Gold Price Is Trapping Bulls In Daily Cycle

Commodities / Gold and Silver 2013 Jan 04, 2013 - 08:27 AM GMTBy: GoldSilverWorlds

The precious metals are not making it easy for investors here. Some are buying afraid of missing a rally, others wanting to but afraid to commit, while the rest want to see more evidence of a change in trend before trusting again. I’m in the 3rd camp, clearly the trend remains down and until proven otherwise I’m just going to need a little more convincing before getting long again.

The precious metals are not making it easy for investors here. Some are buying afraid of missing a rally, others wanting to but afraid to commit, while the rest want to see more evidence of a change in trend before trusting again. I’m in the 3rd camp, clearly the trend remains down and until proven otherwise I’m just going to need a little more convincing before getting long again.

I know many members are looking for a prediction on where gold is headed these next few days/weeks. The reality is that nobody knows, there is evidence to support both the bullish and bearish cases here, and the beholder is free to pick and choose the evidence that best suits his bias. I will tell you that I see a couple of opposing views (new developments) of the Cycle which should find resolution over the next few trading days. All of these scenarios have actionable trading plans so we therefore should be able to walk away from these next few Cycles with decent gains.

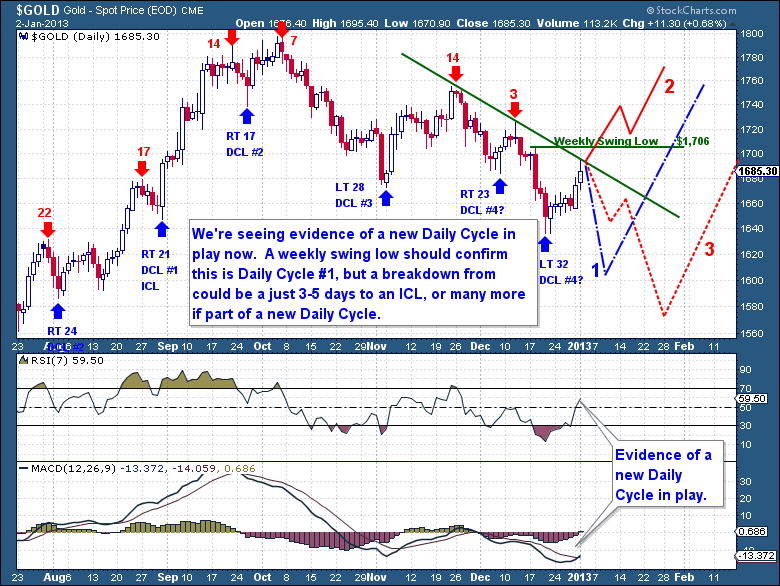

Firstly, the currently marked Cycle remains as this being a very late stage Daily Cycle that is trapping investors before its final collapse (see trend-line #1 on chart below). I mentioned last week that we could see a 2nd half DC rally and Swing Low before the Cycle collapses; this is currently where we stand. But this primary scenario is fast running out of time and room. The Cycle is up against the declining trend-line and fast approaching the Weekly Swing Low ($1,705). If this scenario holds true then gold should fall tomorrow or Friday and spend the next 5 days falling into a DCL and ICL.

But there is a new twist here that we need to be aware of and plan accordingly within our trading strategy. Judging by the strength of gold I believe there is a good chance that Gold printed a Daily Cycle Low on Dec 20th. We’ve witnessed a Daily Swing Low, rising RSI, MACD cross-over, and a 6 out of 7 day rally. This type of strength does suggest that a new Daily Cycle on Day 7 is in play and we would under this scenario assume that Dec 20th ended a stretched 32 Day Cycle. This introduces two new Daily Cycle scenarios:

Firstly, this is the 1st Daily Cycle of a new C-Wave Investor Cycle that is destined to not look back (see trend-line #2 on chart below). In this case gold would have put in a mild or almost “stealth like” ICL and it will be another case of investors afraid to believe in the new Cycle or constantly playing catch up.

The other option few are watching out for is that this new Daily Cycle is the 5th and final Cycle with a good 10-20 days left before a DCL. In this scenario we would see a prolonged and punishing decline into very deeply oversold territory (see trend-line #3 on chart below).

