Global Economy Drowning in Printed Money

Stock-Markets / Quantitative Easing Dec 19, 2012 - 10:56 AM GMTBy: Darryl_R_Schoon

Erroneously believing themselves the cause of their good fortune, Americans continue to deny a changing world

Erroneously believing themselves the cause of their good fortune, Americans continue to deny a changing world

In 2006, when I began writing my book on the coming economic collapse, I didn’t know what the Fed would do regarding liquidity. At the time, whether the Fed would raise or lower interest rates was a soon-to-be multi-trillion dollar question.

In the past, central banks walked a tightrope between higher and lower interest rates. Raise rates too high and economies would slow and/or contract. Keep rates are too low and inflation would result.

Today, the central bankers’ monetary tightrope has become a gangplank.

DROWNING IN AN OCEAN OF LIQUIDITY

On December 12th, Fed Chairmen Ben Bernanke announced the Fed would be doubling down on its bond buying program. Ostensibly in order to create more jobs, the Fed would now buy an additional $45 billion a month of US debt.

The bond buying announced today will be in addition to $40 billion a month of existing mortgage-debt purchases. The FOMC said asset buying will continue “if the outlook for the labor market does not improve substantially” and hasn’t set a limit on the program’s size or duration.

The reason for the Fed’s accelerated bond buying has only a tenuous connection with the US labor market. The real reason is that unless the Fed is the dominant buyer of US debt—which it now is—market forces (remember those?) would cause US interest rates to rise, eventually bankrupting the US Treasury.

RUNNING THE PRESSES

More and more central banks are opting for the endgame ‘solution’, a fatal descent into ‘monetary easing’, i.e. today’s laundered term for running the printing presses. The Swiss National Bank, the European Central Bank, the Bank of England and the Bank of Japan have all joined the Fed in money printing hoping desperately to save their ponzi-scheme of credit and debt.

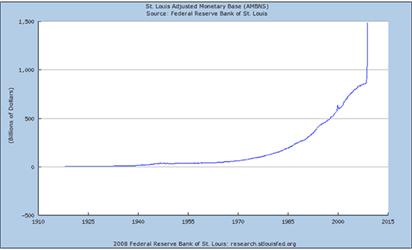

FED FLOODS MARKETS WITH US DOLLARS

Today, the Fed is providing increasing amounts of liquidity at ever cheaper rates to central banks in the hopes of preventing another catastrophic credit crunch. But there is another reason the Fed has doubled its purchases of US debt and won’t set an upper limit on those purchases; and that reason indicates the US economy is in far more danger than Ben Bernanke and the Fed want anyone to know.

Modern economics is not rocket science; it’s a con game that utilizes the bankers’ debt-based banknotes to transfer societal productivity and wealth to bankers. But to optimally do so, the balance between credit and debt must be constantly maintained and economies must constantly expand.

After gold was removed as a constraint on the global money supply in 1971, credit and debt aggregates exploded in size. Ben Bernanke’s error-prone and sometimes brilliant mentor, Milton Friedman, had assured President Nixon that floating exchange rates would naturally balance trade flows. They didn’t and soon the US was responsible for the largest trade imbalance in history.

Japan was the first victim of the US burgeoning trade deficit. In the 1980s, the US trade imbalance with Japan reached unprecedented levels. In my book, Time of the Vulture: How to Survive the Crisis and Prosper in the Process, I describe what happened.

… money was flowing into Japan at an unprecedented rate. Prices were beginning to move upwards and new money was flowing into the stock market at an unprecedented rate, causing the Nikkei to rise faster than market fundamentals might dictate.

By the mid-1980s, the Japanese Central Bank decided to slow the economy down by raising interest rates. This action would dampen any inflationary tendencies and prevent a stock market bubble from forming. However, as logical as this solution was, it was to be opposed by the US government and never implemented.

At the time, most of the Japanese money was being invested in US Treasuries, as the Reagan administration was borrowing heavily to fund its military buildup. During Reagan’s presidency, US government debt tripled from one to four trillion dollars, the greatest percentage increase of US debt in history.

The US knew that any rise in Japanese interest rates would slow the flow of Japanese funds to the US. Japanese investors would much prefer to keep their money in Japan if interest rates were high enough.

