Outlook for the US Economy in 2013

Economics / US Economy Jan 11, 2013 - 12:14 PM GMTBy: Brian_Bloom

POTUS may have made a serious tactical error, in "engineering" the House fiscal cliff vote. US Public Debt limit negotiations loom. The error can be retrieved if he backs down and shows humility in negotiations. If he continues with his arrogant approach, the economy (and the gold price) might head south.

POTUS may have made a serious tactical error, in "engineering" the House fiscal cliff vote. US Public Debt limit negotiations loom. The error can be retrieved if he backs down and shows humility in negotiations. If he continues with his arrogant approach, the economy (and the gold price) might head south.

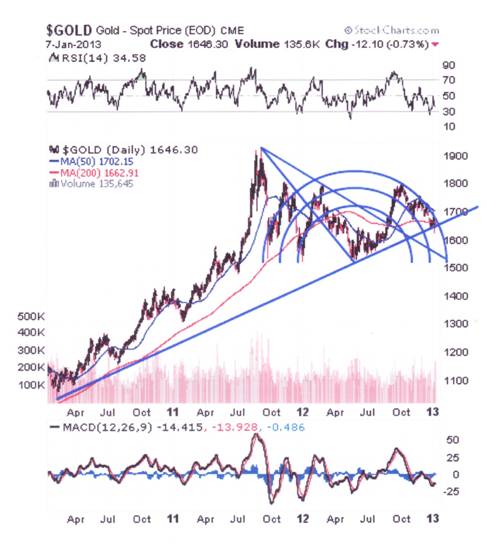

The chart below - courtesy Stockcharts.com – shows very clearly that the gold price has arrived at yet another decision point.

Chart #1 – Gold Price with Fibonacci trend lines

It would be very easy to shoot from the hip here and argue that, therefore, the gold price is about to break upwards – because “everybody” knows that we are facing an era of inflation.

In September 2012, the Fed announced QE3, which entailed buying $40 billion in mortgage-backed securities each month.

Then, on December 12th 2012, the following quote appeared in the media: “As expected, the Fed replaced the existing Operation Twist program due to expire at the end of the year with a fresh round of Treasury purchases that will increase its balance sheet. It committed to monthly purchases of $45 billion in Treasurys in addition to the $40 billion per month in mortgage-backed bonds it started buying in September.” (Source: http://www.cnbc.com/id/100305305/Stocks_Wipe_Out_Gains_to_End_Flat_After_Bernanke_Speech )

The problem with the above is that it is already in the public domain and the market has not (yet?) reacted by buying gold as a hedge against the “obvious” inflation that will result. Why not?

In this analyst’s view, one explanation lies in the possibility that, during the Fiscal Cliff negotiations, the game changed from one of economics to one of politics. Arguably, President Obama was too clever for his own good. By “cornering” the Republicans into voting for a piece of legislation that originated in the Senate (which is not how laws should evolve), he has alienated many opposition politicians with whom he will need to work in the future.

Obstacles that will need to be overcome – from his perspective – are:

- Raising the debt ceiling

- Agreeing to expenditure cuts within the agreed two months after the passage of the Fiscal Cliff legislation

- The “one-on-one” style of negotiation with which he has had so much success will not happen again – as far as Speaker Boehner is concerned.

Quote: “Speaker John Boehner (R-Ohio) is signaling that at least one thing will change about his leadership during the 113th Congress: he’s telling Republicans he is done with private, one-on-one negotiations with President Obama.”

Source: http://thehill.com/homenews/house/275295-boehner-tells-gop-hes-done-with-one-on-one-obama-talks#ixzz2HQDf8InD

Historically, Mr Obama’s style has been to sidestep “process”. Whilst some have accused him of using “Executive Orders” (EOs) to ram his ideas through, the number of these EOs has been grossly exaggerated on the web. In fact, the purpose of an Executive Order is operational as opposed to strategic in nature. Quote: “Executive orders are official documents, numbered consecutively, through which the President of the United States manages the operations of the Federal Government”. (See: http://www.archives.gov/federal-register/executive-orders/disposition.html ).

