Central Banks Bitten By the Gold Bug, Insurance Currency Hedge?

Commodities / Gold and Silver 2012 Dec 18, 2012 - 06:18 AM GMTBy: John_Mauldin

“For every complex problem there is an answer that is clear, simple and wrong.” –H. L. Mencken

“For every complex problem there is an answer that is clear, simple and wrong.” –H. L. Mencken

Possibly, the question I am asked the most is, “What do you think about gold?” While I have written brief bits about the yellow metal, I cannot remember the last time I devoted a full e-letter to the subject of gold. Longtime readers know that I am a steady buyer of gold, but to my mind that is different from being bullish on gold. In this week’s letter we will look at some recent research on gold and try to separate some of the myths surrounding gold from the rationale as to why you might want to own some of the “barbarous relic,” as Keynes called it. My personal reasons for owning gold have evolved over the years. I will tell you the story of my own journey, and you can decide for yourself whether to think about coming along.

I cannot start this letter, however, without a brief but sad note about the tragic events at Newtown. As a parent I cannot imagine the anguish and horror at learning that my child was murdered while sitting in her first-grade classroom. The senseless wasting of so many young lives leaves me profoundly saddened for our country and culture. There is not much that I can say other than to extend my deepest sympathies to the families and friends of the victims – and perhaps to wonder about the wisdom of relegating violence to the level of an arcade game in the movies and games our kids watch and play.

Bitten By the Gold Bug

I wandered as an innocent bystander into the world of investment newsletter publishing in 1981-’82. Back then it was a world inhabited to a great extent by “gold bugs” of one variety or another. The investment newsletter world was in its infancy, and I was something of a direct-mail wizard, brought in to weave my magic with mailing lists and fluid copy. You can’t write effectively about something you don’t know, so I plunged in head first, learning all about Austrian economics and the problems of fiat money.

I was soon a partner in what was then a small research and publishing house called the American Bureau of Economic Research, founded by Dr. Gary North. He inoculated me with reams of material on the case for gold and free markets – things I had not learned in college! I had never heard of Ludwig von Mises or Friedrich Hayek (whom I later got to meet in Austria, but that is another story).

I attended my first New Orleans Conference back in the early ’80s. It was then a rather large gathering of people (4,000 or so) who wanted the US to go back on the gold standard. Remember, it had been only a little more than 10 years since Nixon led us down the path to a fiat currency.

It is hard for younger generations to imagine now that it was once illegal to “hoard gold.” Franklin Roosevelt issued Executive Order 6102, which required all persons to deliver on or before May 1, 1933 all but a small amount of gold coin, gold bullion, and gold certificates owned by them to the Federal Reserve, in exchange for $20.67 (equivalent to roughly $370 today) per troy ounce. Owning gold would remain illegal until President Gerald Ford signed a bill which went into effect on December 31, 1974, re-legalizing the owning of gold. Gold began trading in 1975, just in time for the inflation of the late ’70s.

A gold bubble soon developed, which popped (or imploded, depending on your view) in 1980 with the coming of Fed Chairman Paul Volcker, who broke the back of inflation. But that did little to dampen the enthusiasm of the gold crowd. They were still remembering the very recent past.

A young man in a wheelchair, James (Jim) Blanchard, influenced by Ayn Rand and other laissez faire economic writers, had formed the National Committee to Legalize Gold in 1971. He saw gold ownership as a fundamental human right, a hedge against government mismanagement of money, and the first essential step down the long road to monetary integrity. He hired a biplane to tow a sign saying “Legalize Gold” over President Nixon’s 1973 inauguration.

In 1975, after gold became legal, Blanchard organized a conference in New Orleans for his fellow gold enthusiasts. He was expecting 250 people, but 750 showed up. By the time I arrived at the conference in the early ’80s, it was packed with a bevy of characters straight out of central casting – colorful, often funny, but very serious about the subject of gold and free markets. The memory of the inflation scare in the ’70s was still quite fresh, and inflation was still very high. I got to meet and become friends with some of the true intellectual leaders of the free-market world. (I was the “marketing guy” back in those days, still absorbing and learning.)

