The Great Rotation Makes Stocks a Generational Buy

Stock-Markets / Stock Markets 2013 Jan 15, 2013 - 11:08 PM GMTBy: Money_Morning

Shah Gilani writes: The greatest investing mistake you'll ever make is the one you may be about to make.

Shah Gilani writes: The greatest investing mistake you'll ever make is the one you may be about to make.

If you're not gearing up to get fully invested in 2013 and reap what will be generational rewards, you have no one to blame but yourself.

This is what you've been waiting for. This is your time. Here's how to do it and why.

We've probably reached the end of a 30-year bond market bull stampede. I was there at the beginning and fondly remember my trading desk gorging itself on fixed income.

Back then we filled our blotters with Ginny Maes, Treasuries and municipals, anything that had a double- digit yield. And back in 1982 there was plenty of income to be had.

But we weren't buying for yield, we were buying for capital appreciation. As interest rates fell our book of bonds got more and more profitable. I played that hand for 30 years.

But it's over. It's too late to get into bonds now.

Even if you got into bonds in the past couple of years and made some money, which I doubt, it's not worth getting in now with yields at record lows.

And if I'm wrong and there's life left in the bond rally, how much lower could rates go? The risk- reward parameters that govern good investments just aren't there.

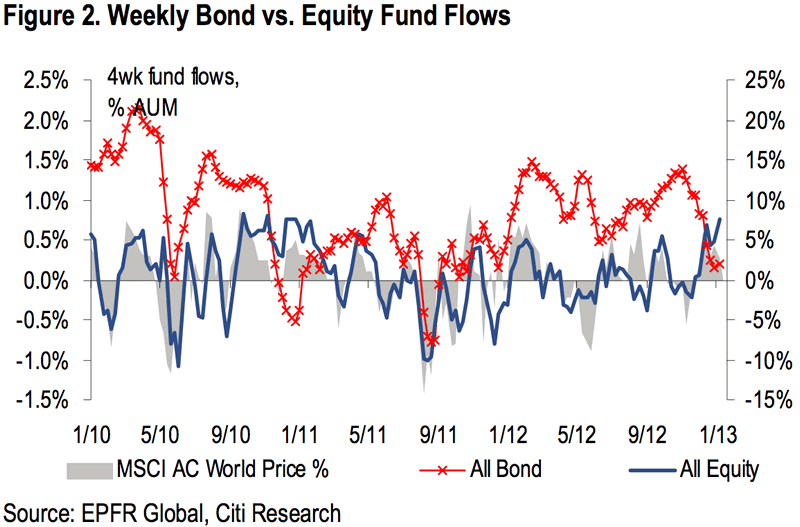

What's likely to happen, and may have already started last week, is being called the "Great Rotation." The Great Rotation is an investment shift out of bonds and into equities.

Last week $22.2 billion flowed into mutual funds and ETFs. That's the second- largest weekly flow on record. Of that total, $8.9 billion flowed into equity mutual funds, which is the most since March of 2000 and the fourth- largest weekly inflow on record.

Is the flow of funds depicted in the chart above the opening salvo in the Great Rotation?

I don't know, but I'm not betting it isn't.

The Bullish Case for Equities

Besides, why not stocks and why not now?

There's more yield available in dividends than there is in bonds. And just like when I was investing for yield back in 1982, there's the potential for capital appreciation in stocks that just doesn't exist in bonds any more.

Corporations have never, in my investing and trading life, been in better shape -- ever.

Since the Great Recession, they are lean from cutting where they had to. Labor costs are well under control and given what may be a stubborn and structurally high unemployment rate, pressure from labor costs are unlikely.

Another reason unemployment is high and corporations have fewer labor pressures is because of rapid advances in technology. Whether it's software programs or robotics, technology is making labor a continuously smaller piece of input costs.

Corporations are diversified. Big corporations in America and household name international corporations across the world are all globally diversified in terms of not only where they sell their products, but where they manufacture them.

Low interest rates have not only allowed corporations to retool their balance sheets, they have allowed them to raise huge amounts of capital for expansion, dividends, rainy day funds, or whatever corporate needs arise.

American nonfinancial corporations are said to be sitting on almost $2 trillion of cash and liquid instruments. But not even the Federal Reserve, which collects such data, really knows.

According to the IRS, which tracks worldwide holdings of U.S. corporations, Fed data underestimates the true amount of corporate cash, which the IRS suggests is three times what the Fed reports.

There are plenty of statistics that show that corporations are in great shape. Investing in the stock market is primarily about the health of the companies you're investing in.

Besides, there are so many "alternatives" when it comes to every industry group; weaker links will always give way to better- performing competitors. And if all the competitors in an industry are struggling, well, there are always other industries!

The basic premise for a bull market is that corporations are in good shape to take advantage of demand. The U.S. economy and the global economy may not be creating significant demand, but don't let that stand in the way of analyzing the shape of the suppliers, who are the corporations. They'll be ready when demand picks up.

With the coming Great Rotation flood of money into stocks, and given corporations' strong competitive positions and robust balance sheets, your getting rich is just a matter of having a plan and getting in.

Going Long the Great Rotation

Here's what you should do.

First, the unknowns are known; so instead of being afraid to invest because of them, invest in spite of them and to make money from them.

So, part one of your plan is to not worry about unknowns, but to plan for them.

Second, while it's sexy trying to hit home runs by finding the next Apple at $2.00, big money isn't made swinging for the fences. Getting rich is about getting on base.

These days, getting on base is a lot easier than it ever has been.

It's easy because these days you can invest in broad spectrums of the market, in specific industries, not just specific stocks. You can invest in countries, commodities, gold, currencies, mortgages -- you name it and there's an ETF or some other vehicle available to you.

The trick is simple, invest in things and asset classes you understand something about and watch because you are interested in them. If you are interested in them you probably know more than enough to make sound buy- and- sell decisions.

Now, here's where the first part, protect yourself from the unknowns, and the second part, invest in what you know and understand, come together. You can invest in bad things happening, and make money if they happen.

There's no reason to not bet against China if you think China is going to fade. There's no reason to not bet on gold if you think gold is going up, or mortgages, or coffee, or oil for that matter. You can invest in anything going in any direction.

And because you can hedge, or actually bet on the unknowns globally or locally, you shouldn't be afraid of the market. You should embrace it.

Stocks, meaning corporations, are in great shape. So, it's a good time to do a little homework and get into some of the companies and asset classes you like.

You don't have to be a rocket scientist. But you have to be in it to win it.

Stocks, and I'm speaking about stocks across the globe, are probably going to face another quarter, maybe two, of waffling over the U.S. debt ceiling, and China, and Europe, and everything else they've been fretting about. B ut still, they rose last year in the face of the same fears.

It's time to get in, slowly at first and with judicious use of stop-loss orders. But, it's time to get in and build a huge portfolio over the next year, because 2013 is going to be the beginning of a generational opportunity.

Source :http://moneymorning.com/2013/01/15/the-great-rotation-makes-stocks-a-generational-buy/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.