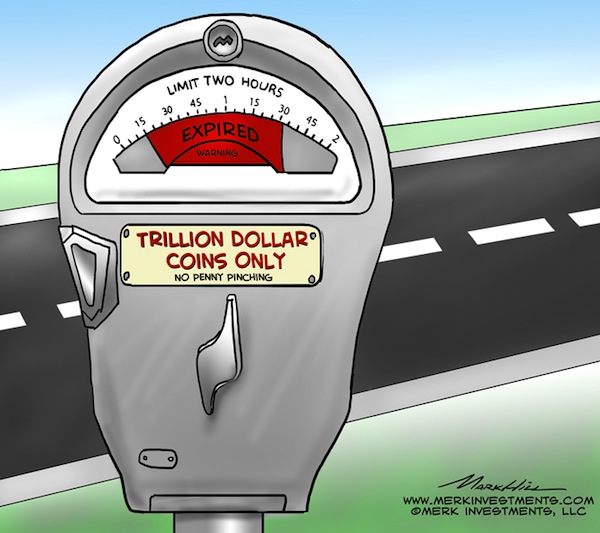

U.S. Trillion Dollar Battle: Print, Baby, Print!

Politics / Fiat Currency Jan 15, 2013 - 10:13 AM GMTBy: Axel_Merk

While the introduction of a trillion-dollar coin has been shrugged off as nonsense, there are plenty of nonsensical concepts employed in our monetary system. Here we’ll shed light on a few of them.

While the introduction of a trillion-dollar coin has been shrugged off as nonsense, there are plenty of nonsensical concepts employed in our monetary system. Here we’ll shed light on a few of them.

Governments - or their central banks - can print a $100 bill. The value of such a piece of paper is worth exactly as much as the supply and demand of a currency dictates. Dollar bills are legal tender for payment of debt, but if someone does not like that the $100 bill is not backed by anything, then anyone is free to decline a $100 bill in exchange for services, and barter instead.

The problem arises when the government decrees that something is worth a certain amount, unless it becomes the basis of the government’s entire framework of reference, as in a gold standard. In my humble opinion, no one, let alone a government can precisely value anything. The value of goods, services, even debt, is in the eye of the beholder, and varies based on supply and demand:

•Consumers buy goods or services because they believe they are “good value;” in other words, they only exchange money for goods in a deal where they see themselves benefiting. Consumers should not blame companies for “over-priced” goods or services; they should blame themselves for paying such prices.

•The perception of what is good value varies from person to person. What may be a must-have $80 a month cable TV subscription, may be a waste to others. It also varies over time, as some may deem a vacation well worth the money during good times, but rather stay at homes when times are tough.

•When monopolies or governments impose prices, distortions, such as supply disruptions can occur. Or conversely, when the government keeps the price of fuel artificially low, it can significantly erode the government’s ability to provide other services, possibly even bankrupt it.

The market currently prices platinum at over $1,600 a troy ounce. If the Treasury were to decree that a specially minted coin is worth $1,000,000,000,000 instead, no rational person would want to buy it. The argument is that the Federal Reserve could be coerced into accepting it at face value, crediting the Treasury’s account at the Fed with $1 trillion for it to spend. In our view, such a move, if it were upheld in the courts, would:

•Highlight the not so well known fact that the Federal Reserve (Fed) does not mark its holdings to market. The lack of mark-to-market accounting leading up to the financial crisis is a key reason why the financial system was brought to its knees in 2008. A major loss at the Federal Reserve, such as writing down a $1 trillion coin to $1,600 may not be too worrisome for those that know that even a negative net worth won’t render a central bank inoperative. However, losses at the Fed would deprive the Treasury of what has become an annual transfer of almost $90 billion in “profits” (see MerkInsight Hidden Treasury Risks?).

•Dilute the value of the dollar. If the Treasury whips up an additional trillion to spend through trickery, odds are that a trillion would no longer be worth what it used to be.

But wait, $1 trillion is already not worth what it used to be, and a $1 trillion coin has not even been minted. And I’m not talking about our grandparents: who had ever heard of trillion dollar deficits before the financial crisis? The Federal Reserve holds just under $3 trillion in assets, up by over $2 trillion since early 2008. When the Federal Reserve engages in “quantitative easing”, QE, QE1, QE2, QE3, QEn or however one wants to call it, the Fed buys securities (mortgage-backed securities, government bonds) from large banks, then credits such banks’ accounts at the Fed. Such credit is done through the use of a keyboard, creating money literally out of thin air. Even Fed Chair Bernanke refers to this process as printing money, even if banks have not deployed most of the money they have received to extend loans. However, the more money the Fed prints, the more debt securities it buys, the greater its income; it’s that argument that has allowed Bernanke to claim that his operations have been “profitable,” neglecting to state that such money printing may pose significant risks to the purchasing power of the dollar.

