Economic Collapse!A Leading Indicator Of Better Times To Come

Economics / Global Economy Jan 10, 2013 - 04:00 AM GMTBy: Darryl_R_Schoon

It’s going to get better; but, first, it’s going to get worse

It’s going to get better; but, first, it’s going to get worse

Time of the Vulture, 3rd ed. 2012

When I presented Time of The Vulture: How to Survive the Crisis and Prosper in the Process to the Positive Deviant Network in March 2007, the economic collapse hadn’t yet happened. The next year, it did.

At the time, I suggested those in attendance shed debt, sell their homes and buy gold. Then, the US real estate market was functioning without direct government aid, gold was $650 per ounce and the financial system was stable.

Those days are gone and are never coming back. The imbalance between credit and debt that occurred during the Great Depression is now back; but, today, the à la 1930s massive deflationary collapse will be accompanied by monetary disorder on a cataclysmic scale.

In August 2008, I wrote about the monetary component of the coming collapse in my article, The Four Tires of the Apocalypse:

The euro, the yuan, the yen, and the dollar—the four major fiat currencies—are The Four Tires Of The Apocalypse; and although the economy’s engine, the credit markets, have seized up and are receiving most of the attention, somebody should take a look at the tires.

The mechanics, the central bankers, are instead focused only on the engine. Their solution again proves that good mechanics are hard to find. Like hacks at the corner garage, they’re pouring more credit into an already flooded engine, a sure sign they don’t know what they’re doing.

They’re not even looking at the tires. They should because the tires are fiat made of paper. The front tires are the Japanese yen and the Chinese yuan. The rear two are the euro and the US dollar; and it’s the two rear tires that now pose the greatest threat, the driver’s side rear, the US dollar, in particular—and the spare in the trunk, the British pound has a leak.

Of the four, the Chinese yuan is the newest, which in credit-driven economies is a plus, as usage in [debt-based] economies equals less tread and more debt. Nonetheless, the Chinese yuan is not capable of carrying more than its present load although it is presently holding its own.

The other front tire, the Japanese yen, unlike the Chinese yuan, is well-worn and its tread is almost gone. Its debt load is enormous (the highest ratio of debt to GDP of all major economies) while its pressure, sic interest rate, is the lowest of all, incapable of handling more.

Currently at only 0.5 % because of an almost fatal blowout in 1990, the Japanese yen still hasn’t yet recovered—that the tire is still in service after its severe blowout is in itself something of a miracle.

But the two rear tires, the euro and the US dollar, are the source of our future trouble as they are particularly vulnerable to the continuing collapse of credit markets. The euro and dollar, like all fiat currencies, are dependent on the strength of their underlying economies, economies addicted to credit from increasingly insolvent banks, banks which are in far more trouble than presently believed.

Like someone who has HIV and has only confessed to having the clap, the money-center banks in Europe and the US are holding assets both on and off their balance sheets that are virtually worthless, with actual losses totaling $1.6 trillion, four times what the banks have yet admitted; and because the value of fiat currencies are a function of their economies, the collapse of the US dollar and euro may be ahead…

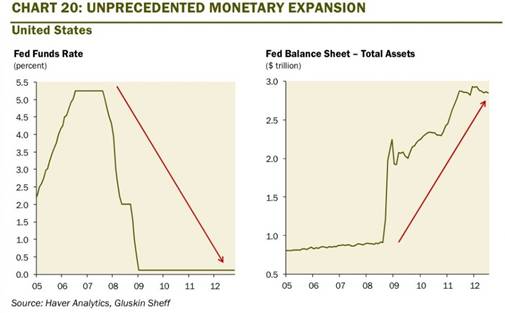

Today in 2013, the focus of the mechanics, i.e. central bankers, is still on the engine which despite trillions of dollars of credit is still in danger of completely seizing-up; and, although the bankers’ solution of even more credit(e.g. QE1, QE2, QE3, etc.) has failed to restore the automobile’s momentum, the failure to do so hasn’t stopped the mechanics’ attempts to add yet more credit to the already flooded engine.

Central banks have the money—after all, they print the coupons that pass as such—to hire academia’s best and brightest; but even their well-paid hirelings cannot solve what cannot be solved. When a paradigm shift occurs, what once worked no longer does. There are no solutions. End of paradigm. End of story.

A PARADIGM SHIFT IS IN PROGRESS

The inability to revive the bankers’ credit and debt-based economy is a sign that a paradigm shift is underway. Economists today believe the global economy is experiencing a series of exogenous shocks, e.g. the collapse of the US real estate bubble, the collapse of financial markets and investment banks in 2008 and the sovereign debt crisis in 2010, etc.; but such shocks appear to be exogenous only because economists are viewing the shocks from within the current paradigm.