Gold was seen as an inflation hedge, a currency hedge, and a shield against government iniquity in the form of deficits and monetization. I will admit I took the bait – hook, line, and sinker. I became an unabashed gold bug. By 1986 I was writing a newsletter on gold stocks. “Research” back then consisted of running up a large telephone bill and buying all the subscriptions to newsletters on investments and gold stocks I could get my hands on.

By 1986, gold was again in a bull market, having seen a dip below $290 in March of 1985, from its blow-off high of $850 on January 21, 1980. All the charts show gold dropping in 1980, but few remember that gold actually closed up $30 for the year at $589.75. Picking natural-resource stocks was not all that hard in a bull market, but avoiding the Vancouver gold bandits was not as easy. You really had to know who was involved in any gold stock you invested in. Information was not as easy to get as it is today.

For personal and business reasons, I had to stop writing the letter and sold it to another established writer. I remember telling my readers that, since I was selling the letter, it was likely that gold would be in a bull market for years to come. As it turned out, though, it was a good time to exit.

I started writing again for a general audience in late 1998, but I did not turn bullish on gold until 2002, when I turned bearish on the dollar. Gold had been in a 22-year bear market and during that time had been anything but an inflation hedge – or a hedge against anything, for that matter. But the supporters of gold held fast to the party line. I still understood the reasons for investing in gold, but some of the data simply did not support the reasons.

Time to Buy, or Sell?

So let’s get this out of the way. For quite some time I have not been a gold bug. There are times to be bullish on gold as an investment, and I have been (as in 2002), but as of this moment I do not see gold as having the potential it did in 2002. But if that is the case, then why am I still buying gold every month?

I am going to draw freely on a very solid paper by my friend Dr. Campbell Harvey of Duke University. Cam and I have communicated since the early part of the last decade. He did the original research on the correlation between the yield curve (the relationship between long-term and short-term interest rates) and recessions, which I learned he had done after I quoted others who had not acknowledged his work. We have since compared notes on numerous topics. He sent me his writing on gold last month, and I now share it with you.

Sidebar: the yield curve is not currently predicting a recession. But interest rates are obviously a manipulated market. It will be interesting to see if we can have a recession with a positively sloped curve. This to me would be just another clear danger signal that monetary policy is no longer working.

Back to gold. Here is a summary from Campbell’s abstract:

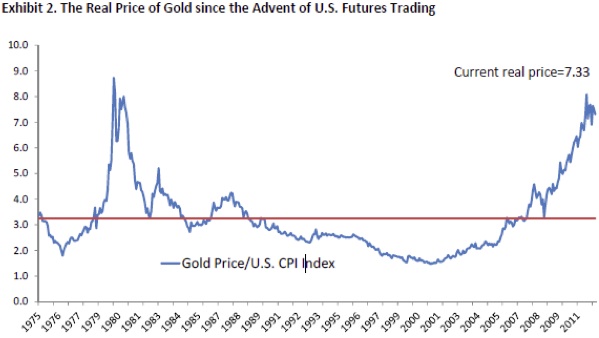

“Gold objects have existed for thousands of years but gold has only been an actively traded object since 1975. Gold has often been described as an inflation hedge. If gold is an inflation hedge then on average its real return should be zero. Yet over 1, 5, 10, 15 and 20-year investment horizons the variation in the nominal and real returns of gold has not been driven by realized inflation. The real price of gold is currently high compared to history. In the past, when the real price of gold was above average, subsequent real gold returns have been below average.

“As a result investors in gold face a daunting dilemma: (1) ignore the past and seek inflation protection by paying a high real gold price that almost guarantees a decline in the future inflation-adjusted purchasing power of gold or (2) embrace the past, avoid gold and run the risk of a greater decline in the future purchasing power of other assets relative to gold if inflation surges. Given this situation, is it time to explore ‘this time is different’ rationalizations?

“We show that new mined supply is surprisingly unresponsive to prices. In addition, authoritative estimates suggest that about three quarters of the achievable world supply of gold has already been mined. On the demand side, we focus on the official gold holdings of many countries. If prominent emerging markets increase their gold holdings to average per capita or per GDP holdings of developed countries, the real price of gold may rise even further from today’s elevated levels.”

Campbell shows us that gold has been erratic as an inflation hedge. Sometimes it is and sometimes it isn’t, depending on what time period you look at.

