U.S. Treasury Bond Market Forecast 2013, The "Bloated" Bubble

Interest-Rates / US Bonds Jan 18, 2013 - 04:59 PM GMTBy: Gordon_T_Long

The Fiscal Cliff theater was great 'off Broadway' drama, but the real show for traders took center stage Sunday December 16th in Japan. The curtain went up for the newly elected Prime Minister of Japan as the star actor in the unfolding global fiat currency drama.

The Fiscal Cliff theater was great 'off Broadway' drama, but the real show for traders took center stage Sunday December 16th in Japan. The curtain went up for the newly elected Prime Minister of Japan as the star actor in the unfolding global fiat currency drama.

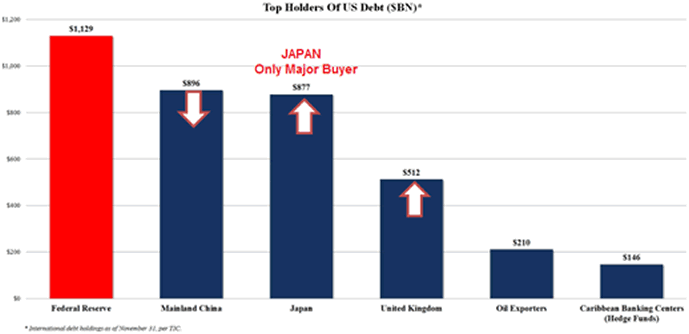

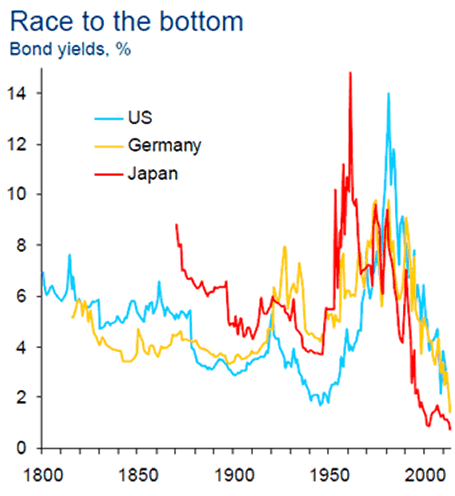

Japan’s incoming leader Shinzo Abe's opening line was to vow to ram through full-blown reflation policies to pull his country out of slump and drive down the yen, warning Japan's central bank not to defy the will of the people. The profound shift in economic strategy by the world’s top creditor nation with a quadrillion Yen debt, could prove powerful for the global economy as a new variant of the "carry trade" seen earlier this decade, but potentially on a much larger scale.

"It is tremendously important for global growth, and markets are starting to take note" Lars Christensen from Danske Bank

"We think this could be the beginning of a fresh reflation cycle for the global system, combining with the US recovery to mark a turning point in the crisis," Simon Derrick from BNY Mellon.

Mr Abe’s Liberal Democratic Party (LDP) won a landslide, securing a two-thirds "super-majority" in the Diet with allies that can override senate vetoes. Armed with a crushing mandate, Mr Abe said he would "set a policy accord" with the Bank of Japan for a mandatory inflation target of 2pc, backed by "unlimited" monetary stimulus.

Mr Abe’s Liberal Democratic Party (LDP) won a landslide, securing a two-thirds "super-majority" in the Diet with allies that can override senate vetoes. Armed with a crushing mandate, Mr Abe said he would "set a policy accord" with the Bank of Japan for a mandatory inflation target of 2pc, backed by "unlimited" monetary stimulus.

"It's very rare for monetary policy to be the focus of an election. We campaigned on the need to beat deflation, and our argument has won strong support. I hope the Bank of Japan accepts the results and takes an appropriate decision,"

The menace behind his words did not have to be spelled out. Shinzo Abe has already threatened to change the Bank of Japan’s governing law if it refuses to comply. "An all-out attack on deflation is on its way," said Jesper Koll, Japanese equity chief at JP Morgan. Mr. Abe plans to empower an economic council to "spearhead" a shift in fiscal and monetary strategy, eviscerating the central bank’s independence.

The council is to set a 3pc growth target for nominal GDP, embracing a theory pushed by a small band of "market monetarists" around the world. "This is a big deal. There has been no nominal GDP growth in Japan for 15 years," said Mr Christensen.

