The Twitter Stock Market Investor Sentiment Indicator

Stock-Markets / Stock Market Sentiment Dec 10, 2012 - 09:12 AM GMTBy: PhilStockWorld

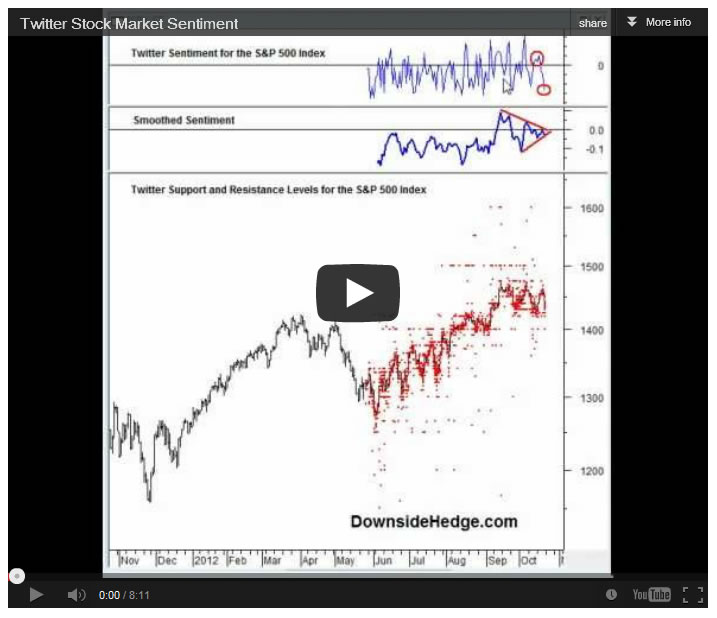

The Downside Hedge Twitter Sentiment indicator for the S&P 500 Index (SPX) is confirming the current uptrend. Both daily and smoothed sentiment are showing very strong readings that reflect the optimism of market participant’s tweets. We saw a good number of tweets early last week predicting the market would hold support and that any dip should be bought. This proved to be true as the dip to 1400 on SPX was bought aggressively. Later in the week traders were tweeting about trading the current range, but still wanting to be buyers to levels as low as the 1385 on SPX (near the 200 day moving average).

The Downside Hedge Twitter Sentiment indicator for the S&P 500 Index (SPX) is confirming the current uptrend. Both daily and smoothed sentiment are showing very strong readings that reflect the optimism of market participant’s tweets. We saw a good number of tweets early last week predicting the market would hold support and that any dip should be bought. This proved to be true as the dip to 1400 on SPX was bought aggressively. Later in the week traders were tweeting about trading the current range, but still wanting to be buyers to levels as low as the 1385 on SPX (near the 200 day moving average).

Smoothed Twitter sentiment continues to print well above zero and above its rising trend line. This is due to a large volume of tweets mentioning that the fiscal cliff disagreement would be solved. In addition, there were many tweets suggesting that the market will be range bound until the issue is behind us. Not very many traders want to be aggressively long or short until they have more clarity, which is giving an overall bullish bias to sentiment.

Our Twitter support and resistance levels have tightened significantly adding further proof that traders are waiting for a break of the current range of 1385 on the downside and 1425 on the upside in the S&P 500 Index (SPX). We are still seeing tweets for 1400 on SPX as support. However, 1385 is getting so much attention that we believe that 1385 is the current line in the sand for the bulls. For this reason we consider 1385 major support. A break below 1385 would most likely bring more selling.

Above the market, traders were tweeting 1425 in large volume as a target for SPX, but no higher. This is interesting considering the fact that our Twitter sentiment indicator is showing so much strength. We suspect this reflects the fact that traders are tweeting that they want a correction that they can buy rather than a push higher right now. A break above 1425 on SPX may catch many traders off guard, which could create a quick rally to 1435 or 1450 as those waiting for a dip start to chase prices higher.

Overall from a sentiment, support, and resistance perspective we have to conclude that money managers and traders are waiting with optimism. They believe the market is going higher, they want to be buyers below the current level, but they’re willing to wait for a clear signal before allocating much money.

Note from dshort: Here is a YouTube video in which Blair gives an explanation of the indicator and examples of how he used it in his posts over the last several weeks.

--------------------------------------------------------------------------------

For additional background information on this indicator, see Gauging Investor Sentiment with Twitter.

Blair Jensen at Downside Hedge tracks Twitter sentiment and provides hedging strategies for individual investors.

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2012 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.