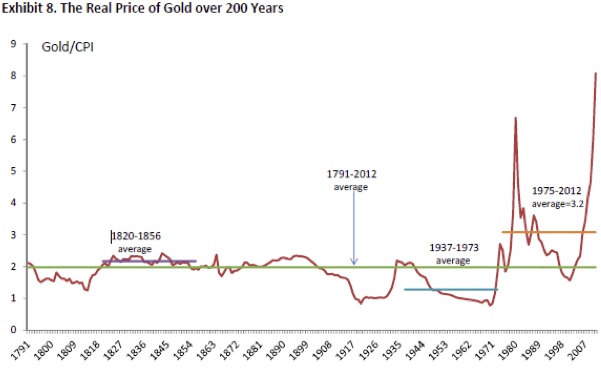

Want to go back beyond 1975? The real price of gold is well above it long-term average in terms of inflation. Look at this next chart.

Of course, this assumes you believe official inflation statistics. If my health insurance costs are a measure of inflation, then gold is barely keeping up. Not to mention the costs of private school tuition and colleges. (I paid my first private school bill in 1980 when Tiffani started the first grade. And now my youngest, Trey, is in his final year of high school. Can you believe a 15x rise in private school costs? Gold is also trailing badly on that front!)

Gold in Ancient Rome and Today

But what about gold as a long-term currency hedge? Campbell has some interesting material:

“The Romans were skilled at building roads and aqueducts as well as recording how much it cost to staff a Roman legion. Legionnaires were the lowest-ranking soldiers in a Roman legion, similar to a private in the U.S. Army. A centurion commanded a century of 80 legionnaires and had a rank somewhat similar to a captain in the U.S. Army.

“In the era of Emperor Augustus (reigned from 27 B.C. to 14 A.D.), a Roman legionnaire was paid about 2.3 ounces of gold a year (225 denarii) and a centurion was paid about 38.58 ounces of gold a year (3,750 denarii). Converted to U.S. dollars, the pay of a Roman legionnaire was about 20% that of a modern-day private in the U.S. Army, and the pay of a centurion was about 30% greater than the pay of a captain in the U.S. Army.

“… Similar to the U.S. aggregate experience since 1791, there is little or no income growth in military pay over 2,000 years. Interestingly, this conclusion is not that sensitive to the final price of gold.

“There are two insights here. First, incomes denominated in gold might be a very long†term hedge – in that the real purchasing power of some wage rates is roughly preserved. Second, it helps us to begin to understand what the expected return on gold is not. Even though 2,000 years is only a fraction of the time that gold has been mined, it provides a lot of compounding periods. A claim that gold could have ‘equity†like’ returns in the future needs to be reconciled with the past. Starting in the year 12 A.D., one dollar compounding at just 1% a year turns into $439 million over 2,000 years. If the rate of return is increased to 1.62%, the ending value is $100 trillion – more than today’s capitalization of world stock and bond markets.

“In ‘normal’ times, gold does not seem to be a good hedge of realized or unexpected short†run inflation. Gold may very well be a long†run inflation hedge. However, the long run may be longer than an investor’s investment time horizon or life span.”

Indeed. I have often seen writing which shows that the buying power of a gold coin is roughly what it was 100 years ago or during whatever period the writer chooses. And that is in fact true. And I dare say that in 100 years an ounce of gold will still buy about what it does today in terms of commodities. (Technology, on the other hand, will get cheaper.)

But that makes gold a store of value, not an investment. Stocks have readily outperformed gold over the last century, and a thousand dollars in gold bought in 1980 when Volcker was chairman of the Fed would be up roughly twice from the 1980 peak and three times from that year’s average. But a 30-year bond would be up many multiples of that. And a zero-coupon bond? That would beat either stocks or gold, hands down. The yield on gold, which is nothing, is one of the reasons that Buffett does not like the stuff. But then gold has performed better than his stocks in recent years, so he may just be jealous.

But a 1980 dollar won’t buy near what it would back then, nor would one from 1900. Inflation does erode buying power. (And to be fair, since it was formed, Berkshire Hathaway has massively outperformed gold.)

Is Gold a Currency Hedge?

