Fiscal Cliff, Why The Rich Will Not Abandon Dividend Stocks

Politics / US Politics Dec 09, 2012 - 01:28 PM GMTBy: Richard_Shaw

WHO ARE THE RICH? First an apology for using the term “rich”. Because this is about pending tax policy, we are using the Washington D.C. working definition of rich. You know — the movement that began with soak Warren Buffet and Bill Gates, because billionaires don’t pay enough and actually want to pay more — the soak the billionaires movement that quietly became the soak the millionaires movement, that morphed into soak the rich, who we find are those couples who make $250,000 per year or more (and singles who make $200,000 per year or more).

WHO ARE THE RICH? First an apology for using the term “rich”. Because this is about pending tax policy, we are using the Washington D.C. working definition of rich. You know — the movement that began with soak Warren Buffet and Bill Gates, because billionaires don’t pay enough and actually want to pay more — the soak the billionaires movement that quietly became the soak the millionaires movement, that morphed into soak the rich, who we find are those couples who make $250,000 per year or more (and singles who make $200,000 per year or more).

No doubt, $250,000 goes a long way for lifestyle in some towns, but barely keeps a family above water in NYC and some other places. Anyway, $250,000 is the threshold for higher taxes being discussed as part of the fiscal cliff resolution, so we’ll go with that for the purposes of this letter.

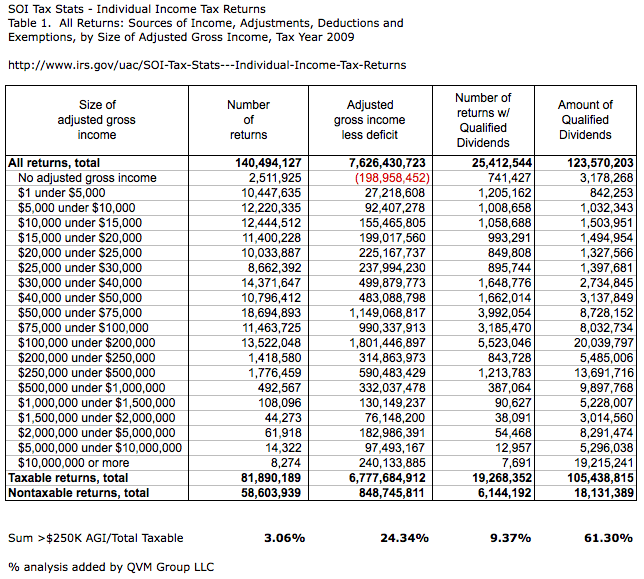

Actually the argument of soak the rich, got changed to soak the top 1%, then the top 2% and recently in one speech the top 3%. We think it is more reasonable to talk about percentile tiers than rich versus middle versus poor, but unfortunately for everybody, there is no way out of all our financial problems without everybody paying more one way or the other. Washington surely has more recent data, but based on the published 2009 IRS tax statistics, those tax filers with adjusted gross income of $250,000 or more were 1.78% of all filers, and 3.06% of filers who owed any taxes.

[note: we are working off of Adjusted Gross Income here, and the law is proposed based on Taxable Income which is not the same number, so the tax impact in this discussion is somewhat different, but this data is probably good enough to study the general question; and if lots of deductions are capped or eliminated, AGI will begin to approach the taxable amount.]

If you should care to inspect the IRS tax statistics for 2009, they are available at this link.

We have the dilemma that the United States has increasingly tried to create a European style entitlements state (and playing the world’s policeman via a giant military), while at the same time taxing like a state where everyone has personal responsibility for their own outcomes. As anyone who looks at Europe will see, it is not just the rich who pay a lot for universal benefits.

It is also a practical fact that corporations (and therefore the owners of private and public companies) don’t ultimately pay taxes. When their costs go up (whether through taxes, labor costs, or other input costs), they eventually pass them through to the broad population in the form of higher prices for goods and services — in which case everybody pays.

BACK TO WHY THE RICH WILL NOT ABANDON DIVIDEND STOCKS

Those who fear that dividend stocks will collapse due to the scheduled increase of dividend taxes to the ordinary rate are most likely wrong, because the impact is far less on the rich (as defined above) and far less overall than the surface numbers suggest.