Further, the number of EOs issued by President Obama has not been significantly different from those of his predecessors. By way of illustration, below is a list of the numbers of EOs issued by presidents George W. Bush and Obama

Table 1: Executive Orders issued by George W Bush

- 2009 - E.O. 13484 - E.O. 13488 (5 Executive orders issued)

- 2008 - E.O. 13454 - E.O. 13483 (30 Executive orders issued)

- 2007 - E.O. 13422 - E.O. 13453 (32 Executive orders issued)

- 2006 - E.O. 13395 - E.O. 13421 (27 Executive orders issued)

- 2005 - E.O. 13369 - E.O. 13394 (26 Executive orders issued)

- 2004 - E.O. 13324 - E.O. 13368 (45 Executive orders issued)

- 2003 - E.O. 13283 - E.O. 13323 (41 Executive orders issued)

- 2002 - E.O. 13252 - E.O. 13282 (31 Executive orders issued)

- 2001 - E.O. 13198 - E.O. 13251 (54 Executive orders issued)

Table 2: Executive Orders signed by Barack Obama

- 2009 - E.O. 13489 - E.O. 13527 (39 Executive orders issued)

- 2010 - E.O. 13528 - E.O. 13562 (35 Executive orders issued)

- 2011 - E.O. 13563 - E.O. 13596 (34 Executive orders issued)

- 2012 - E.O. 13597 - E.O. 13632 (36 Executive orders issued

Having said this, one serious issue flows from president Obama’s predisposition to regard Congress as an obstacle to the execution of “his” plans. Here are some quotes from various recent speeches he has made:

December 31st 2012: "Republicans in Congress said they would never agree to raise tax rates on the wealthiest Americans," he [Obama] said, laying the blame on Republicans.” (source: http://www.weeklystandard.com/blogs/obama-hits-congress-big-deal-too-much-hope-time_692467.html )

December 28th 2012: Obama took Congress to task for stalling on negotiations in a manner that is reminiscent of the 2011 stalemate that brought the nation close to the brink of defaulting on its debt and that hurt the economic recovery.

"This is déjà vu all over again," he said.

"America wonders why it is that in this town for some reason you can't get stuff done in an organized timetable," he added. "Well, we're now at the last minute." (Source: http://www.reuters.com/article/2012/12/28/usa-fiscal-obama-congress-idUSL1E8NS7DN20121228 )

October 20th 2012: “They [Congress] banded together and prevented millions of Americans — including many of you listening today — from saving $3,000 a year. That’s money that could have gone back into the value of your home, or your kid’s college savings account. That’s money that could have gone into your local businesses, so they could hire and create more jobs in your town.

But Republicans in Congress still won’t let that happen. And that’s only held back the economy, when we should be doing everything we can to accelerate our economic engine.”

Source: http://news.investors.com/politics-andrew-malcolm/102012-630200-obama-weekly-remarks-criticizes-congress-for-not-passing-mortgage-credit-bill.htm#ixzz2HSdtOFyf

October 24th, 2012: Obama Blames Congress for Defense Sequester (http://heritageaction.com/2012/10/obama-blames-congress-defense-sequester/ )

October 19th 2012: Obama Blames Congress For Not Closing Guantanamo Bay

September 29th 2012: Obama blames Congress for slow housing recovery (http://blogs.suntimes.com/sweet/2012/09/obama_blames_congress_for_slow.html )

August 20th 2012: A vacationing U.S. President Barack Obama accused Congress on Saturday of holding back the U.S. economic recovery by blocking "common sense" measures he said would create jobs and help growth. …. “"The only thing preventing us from passing these bills is the refusal by some in Congress to put country ahead of party. That's the problem right now. That's what's holding this country back,"

Interim Conclusion #1

There is a clear pattern of evidence: President Obama is seriously frustrated by the fact that a majority Republican Congress – elected according to Due Process by the electorate of the US – has steadfastly refused to just roll over and comply with his wishes.

Analyst comment:

The reader should take note of the words “elected according to Due Process by the electorate of the US.”