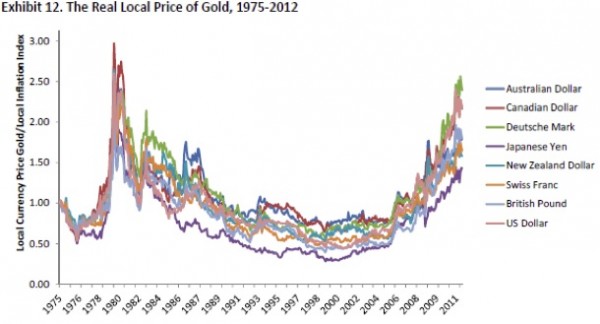

Dr. Harvey’s work seems to suggest that gold is not a currency hedge per se. Quoting:

“Exhibit 12 shows how the local currency real price of gold has fluctuated in a number of countries: Australia, Canada, Germany, Japan, New Zealand, Switzerland, the U.K. and the U.S. In each case the local currency price of gold is divided by a local inflation index and the resulting ratio is normalized to an initial value of 1.0. The message of Exhibit 12 is that since 1975 the real price of gold in these eight countries seems to have moved largely in tandem. The real price of gold reached a high level in 1980 amongst all eight countries. The real price of gold fell to a low level in each of the eight countries in the 1990s, and more recently the real price of gold has risen to very high levels in all eight countries. The historical evidence of a seemingly common local currency movement in the real price of gold does not lend itself to a convenient ‘gold as a currency hedge’ explanation. In fact, the change in the real price of gold seems to be lar gely independent of the change in currency values. Furthermore, since the real price of gold seems to move in unison across currency perspectives, it is unlikely that currency movements help in explaining why the real price of gold fluctuates.”

Then Why Buy Gold?

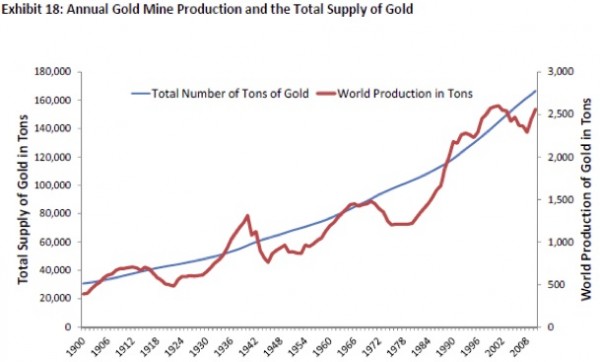

If gold is not a long-term inflation hedge or a currency hedge, and if it produces no income, then why buy it? I can think of three main reasons. First is that the price of gold might go up. It is a very scarce commodity relative to the demand. All the gold ever mined is estimated to be only about 171,000 tons, and less than a third of that amount is estimated to still be recoverable. Overall, gold demand does not seem to vary with price. As Campbell explains:

“The USGS keeps track of estimated annual global gold mine production. Exhibit 18 presents the USGS gold mine production time series, which starts with the year 1900. Annual global mine production has averaged about 2,500 tons per year for the last few years. In 1900, about 30,000 metric tons of gold had already been mined. This means that over 80% of the current aboveground supply of gold has been mined since 1900 and that the aboveground stock of gold has increased by about 1.5% per annum. If global production of gold continues at a rate of 2,500 metric tons a year, and if the USGS is correct in its estimate that there are only 51,000 metric tons of exploitable gold reserves, then gold production will be exhausted in about 20 years.”

There is simply not enough gold in the world that has been mined or will be mined in the next few decades to meet the demand for gold by central banks if they all decide to diversify their portfolios. If the BRIC countries decide to bring their gold-to-currency ratios up to the standard of the US (a standard admittedly declining of late), they would need to find 78,000 tons, not quite half the gold ever mined. If they decided that Switzerland was the “gold standard” for central banks, they would need to buy more than twice the amount of gold ever mined. Neither is possible – and that is just the BRIC countries.

Central Bank Insurance

Which brings us to the second reason to buy gold: “central bank insurance.”

In a perfect world, gold would be a collector’s item, shiny jewelry, or an industrial metal. But this is not a perfect world. Central banks can print money and debase currencies. They don’t have to; it’s a choice, but it’s one that is made all too often.

