Commodity Stocks Risk On Rally: Rare Earth And Uranium Miners Outperforming

Commodities / Resources Investing Dec 19, 2012 - 04:02 AM GMTBy: Jeb_Handwerger

For months, we have been highlighting to our readers that China’s economy is beginning to pick up which could positively influence commodity prices. The fears of a slowdown were overblown.

For months, we have been highlighting to our readers that China’s economy is beginning to pick up which could positively influence commodity prices. The fears of a slowdown were overblown.

China’s stock markets (FXI) have been rallying since early September because speculation is rising that the newly chosen Communist Party may boost the economy. The China 25 index fund (FXI) is approaching a major 52 week high breakout.

This may be impacting iron ore and industrial metal prices which have moved higher as Chinese industries may be beginning to aggressively stockpile ahead of 2013.

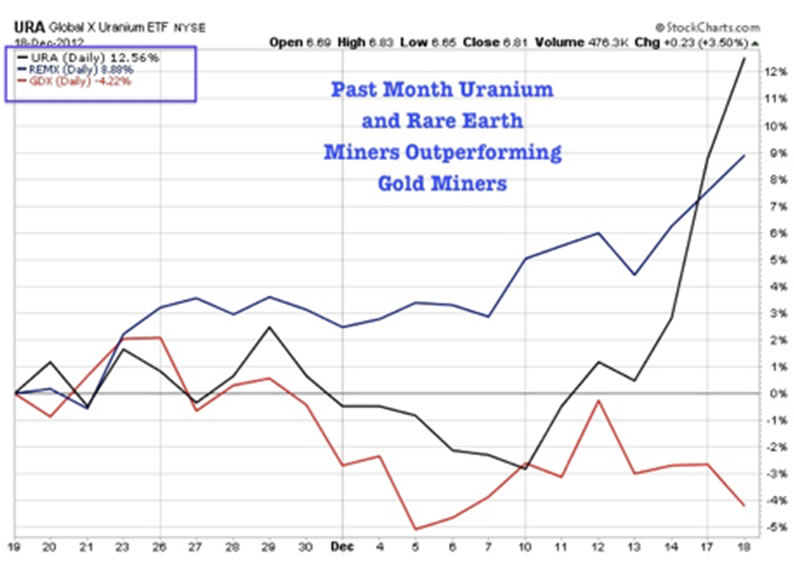

Uranium and rare earth miners are outperforming gold miners by at least 13 percentage points over the past month. This may be forecasting a risk on rally as investors speculate that China, Japan and the emerging economies are bottoming.

Uranium miners (URA) are rebounding gapping above the 50 day moving average as China starts construction on new reactors and as Japan announces a pro-nuclear party, whose goal is to use additional stimulus to weaken the Yen. This past month they are up over 12%.

Rare earth miners (REMX) are showing increased insider buying and must be watched as the Chinese are cutting down on exports and curbing production. Keep your eyes on the heavy rare earth miners located in favorable geopolitical settings with low costs to get into operation. The rare earth miner ETF is up close to 9% this past month.

Graphite is another key area which must be watched as China produces over 80% of the world’s supply. China uses a lot of graphite in steel making and may not be able to supply the world for much longer. China produces over 80 per of the world’s graphite supply.

There have been pundits fearing a China slowdown but the charts are showing otherwise. China may be rapidly acquiring natural resources during the quiet end of the year market to secure commodity supply in expectation of a major state funded stimulus.

Attention must be paid to this renewed interest in ferro alloy, copper (COPX), rare earth (REMX) and uranium miners (URA) during a quiet Year End market dominated by Fiscal Cliff news which has diverted the focus away from these undervalued sectors which are stealthily rebounding impressively.

China is investing in infrastructure projects and has been stimulating the economy in 2012 and may increase that in 2012. China now dominates the steel making industry and accounts for more than 60% of world demand. They have also become a net importer of many industrial metals for their own domestic economy.

The media tends to sell doom and gloom about the global economy and especially the oversold commodity sector (DBC). They highlight that the major commodity producers have already begun to cut production. This may be indicating to our contrarian antennae that the bottom has been reached in these commodities as mines shutdown putting pressure on available supply. India, the third largest exporter of iron ore has cut back considerably this past year, which may cause a near term deficit.

The global printing of money started by an open ended QE3 and culminating with unemployment targets by the Fed is beginning to cause a flight into risk on assets as investors are realizing paper currencies are losing value and are looking into real undervalued industrial metal assets such as uranium (URA), copper (JJC), graphite and rare earths (REMC) many of which are trading at a fraction of the value it was before the credit crisis in 2007.

Subscribe to my free newsletter to get up to the minute updates on rare earths, uranium, gold and silver.

By Jeb Handwerger

Disclosure: I am long GLD, SLV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

© 2012 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.