The point of all the above can probably best expressed by the following YouTube of “John McCain blasting President Obama for his antagonistic, gloating Press remarks earlier today on the “Fiscal Cliff” negotiations. McCain wondered, based on Obama’s actions, whether he really wants a deal to get done.” (Source: http://beforeitsnews.com/tea-party/2012/12/sen-john-mccain-blasts-president-obamas-antagonistic-laughing-cheering-applauding-press-conference-on-fiscal-cliff-video-123112-2471232.html )

If one listens to the actual press remarks which so upset Senator McCain (which the reader can do at http://freedomslighthouse.net/2012/12/31/a-gloating-president-obama-speaks-on-deal-within-sight-regarding-fiscal-cliff-video-123112/ ) those remarks sound very sensible and reasonable at face value: No one wants old folks and students and/or any middle class voter to be hurt by reckless tax increases and/or spending cuts. Unfortunately, all this begs the question: So how are you going to pay for all these nice things you want to do, President Obama?

Well, he did make reference to a “balanced approach” but what do those words really mean? How does one take a “balanced approach” to amputating the gangrenous foot of a chain smoker?

The answer to this question is that one relies on “Due Process”. The duly elected President of the US needs to understand that he has a mandate to lead the country, not to govern it. Government is of the people and by the people and the House of Representatives has been elected to represent the wishes of the majority of voters just as the president has been elected to represent the wishes of the majority of voters. Perhaps the reason the country has a Democrat President and a Republican dominated House is that the majority of the American people do not want radical change and they also do not want a dictatorship. Perhaps they want the “Due Process” that President Obama seems so keen to sidestep.

So, in this context, Speaker Boehner’s decision to cease one-on-one negotiations with President Obama may be highly significant. What it signals is that the Republicans are going to insist on Due Process, regardless of how mocking and disparaging King Barack attempts to be in his public utterances. In short: In snookering Congress into voting for the Fiscal Cliff band-aid, he may well have used up all his remaining goodwill. Now, in the view of this analyst, he can expect to have to go 13 rounds in a bloody, bare-knuckled fight with an antagonistic Congress. It certainly looks to this analyst as if the political game has shifted seriously against the US president.

In context of a gold price that is breathlessly awaiting the outcome of the inflation/deflation battle, has anything else changed? The short answer is “yes”, and that change is also set to hamper the President in his aspirations to be a benevolent despot (Note: For the meaning of this term, see http://www.britannica.com/EBchecked/topic/931000/enlightened-despotism )

At the most recent Fed meeting in December 2012, the decision to continue with Quantitative Easing was not unanimous. Quote: "A number of participants indicated that additional asset purchases would likely be appropriate next year after the conclusion of the maturity extension program in order to achieve a substantial improvement in the labor market," the minutes said.

Still, support at the Fed for more QE is not unanimous.

Charles Plosser, the head of the Fed's Philadelphia branch and a regular critic of easy money policies, argues that QE and other efforts have not had the impact intended on growth and jobs, and are raising the risk of a return to high inflation.

Arguing alongside him has been FOMC member Jeffrey Lacker, head of the Richmond Fed. (Source: http://www.interaksyon.com/business/50069/fed-likely-to-expand-qe-as-twist-ends-cliff-looms )

Analyst Comment: The evidence suggests that Ben Bernanke will not have a free hand to continue “blindly” with Quantitative Easing to infinity. Other members of the FOMC are now beginning to question whether a continuation of this approach will turn out to be counterproductive.

Interim Conclusion #3

The evidence suggests that there are building downward pressures on monetary inflation. The core objective of a “balanced” approach by the duly elected president of the US and the duly elected Congress of the US will be to “balance” the budget. Significant and tangible movement in that direction will very likely be the price that President Obama will have to pay to gain Congress’s permission to raise the debt ceiling, regardless of his pompously confident posturing. Further, if a more cautious approach to the future is being aired by some members of the FOMC, it seems likely that the Fed’s appetite to flood the financial markets with cash will soon begin to abate.

This interim conclusion also reflects the view of a large Australian Financial Institution, as expressed in its December 2012 newsletter. Quote: “In 2013 I expect we’re likely to see the culmination of this changing role of central banks, with their focus shifting further away from inflation to explicit nominal growth targeting. This process is already well underway in the US and is also highly likely in the UK (See new BoE Governor to be Carney’s recent speech ) and Japan.” (BT Investment Management Newsletter edited by Vimal Gore, December 2012)

Of course, the above begs another question: “Will these various downward pressures be deflationary – in which case, the gold price may well fall sharply?”