It seems to me that gold rises and falls in relation to any given currency in concert with general concerns about the long-term viability of the obligations of the government issuing the currency. In the US, the price of gold fell after Volcker slew inflation and then Clinton/Gingrich balanced the budget and the US continued to do so until Greenspan began to openly implement a policy of financial repression at about the same time the Bush administration began to run large deficits and lose control of spending. Then gold rose again, and it has gone up even more as the current administration has showed no sign of wanting to rein in spending.

If I were in Japan right now, I would be buying gold or dollars or anything not denominated in yen. I would not worry so much in Norway, where I will be in a few weeks.

I think there are better investments than gold in terms of future buying power. But I am not certain. At the end of the day, I simply don’t trust the b*st*rds who run this place. (That is supposed to be a laugh line.) I buy gold as insurance against a government and voting population that cannot get its deficit under control and refuses to control entitlement spending. The numbers are clear: the current system is not sustainable.

While I think (hope?) that wisdom will prevail in the face of certain disaster, the history of governments suggests that it will not happen without a crisis. Governments can do foolish things. It is all too possible that governments worldwide will try various forms of protectionism and a currency war in order to try to boost their own exports. That is not a prescription for stable currency valuations. Just in case things don’t go smoothly, I buy a little gold every month.

If the US were to behave responsibly and bring its deficit and entitlement spending under control, then I rather imagine that the dollar would become quite strong over time and that gold would fall in dollar terms. I hope I can decide to pare back my gold purchases next year, as we make good political choices. Right now, that seems unlikely. Taxes are going up, because Republican Senator John McCain and his friends decided not to make the Bush tax cuts permanent back when they were passed. But I see no compromise that will solve the deficit problem. At best, we’ll get maybe 30% of the way there, at least with what I see and hear being discussed.

To get the rest of the way there we will need to see even more tax increases in one form or another. The next phase of deficit control will not be done just with spending cuts and reforms. If you believe it will, I have some swamp land to sell you. The current “compromise” that is being attempted is just the beginning of tax increases, not the end of them. The alternative to tax hikes is that we risk a real fiscal cliff in a few years. If that plays out, I might want to own even more gold.

Finally, let’s assume that we do get a reasonable political solution. Would I sell my gold? No, as it is not an investment, at least not for me. It is insurance against a difficult situation. Can I think of reasons I might sell gold? Yes, but not because things were just so wonderful that I could peer into the future and see a world in which gold would not be needed as a form of insurance against unforeseen events.

I have health insurance, fire insurance, life insurance, and so on. I dearly hope I never use any of them. But I keep buying insurance anyway, because I don’t know the future. And the same rationale is what keeps me accruing gold as a portion of my assets.

What portion should that be? It varies with individuals and their circumstances. When I was younger and made less and had seven kids to feed, educate, and clothe, I had less money available to buy gold. Now I am catching up a little. I tend to buy the same amount every month. I take delivery and put the coins in a vault.

I can’t tell you what you should buy, but mostly it has to do with your own circumstances and comfort level. Is 5% of your portfolio holdings enough? 10%? I guess it depends on what you might need it for.

I see gold as a bridge from what would be a fairly bad scenario (either because of governmental or personal circumstances) to a situation where I could earn an income to cover the daily needs of my family. If everything goes right, on the other hand, I will one day hand over those quaint gold coins to my great-great grandkids.

I truly hope the value of gold goes down. First, that would mean everything else in my list of assets was appreciating. Since gold is a small portion of my net worth, the loss would not be all that great. Second, it would mean I could get more gold-coin insurance for the amount I am spending each month. A hypothetical $10,000 used to buy more than 30 coins; today it only gets you five or six. I am not certain I will like a world where it only gets me three. And I am certain I will not be happy if it only gets me one.

One more thought. If things turn out well with the US deficit, I might hedge my gold against another currency managed by a government that was not doing the right thing. There will always be one or two of those around. But we will have to wait a year or so to get to that point.

How to Buy Gold

With regard to buying gold, a few thoughts. I buy gold one-ounce coins (typically US Eagles) and take delivery. You don’t need a very large safety deposit box for a rather shockingly small physical amount of gold, relative to the dollars you spent. Would that we could have the problem of owning too much gold for our bank vaults to hold! I want my gold near me and readily available.

I would shop around for the best price I could get. You see ads where companies are selling gold at spot. They can’t stay in business long and not make a profit. Someone has to inventory that gold for you to be able to buy it, and that means costs of storage as well as hedging. Markups can cost you as high as 15-20% if you are not careful. A few points in commissions is much more like it. There are any number of reputable dealers.

