Big Move Ahead in Copper ETFs and Stocks

Commodities / Copper Dec 31, 2012 - 08:00 AM GMTBy: Chris_Vermeulen

With 2012 now behind us it’s time to start looking for some new long term investments which have big potential gains in the new year. Copper is one metal that has caught my eye.

With 2012 now behind us it’s time to start looking for some new long term investments which have big potential gains in the new year. Copper is one metal that has caught my eye.

The long term monthly chart of the copper ETF JJC shows a potential cup and handle pattern accompanied with bullish volume characteristics. Last year copper traded sideways in a narrowing range. This type of price action tends to bore traders and investors forcing them to look elsewhere for new to trades. The saying is “If the market doesn’t shake you out, it will wait you out”

You can see on the monthly chart that the interest in this commodity diminished. You can tell because of the sideways movement and declining volume. I like to focus on investments which are out of favor but are showing signs of another big trend starting. getting on the train before it leaves the station can make for a fun ride. I do post some of my trading ideas with my charts updating live each day here: https://stockcharts.com/public/1992897

Take a look at the charts, analysis and my best copper stock setup below:

JJC – Copper Total Return ETN Profile

Description: The index includes the contract in the Dow Jones-UBS Commodity Index Total Return that relates to a single commodity, copper (currently the Copper High Grade futures contract traded on the COMEX).

Copper Miner Stocks ETF COPX – Weekly Chart

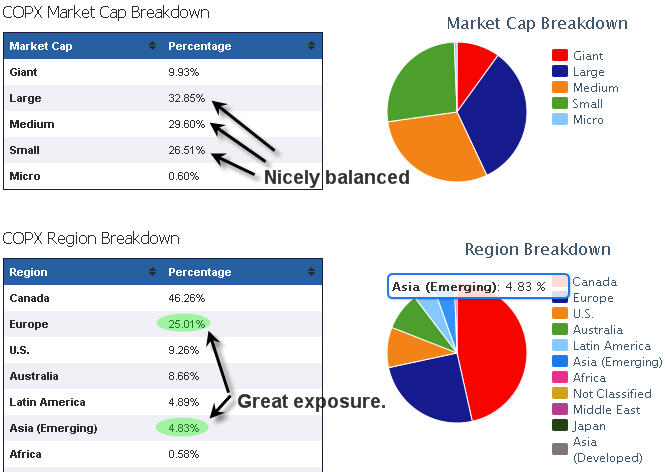

This ETF holds a basket of copper mining stocks which is showing signs of a new trend starting. Take a look at the top holdings stocks and fund breakdown to get a feel for the exposure it provides.

COPX Top Ten Holdings

1.Inmet Mining Corporation (IEMMF): 6.62%

2.KGHM Polska Miedz SA (KGH): 5.24%

3.Xstrata PLC (XTA): 5.04%

4.Grupo Mexico, S.A.B. de C.V. (GMEXICO B): 4.89%

5.Jiangxi Copper Company Limited H Shares (00358): 4.83%

6.HudBay Minerals, Inc. (HBM): 4.82%

7.Antofagasta PLC (ANTO): 4.78%

8.Southern Copper Corporation (SCCO): 4.75%

9.Lundin Mining Corp (LUNMF): 4.55%

10.Kazakhmys PLC (KAZ): 4.55%

Best Copper Stock Setup – LUNMF

After reviewing the main holdings in this fund I noticed one stock that looks ready to start a new bull market. Lundin Mining. shares look to be building a Stage 1 base and could break out and start to rally any week. Keep in mind 3/4 stocks move with the broad market so we do want the major indexes to find a bottom or at least trade sideways if we want copper stocks to start their run.

Copper Futures, ETF and Stock Trading Conclusion:

Copper has lost its shine over the past 12 months but could start to make headline news in the near future. I like both COPX and LUNMF if we see further strength. If you would like to get more of these trading and investing ideas and alerts be sure to join my newsletter at: http://www.TheGoldAndOilGuy.com

By Chris Vermeulen

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.