Silver Price Forecast To Gain 29% in 2013

Commodities / Gold and Silver 2013 Dec 20, 2012 - 12:06 PM GMTBy: GoldCore

Today’s AM fix was USD 1,667.00, EUR 1,259.25 and GBP 1,024.96 per ounce.

Today’s AM fix was USD 1,667.00, EUR 1,259.25 and GBP 1,024.96 per ounce.

Yesterday’s AM fix was USD 1,674.50, EUR 1,261.49 and GBP 1,027.87 per ounce.

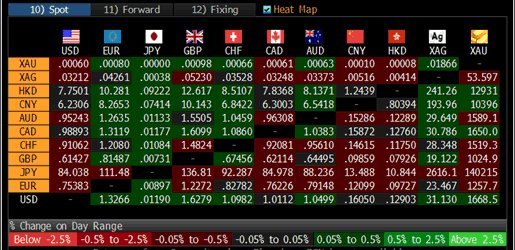

Cross Currency Table

Precious metals remained under pressure yesterday and closed with losses for both gold and silver. Gold closed down 0.2% or $3.50 to $1669.30/oz. Silver closed with a loss of 1.7% - down 54 cents to $31.10/oz.

GOLD SPOT $/OZ and 100, 200 and 465 Day SMAs– September 2011 To Today

Prices again crept gradually higher in Asian trading prior to some retrenchment in early European trading but dollar weakness was supporting gold and silver.

Further weakness could be seen and it is worth noting that gold and silver saw considerable weakness last December (see chart above) and both bottomed near year end on December 29th prior to strong gains in January 2012.

Support for silver is at $30.67/oz and $30/oz. Gold’s support is at $1,647/oz and below that at $1,600/oz.

Silver will rise as much as 29% to $40.25/oz, from $31.10/oz today, in 2013.

This is based on the median estimate of 49 analysts, traders and investors compiled by Bloomberg.

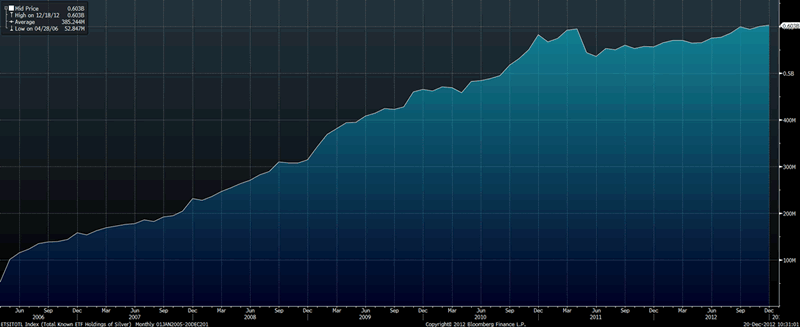

Global investment through silver backed exchange traded products reached a record 18,854 metric tons in November, or more than nine months of mine output, data compiled by Bloomberg show. Holdings are now valued at about $19.2 billion.

Bullion dealers all over the world report robust demand for silver and there has been a shift in many Asian and Middle Eastern markets from gold to silver - due to silver's relative cheapness and undervaluation versus gold.

According to Bloomberg, one of Singapore’s largest suppliers of coins and bars to retail investors, says sales tripled since October, part of a global surge in demand for silver that drove holdings to a record.

Silver almost tripled since the end of 2008, lagging behind only platinum in gains for precious metals this year as policy makers from the U.S. to China to Europe pledged more action to boost economies. That’s attracting investors betting that stimulus will stoke inflation and debase currencies. It’s also leading to diversification into silver by some who believe that economic growth will strengthen industrial demand for silver, 53% of which is used in everything from televisions to batteries.

Silver advanced 12% to $31.13 this year, compared with a 6.6% gain for gold and 14% rise for platinum. The Standard & Poor’s GSCI Index of 24 commodities dropped 0.3 percent and the MSCI All-Country World Index of equities jumped 14%. Treasuries returned 1.8%, according to Bloomberg.

Hedge funds and other large speculators increased bets on higher prices 12-fold since the end of June, to a net 34,862 futures and options, U.S. Commodity Futures Trading Commission data show. That’s about 50% higher than the average over the past five years, a period during which traders have never been bearish.

Equity investors also believe higher prices are coming.

Shares of Mexico City-based Fresnillo Plc (FRES), the largest primary silver producer, rose 25% this year. The company will report a 22 percent gain in net income to a record $927.1 million in 2013, according to the mean of seven estimates compiled by Bloomberg. Coeur d’Alene Mines Corp. (CDE) in Idaho, which gets about 65 percent of its revenue from silver, fell 6.3 percent to $22.63 since the start of January and will reach $31.89 in 12 months, the average of analysts’ predictions shows.

Investors bought 1,464 tons through ETPs this year, data compiled by Bloomberg show.

Silver holdings in the IShares Silver Trust, the biggest exchange-traded fund backed by silver, were unchanged at 9,871.29 metric tons as of Dec. 19, according to figures on the company’s website.

Total Known ETF Holdings of Silver

Prices could go lower should economic growth slow because it would curb demand for consumer goods. A car contains as much as 30 grams and a mobile phone about 0.25 gram, according to the Washington-based Silver Institute.

However, investment and store of value demand for silver looks set to continue to grow at a steady rate in 2013 and this should compensate for any decline in silver industrial demand as it has done in recent years.

The silver market remains a very small market and this continuing global investment and store of value demand should lead to silver reaching a real record high, inflation adjusted, of over $140/oz in the coming years.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.