But do not get talked into semi-numismatic coins. In a crisis those coins will only be worth their gold content. If a dealer tries to “bait and switch,” then find another dealer. If you want to collect coins, and many people do (I used to, and understand the pleasure of collecting coins), then by all means go for it. But remember that a collectible of any type is not generally good insurance in a crisis. A crisis is when you want to buy collectibles, whether coin or art or antiques.

Second, if you are buying physical gold, you should not be planning to sell any time soon. Commissions can eat up a lot of the price. Gold is a true buy-and-hold asset. If you want to trade on the price of gold, use the gold ETF, GLD.

Finally, a brief commercial. Mauldin Economics is a member of the Hard Assets Alliance. This a group of firms (generally publishers) that have come together to combine buying power to offer gold in an unusual format.

The Hard Assets Alliance gives you the ability to buy gold and either take delivery or have it stored in the US (New York or Salt Lake City) or Australia, London, Switzerland, or Singapore. Prices are very transparent. There are typically four large dealers involved, which will bid to either buy or sell at any given time. The price quoted is the average of the lowest three, and the price you get is the lowest at the time of purchase. The price will vary with the price of gold. You can clearly calculate commissions. Storage fees are typically 0.6-0.8%, depending on the country. You can buy gold and have it stored in one of the cities listed above, and then take delivery at some future point in those cities, should you so choose.

You can go online and see the costs and commissions. If you can get a better price somewhere else, then take it. Gold doesn’t care where you bought it. You can also sell the gold you bought through the Alliance with a click of the button, although I would not be buying physical gold to sell. You can do that better with GLD.

If you are interested, you can find out more here.

Scandinavia, Europe, and Toronto Oh, and the Mayan Calendar

It is time to hit the send button. I am home for a bit (with maybe a trip here or there) and plan to do a lot of thinking, get some rest, read a lot, work out more, and enjoy the holidays. All my kids will be here for Christmas Day, which is just around the corner, so that means lots of shopping.

I am off to Oslo, Stockholm, and Copenhagen on a speaking tour for Skagen Funds in early January, then plan to be in Dublin for a few days, and then London for a day for a conference. I’ll spend some time in Greece before closing out my European vacation in Geneva. All that in a mere 16 days. Then I’ll be back for a few days before I head off to Toronto for a speech for my Canadian partners, Nicola Wealth Management. I will spend that Sunday watching the Super Bowl with my good friend David Rosenberg!

That is assuming that we are all still here, of course. Evidently there are a number of people quite concerned about this Mayan calendar thing. I still think those old Mayans were predicting the breakup of the euro. If you take the time to look deeply into the symbols they carved on that stone, you can clearly see the wheels coming off Greece and Italy. I think their timing is going to be off a little, though. Maybe they just ran out of room on the stone. If we could just dig up the next chapter!

And speaking of chapters, I went to see The Hobbit with several of my kids on Saturday. It was wonderfully done, a tale well told. In my humble opinion, the Lord of the Rings may be the finest example of English literature I have encountered. I have read it 13 times, although not in the last decade. I used to read it for inspiration. Maybe I should take it up again.

As I was walking out of the movie with Melissa, she was going on and on about how minor details in the movie and the book were different. I was silent, and she began to press me on my opinion. She grew up with me reading Tolkien aloud to her and her siblings, so she knew my interest, or thought she did.

I finally had to say, “I have a small confession to make.” She looked at me with a weird, “You gotta be in an alternative world or not really my Dad” look and said, “Don’t tell me you haven’t read the book.”

“Well, actually, no. I concentrated on the Lord of the Rings, and Tolkien tells us enough of The Hobbit to figure it out.” She was shocked. She immediately ran to catch up to Tiffani and profess her horror at what they both considered to be a major deception. I pointed out that I had never said I had read it – they had just assumed.

I will now load The Hobbit into my iPad and read it before the next film arrives. I have my assignment. I must restore order and faith among my adult children.

Have a great week. And enjoy the time of the year. And especially hug the little ones. Life is so fragile.

Your contemplating large changes in my life analyst,

John Mauldin

subscribers@MauldinEconomics.com

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2012 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.