Will Gold Follow What it Did This Time Last Year?

Commodities / Gold and Silver 2012 Dec 27, 2012 - 11:46 AM GMTBy: Jesse

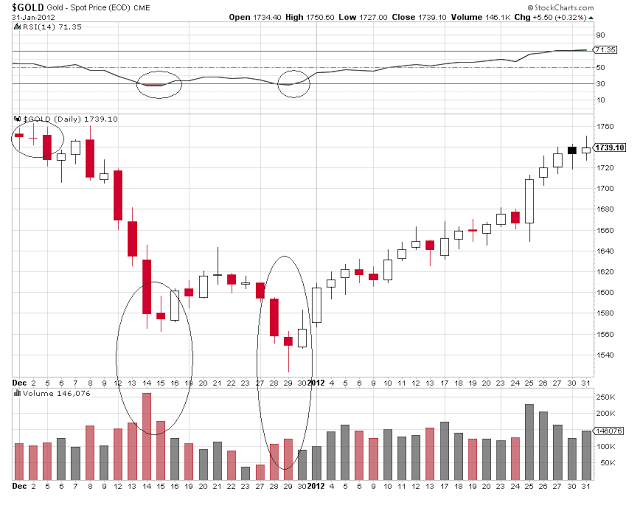

As you can see, gold had a 'tap tap' bottom at the end of last year, with a final intraday low on the 29th, the second last trading day of the year.

As you can see, gold had a 'tap tap' bottom at the end of last year, with a final intraday low on the 29th, the second last trading day of the year.

It rallied in January back to where it had been at the beginning of December.

We may be seeing a repeat of what I think is an 'end-of-year' phenomenon this year.

If so, we *might* see one more low this week, probably tied in with some sort of selloff related to the 'fiscal cliff.'

This sort of thing could be government related but it seems more probable that it is related to the gaming of large short positions as they are marked to market at year end. That, and of course, the obvious price manipulation that allows big players to pick up assets like miners and bullion on the cheap.

The 'bombing' of gold with large contract sell orders in quiet periods is leaving tracks all over the tape, that most can see, except if they are willfully blind.

It would not be surprising if we don't see exactly that double tap bottom again this year. We had an odd overnight plunge to 1649 on futures open after Christmas, and that may mark the bottom.

We *could* go back down to visit there again, and maybe even the prior double low of 1636 from just before the holiday.

It is hard to imagine since it does seem rather obvious, even for these markets. Still, as Eliot Spitzer observed some years ago, what surprised the real investigators the most when they exposed market manipulation was the clumsy obviousness of it, more like a smash and grab than a well planned and quiet intrusion. Why bother with finesse when no one will call the cops? And if called, they fail to act?

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2012 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.