Crude Oil $100+ Price is Here to Stay

Commodities / Crude Oil Feb 27, 2008 - 09:10 AM GMTBy: Donald_W_Dony

A brief review of the driving factors pushing oil higher - Over the last year, as oil has advanced from US$50 to $100, there has been countless academic papers on why the worlds most heavily traded commodity will likely not increase much above US$70 to $80. The main rationale? Alternative energy sources (e.g., coal, biofuels, wind, solar and uranium) will fill the gap and keep oil at a more comfortable level well below the infamous US$100 mark.

A brief review of the driving factors pushing oil higher - Over the last year, as oil has advanced from US$50 to $100, there has been countless academic papers on why the worlds most heavily traded commodity will likely not increase much above US$70 to $80. The main rationale? Alternative energy sources (e.g., coal, biofuels, wind, solar and uranium) will fill the gap and keep oil at a more comfortable level well below the infamous US$100 mark.

While these resources can and will provide a slight buffer against the tsunami of global energy demand, our global economies are still too highly attached to fossil fuels and are not expected to shift soon.

The simple factors of world demand over current and predicted supply clearly demonstrates why oil will not be retreating in price but can be expected to continue its upward path well into the next decade.

Chart 2 illustrates oil discovery (new supply coming on-stream) versus global consumption. The peak in the supply/consumption ratio was in the 1960s. For over 40 years, the line has continued to fall, as demand has rapidly outstripped existing and newfound oil. The crossover into the new reality of lower reserve levels developed in the mid-1980s. As of 2007, over 22 gigabarrels (22,000,000,000) are being consumed per year over existing supply.

Chart 3 shows all new oil supply coming on to the market going back to the 1930s. Again, the peak was in the 1960s. No new major reserves have been found since the massive North Sea discovery in 1961.

Though the U.S. is still the largest oil consuming nation, soaring new demand has largely come from the Asia/Pacific region and especially from China. Chart 4 shows the percentage of new growth as compared to other regions of the world. China is up over 3,000% in the last three years and with the trend steadily escalating.

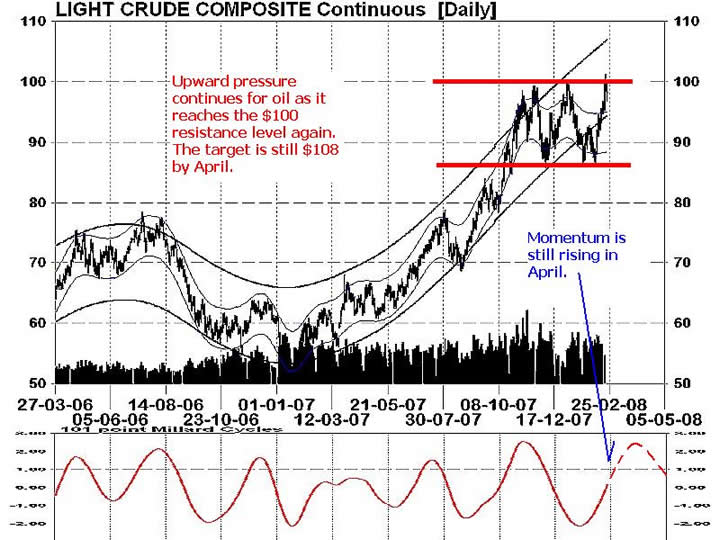

Investment approach: Supply/demand numbers clearly illustrate that oil will be advancing over the years to come. Technical models point to short-term consolidation above the main $85 support level (see Chart 1) and moving through the $100 resistance line, towards its first target of $108 by the second quarter of 2008. The second higher target of $115 is anticipated by the peak in the driving season (July & August).

A good method to invest in oils long-term upward trend is with a crude oil commodity exchange traded fund. There are two on the markets now. In U.S. dollars, the U.S. Oil exchange-traded fund, symbol USO and in CDN dollars, the new Horizon BetaPro Crude Oil Bull (HOU). Both will follow the rise in oil.

Additional research on commodities and other exchange traded funds are in the up coming March newsletter. This report will be posted on www.technicalspeculator.com on March 1st.

Your comments are alway welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2008 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.