Technical Traders Charts for Dollar, Stocks, Gold, Oil and Bonds

Stock-Markets / Financial Markets 2013 Jan 15, 2013 - 11:02 PM GMTBy: Chris_Vermeulen

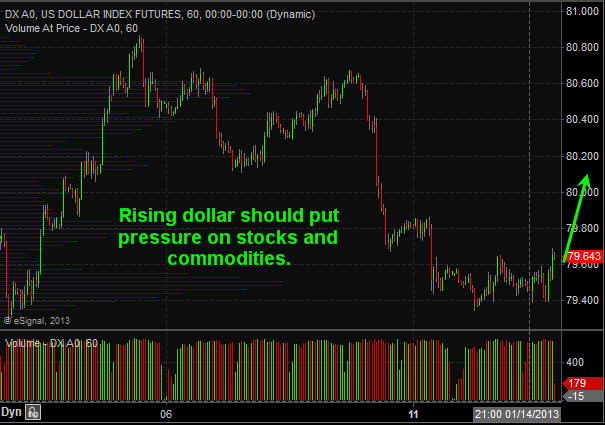

Yesterday’s trading session played out exactly as posted in the morning chart update. Today will be a different story from the looks of it as the dollar index looks to be putting in a bottom and that has the SP500 down 0.40% this morning. It may trigger our first entry point to let long stocks today.

Yesterday’s trading session played out exactly as posted in the morning chart update. Today will be a different story from the looks of it as the dollar index looks to be putting in a bottom and that has the SP500 down 0.40% this morning. It may trigger our first entry point to let long stocks today.

Dollar Index:

SP500 Futures:

Natural gas has been holding up well the past two sessions and looks as though it is forming a cup and handle pattern at the $3.40 level. The first upside target would be $3.50 then $3.60.

Crude oil has been trading sideways/higher the past week but the on balance volume clearly shows sellers are unloading contracts at the $94 level. Yesterday I talked about how crude oil was walking a fine line up its support trend line and once that breaks look out! Price is holding up but be aware it could drop fast and hard any day here.

Gold and silver traded higher yesterday while the miners lagged. This is not a bullish sign for the metals. The trend remains down and we need a clean break before getting long.

Bonds continue to their march higher as expected and this type of price action points to lower stock prices. This morning stocks are set to gap sharply lower confirming money is rolling back into the safe haven (bonds) for protection from falling share prices.

If you would like to keep up to date on market trends and trade ideas be sure to join my newsletter at http://www.thegoldandoilguy.com

By Chris Vermeulen

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.