But during this time, the Reagan administration needed a constant flow of foreign dollars to pay for its military expenditures and when it heard about the plans of the Japanese Central Bank, it did more than register a protest. It threatened Japan with economic sanctions.

If the Japanese went ahead with their interest rate increase, the US threatened to retaliate with import tariffs on Japanese automobiles, electronics, and consumer goods. This threat was real enough to cause the Japanese to cancel their interest rate increase.

As a result, the US military buildup continued and the price of Japanese real estate and stocks, fueled by excessive amounts of liquidity, exploded upwards. Japanese real estate prices increased 70 times over and stock prices increased over 100-fold, with the Nikkei reaching a market top at 38,992 in January 1990.

As with all speculative bubbles, the Nikkei collapsed—and the collapse of the Nikkei in 1990 unleashed deflationary forces not seen since the Great Depression of the 1930s. Prices of stocks and real estate in Japan began a long and steep multi-year descent.

Commercial real estate lost 80 % of its value in the next decade and the Nikkei fell from 38,992 in 1990 to 8,237 in 2003. Deflationary cycles are long and protracted and if not stopped will become deflationary depressions, an economic phenomenon for which there are no ready answers.

In a deflationary cycle, prices fall because of decreasing demand for services and goods. Should deflation take root in the US, real estate prices, stock prices, and prices of services will fall for years until a bottom is eventually found. And in a depression, when a bottom is found there will be no upward bounce. The economy will merely lie inert as it did during the 1930s.

pp. 53-55, Time of the Vulture: How to Survive the Crisis and Prosper in the Process, 3rd ed. (2012).

Today, Fed chairman Ben Bernanke is well aware of Japan’s 22 year struggle with deflation; and had argued in 2000, that Japan had not done enough to increase the money supply. Now, after his own futile attempts to increase America’s money supply, Bernanke might be more understanding of the vast powers of deflation.

Milton Friedman, Bernanke’s mentor, had convinced Bernake that by increasing the money supply, central bankers could have prevented the 1930s deflationary depression. But Friedman was wrong—again.

When the 2008 collapse threatened to send the US economy into a deflationary descent, Bernanke immediately applied Friedman’s patent medicine—believed to be 100% safe and guaranteed to work—by flooding the US economy with credit and money.

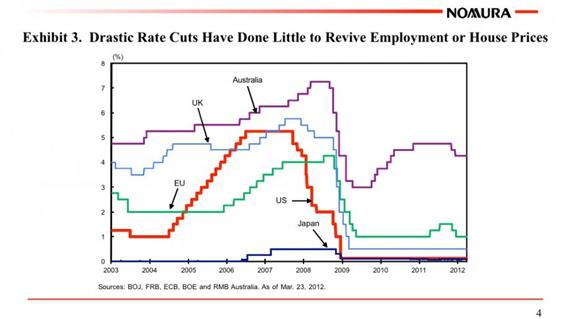

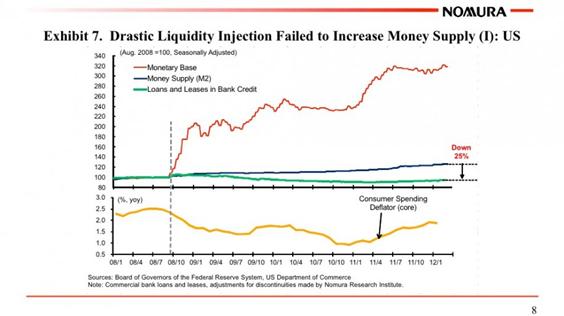

But Milton Friedman’s monetary medicine didn’t work. Despite Bernanke’s injection of massive amounts of liquidity and bond buying, i.e. QE1 and QE2 etc, the US economy didn’t respond as expected. Trillions of dollars borrowed and spent did not revive US employment or raise real estate prices.

Bernanke’s ‘drastic liquidity injection’ in 2008 also failed to increase the quantity of money in circulation, see M2 (the blue line in exhibit 7 below). In the end, Friedman’s theories had given Bernanke false hope, not a solution to severe deflationary contractions.

At Friedman’s 90th birthday party in 2002, Bernanke had assured Friedman that because of his theories a depression would never again happen. He also apologized to Friedman on behalf of central bankers for having caused the Great Depression—and for that apology, Bernanke owes an apology to his fellow central bankers.