The LDP plans what some have dubbed a "currency warfare fund" to weaken the yen with a blitz of foreign bond purchases, copying Switzerland’s success in capping the franc.

The effect of Switzerland’s unlimited bond purchases has been to finance most of the eurozone’s budget deficits for the last year with printed money. If Japan tries to do this - with a vastly bigger economy - it would amount a blast of quantitative easing for the world.

Japan’s curse as creditor nation with $3 trillion of net assets abroad is that safe-haven flows cause the yen to strengthen during a crisis, tightening policy in a "pro-cyclical" fashion when least wanted, this time due to the Fukushima nuclear disaster and Europe’s sovereign debt saga.

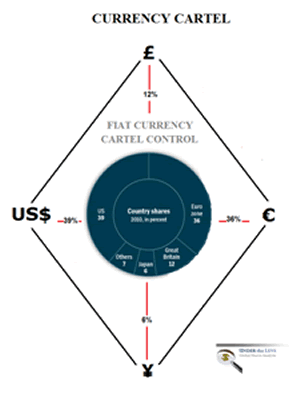

In the last 90 days the US, EU and now Japan have announced "unlimited", "Uncapped" monetary policy with UK's soon to be bank of England Governor, Carney indicating he wants inflation & growth targeting also when he assumes the reins.

