S&P 1470-1474 Area Crucial for Stock Bulls

Stock-Markets / Stock Markets 2013 Jan 04, 2013 - 07:09 AM GMTBy: David_Banister

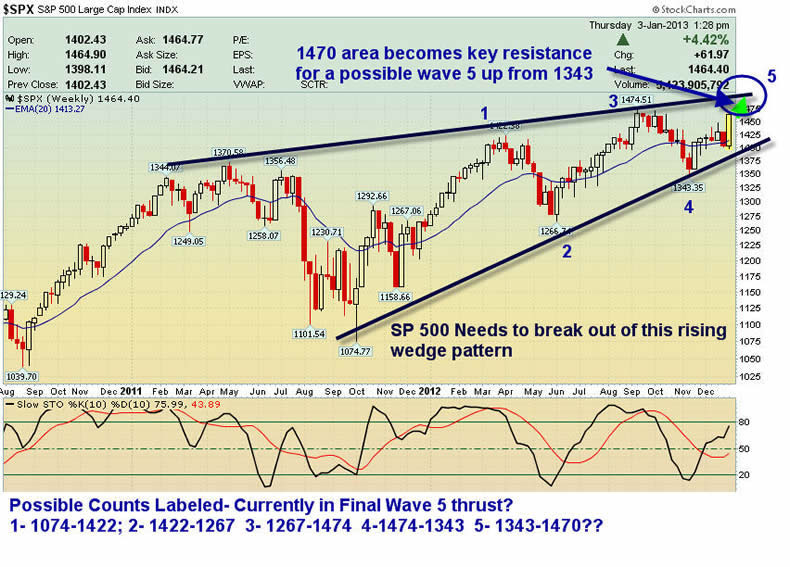

The SP 500 has been in a potential 5 wave rally going all the way back to October 2011 lows of 1074. This type of 5 wave rally is common in a Bull Market, but must be watched closely as it could also signal another large correction just around the corner from current 1464 levels on the SP 500 Index. Once you complete a 5 wave bullish pattern, there is commonly a 3 wave corrective decline, therefore determining where those key pivot points are is crucial for market watchers.

The SP 500 has been in a potential 5 wave rally going all the way back to October 2011 lows of 1074. This type of 5 wave rally is common in a Bull Market, but must be watched closely as it could also signal another large correction just around the corner from current 1464 levels on the SP 500 Index. Once you complete a 5 wave bullish pattern, there is commonly a 3 wave corrective decline, therefore determining where those key pivot points are is crucial for market watchers.

If we take a look at the length of the 5 waves in the Rising Wedge pattern from the October 2011 lows of 1074 below, and compare them with other waves 2-5, we can see several fibonacci fractal relationships amongst all of them. This is one of the clues I look for when trying to analyze pivot points and knowing at least what I should be watching for further clues.

In most cases, wave 3 is commonly the largest of a 5 wave structure, but that does not preclude wave 1 from being the largest in the series. To wit, recall the nasty decline into October 2011 that spurred the next big market advance of about 350 points off the bottom. When you have a significant decline preceeding the early stages of a 5 wave advance, often the first wave in the pattern is in fact the largest, which may be the case here.

Let’s take a look at a possible 5 wave count just so we know what to be aware of :

Wave 1: That 350 point advance was a possible wave 1 off the 1074 lows of Oct 2011.

Wave 2: managed to retrace 155 points of that advance into June 2012, a common wave 2.

Wave 3: rallied to the 1474 pivot, which was a 207 point rally. 207 points is about 61% fibonacci relationship to wave 1′s 350 point advance, again another clue.

Wave 4: dropped as we know from 1474-1344, or 130 points. 130 points is also about 61% of Wave 3′s prior advance on the downside.

Wave 5: Theoretically this wave 5 is now from 1343, and if we took 61% of wave 3 advance and add it to 1343, we come up with about 1470.

1470 would then be a double top in the market, stop wave 5 in its tracks… and be followed by a large correction.

So with the above in mind, we advise watching 1470-74 with keen interest as the market will want to take this area out with authority to continue the intermediate bull run. If not, we could be in for some downside trouble…

Consider joining us for free weekly reports at www.markettrendforecast.com or sign up for a 33% discount on a one year subscription today

Dave Banister

CIO-Founder

Active Trading Partners, LLC

www.ActiveTradingPartners.com

TheMarketTrendForecast.com

Dave Banister is the Chief Investment Strategist and commentator for ActiveTradingPartners.com. David has written numerous market forecast articles on various sites (SafeHaven.Com, 321Gold.com, Gold-Eagle.com, TheStreet.Com etc. ) that have proven to be extremely accurate at major junctures.

© 2013 Copyright Dave Banister- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisor.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.