Monetary Malpractice: Deceptions, Distortions & Delusions

Politics / Central Banks Dec 27, 2012 - 03:50 AM GMTBy: Gordon_T_Long

The Hippocratic Oath is an oath taken by physicians swearing to practice medicine ethically, honestly and above all, to do no harm to the patient. Unelected central bankers do not take such an oath. They do however swear allegiance to the Constitution.

The Hippocratic Oath is an oath taken by physicians swearing to practice medicine ethically, honestly and above all, to do no harm to the patient. Unelected central bankers do not take such an oath. They do however swear allegiance to the Constitution.

On February 6, 2006, Ben Bernanke took an oath to the Constitution at his swearing-in ceremony as Chairman of the Board of Governors of the Federal Reserve System. The significance of this is that as a federal officer, despite being the front man for a privately owned, quasi government bank, he can be prosecuted for any violations of the Constitution that he swore to uphold.

Bernanke is likely never to be charged with a crime against the constitution, but he is certainly guilty of malpractice. As a result of his untested and uncharted monetary policies, he has created broad based Moral Hazard and Unintended Consequences that have inflicted immeasurable and potentially fatal harm to the America he swore allegiance to.

Deceptions, Distortions & Delusions

By the Deceptive means of Misinformation and Manipulation of economic data the Federal Reserve has set the stage for broad based moral hazard. Through Distortions caused by Malpractice and Malfeasance, a raft of Unintended Consequences have now changed the economic and financial fabric of America likely forever. The Federal Reserve policies of Quantitative Easing and Negative real interest rates, across the entire yield curve, have been allowed to go on so long that Mispricing and Malinvestment has reached the level that markets are effectively Delusional. Markets have become Dysfunctional concerning the pricing of risk and risk adjusted valuations. Fund Managers can no longer use even the Fed's own Valuation Model which is openly acknowledged to be broken.

Monetary Malpractice

-

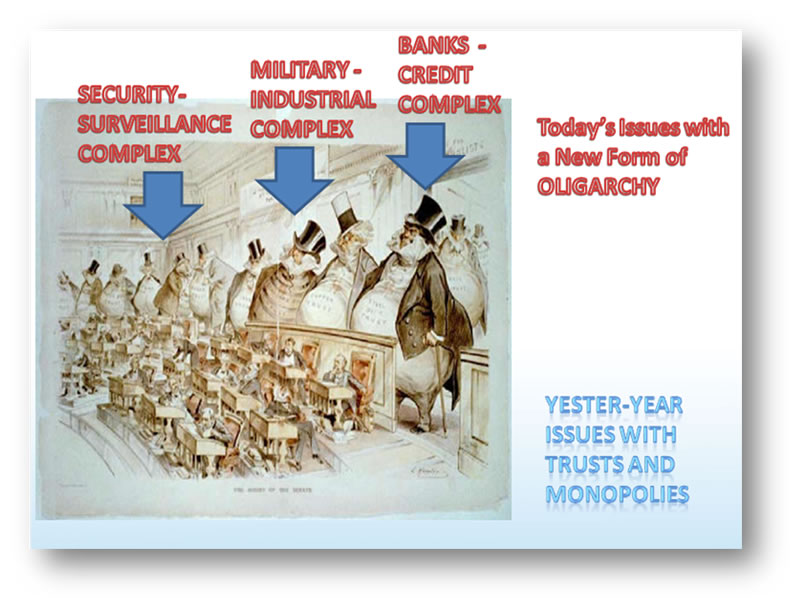

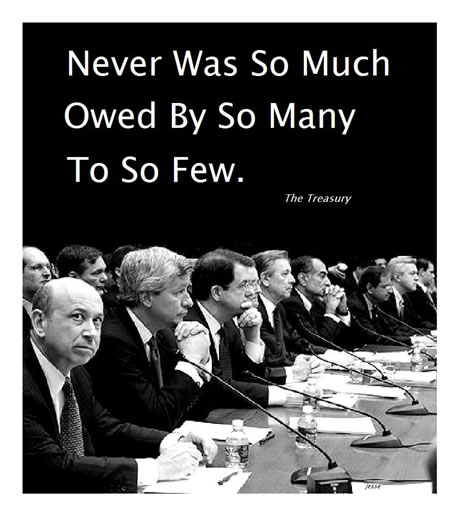

Low interest rates and massive transfers of capital from Fed to banks has allowed banks to become hedge funds, making most of their money through proprietary trading and the creation of ever-more exotic instruments (moral hazard). This has lead to a merger of the banks, government and military/industrial complex into one entity (unintended consequence) that is not focused on expanding its power rather than serving its original constituents.

