Gold Price Manipulation New Years Sell Off?

Commodities / Gold and Silver 2013 Jan 04, 2013 - 07:20 AM GMTBy: GoldCore

Today’s AM fix was USD 1,632.25, EUR 1,254.32 and GBP 1,018.37 per ounce.

Today’s AM fix was USD 1,632.25, EUR 1,254.32 and GBP 1,018.37 per ounce.

Yesterday’s AM fix was USD 1,684.50, EUR 1,285.09 and GBP 1,039.69 per ounce.

Silver is trading at $29.33/oz, €22.64/oz and £18.39/oz. Platinum is trading at $1,545.00/oz, palladium at $680.00/oz and rhodium at $1,150/oz.

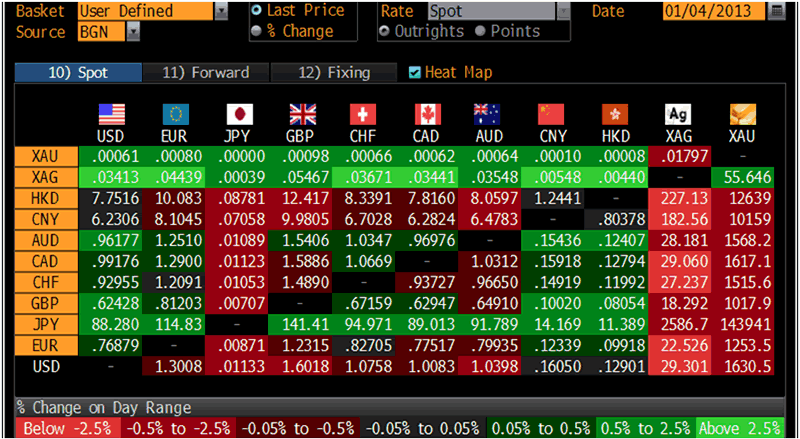

Cross Currency Table – (Bloomberg)

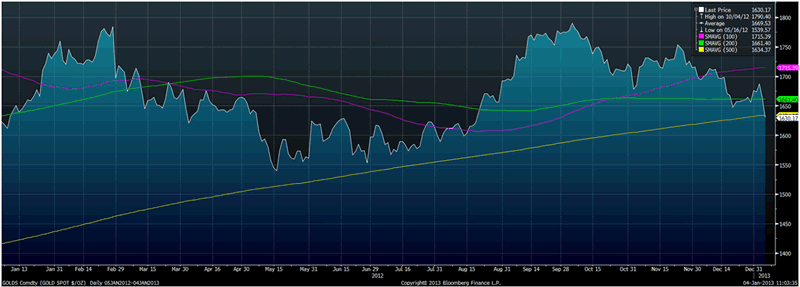

Gold fell $20.20 or 1.2% in New York yesterday and closed at $1,664.50/oz. Silver slipped to as low as $29.972 and finished with a loss of 2.55%.

Gold in US Dollars (1 Month) – (Bloomberg)

Gold fell a further 2% to a 4 and a 1/2 month low today after minutes from the U.S. FOMC meeting highlighted increasing concerns over its highly stimulative monetary policy, sending stock markets tumbling and boosting the dollar.

Today, U.S. non-farm payrolls data is due at 1330 GMT which will show whether the fragile US economy really is recovering.

Silver's slip yesterday made its value at its cheapest compared to gold since late August, with 55.76 ounces of silver now equal to one ounce of gold, against 50.4 in early December.

Gold's price falls may be due to profit taking by speculative players. Since December 20th gold had risen from $1,638/oz to $1,694/oz or by 3.5%.

It may also be the case that bullion banks with large concentrated short positions are using the pretext of the Federal Reserve minutes to manipulate the price lower - both to profit and to allow them to close out their significant short positions at more advantageous prices and possibly even go long.

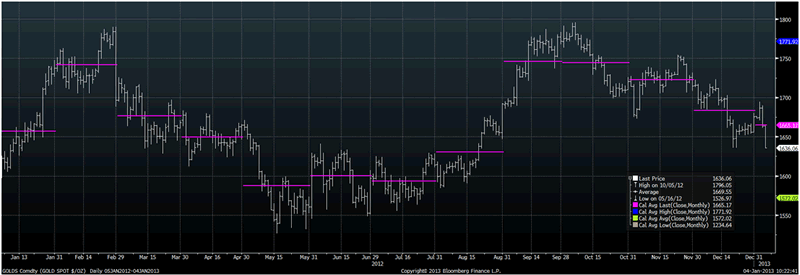

Gold in US Dollars (1 Year) with 50, 100 and 200 Day Moving Averages – (Bloomberg)

Federal Reserve policy makers said that they probably will end their $85 billion monthly U.S. bond purchases sometime in 2013. The key word is probably and many doubt whether the Federal Reserve will stop their debt monetisation programmes any time in 2013.

Even if the Fed did end them, ultra loose monetary policies and negative real interest rates are set to continue as are competitive currency devaluations - two other fundamental pillars supporting the precious metal markets.

Gold in US Dollars (1 Year) With Monthly Average Price – (Bloomberg)

Yet again, the precious metals move down began in earnest during illiquid markets in Asia. On Thursday, gold fell almost 1.5% during the first three hours of Asian trading.

Gold has broken below the December low of $1,635/oz and below the 50, 100 and 200 day moving averages. However, technical analysis should be ignored in favour of fundamental analysis given that there are strong grounds for suspecting that the gold and silver markets are subject to manipulation by certain banks in the same way that interest rates were in the LIBOR manipulation.

The move down is overdone and the smart money will again see the over reactive sell off, manipulative or not, as a nice gift to start the New Year and will again accumulate on the dip.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.