US Dollar Index Very Long Term Chart - A Rake's Progress

Currencies / US Dollar Dec 13, 2012 - 11:40 AM GMTBy: Jesse

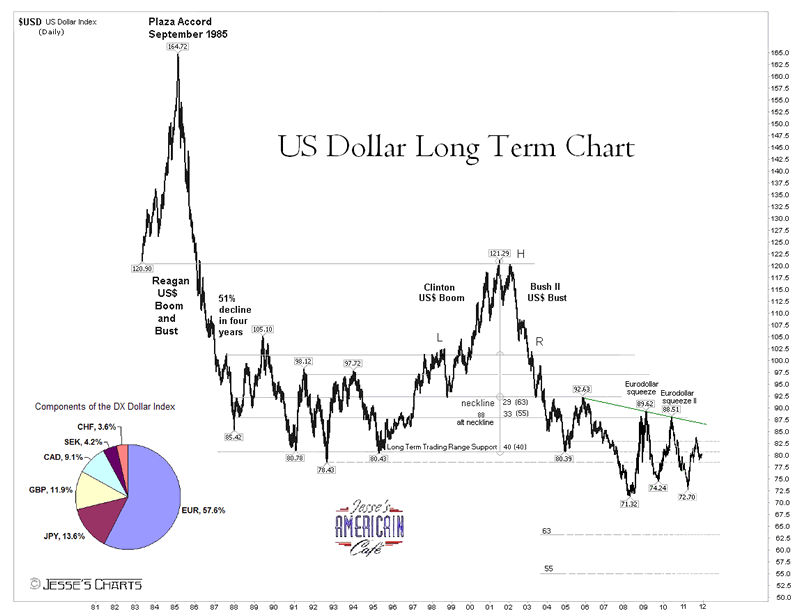

Here is an end of year update on the very long term US dollar chart, la douleur du monde.

Here is an end of year update on the very long term US dollar chart, la douleur du monde.

As a reminder, this is a chart based on the DX dollar index.

That index is woefully out of date with the progress of the world economy and the currency wars with their competitive devaluations and rising currencies of the developing nations.

The DX Index is far too heavily weighted to Europe and Japan, and does not include any of the BRICs.

What it has to its merit is a history of pricing points, that were more meaningful in the past.

A Rake's Progress is a series of eight paintings by William Hogarth that show the decline and fall of Tom Rakewell, the spendthrift son and heir of a rich merchant, who comes to London, wastes all his money on luxurious living, prostitution and gambling, and as a consequence is imprisoned in the Fleet Prison and ultimately Bethlem Hospital, or Bedlam.

Below is painting number six, in which young Tom begs for help from the almighty after a losing night of gambling.

One of my favorite pied-à-terres in London for short layovers many years ago was the Hogarth Hotel off Earl's Court Station on the Piccadilly Line, a serviceable route to and from Heathrow. The area was at one time called Aussie Alley because of the tendency of Australians to cluster there for some reason.

For longer term stays there was a favorite hotel in Mayfair, which was closer to the book stores and my bank, and a small residence in Hampstead Heath which was convenient to almost nothing, but pleasant in the summer. This was my favorite time of the year in London for long walks, the theatre of course, and Christmas shopping in Knightsbridge.

As Samuel Johnson observed, "You find no man, at all intellectual, who is willing to leave London. No, Sir, when a man is tired of London, he is tired of life; for there is in London all that life can afford." And I think the emphasis is well-placed on 'afford.' New York is extravagant, Paris is comfortable, Rome is expansive, but London is civilized.

This is not to be confused with The City, of course, which is a bastion of vipers and thieves. lol.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2012 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.