Note that we don’t need the Fed. Amongst others:

•If the Treasury wants to issue debt, it can do so without the Fed.

•If the Treasury wants to manage the maturity of the outstanding government debt portfolio, it can do so without the Fed’s Operation Twist.

Congress and the Administration love the Fed because it is an off-balance sheet entity for the government with special features; the Fed has ‘unlimited resources’ (it can print its own money); and the Fed can have a negative net worth without defaulting.

The way a trillion dollar coin could work is if not just one, but all platinum coins of the same fine ounce content (say one troy ounce) were decreed to be worth $1 trillion. It would be the re-introduction of a gold, well, platinum standard, as it would link the value of a precious metal to the value of the currency. The government would quite likely want to punish any speculators that are front-running the idea of valuing platinum at $1 trillion, possibly even outlawing private ownership. But it would put the value into context and anyone could buy a substitute. Pricing of all goods and services would adjust to reflect the new value of $1 trillion for a troy ounce of platinum. In plain English, such a move would substantially move up the price level.

We deem the re-introduction of a precious metals standard to be rather unlikely, precisely because it takes away the power of Congress to spend: it could only spend money if it got hold of more platinum. Unless, of course, Congress realizes that it may get away with not backing all of the currency with platinum or resets the price of a platinum coin yet again. Soon enough, the “platinum window” would be closed again, just as Richard Nixon closed the gold window in 1971. Let’s call it a coincidence Nixon would have turned 100 years old this year, just as the Federal Reserve is celebrating its 100th anniversary.

While most agree that a $1 trillion platinum coin is a silly idea, few think that a $100 bill is also absurd. There are indeed key differences:

•$100 bills are all one and the same. Well, almost. In some developing countries, newer bills are worth more than older ones (because of counterfeit bills in circulation).

•A platinum coin has intrinsic value: its fine ounce content of platinum. In contrast, the $100 bill is worth the paper it is printed on.

To be precise, a $100 bill is a Federal Reserve Note:

•The holder of a $100 bill may deposit such bill into his or her account.

•The bank can deposit the $100 bill at the Fed. In turn, the Fed will credit the bank with $100 in checking account.

•The bank can withdraw the deposit of $100 from the Fed.

•The bank account holder can withdraw $100 from the bank yet again.

Importantly, the $100 is always an obligation: an obligation of the bank, the government (through FDIC insurance in case of default of the bank) and the Fed (currency in circulation appears on the liability side of the Fed’s balance sheet). Most currency is not issued in paper, but in electronic form. Banks receiving a $100 electronic credit can, through the rules of fractional reserve banking, lend out a multiple of such deposits. Because of this, currency always carries counter-party risk. By regulation, if the counter-party is the Federal Reserve or the Treasury, it is considered to be risk-free. But it’s still a debt security. Moreover, the rating agency Standard & Poor’s does not consider US debt risk-free, having downgraded it because of the dysfunctional political process in addressing the long-term sustainability of U.S. deficits.

In contrast, a coin in itself does not have counter-party risk. It’s a coin with intrinsic value. If a government decreed a value onto that coin, there’s a risk that such decree may change or be undermined.

Precious metals coins may be considered barbarous relics, but at least they do not carry counterparty risk. Indeed, we like the fact that gold in particular has comparatively little industrial application, making it a pure play on monetary policy.

So what is an investor to do? In our opinion, investors must gauge for themselves what something is worth, rather than rely on a government. That applies to the dollar as much as it does to a platinum coin or any security. Notably, forget about the notion that something is risk-free. Those trusting their governments to preserve the purchasing power of their savings will be the losers. Those throwing out the risk free component in their asset allocation models may well come out with fewer bruises.

And while the gold standard has some admirable features, democracies tend to favor spending over balancing books. Over the past 100 years, we have moved further and further away from the gold standard. While a collapse of the fiat monetary system might temporarily get us back on a gold standard, don’t trust a government to take care of you. In practice, this means that investors need to create their personal frame of reference as to how to deploy investments; rational investors are unlikely to mint a personal $1 trillion coin, realizing that no one would pay $1 trillion for it. It also means there is no single safe haven during times of crisis. The fact that precious metals have no counter-party risk is an attractive feature, but don’t kid yourself: if your daily expenses are in U.S. dollar, the value of your purchasing power will fluctuate. Investors must be able to sleep at night with their investments; if not, consider reducing your exposure.

Please sign up for our Webinar on Tuesday, January 15, 2013, that focuses on our outlook for this year. Please also sign up for our newsletter to be informed as we discuss global dynamics and their impact on gold and currencies.

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Rick Reece is a Financial Analyst at Merk Investments and a member of the portfolio management

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.