U.S. Gold Bullion Reserve, the 14 Carrot Rabbit

Commodities / Gold and Silver 2013 Jan 04, 2013 - 04:12 PM GMTBy: Richard_Mills

“14 Carrot Rabbit” is an animated cartoon featuring Bugs Bunny and Yosemite Sam.

“14 Carrot Rabbit” is an animated cartoon featuring Bugs Bunny and Yosemite Sam.

The story begins with an old man named Louie successfully gold panning on his claim. Chilkoot Sam (Yosemite Sam) of nasty reputation and carrying a gun, scares Louie away and claims his gold.

Chilkoot Sam gets ten bucks for the gold from Pierre at the “Next To Last Chance Saloon.”

Sam is extremely unhappy to receive only $10 for ‘his’ gold. However something happens right in the middle of his violent tirade that makes him forget about his poor payday - Bugs Bunny staggers in with a huge gold nugget he trades for a few measly carrots.

After Bugs takes his leave, Sam asks Pierre where the carrot cruncher got his gold. All Pierre can tell him is that the bunny gets a ‘funny feeling’ when he's near gold.

Executive Order 6102

On April 5, 1933, President Roosevelt signed Executive Order 6102 making the hoarding of gold certificates, coins and bullion illegal by American citizens, forcing them to sell their gold to the Federal Reserve. The value of the gold held by the Federal Reserve increased from $4 billion to $12 billion between 1933 and 1937.

“On March 6, 1933, Executive Order (EO) 6073 was passed by Franklin Delano Roosevelt (FDR), the 32nd President of the United States in an attempt to solve the dire banking crisis. Executive orders have been around since 1789, allowing Presidents to issue legally binding orders unilaterally, without the consent of Congress. During his Presidential tenure, from 1933 to 1945, Roosevelt would issue 3,728 Executive Orders. This was his third and it was a doozy.

Just two days after Roosevelt was inaugurated as President, he proclaimed a “banking holiday”. From and including Monday, March 6, 1933 to Thursday, March 9, 1933 no bank “would pay out, export, earmark, or permit the withdrawal or transfer in any manner or by any device whatsoever of any gold or silver coin or bullion or take any other action which might facilitate the hoarding thereof…” Sold to the American people as an attempt to control speculation and regulate interest rates, he closed America’s banks, thwarting customers from withdrawing their paper money holdings or converting their holdings to gold.” Kal Kotecha, juniorgoldreport.com

United States Bullion Depository

In 1936, the U.S. Treasury Department began construction of the United States Bullion Depository at Fort Knox, Kentucky.

Today the fortress is guarded by the U.S. Mint Police and protected by layers of physical security; alarms, video cameras, mine fields, barbed razor wire, a bombproof roof, poison-gas booby traps, an emergency flooding system and electric fences.

The Depository premises are within Fort Knox, a United States Army post. A total of 30,000 soldiers with their associated tanks, armored personnel carriers, attack helicopters, and artillery are all stationed nearby.

Below the fortress lies the gold vault lined with granite walls and protected by a blast-proof door weighing 22 tons. No one person knows the complete combinations required to unlock the vault, members of the Depository staff must dial separate combinations known only to them.

The fortress includes a separate emergency power plant, water system, and other necessary facilities.

The Depository is under the supervision of the US Treasury Department's Director of the Mint. It’s a classified facility and access is restricted. For security reasons no visitors are allowed inside the depository grounds - a Presidential order is required to gain access.

The Unites States government says: “The United States Bullion Depository holds 4,578 metric tons (5,046.3 short tons) of gold bullion (147.2 million oz. troy).”

Chris Weber, author of “The Great American Disaster: How Much Gold Remains In Fort Knox?” says:

“The only audit that has ever been done of the gold inside Ft Knox was done days after Dwight Eisenhower became President in January of 1953. After 20 years of Democratic presidents, the American public wanted to be sure that the gold confiscated from them was still there. Thus, the new President ordered an audit within hours after taking office.

The central problem was that it wasn't much of an audit. To sum it up:

- Representatives of the audited group were allowed to make the rules governing the audit. No outside private experts were allowed.

