Bundesbank Repatriates Gold From Federal Reserve and France Ahead of Systemic Crisis

Commodities / Gold and Silver 2013 Jan 16, 2013 - 03:46 PM GMTBy: GoldCore

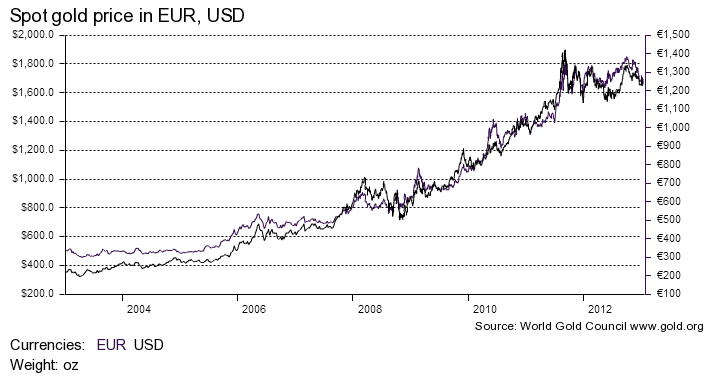

Today’s AM fix was USD 1,679.75, EUR 1,262.78 and GBP 1,047.55 per ounce.

Today’s AM fix was USD 1,679.75, EUR 1,262.78 and GBP 1,047.55 per ounce.

Yesterday’s AM fix was USD 1,681.00, EUR 1,257.67 and GBP 1,045.92 per ounce.

Silver is trading at $31.17/oz, €23.59/oz and £19.78/oz.

Platinum is trading at $1,671.50/oz, palladium at $706.00/oz and rhodium at $1,125/oz.

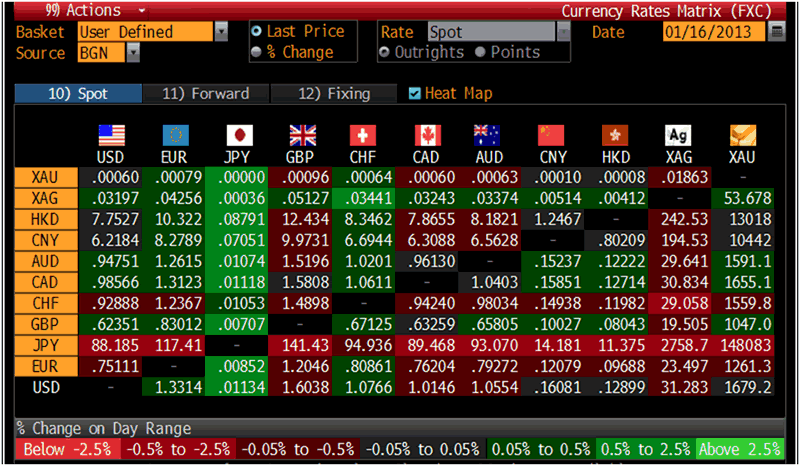

Cross Currency Table – (Bloomberg)

Gold climbed $10.50 or 0.63% in New York yesterday and closed at $1,678.90/oz. Silver surged to a high of $31.382 in Asia before it fell back to $31.02 in London, but it then rose to as high as $31.503 in New York and finished ended with a gain of 1.06%.

Gold was flat and close to a 2 week high it hit in the prior session, while platinum reversed early losses but was also trading sideways.

Yesterday, in a speech that showed him as perhaps the most dovish of the central bank's 19 policymakers, Minneapolis Federal Reserve President Narayana Kocherlakota said the Fed "should provide more monetary accommodation" by targeting a 5.5% unemployment level.

These comments in defiance with his hawkish peers, showed a case for argument that the U.S. central bank's accommodative policies are appropriate and may even need to be eased further.

U.S. American Eagle gold and silver coin sales have been exceptionally strong in January, building on a late 2012 rally as collectors and some store of wealth buyers scramble to purchase newly minted 2013 coins and investors seek safe haven from U.S. economic uncertainty.

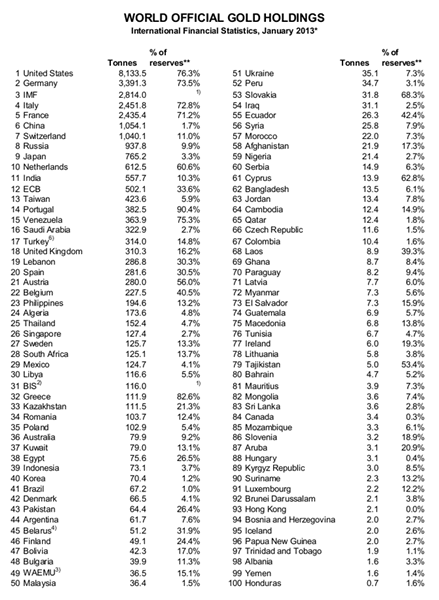

This morning, the Bundesbank presented a new management plan for Germany’s 270,000 gold bars, the world’s second largest gold holdings trailing only the United States.

Germany’s central bank will repatriate part of its $200 billion gold reserves stored in vaults in the Federal Reserve in New York and the Banque de France in Paris. It is believed that the Bundesbank may have repatriated the gold in order to be prepared for a systemic crisis and currency crises.