FOLLOWING JAPAN TO THE CEMETERY IN A BALANCE SHEET RECESSION HEARSE

Central bank economists given the impossible task of reviving the fatally-damaged credit and debt con game are aware of the work of Nomura economist, Richard Koo. Koo has described the current economic crisis as a ‘balance-sheet recession’; and, in so doing, Koo has ‘zeroed in’ on the cause of the Great Depression and similar collapses.

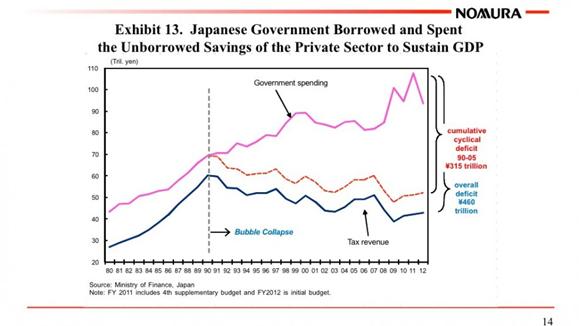

Koo determined that a collapse in private demand which happens after the collapse of massive speculative bubbles, e.g. 1929 US stock market crash, the 1990 Japanese Nikkei crash, the 2000 US dot.com and 2007 US housing bubble crash etc., can only be offset by increased government borrowing and spending, the course that almost all central banks are now following.

Note: Because of Koo’s findings, apologies to Keynes may be in order.

Unfortunately, however, Koo’s solution is no solution at all. At best, it’s a short-term strategy to keep an economy functioning until, hopefully, deflationary forces have run their course; but, today, Japan—Koo’s poster economy—is itself on the verge of finally succumbing to the deadly deflationary forces it successfully resisted for 22 years.

The US, the UK, Europe, etc. will not be so lucky. They do not have the massive savings Japan drew down in its 22-year battle to survive nor do they have the export industries needed to maintain GDP growth while domestic demand withers.

For 22 years, Koo’s balance-sheet solution worked for Japan; but it is highly questionable that it will work for 23; and for today’s slowing and contracting economies, 2-3 years may be the most that can be hoped for; and while Koo’s balance-sheet solution can prolong the life of terminally ill economies, it can’t cure them.

GOLD, 2012 AND THE END TIMES

I recently gave an interview to sgtreports, a gold and silver site, regarding my views on the future. Titled, Collapse of the World’s Power Structures, the response has been overwhelmingly positive which reflects my own views about the future. I have always believed the economic crisis is part of a far greater shift with spiritual implications, although a cataclysmic financial rendering is an integral part of that shift.

Today, I was asked by Gold Silver Worlds to give my views on the significance of the end of the Mayan long count calendar, its relevance to gold and silver and the changes that are today in motion. The GoldSilverWorld interview will be posted at http://goldsilverworlds.com/ appropriately on December 21st, the supposed end date of the 5,125 year long count Mayan calendar.

I believe in the interconnectivity of events and that includes today’s upward trend of gold and the concomitant collapse of paper-based financial markets. Change takes time and fundamental change is no different except it is far more disruptive.

We are in the end game of the present economic paradigm. That it coincides with the end of the Mayan long count calendar may not be coincidence. One of the signs of the end times given in the Bible is the verse, The first shall be last and the last shall be first (Matthew 20:16).

The words, the last shall be first, may indeed indicate the end times are truly at hand. This year, the San Francisco Giants won the World Series, the San Francisco 49ers are in the running for the NFC championship and San Francisco’s usual bottom dwelling Golden State Warriors basketball team is coming off a 6-1 road trip having defeated last year’s NBA champions, the Miami Heat, in the process. The end times may be far better than I expected.

MERRY CHRISTMAS

“WHAT HAPPENED TO ALL THE GOLD? WASN’T THERE MORE?”

My current youtube video, The Cat, Mouse & the Fiscal Cliff, presents capitalism and America’s fiscal dilemma in a hopefully more understandable context. Best wishes to all in the coming New Year. The next Mayan long count calendar cycle is about to begin and it’s going to be far, far better than the last cycle.Buy gold, buy silver, have faith

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.