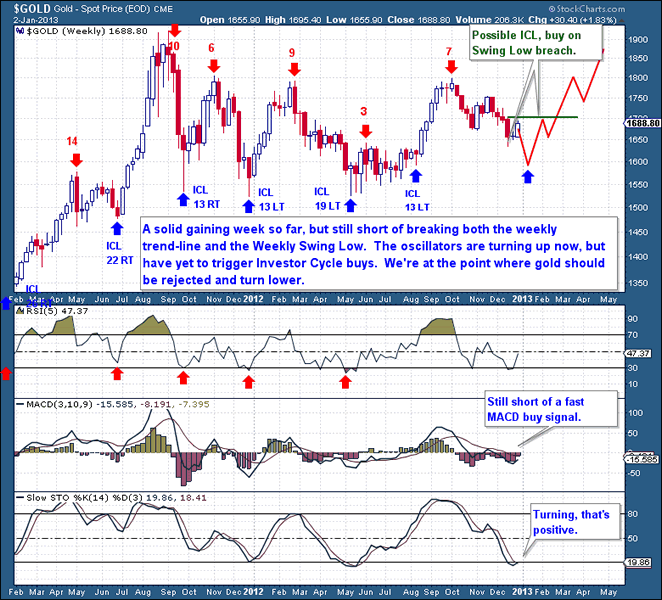

On the weekly chart below we can now see the recent strength of the Daily Cycle showing up within the slower Investor Cycle oscillators. By no means flashing a buy signal, but for the most part strongly suggesting that just another solid week would have me convinced that a new Investor Cycle was in play. If price could break above $1,705 (Weekly Swing Low) then gold would have also broken through the declining trend-line and the MACD would cross into positive divergence. This is why if my primary outlook is in play, then a downturn would need to come this week to avoid triggering an Investor Cycle buy signal.

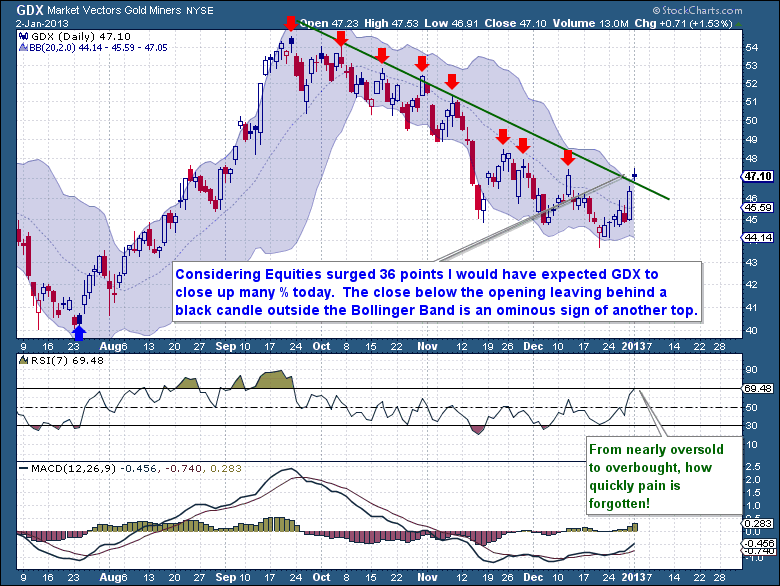

The miners continue to tease investors with the promises of riches. Within just a few short sessions they have managed to traverse the Bollinger Band from deeply oversold to overbought. I’ve stayed far away from the miners simply because the chart says it all. With 7 consecutive lower highs I just won’t trust that the miners are in a new upward trend until I see the breakout with a corresponding gold ICL.

Up until today’s session the recent action was beginning to look encouraging. That was until today when the miners managed to close below the opening price and print a blank candle, a sign which looks ominously like yet another short term top. Again much of the miners fate will depend on where gold is headed in the short term. For now I see no advantage or edge in stepping in front of a declining and overbought asset.

This as is an excerpt from this Wednesday’s premium mid week update focusing on US Dollar from the The Financial Tap, which is dedicated to helping people learn to grow into successful investors by providing cycle research on multiple markets delivered twice weekly, as well as real time trade alerts to profit from market inefficiencies. They offer a FREE 15-day trial where you’ll receive complete access to the entire site. Coupon code (ZEN) saves you 15%.

Source - http://goldsilverworlds.com/gold-silver-price-news/gold-is-trapping-bulls-in-daily-cycle/

© 2013 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.