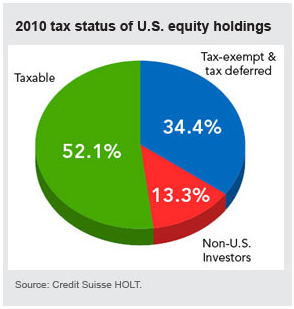

FIRST, only about 1/2 of all dividends are earned by individual taxpayers, as this graphic from Fidelity for 2010 shows:

SECOND, about only 60% of all dividends earned by individuals were earned by those in the rich category, as this table of extracted data from the 2009 IRS tax statistics shows:

(click image to enlarge)

THIRD, when you combine the 50% of stocks owned by individuals with the approximate 60% of dividends in individual tax returns that are earned buy the rich, you see that about 30% of overall dividends are earned by the rich (assuming that individual accounts, tax-deferred, and tax-exempt accounts, and non-US accounts have an approximately equal mix of dividend and non-dividend stocks,

That means that 70% of those individual accounts and tax-deferred and tax-exempt accounts, and non-US holders of dividend stocks are not scheduled to have any reduction in net cash flow from dividends as a result of the 2013 US tax rates for dividends. They have no direct tax related reasons to move out of dividend stocks.

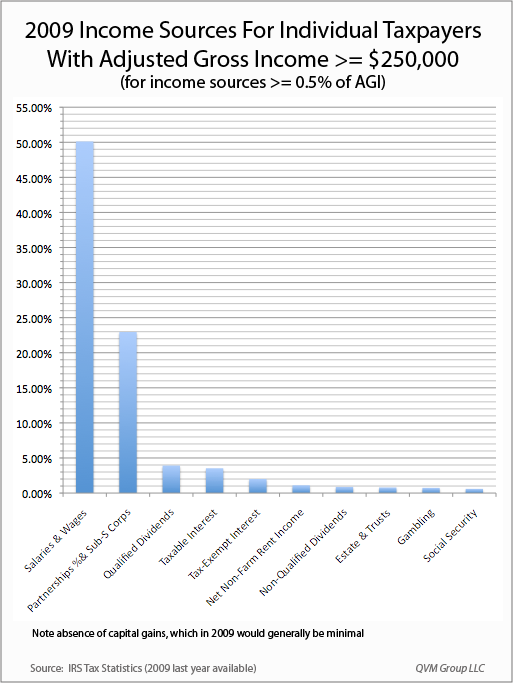

FOURTH, dividend income is only about 3.9% of the adjusted gross income of the $250,000+ earners who garner 30% of all dividend income, as shown in this chart which compares the percentage of income for the rich that comes from each source that is at least 1/2% of their adjusted gross income.

The rich got about 50% of their income from wages and salaries, about 23% from partnerships and sub-S corporations, 3.9% from dividends, 3.5% from taxable interest and 2.0% from tax-exempt municipal bond interest in 2009.

In 2009, capital gains were negligible, and are larger these days, but capital gains are less reliable than dividends. The rich are not likely to decide to go solely for capital gains as a result of tax rate changes They will want some mix of stable income and gain potential. They can’t go substantially to bonds right now, because rates are very low and there is no income growth potential.

Muni bonds not only have credit risk which is rising, but tax exemption itself is potentially on the chopping block. The Simpson-Bowles report recommended grandfathering old muni bonds and eliminating all tax exemption for new muni bonds. The President has proposed limiting the tax benefit of muni bonds to 28% (in an environment where the full tax would be 43.4% (39.6% + 3.8% Medicare surcharge tax on all investment income).

FIFTH, the additional 24.6 points of tax on dividend income will be only somewhat less than 1% of their total adjusted gross income that is taken away versus this who are not rich. That is not enough to cause the rich to walk-away from dividends. (that is 24.6% of the 3.92% that came from qualified dividends in 2009) — the rich also got 0.88% of their income from non-qualified dividends in 2009, but they were subject to ordinary rates at that time.

We didn’t include the 3.8% Medicare tax as an additional burden on dividend income, because it is also applicable to every other sort of investment income; including interest, dividends, capital gains both long and short, rents, and royalties. There is simply no place to hide from that.

CLOSING

We don’t want to pay more taxes, and most likely you don’t want to either; and the extra bite out of dividend income is unpleasant. However, in light of these facts, we don’t see the market overall reacting as drastically to the change in dividend tax rates as the 15% to 43.8% (basically 3X) change to the top rate suggests on the surface.

A minority of all dividend income is earned by the rich. A small portion the total income of the rich comes from dividends. Dividends are less than 1/2 of the investment income of the rich. And, the rich don’t have many other places to go to find yield that provides the combinations of income growth, liquidity and relative stability and safety as high quality, brand dominant companies with good dividend coverage and long histories of paying and increasing dividends.

What do you think?

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2012 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.