-

Low interest rates and easy money have lead to massive concentrations of wealth as bankers and corporate CEOs take ever-greater risks, keeping the profits and handing the losses off to taxpayers (moral hazard). Wealth disparities have exploded (unintended consequences), creating in effect an aristocracy - and a disaffected majority. Political instability has risen (unintended consequence), leading the government to build a police state apparatus. The coming confrontation will look like Greece, with the addition of advanced technology on all sides (very unintended consequence).

"An environment where financial crises are seen to be a regular part of the landscape is one where people might actually take more precautions. People would maintain a margin of safety in all their decisions, investment and otherwise, regulations would be well thought out and diligently enforced, and the unscrupulous and the incompetent would quickly fail and disappear from the scene. Modern day attempts to abolish failure only serve to ensure it, as moral hazard - the likelihood that people's behavior changes in response to artificial supports or guarantees - surges. Attempts to prevent or wish away future crises only make them more likely. Only by allowing, even welcoming, episodic failure do we have a chance of reducing the likelihood and magnitude of future financial crises."

~ On The Morality Of The Fed 12/21/12 The Baupost Group

Moral Hazard

In economic theory, a moral hazard is a situation where a party will have a tendency to take risks because the costs that could incur will not be felt by the party taking the risk

-

A moral hazard may occur where the actions of one party may change to the detriment of another after a transaction has taken place.

Example: persons with insurance against automobile theft may be less cautious about locking their car, because the negative consequences of vehicle theft are now (partially) the responsibility of the insurance company.

-

A party makes a decision about how much risk to take, while another party bears the costs if things go badly, and the party isolated from risk behaves differently from how it would if it were fully exposed to the risk.

Example: the Euro debt crisis, in which the troika of relief funds (aka the ECB, the IMF, and the EC) for heavily indebted nations like Greece are waiting as long as possible to act. The risks of a money run, and the consequential market crash in Europe is by far not as detrimental to these institutions as to the indebted nations themselves.

-

An individual or institution does not take the full consequences and responsibilities of its actions, and therefore has a tendency to act less carefully than it otherwise would, leaving another party to hold some responsibility for the consequences of those actions.

-

One party in a transaction has more information than another.

In particular, moral hazard may occur if a party that is insulated from risk has more information about its actions and intentions than the party paying for the negative consequences of the risk. More broadly, moral hazard occurs when the party with more information about its actions or intentions has a tendency or incentive to behave inappropriately from the perspective of the party with less information.

-

One party, called an agent, acts on behalf of another party, called the principal.

The agent usually has more information about his or her actions or intentions than the principal does, because the principal usually cannot completely monitor the agent. The agent may have an incentive to act inappropriately (from the viewpoint of the principal) if the interests of the agent and the principal are not aligned.

"A party will have a tendency to take risks because the costs that could incur will not be felt by the party taking the risk"

- Bad bankers run good bankers (i.e. those reluctant to lend to bad credits) out of the business.

Result: banks become hedge funds, predatory, corrupt.

-

Big banks use their too-big-to-fail status to borrow much cheaply than well-run smaller banks, and then proceed to push the latter out of mortgages and other lucrative business lines.

- Big banks then accelerate their growth.

Result: financial oligarchy in which the banks/government/military industrial complex merge into one organization. Bernanke, Jamie Diamond and Obama are division heads in this empire.

Final Result: Police state in which the Bill of Rights is ignored and technology is used to suppress dissent while inflation siphons wealth from the 99% to the 1%.

- Real estate appraisers forced to meet the number.

Result: Buyers end up underwater on day one.

-

Governments begin to lie about economic stats to obscure the impact of bad policy.

- Businesses take excessive risks because borrowing is so easy and government stats paint a too-rosy picture.

