Pay Differential Between Private Sector and Government Workers

Politics / Government Spending Dec 12, 2012 - 04:01 AM GMTBy: BATR

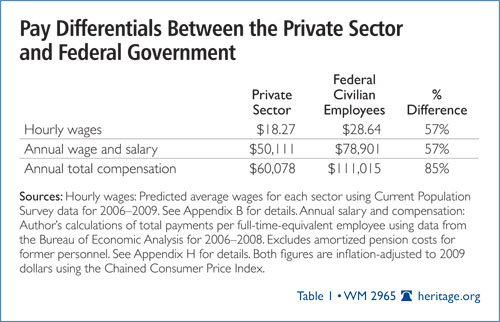

A dreadful warning arises, when public sector employment pay and benefits outstrips the remuneration earned by the private employment workers. Even the most hardened government proponent, must succumb to the reality that private business generates real wealth that finances government through taxes. The expenditures of government on all levels are linked to the profitability of enterprises and sufficient margin that affords the ability to pay revenue levies. Thus, the proportion of wages between private enterprises and public employees has significant consequences.

A dreadful warning arises, when public sector employment pay and benefits outstrips the remuneration earned by the private employment workers. Even the most hardened government proponent, must succumb to the reality that private business generates real wealth that finances government through taxes. The expenditures of government on all levels are linked to the profitability of enterprises and sufficient margin that affords the ability to pay revenue levies. Thus, the proportion of wages between private enterprises and public employees has significant consequences.

Consider the coverage of that bastion of mainstream reporting CBS News when making a comparison in Does the Government Pay More than the Private Sector?

"Bureau of Labor Statistics data shows that federal employees in occupations that exist in both the public and private sectors made an average salary of $67,691 in 2008, USA Today reports. Meanwhile, private sector workers in those occupations made $60,046. Government data also shows federal workers received benefits valued at $40,785, compared with benefits valued at $9,882 for private sector workers."

Now on the surface this assessment is very plausible. Common sense, after the financial collapse in 2008, with the dramatic rise in private sector unemployment and reduced wages, federal employees are sitting pretty. Before the alarm bell sounds, deliberate over the assessments from friendly government sources.

The Congressional Research Center study on Comparing Compensation for Federal and Private-Sector Workers, has some interesting conclusions.The list of Pay Scales at TSA provides a departure from Federal employees because the TSA does not use the standard GS grading system. The TSA uses an "SV" grading system, which is a system of discrete grades with pay ranges that differ from GS pay ranges. Civil Service work rules and pay scales have long rejected any direct relationship with productive results. However, in the conflicted thinking of Washington speak the President extends federal pay freeze. Note that a reduction in wages and benefits is an unknown thought, even in a collapsing economy.

"Federal workers with less than a bachelor’s degree have on average a wage premium compared to private sector counterparts, while federal workers with post-graduate educational attainment experience a wage penalty relative to private sector counterparts.

As with wage differentials, the CBO study finds a declining benefit premium as educational attainment rises. That is, the benefit premium declines from 72% for federal workers with a high school degree or less to 2% for federal workers with a professional degree or doctorate. The CBO study finds an average benefit differential of 48% for federal workers compared to private sector workers."

OK, we have all heard enough of that "fair share" mantra. Now the banner carriers of Big Government raise their ugly heads and reveal their real motives in The truth about federal salary numbers."The freeze will stay in effect until a spending plan is passed, but the presidential election makes it unlikely that will happen before the start of fiscal 2013 on Oct. 1. As a result, the president is required by the end of August to come up with an "alternative pay plan" to avoid a legal trigger that would automatically raise federal pay in line with private-sector salaries.

In a letter to House and Senate leaders, the president reiterated his support for ending the pay freeze with a 0.5 percent raise, to take effect Jan. 1, 2013, that he proposed early this year.

"Civilian federal employees have already made significant sacrifices as a result of a two-year pay freeze," Obama wrote. "As our country continues to recover from serious economic conditions affecting the general welfare, however, we must maintain efforts to keep our nation on a sustainable fiscal course. This is an effort that continues to require tough choices and each of us to do our fair share."

"The Federal Salary Council, an advisory body of academics and leaders of public employee unions, suggested last month that federal workers are underpaid by an average of 35 percent relative to nonfederal employees. The council’s data come from the "President’s Pay Agent," the bureaucratic entity that conducts the federal government’s annual pay comparison.

If these figures are to be believed, federal employees are paid only 65 cents for every dollar received by nonfederal employees doing the same work. Put another way, the average federal employee who shifts to a job outside government would increase his salary by 54 percent."

Weak private sector employment persists. Wages are stagnant or regressive. New jobs are sporadic, at best. Prospects of a prosperous recovery are slim. Government dependency seems like the only growth occupation. No bureaucratic study or public union advocacy changes the facts that the private enterprises are fighting a rear guard effort to subsist.

With the election of President Obama to a second term, the reigns of restraint on public agencies and expenditures are non-existent. Democratic Leader Nancy Pelosi says ‘No Time To Waste’ On National Debt is a factual appraisal of the attitude that drives the disparity between employment in enterprises that have to earn their way to profits and public agencies that are protected from the harsh consequences of a balanced budget. "We look forward to hearing from voices across the private sector as we work together to reach a balanced agreement," said Pelosi.

The relationship equilibrium between the private and public spheres is out of line. More government spending never generates a genuine economic recovery. Making matters worse, the prospects of a rise in government salaries only exasperates the problem. The need for a true dramatic across the board reduction in federal agency budgets is the proper response. Private businesses understand the need to scale back in a depressed economy in order to survive. In spite of this certainty, the federal government operates as if their ranks are the new and only economy.

In an age of disappearing private pensions and job security, why allow "public servants" to dominate the job market because of odious taxpayer subsidies. The current pay differential between the free market and the federal bureaucrat guarantees a marginal economy at best.

James Hall – December 12, 2012

Source : http://www.batr.org/negotium/121212.html

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2012 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

BATR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.