The increasingly serious shocks are not exogenous. They are the result of increasing internal systemic instability, an indication that a fundamental paradigm shift is occurring; and, when paradigms shifts occur, the question is not how the paradigm can be saved—the question is when and how it will end.

Today, central bankers are unable to control markets just as economists are unable to explain them. This is characteristic of what Thomas Kuhn called a paradigm change. In The Structure of Scientific Revolutions, Kuhn’s uniquely insightful academic monograph published in 1962, Kuhn introduced the concept of paradigm change into the general lexicon.

Paradigm changes.. result from the invention of new theories brought about by the failure of existing theory to solve the problems defined by that theory. This failure is acknowledged as a crisis by the scientific community.

http://des.emory.edu/mfp/Kuhn.html

SYSTEMIC INSTABILITY & PARADIGM CHANGE

The present financial crisis is caused by a systemic failure of credit and debt-based economies. The maturation of the modern credit economy has led to such levels of debt that additional credit can no longer induce sufficient growth to service and/or retire previous debt.

This is in keeping with Hyman Minsky’s financial instability hypothesis; and, because the modern banking system itself is the cause of the current instability with apparently exogenous forces merely exacerbating systemic weaknesses, efforts by central bankers to respond to these forces will inevitably prove inadequate.

The balance between credit and debt, when disrupted in modern economies, fails to produce adequate growth; and efforts of central bankers in post-peak modern economies to induce the necessary growth results only in sequential asset bubbles and the continuing debasement of currencies.

Credit-based capitalist economies need to constantly expand in order to deal with constantly expanding levels of compounding debt; and when central bankers are no longer able to induce sufficient expansion, economies collapse as debt levels become unsustainable.

That this is now occurring comes as a surprise to modern economists who correlated the previous extraordinary success of credit-based economies with infinite longevity. Economic historian David Hackett Fisher provides evidence to the contrary, that no era lasts forever; that all periods of social, cultural and economic equilibrium end in waves of rising prices resulting in economic collapse. The present era is no exception; and that we have forgotten history does not mean we are immune to its reach.

Professor David Hackett Fisher, author of The Great Wave: Price Revolutions and the Rhythm of History, observed that recurring price-revolutions, i.e. waves of rising prices, appear throughout history resulting in the collapse of existing eras, e.g. the Middle Ages, the Renaissance, the Enlightenment, etc.

According to Professor Fisher, the current price-revolution will end The Era of Victorian Equilibrium, i.e. the era of modern banking/capitalism; for modern banking/capitalism was responsible for England’s extraordinary power and wealth during that period.

Capitalism, an inherently unstable system of vast potential, has played a major role in world events for over two centuries. Today, however, capitalism is in disarray; for we are approaching the culmination of another great wave of rising prices which will bring capitalism’s two-centuries-in-the-sun to a devastating close.

The present wave shares characteristics with all price-revolutions. The primary characteristic is rising prices and the present wave will be no exception. In each of the four previous price-revolutions since the 12th century, Professor Fisher noted:

..Food and fuel led the upward movement. Manufactured goods and services lagged behind. These patterns indicated that the prime mover was excess aggregate demand, generated by an acceleration of population growth, or by rising living standards, or both.

Eventually, prices went higher, and became increasingly unstable. They began to surge and decline in movements of increasing volatility. Severe price-shocks were felt in commodity movements. The money supply was alternately expanded and contracted. Financial markets became unstable. Government spending grew faster than revenue, and public debt increased at a rapid rate. In every price-revolution, the strongest nation-states suffered severely from fiscal stresses: Spain in the 16th century, France in the 18th century, and the United States in the 20th century.

…Wages, which had at first kept up with prices, now lagged behind. Returns to labor declined while returns to land and capital increased. The rich grew richer. Inequalities of wealth and income increased. So did hunger, homelessness, crime, violence, drink, drugs, and family disruption.

pp. 237-238, David Hackett Fisher, The Great Wave: Price Revolutions and the Rhythm of History, Oxford University Press, 1996

The banker’s credit and debt-based paradigm is ending and despite what central bankers and governments desperately wish, in 2013 or soon thereafter, their economic engine will either seize up or the bankers’ excessive monetary easing will cause one or more of the tires to explode. You can bank on it

PROFESSOR ANTAL E. FEKETE AND THE NEW AUSTRIAN SCHOOL OF ECONOMICS

The growing interest in the school of Austrian economics is a function of the times. The present economic paradigm built on paper banknotes, credit and debt is in disarray; and, as the bankers’ credit and debt-based paradigm is increasingly unable to solve the problems it caused, the search for alternative explanations and answers is gathering momentum

Confronted with..crisis, scientists take a different attitude toward existing paradigms, and the nature of their research changes accordingly. The proliferation of competing articulations, the willingness to try anything, the expression of explicit discontent, the recourse to philosophy and to debate over fundamentals, all these are symptoms of a transition from normal to extraordinary research.

