China's Gold Volume “Shot Through The Roof” Yesterday Ahead Of Lunar New Year

Commodities / Gold and Silver 2013 Jan 08, 2013 - 06:15 AM GMTBy: GoldCore

Today’s AM fix was USD 1,653.75, EUR 1,261.06 and GBP 1,028.07 per ounce.

Today’s AM fix was USD 1,653.75, EUR 1,261.06 and GBP 1,028.07 per ounce.

Yesterday’s AM fix was USD 1,653.75, EUR 1,267.82 and GBP 1,029.60 per ounce.

Silver is trading at $30.38/oz, €23.25/oz and £18.95/oz. Platinum is trading at $1,569.50/oz, palladium at $672.00/oz and rhodium at $1,150/oz.

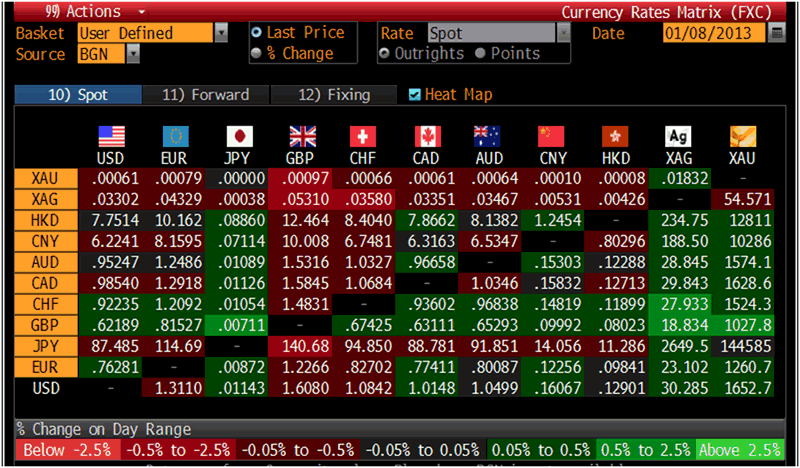

Cross Currency Table – (Bloomberg)

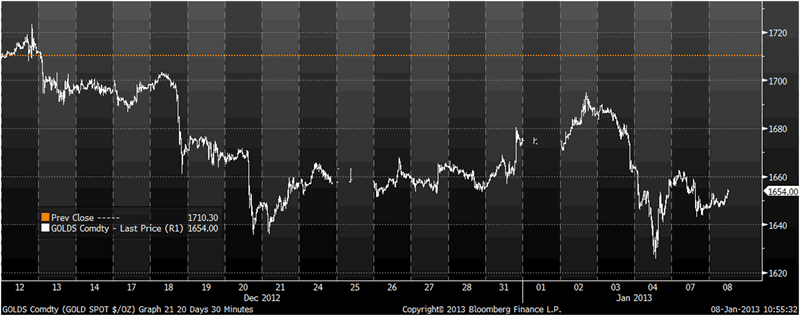

Gold fell $9.90 or 0.6% in New York yesterday and closed at $1,646.40/oz. Silver slipped to a low of $29.84 and finished with a loss of 0.2%.

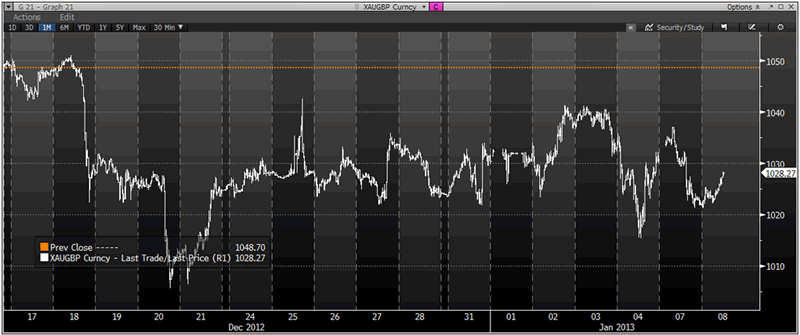

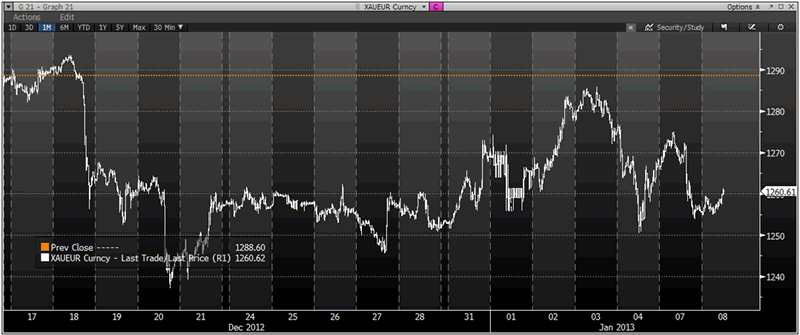

Gold’s losses in recent days have been more pronounced in dollar terms as gold’s price fall in euros, pounds and other fiat currencies has been far more modest (see charts). Given the challenges facing all currencies in 2013 the price decline is likely another correction prior to further gains.

Gold Spot $/oz, 21 days, 30 minutes – (Bloomberg)

Gold edged up on Tuesday as the euro held steady on to two days of gains on hopes that the European Central Bank will not cut interest rates at a meeting this week.

A Reuter’s poll of economists forecast no rate cut but they cannot agree on whether there will be further cuts in the next few months due to a muddled Eurozone economy.

Data showed Eurozone sentiment improved for its 5th month in a row, based on a drop in Spanish jobless figures and a successful Greek bond repurchase.

Harmony Gold, South Africa’s 3rd biggest gold producer said its Kusasalethu mine remains closed and could be shut permanently with the loss of around 6,000 jobs after managers received death threats and police were shot at.

XAU/GBP, 1 Month – (Bloomberg)

Reuters report that Asia's physical market has picked up so far this year, with buyers tempted by last week's big drop in prices -- when prices retreated to as low as 1,626 per ounce -- and on demand ahead of the Lunar New Year, traders said.

The trading volume on the Shanghai Gold Exchange's 99.99 gold physical contract shot through the roof on Monday, hitting a record of 19,504.8 kilograms, after double-counting transactions in both directions.

XAU/EUR, 1 Month – (Bloomberg)

"Physical demand is very strong," said a Beijing-based trader. "It's a combination of the attraction of lower prices as well as pre-holiday demand."

But such appetite could waver if prices recover towards $1,700, he added.

U.S. gold gained 0.1 percent to $1,648.60. Shanghai's 99.99 gold traded at 331.58 yuan a gram, or $1,658 an ounce - a $10 premium over spot prices, compared to single-digit premium most of last year.

Technical analysis suggested that spot gold could edge higher to $1,665 an ounce, and a previous target of $1,625.79 has been temporarily aborted, said Reuters market analyst Wang Tao.

Bloomberg quoted Feng Liang, an analyst at GF Futures Co., a unit of China’s third-biggest listed brokerage who said “the recent price drop has attracted some purchases, evidenced by the volumes in China,” “Whether this rebound can be sustained depends on the emergence of physical buyers, especially from China and India, at a time when demand is meant to be strong.”

In China, demand typically picks up before Christmas and lasts through the Lunar New Year in February. India’s wedding season, a peak-consumption period for gold jewelry, runs from November to December and from late March through early May. The countries are the two biggest bullion consumers.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.