Germany's central bank plans to retrieve some 1,500 tonnes of gold stored in the vaults of the Federal Reserve as well as its 450 tonnes of gold with the Banque de France.

This is an important development as it shows how gold is reasserting itself as an important monetary asset. This could lead to a further increase in investment demand in the coming months - especially in western markets where investment demand has been tepid at best in recent months.

Storing German gold reserves outside Germany was a legacy of World War II when the allies allowed Germany to have a new currency but took possession of their gold reserves.

Then with the threat of the Soviet Union and East Germany during the Cold War, the Bundesbank was happy to leave their gold reserves in the Federal Reserve, BOE and in Paris. Now a more confident Germany but one which is very concerned about the euro crisis nonetheless wishes to store their gold reserves in Germany.

The move comes about after the exertion of a lot of political pressure by the German people, press and politicians who are concerned about the eurozone debt crisis and continuing debasement of the euro.

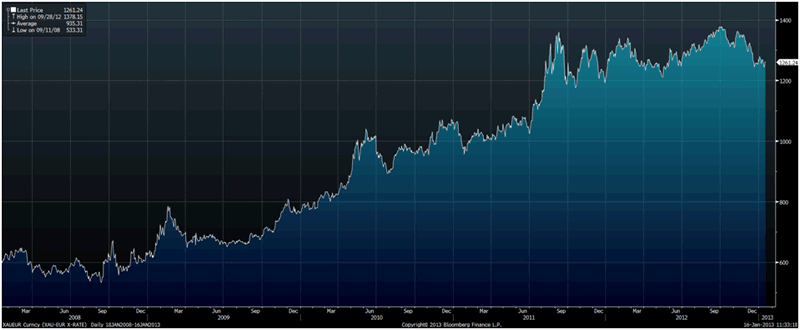

XAU/EUR Exchange Rate, 2008-2013 – (Bloomberg)

Spiegel, a German weekly, reported last year that some in Germany had been campaigning for the repatriation of the country’s gold bars.

Called the “Gold Action” initiative, the campaign warned that there is an acute danger that German gold could be expropriated as a result of the global financial and debt crisis, and activists are concerned that the German government – also the eurozone’s paymaster – could soon be forced to sell its gold to cover the costs of the crisis.

Besides the location of the gold, there were also concerns about the nature of the gold.

The German Court of Auditors told legislators that the gold had "never been verified physically" and ordered the Bundesbank to secure access to the storage sites. It called for repatriation of 150 tons over the next three years to test the quality and weight of the gold bars. It is said that Frankfurt has no register of the numbered gold bars according to The Telegraph.

This suggests that the German gold reserves were not allocated. Ordinarily, central bank monetary reserves are held in an allocated format.

The incident is reminiscent of General De Gaulle’s move in 1968 when he took delivery of French gold reserves from America which hastened an end to the London Gold Pool and to America moving from a fixed gold price of $35/oz and to the 1970’s gold market when gold rose 24 times.

It shows a growing lack of trust in the U.S. Federal Reserve and a lack of trust amongst the central banks themselves. It is likely to lead to a further decline of trust in the U.S. dollar.

Significantly, the development is being picked up very widely in mainstream, non specialist financial press and media who rarely cover gold. Therefore, an entire new audience is realising how central banks increasingly value gold as a monetary reserve.

It is close to going viral on Twitter and on the internet.

Yesterday, PIMCO (@PIMCO) co-founder and the largest bond manager in the world, Bill Gross tweeted:

“Report claims Germany moving gold from NY/Paris back to Frankfurt. Central banks don’t trust each other? “

His tweet was retweeted 276 times and favourited 31 times.

Daily Telegraph News in the UK tweeted (@TelegraphNews )

"Extraordinary breakdown in trust between leading central banks" leads Bundesbank to pull gold from New York and Paris

The Telegraph’s tweet was retweeted 184 times and also favourited 31 times.

In recent years, besides Reuters, Bloomberg, CNBC , the FT and the Telegraph in the UK, gold rarely gets covered in the non specialist financial media such as The Guardian, The Times, BBC, Sky etc and rarely in the tabloid press.

We view this as a contrarian indicator and believe that as gold continues its journey from the fringe to the mainstream in the coming years - it will be covered in all business and financial media as frequently as stocks, the FTSE, the S&P 500 (etc.), are today. You may even see gold prices quoted on the BBC and CNN and Jeremy Paxman and Piers Morgan talking about currency wars and gold.

Finally, the move shows that possession remains nine-tenths of the law and the vital importance of owning physical gold in the safest way possible.

Legendary gold trader Jim Sinclair said the Bundesbank’s move “sends a message about storing gold near you and taking delivery no matter who is holding it.”

He said it is a pivotal event in the gold market and the latest warning for investors that they should keep metal bars under their physical control, rather than relying on paper contracts.

"This sends a message about storing gold near you and taking delivery no matter who is holding it. When France did this years ago it sent panic amongst the U.S. financial leadership. History will look back on this salvo as being the beginning of the end of the U.S .dollar as the reserve currency of choice," he said.

The Bundesbank’s gold repatriation shows the vital importance of either taking possession of physical gold or storing bullion in an allocated format with the strongest, non financial and non banking counter parties in the world. Allocated storage should be sought in locations where there is little risk of expropriation or nationalisation.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.