Why Bernanke’s Terrified of 2013

Economics / US Economy Dec 24, 2012 - 06:08 AM GMTBy: Graham_Summers

On December 12, the US Federal Reserve surprised yet again by announcing QE 4: a program through which it would purchase $45 billion of US Treasuries every month.

On December 12, the US Federal Reserve surprised yet again by announcing QE 4: a program through which it would purchase $45 billion of US Treasuries every month.

Between this program and the Fed’s QE 3 Program announced in September, the Fed will be monetizing $85 billion worth of assets every month ($40 billion worth of Treasuries and $45 billion worth of Mortgage Backed Securities) ad infinitum.

Indeed, the Fed’s new policies are anchored to its goal of getting employment down to 6.5%. This means the Fed will buy these assets non-stop until employment gets down to 6.5%.

I’ve spoken to a number of people in the financial community as well as outside investors and no one seem to grasp the significance of this announcement.

First and foremost, QE does not create jobs. The UK has announced QE efforts equal to an amount greater than 20% of its GDP and has not seen any meaningful job growth. Similarly, Japan has announced nine rounds of QE for a combined effort equal to 20% of its GDP over the last 20 years and job growth remains dismal there.

Based on this, the Fed’s decision to anchor its QE efforts to employment is a bit hard to swallow. Indeed, I would argue that the Fed’s moves have very little to do with employment and instead are meant to address the following:

1) The US economy is nose-diving again and the Fed is acting preemptively.

2) The Fed is trying to provide increased liquidity going into the fiscal cliff.

3) The Fed is funding the US’s Government massive deficits.

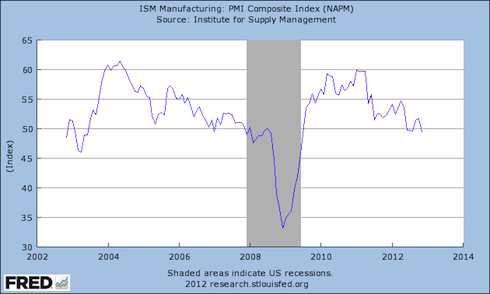

Regarding #1, the November ISM report indicates the US economy is again contracting. Looking at the chart, you can sense why Bernanke and the Fed are getting concerned: the similarities between the recent downturn of the last few years and that going from 2004- 2008 are striking. It’s obvious helicopter Ben doesn’t want us breaking into the mid’40s range.

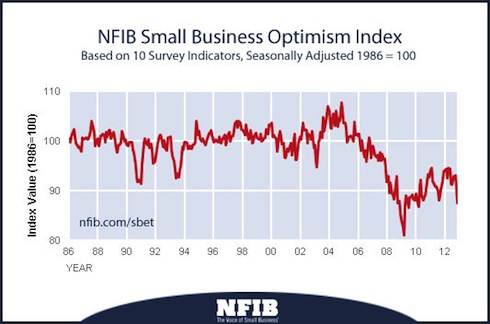

Similarly, the ECRI, which has proven a far better judge of the onset of US recessions than the NBER, has stated that the US likely slipped back into recession in September. Bernanke and the Fed have close ties to the ECRI. I believe they’re moving preemptively based on this announcement. We get additional indication of things worsening in the US economy from the NFIB’s Small Business Optimism Index. This measure has entered an absolute free-fall, posting its single largest drop in over 30 years. To put this into perspective, this indicates that Small Business Owners are becoming less optimistic about the future of the economy faster now than they were after Lehman failed.

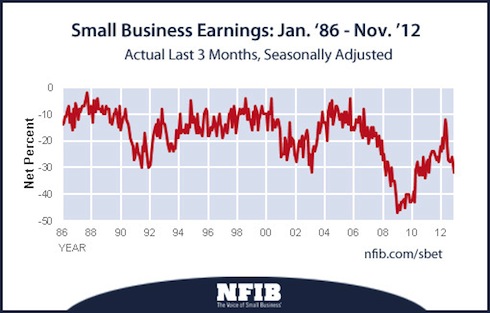

In additional to this, small business earnings are have rolled over sharply since the beginning of 2012. Small businesses account for 70% of jobs. To see both small business owner optimism and as well as small business earnings cratering is a bad sign for the US economy.

Bernanke firmly believes that the single biggest reason the Great Depression lasted as long as it did was because the Federal Reserve didn’t do enough to fight it at the time. This is the driving thesis behind his life’s work and his tenure at the Fed.

With the above information making it clear that things started to get quite ugly in September, QE 4 should be seen as his attempt to act preemptively to stop another 2008-type economic plunge.

In addition to this, we know that Bernanke has stated point blank that the Fed does not have the tools to deal with the fiscal cliff.

The U.S. economy is already being hurt by the “fiscal cliff” standoff in Washington, Federal Reserve Chairman Ben Bernanke said Wednesday. But Bernanke said the Fed believes the crisis will be resolved without significant long-term damage.

The steep tax increases and spending cuts can be avoided with a successful budget deal, Bernanke said during a news conference after the Fed’s final meeting of the year. The Fed’s latest forecasts for stronger economic growth next year and slightly lower unemployment assume that happens…

Bernanke repeated his belief that if the scheduled tax hikes and spending cuts do take effect in January, they will have a significantly adverse effect on the economy, regardless of what the Fed might do.

“We cannot offset the full impact of the fiscal cliff. It’s just too big,” Bernanke said.

http://news.yahoo.com/bernanke-says-fiscal-cliff-already-hurting-economy-201018687–finance.html

Given Bernanke’s extensive connections on capital hill, the move to implement QE 4 should also be seen as a warning that we will very likely be going over the fiscal cliff; not having the tools to deal with the aftermath of this mess, the Fed is moving preemptively to prepare the system for what’s coming.

Finally, and most critically, the Fed’s implementation of QE 4 represents the Fed’s full commitment to finance the US’s deficits.

In 2011, the Fed bought over 70% of US debt issuance. Based on the projections for QE 4, the Fed will buy upwards of $480 billion of the $918 billion in new US debt to be issued next year: roughly 52% of all new debt issuance.

Between this and the Fed’s monthly monetization of $45 billion worth of Mortgage Backed Securities, the Fed will be soaking up 90% of all net new dollar-denominated fixed-income assets next year.

There are several implications to this.

1) The US will be lurching ever closer to an EU-style debt crisis.

2) There will be an even greater shortage of high quality collateral in the financial system going forward.

3) Inflation will continue to rise.

Regarding #1, by soaking up so much of the US’s new debt issuance, the Fed is permitting the US Government to continue overspending at a time when the bond market would normally begin raising interest rates.

Last year the US paid $454 billion in interest payments on its debt. This was at a time when the average interest rate was only slightly above 2%.

During the same year, the US only took in about $2.3 trillion in tax revenue. So, even with interest rates at historic lows, we’re spending about 20% of tax receipts on interest payments.

Now let’s suppose that interest rates rise to an average of 4%. At that rate, the US would owe nearly $900 billion in interest payments: enough to soak up nearly 40% of all US tax receipts. And this is assuming tax receipts don’t fall as the economy contracts (historically taxes do fall during times of contraction).

This is why the Fed is committed to keeping interest rates low: if interest rates were to rise then the payments on the debt would send the US into an EU-style debt crisis along with the commensurate intense austerity measures being implemented.

Having said that, the bond market may force the Fed’s hands, at which point it’s Checkmate for Bernanke.

If you’re an individual investor (not a day trader) looking for the means of profiting from all of this… particularly the US going over the fiscal cliff… then you NEED to check out my Private Wealth Advisory newsletter.

Graham Sumers

Chief Market Strategist

Good Investing!

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2012 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.