THE US NOW HAS SOMEONE OTHER THAN THE FED TO BUY US TREASURY DEBT > Abe's NEW JAPAN

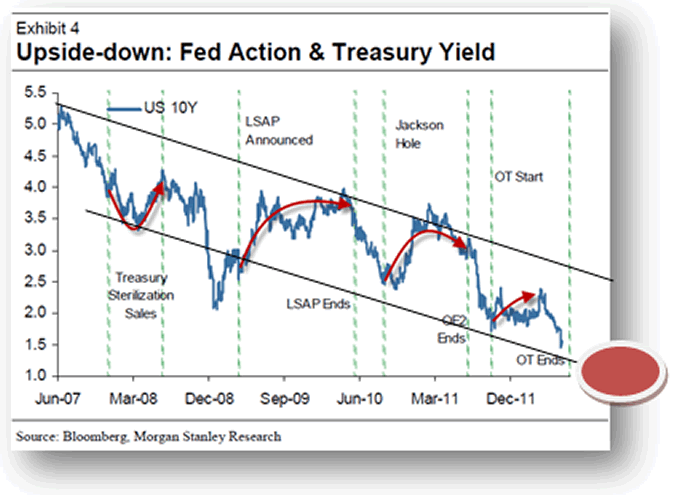

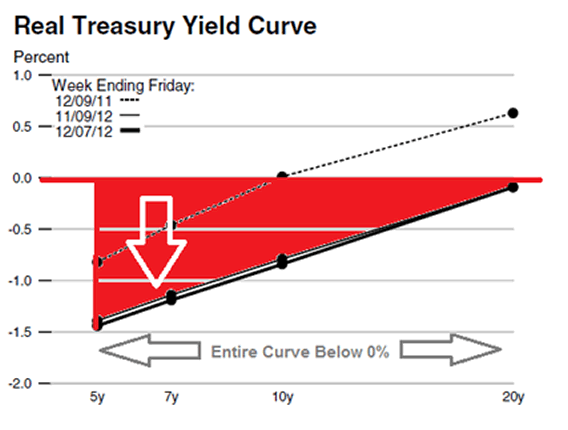

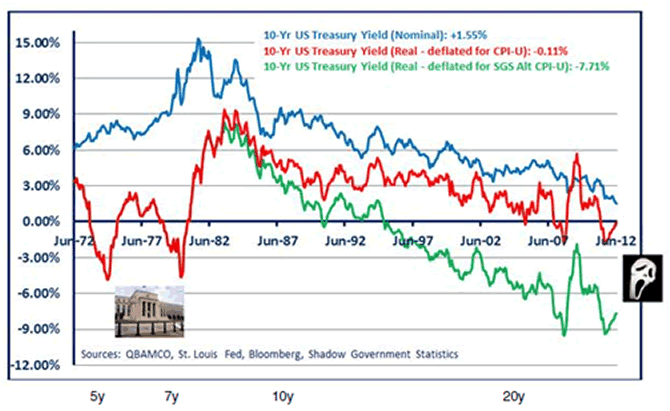

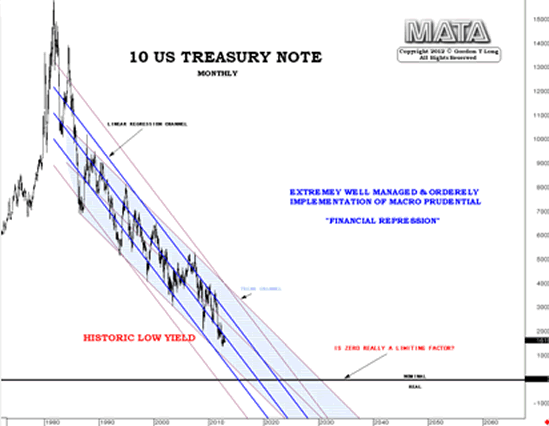

GOAL: Sustained Negative Real Interest Rates

The Fed's action are about the debt market and financing the US debt. All announcements have had this as a planned and timed goal.

The goal has been to get interest REAL interest rates as low as possible, and the expected duration to be as long as possible.

The result have been much harsher than the official chart (above), when inflation is realistically factored (below)

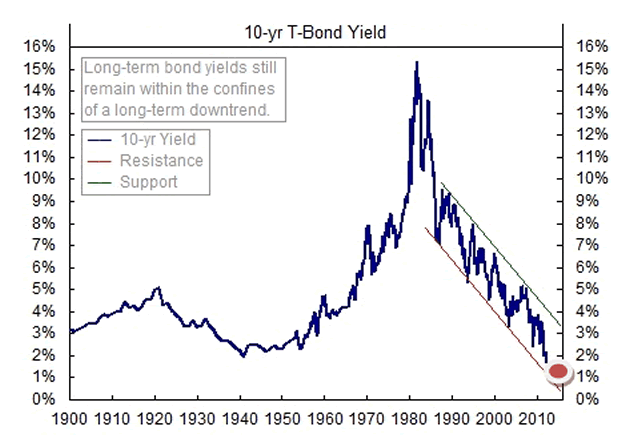

OBJECTIVE: A 1.0 - 1.2% 10Y US Treasury Yield

This has been a long term strategy since Paul Volcker initiated major changes in Fed Policy

It has placed the world's fiat currencies on a race to debase.

TRADER WATCH:

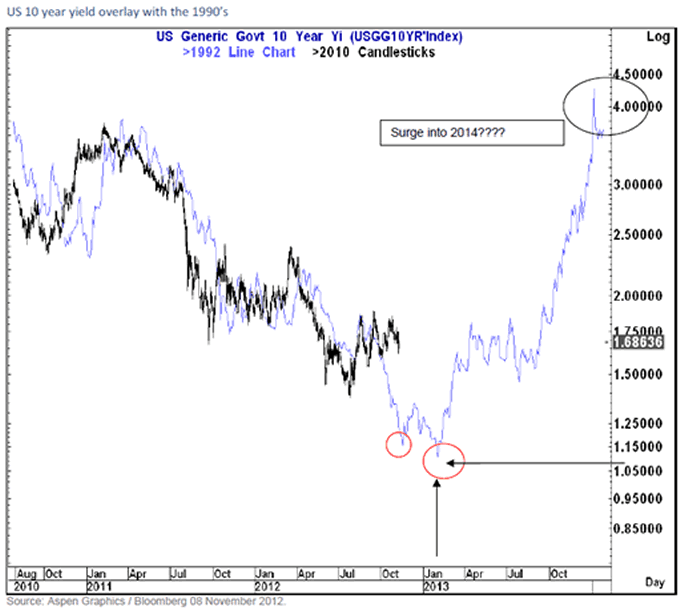

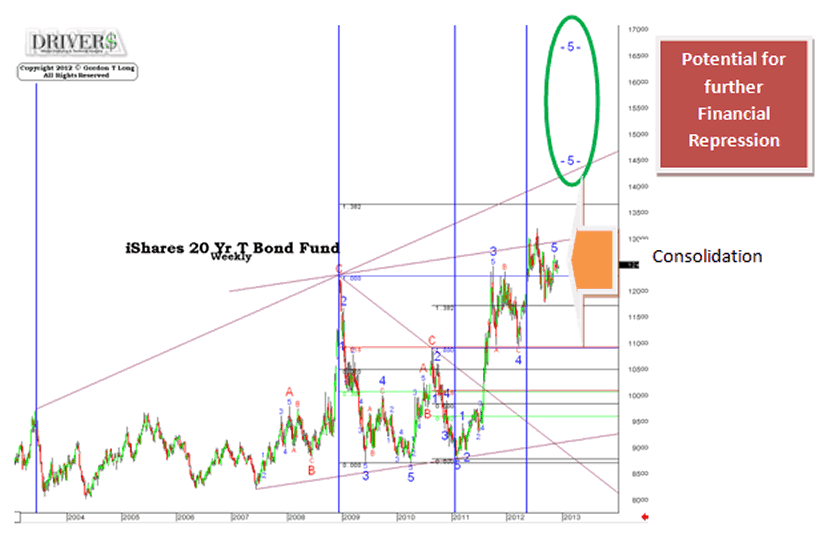

Our analysis which we have been calling throughout 2012 is that we are headed to 1.0 to 1.2% on the 10 Year US Treasury. The pattern below corroborates this outlook with an interesting analogy.

Market have reacted to this strategic and obvious debasement by:

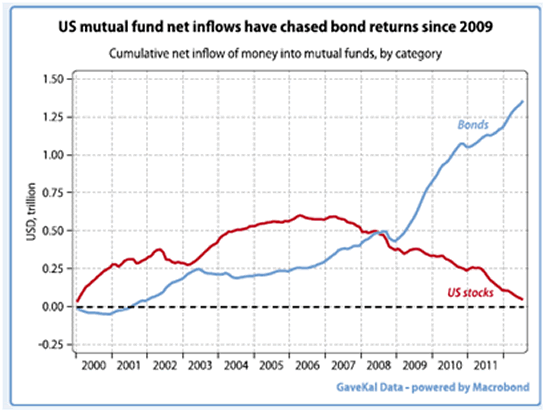

1- Stampeding, relentlessly into the Bond Market and creating a disturbing potentially destabilizing bond bubble.

A bubble that could pop with a disappointing post Fiscal Cliff debt ceiling resolution and consequential downgrade of the US debt.

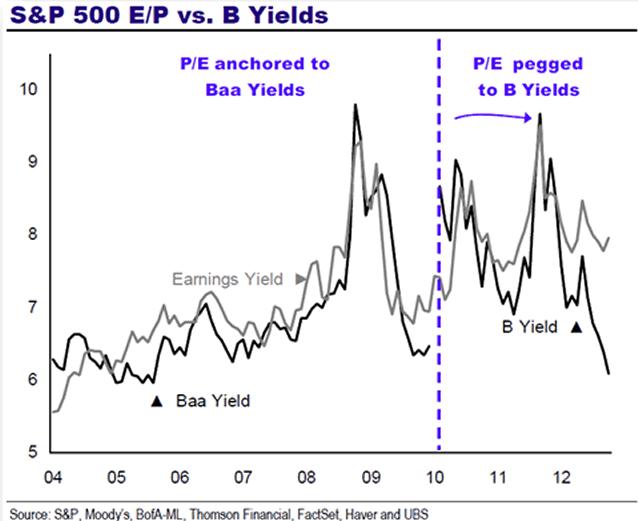

2- Pricing PE Equities equivalent to High Yield Junk

CONCLUSION

We can expect the MACRO DRIVER$ to be:

1- US Treasuries to continue to rally in moving ever closer towards 1.0-1.2% (see charts below)

2- The US dollar in the near term to strengthen against the Yen, but weaken against the Euro.

3- Equities to rally on a weaker US dollar, until the US debt is threatened with another downgrade in Q1 2013 which will have a potentially disastrous fall-out on credit and risk pricing.

4- Equities will fall on the re-pricing of credit and risk, earnings revenue and margin issues and slowing real global growth.

This chart shows what we presently anticipate . "THIS IS A MAJOR INFLECTION POINT.

REMEMBER: Financial Repression is at work here and US Bond Yields and Interest Rates MUST be further reduced.

We presently expect the 10 Year US Treasury Bill to eventually break below 1% which supports the potential target shown above.

Sign Up for our FREE Thesis Paper: FINANCIAL REPRESSION

To read more, go to GordonTLong.com

Gordon T Long Publisher & Editor general@GordonTLong.com

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2012 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.