Don't fall for the Stock Market Rally, New Crash Formation is Made

Stock-Markets / Stock Markets 2013 Jan 02, 2013 - 10:25 AM GMT Insanity has reached new heights. SPX has risen this morning to challenge its massive Rising Wedge formation at its very apex. At the same time, it has formed a new Orthodox Broadening Top nested within the original formation. There is no doubt in my mind that the markets are headed for disaster.

Insanity has reached new heights. SPX has risen this morning to challenge its massive Rising Wedge formation at its very apex. At the same time, it has formed a new Orthodox Broadening Top nested within the original formation. There is no doubt in my mind that the markets are headed for disaster.

The buy-and-hold investors have to be ecstatic. Everyone must be all in by now, and levered to the hilt. The only segment that is laughing all the way to the bank are the HFT companies that are in cash by the end of the day. You simply cannot outrace these guys. At this time, the upside is miniscule compared to the massive downside risk.

That the stock market is manipulated is no longer in question. One explicit goal in the Fed's zero-interest rate policy (ZIRP) is to drive capital into risk assets such as stocks. That is a first-order, transparent policy of manipulation, i.e. a centrally managed policy aimed at managing markets to meet a key central-planning goal: creating an illusion of prosperity via an elevated stock market and the resultant "wealth effect" for the 10% who own enough stocks to matter.

Indirect manipulation is hidden from public view lest the rigging of the market taint the perception that a rising market is "proof" that Federal Reserve and Administration policies are "succeeding." Indirect manipulation is achieved via Federal Reserve quantitative easing operations, unlimited liquidity and lines of credit to fund bank speculations and masked buying of market futures.

This multilevel manipulation creates a Boolean either/or for any Bear market: either it is a planned "panic" that profits the banks or a systemic failure of the orchestrated campaign of market manipulation.

I expect a systemic failure. There have been too many warnings that have been ignored. A drop below 1398.00/1388.00 brings on something that none of us are prepared for, I’m afraid. Today is a regular pivot day. It is also between a Trading cycle Pivot on Monday, Dec. 31 and a Primary Cycle pivot on Friday. Tomorrow is the ideal turn date for this combination.

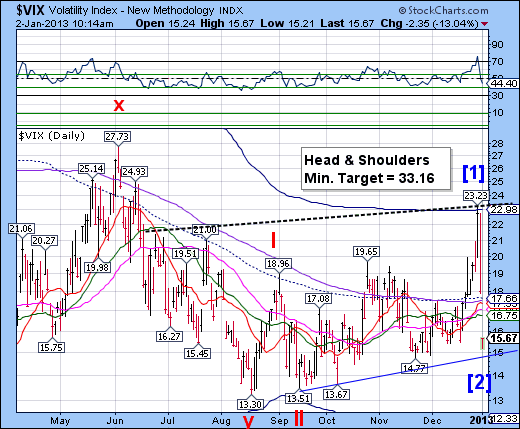

What we are looking at is VIX compression at its finest. Whether it is known to its perpetrators or not, the VIX has made a near- Fibonacci 86.9% (88.66%) retracement and may have found support at an appropriate trendline.

Today is a lesser pivot day, but tomorrow is a Primary Cycle pivot for the VIX. I expect to see a turn into Primary Wave [3] in the next 24 hours.

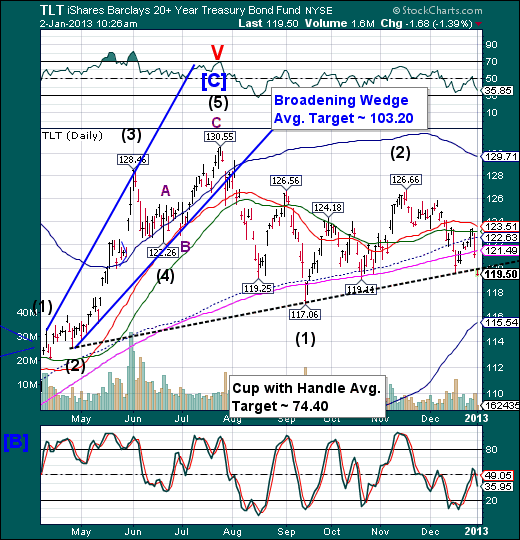

The new for today is that the Long Bond has broken beneath the Lip of its Cup with Handle formation. This signals the largest shift in the bond market, from a 31-year-old-bull market to a secular bear market.

The scaled-down deal passed in the Senate addressed the fiscal cliff but did nothing to address longer term fiscal health of the nation. This puts the US rating at risk for a downgrade. However, credit rating agencies may decide to wait and see what emerges from the subsequent talks.

Unfortunately, the bond vigilantes aren’t waiting. Simply put, the debt problem is beyond any solution.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.