for Successful Trading

InvestorEducation / Learn to Trade Jan 20, 2013 - 04:01 PM GMTBy: Nadeem_Walayat

This is a continuation of my series on how to interpret and trade the Financial Markets (as opposed to forecast), specifically building upon my last article that summarised the key elements of trading in terms of reacting to price movements in real time (Stock Market Crash Investing Lessons and the Real Secrets of Successful Trading ). This article seeks to expand on one key component which is the role chaos theory plays in interpreting triggers for action. A trigger is an immediate call to action, and not a wishy washy signal to suggest action.

This is a continuation of my series on how to interpret and trade the Financial Markets (as opposed to forecast), specifically building upon my last article that summarised the key elements of trading in terms of reacting to price movements in real time (Stock Market Crash Investing Lessons and the Real Secrets of Successful Trading ). This article seeks to expand on one key component which is the role chaos theory plays in interpreting triggers for action. A trigger is an immediate call to action, and not a wishy washy signal to suggest action.

However, this article will not not seek to reinvent the wheel by explaining what chaos theory is and its developmental history. So if you do not know anything about chaos theory then you best browse the internet first for chaos theory and fractals or better still read one of the many books published on the subject. In terms of suggesting a book, I can only refer to the last book I read on this subject which was well over 20 years ago - James Gleicks "Chaos: Making a New Science". Fortunately you only really need one good book to get a solid grounding in chaos theory i.e. it is not necessarily to stuff your bookshelf full of books on chaos theory and fractals.

However, this article will not not seek to reinvent the wheel by explaining what chaos theory is and its developmental history. So if you do not know anything about chaos theory then you best browse the internet first for chaos theory and fractals or better still read one of the many books published on the subject. In terms of suggesting a book, I can only refer to the last book I read on this subject which was well over 20 years ago - James Gleicks "Chaos: Making a New Science". Fortunately you only really need one good book to get a solid grounding in chaos theory i.e. it is not necessarily to stuff your bookshelf full of books on chaos theory and fractals.

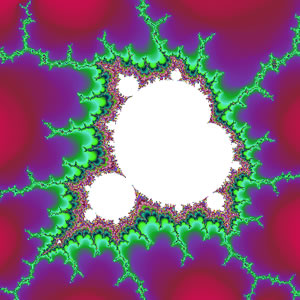

Another suggestion would be to play around with the Mandelbrot and Julia sets for which many websites have sprung up over the years that enable one to experience what fractals are without having to buy or write programs to generate them which is even possible with the likes of Excel,or take a look at the video version of this article (goes live in a few days).

Are Elliott Wave's Chaos Theory?

Whilst there are many elements to chaos theory, my focus that grew out of studying the Julia and Mandelbrot sets was fractals. In that clearly the stock and other market price action resembles fractal structures as the same structure appears to repeat on ALL time frames. At the time it seemed that Elliott Wave and Chaos theory were very similar of not the same thing, in that Elliott Waves are the fractals for market price action that appear to on ALL time frames as discovered in the 1930's by RN Elliott which was decades before Mandelbrot appeared on the scene.

However on spending many, many years going down this path I concluded that Elliott Waves and Chaos Theory are NOT the same. Elliott Wave theory is something ELSE, yes, it resembles Chaos Theory i.e. Fractals, but it is not Chaos theory Fractals.

Again they look very similar but in a way Chaos Theory is Elliott Waves without having to know the WAVES! That may sound confusing but that is actually how it is. In Chaos Theory all one would know is What is Impulse and What is Corrective, and that is it! None of the 5th of the 5th of the 5th or ABC or the rest matter, just Impulse or Corrective. Which is probably what many experienced elliotticians eventually conclude without ever having ventured into chaos theory that at the end of the day the only thing that matters is Impulse or Corrective and not What Elliott Wave implies i.e. that Stocks 1987 peak was the final 5th of the 5th of the 5th and then so were each of the subsequent bull market peaks right into the present days bull market.

Fractal Theory

In a way Chaos Theory should really have been called Fractal Theory, because rather than chaos i.e. randomness it actually implies order and structure, and that structure is found in fractals.

The point about Fractals is that they give you a window into probabilities for price action on ALL market levels, i.e. hourly, daily, weekly, monthly, even yearly. I.e. fractals are akin to flexible pattern recognition, simple patterns that repeat and result in high probabilities given certain conditions which in themselves are flexible, so it unlike traditional chart patterns such as Head and Shoulders, the interpretation of market fractals is dependant upon changing conditions, such as trend, cycles, and volume.

What are Market Fractals ?

Simply put Market fractals are trend changes. A trend change is either a reversal of the Impulse trend or an end of the Corrective trend on ANY time frame.

Fractal Patterns

Fractal patterns are not complicated, you already know the more common ones, such as spike, double and triple tops and bottoms that occur on ALL time frames, what you don't know or have not studied are the conditions that increase their probabilities for particular markets at particular points in time, such as volume, preceding trend, and momentum oscillators (I use the MACD) once you factor these into the equation amongst your TRIGGER (Fractal) increases in probability exponentially, as it reduces the instances of its occurrence. Still it does requires HARD WORK for the market one trades to identify the current TRIGGERS (Fractals), especially when one starts going down the path of fractals of fractals i.e. in this example, a double top plus double top fractal.

Trading Fractals

It all boils down to practice, knowing current fractal patterns and having them engrained in your mind, and then you WAIT for the FRACTAL TRIGGERS, and REACT in real time, just as as you trade traditional price patterns such as double and triple tops as identified in real time. Fractal triggers are not limited to Bar charts, as you can use other types of charts, my preference is for swing charts as illustrated in "How to Trade Commodities" by WD Gann (not to confuse with the rest of his work which in my opinion is a red herring).

Once you understand that Chaos Theory comprises fractals that give a high probability of an outcome given x, y,z condition then one starts to see fractals EVERYWHERE, for fractals ARE Nature. It is how our universe is constructed on every level, we are living in an unfolding fractal universe, nothing is fixed, everything is in motion, if you understand this then you will now know more truth than anything you will find in any ancient superstition.

The bottom line is this, that there is no black or white, no holy grail, everything has its basis in how we interpret the world around us is be it markets or the wider environment, fractals appear to offer the best window into a better interpretation of the world in our time, until the next innovation comes along.

Ensure you are subscribed to my always free newsletter to get the in-depth analysis and detailed trend forecasts in your email in box.

Also subscribe to our new youtube channel for video versions and additional educational material.

Also subscribe to our new youtube channel for video versions and additional educational material.

Source and comments - http://www.marketoracle.co.uk/Article38592.html

Nadeem Walayat

Copyright © 2005-2013 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of three ebook's - The Inflation Mega-Trend; The Interest Rate Mega-Trend and The Stocks Stealth Bull Market Update 2011 that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.