Result: Massive Mal-investment

-

Banks create unlimited amounts of derivatives and asset backed securities because financing is so easy and they know that, should the market fail, governments will have no choice but to bail them out.

-

Individuals borrow excessively because credit is extremely easy to get. The market signals that they're highly credit-worthy and that the future is brighter than it actually is.

-

Investors move further out on the risk spectrum because:

-

There's no yield available in low-risk paper,

-

Government stats paint a too-rosy picture, and

- The conventional wisdom is that the government can't let high-risk investment fail.

Result: Extremely fragile national balance sheet,

Result: Overexposure to stocks and junk bonds,

Result: Retirees with capital at risk that might never be recovered.

-

Unintended Consequences

Unintended consequences(sometimes unanticipated consequences or unforeseen consequences) are outcomes that are not the ones intended by a purposeful action.

Unintended consequences can be roughly grouped into three types:

-

A positive, unexpected benefit (usually referred to as luck, serendipity or a windfall).

-

A negative, unexpected detriment occurring in addition to the desired effect of the policy (e.g., while irrigationschemes provide people with water for agriculture, they can increase waterborne diseases that have devastating health effects).

-

A perverse effect contrary to what was originally intended (when an intended solution makes a problem worse), such as when a policy has a perverse incentive that causes actions opposite to what was intended.

"Unintended consequences are outcomes that are not the ones intended by a purposeful action"

Unintended Consequences

> Dysfunctional Markets

> Instability

Dysfunctional Markets

Dysfunctional Marketsare considered operating when normal and expected 'causes and effects' no longer occur.

Dysfunctional Markets exhibit characteristics such as Malpractice, Malfeasance, Mispricing & Malinvestment.

Monetary Malpractice

Europe

Malpractice: Instead of allowing excessive peripheral country debt to be wiped out, ECB is guaranteeing it.

Result: Investors buying bonds they wouldn't otherwise buy, and Spain and Greece continuing to build up debt

USA

Malpractice: Low interest rates lead to a vast oversupply of houses. But instead of letting prices fall to market clearing levels, the Fed lowered rates even further and is now buying mortgage bonds as part of QE3.

Result: Mortgage rates are at near-record lows and home building is rising again, even though we still have too many houses (malinvestment), flipping is back (moral hazard), first-time home buyers are being priced out of starter homes (unintended consequence) and mortgage debt is beginning to rise again (moral hazard). Important to understand is that homes are not productive assets. They eat capital and the more big houses we have the less productive we are as a society (unintended consequence).

Malpractice: Low interest rates are pushing pension funds and individuals into riskier assets.

Result:

They were forced to buy equities and junk bonds to achieve decent yields.

Now the yields on those two classes have been lowered to the point where they don't work, so pension funds are moving back into collateralized loan obligations (CLOs), securities created from pools of corporate loans.

JP Morgan forecasts three times as many CLOs will be created this year as in 2011.

Malpractice: The Fed's willingness to monetize debt prevents the US from living within its means.

Result: Without a printing press we would have to prioritize and limit spending. But with a printing press we don't. The US can run a global military empire and a cradle to grave welfare state, and simply print the money it needs (moral hazard).

An ongoing, accelerating debt buildup (unintended consequence) that:

Makes it harder to live within our means because we first have to pay interest on this rising debt, and

Increases the odds of a catastrophic meltdown as rising debt renders the system more unstable (unintended consequence).

Conclusion

"We must question the morality of Fed programs that trick people (as if they were Pavlov's dogs) into behaviors that are adverse to their own long-term best interest.What kind of government entity cajoles savers to spend, when years of under-saving and over-spending have left the consumer in terrible shape? What kind of entity tricks its citizens into paying higher and higher prices to buy stocks? What kind of entity drives the return on retiree's savings to zero for seven years (2008-2015 and counting) in order to rescue poorly managed banks? Not the kind that should play this large a role in the economy."

~ On The Morality Of The Fed 12/21/12 The Baupost Group

Good luck, and good trading.

Download your FREE TRIAL copy of the latest TRIGGER$ Checkout the GordonTLong.com YouTube Channel for the latest Macro Analytics from expert Guests

Gordon T Long Publisher & Editor general@GordonTLong.com

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2012 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.