The answer to this question will revolve around how robust the US economic turnaround will be. The evidence suggests that the US economy may have bottomed – for the time being – and the question arises as to whether this economic growth momentum can be maintained or whether it will be stifled. In turn, this will be dependent on President Obama’s propensity to start behaving like a responsible adult rather than continually playing to an admiring and adoring gallery of hopeful (and largely economically ignorant) followers.

Of great interest – and in fairness to President Obama – an Executive Order that he signed on April 13th, 2012 was EO 13605, entitled: “Supporting Safe and Responsible Development of Unconventional Domestic Natural Gas Resources” (See http://www.gpo.gov/fdsys/pkg/FR-2012-04-17/pdf/2012-9473.pdf ). The membership of the committee that was established under this EO seems to be very sensibly representative of the various interest groups including business, technology, environment, defence, health, capital markets and economists. On balance, it seems like a very constructive action that was taken by the White House – for which credit should be given - and, according to informal comments that have been made to this analyst by representatives of Financial Institutional thinking in Australia, it seems to be working. The US economy, according to them, is gathering a notable head of steam (unlike Europe which remains a basket case).

Nevertheless, the chart below (of the S&P Global 1200 Industrials, source http://www.google.com/finance?cid=10264130 ) shows that it, too, is at a cross roads:

Chart #2 – Global S&P 1200 Industrial Index

Note how the index appears to be peeping up through the downward pointing trend line.

If this breaks up, will it be a sign that inflation is rearing its head again?

In this analyst’s view, the answer is “no” – because of the patterns that are emerging on the US Treasury yield charts. The 3% X 3 box reversal chart below (courtesy stockcharts.com) has given one buy signal and may be on the verge of giving a second one if the yield should rise above 3.196% (It is currently 3.071%). A similar chart (not shown) of the ten year yield has already given this second buy signal, which implies that the markets are anticipating further economic improvement.

Chart #3 – 3% X 3 box reversal Point & Figure chart of the 30 year US T-Bond yield

Interim Conclusion #4

The financial markets seem to be functioning as expected – which implies that “sanity” is returning to the markets. Any upward pressure on inflation will be offset by rising interest rates. Whilst this will serve as a speed governor of the economy, it seems likely that the US economy will experience modest growth in 2013 and beyond.

Overall Conclusion

Provided President Obama brings under control the psychopathic behaviour that he has been evidencing in recent months, and provided a “balanced” outcome to the negotiations between Democrats and Republicans can be achieved, the US economy will likely grow modestly. This will likely lead to a sideways movement of the gold price, which will continue to bounce in a trading range between $1560 and $1800 an ounce. However, if the political testosterone flows too freely, and if President Obama continues to behave in a manner that is unbefitting the leader of the most significant democracy on the planet, then the $1109 price target for the gold price remains eminently possible because, if debt ceiling talks break down, there will be a credit crunch and an economic implosion followed by serious price deflation.

Analyst Comment

Given the economic chaos in Europe and the political chaos in the Middle East, it is quite clear that yesterday’s thought paradigms will not be appropriate in tomorrow’s world. Further, it should never be forgotten that China’s economic statistics are largely contrived by a central planning political organisation that has been using (unnecessary) Real Estate development to drive the Chinese economy. As at March 2011, according to the documentary entitled “China’s Ghost Cities and Malls” that can be accessed via my website at http://www.beyondneanderthal.com/research-links/economicsfinance/ there were 64 million unoccupied apartments in ghost cities across China. The internet babble about how China is positioning to take over the entire planet may be more hysterical than real. Of course, if yesterday’s thought paradigms will no longer be appropriate, then the obvious question is: What will tomorrow’s thought paradigms look like? Attempting to answer that particular question was one of the objectives of my two factional novels, which can be ordered via my website.

Author, Beyond Neanderthal and The Last Finesse

Beyond Neanderthal and The Last Finesse are now available to purchase in e-book format, at under US$10 a copy, via almost 60 web based book retailers across the globe. In addition to Kindle, the entertaining, easy-to-read fact based adventure novels may also be downloaded on Kindle for PC, iPhone, iPod Touch, Blackberry, Nook, iPad and Adobe Digital Editions. Together, these two books offer a holistic right brain/left brain view of the current human condition, and of possibilities for a more positive future for humanity.

Copyright © 2013 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.