- Those government bureaucrats involved were inexperienced in their tasks, by their own admission.

- The entire audit of the largest gold hoard ever concentrated in history lasted only seven days.

- Only a fraction of the gold was actually tested. Later, the officials put this fraction at just 5%.

- Based on that fraction, the official committee reported that, in their opinion, all the holdings would have matched their records if they'd all been tested.

- If the audit was accurate, the fact remains that almost 80% of it went overseas in the coming years. If the audit was not accurate, the amount of gold lost could have been even more. "

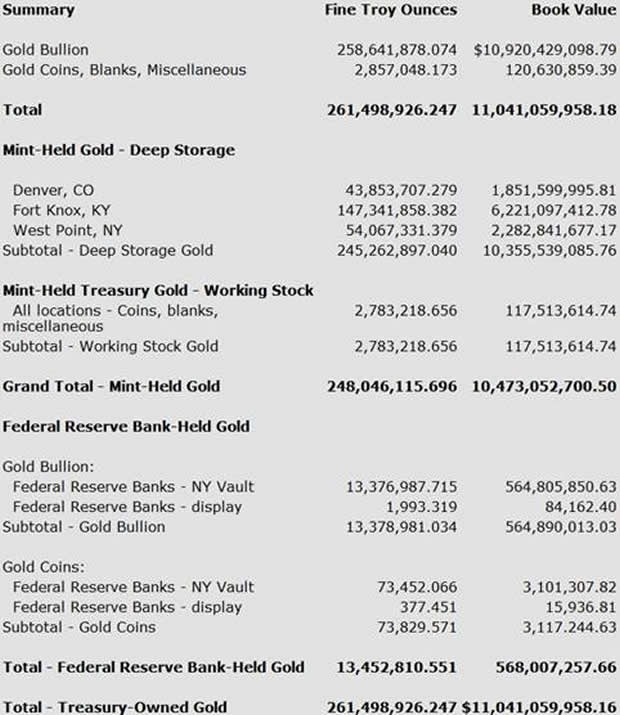

The US Mint reported its Schedule of Custodial Deep Storage Gold and Silver Reserves as of September 30, 2010 and 2009.

Gold Reserve Transparency Act of 2011

The truth is that annual reviews of the facility are conducted by the Office of the Inspector General of the Treasury. Eric M. Thorson, inspector general of the Department of Treasury, is the first outsider to be granted full access to the U.S. Bullion Depository and he is responsible for keeping track of the U.S. Mint's deep storage gold and silver reserves.

Thorson insists the gold reserves exist and in exactly the amounts reported.

Status Report of U.S. Treasury-Owned Gold

Department of the Treasury Financial Management Service November 30th, 2012

Deep Storage: Deep-Storage gold is the portion of the U.S. government-owned Gold Bullion Reserve that the U.S. Mint secures in sealed vaults, which are examined annually by the Department of Treasury's Office of the Inspector General. Deep-Storage gold comprises the vast majority of the Reserve and consists primarily of gold bars. This portion was formerly called "Bullion Reserve" or "Custodial Gold Bullion Reserve."

Working Stock: Working-Stock gold is the portion of the U.S. government-owned Gold Bullion Reserve that the U.S. Mint uses as the raw material for minting congressionally authorized coins. Working-Stock gold comprises only about one percent of the Reserve and consists of bars, blanks, unsold coins, and condemned coins. This portion was formerly listed as individual coins and blanks or called "PEF Gold."

Conclusion

In the cartoon “14 Carrot Rabbit” Bugs Bunny gets a ‘funny feeling’ when he's near gold. I suspect if Bugs got near Ft. Knox today he’d get that funny feeling - like he did in 1952 when the cartoon was released - and more.

Perhaps, for a New Year’s resolution we should all have on our radar screens the truth in regards to the many conspiracy theories floating around the internet in regards to gold. The truth is certainly on mine, is it on yours?

If not, maybe they should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including:

Wall Street Journal, Market Oracle, SafeHaven , USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2013 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard (Rick) Mills Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.