Thomas Kuhn, The Structure of Scientific Revolutions, Chapter VIII, 1962

My first exposure to Austrian economics was in 1973 when I read the obituary of Ludwig von Mises in the Wall Street Journal. Von Mises’ belief that through freedom of choice, i.e. the exercise of free will, humanity would reach its full potential resonated strongly with my own core beliefs.

A much deeper understanding of Austrian economics occurred as a result of my friendship with Professor Antal E. Fekete, a strong proponent of the Austrian School of Economics. In keeping with that friendship I would like to share an announcement from Professor Fekete:

- Effective December 31, 2012, I have retired as President of NASOE [The New School of Austrian Economics], following my 80th birthday

- Professor Juan Ramon Rallo of King Karlos University [King Juan Carlos University] Madrid, Spain, has been appointed as new president effective January 1, 2103

- An anonymous donor has donated $1 million to establish a fund for the purpose of supporting the work of NASOE. By the terms of the donation the fund is to be kept in physical gold and silver

- The first meeting of NASOE will be in Madrid, March 29-31, 2013. More information will be available soon

The contributions of Professor Fekete to the understanding of today’s economic crisis are many and worthy of thought and discussion; and Professor Fekete’s choice of Professor Juan Ramon Rallo to succeed him at the New Austrian School of Economics is an excellent one.

Appropriately enough, an article by Professor Rallo, posted by the Ludwig von Mises Institute in January 2009, is entitled Economic Crisis and Paradigm Shift. More commentary and thoughts by Professor Rallo can be viewed on his Facebook (English translation) page.

THE PARADIGM SHIFT AND GOLD

It is not possible to discern a new paradigm before it emerges. When the Middle Ages were still collapsing, the possibility that the Renaissance would succeed it was impossible to then see. So it is today.

The transition between the old paradigm and the succeeding paradigm will not be easy. They never are. Professor David Hackett Fisher’s Great Wave has yet to completely crest and break although it now appears to be gathering the terrible and requisite strength to do so.

Of such price-revolutions, Professor Fisher writes: This model understands price-revolutions as autogenous, self-generating processes. It is an historical idea. Each stage contains within itself the seed of the next stage; and the one after that. The causal sequence is not fixed and rigid in its determinism. It develops as a chain of individual choices, and as a consequence its structure changes from one great wave to the next.

…we are living in the late stages of a very long price-revolution, perhaps in the critical stage. It also tells us that these are global processes. Our destiny is now closely linked to the condition of all humanity. The patterns of the past also suggest that what will happen in the future depends in no small degree on the choices that we make. Human beings do not hold everything in our hands, but our collective power to shape historical processes has grown enormously in the past 800 years. We can use this power wisely or foolishly. Our choices will make a difference for our children and grandchildren, and for generations yet unborn.

I will not sum up Professor Fisher’s thoughts for they are not hard and fast answers but rather suggestions for navigating the perilous and consequential times ahead. Just as the current paradigm cannot solve the current crisis, neither will reflexive ideological responses by the left and right formed by the present paradigm , e.g. state intervention vs the ‘free market’, work either.

Such responses may provide ideological comfort in such times but history shows they have little relevance in transiting what now confronts us. I suggest reading Professor Fisher’s book, The Great Wave, for a deeper understanding what is now about to happen.

If you believe you already possess the requisite understanding, you are most likely wrong. When paradigms change, the rules change too. What is known is that gold and silver will provide safety when paper currencies will become worthless; but in a paradigm shift of this magnitude, gold and silver alone will not insure a successful transit.

When houses are built on sand

And money’s based on debt

The end times are in motion

But you ain’t seen nothing yet

Gold and silver will help

When money’s no longer gold

But only faith will give you the strength

To make it to the end of the road

My current youtube video is titled: Time of the Vulture 2013 wherein I discuss the significance and futility of QE3. The Fed’s decision to provide monetary easing ad infinitum will eventually end in the destruction of paper money itself.

When I wrote Time of The Vulture: How to Survive the Crisis and Prosper in the Process, most did not believe an economic crisis of historic magnitude was about to occur. Today, most don’t believe a far better world will emerge out of the coming economic collapse.

It will. A better world is coming. You can bank on it.

Buy gold, buy silver, have faith

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.