Gold Is A Physical Safe Asset Says Central Bank of Korea

Commodities / Gold and Silver 2012 Dec 05, 2012 - 07:28 AM GMTBy: GoldCore

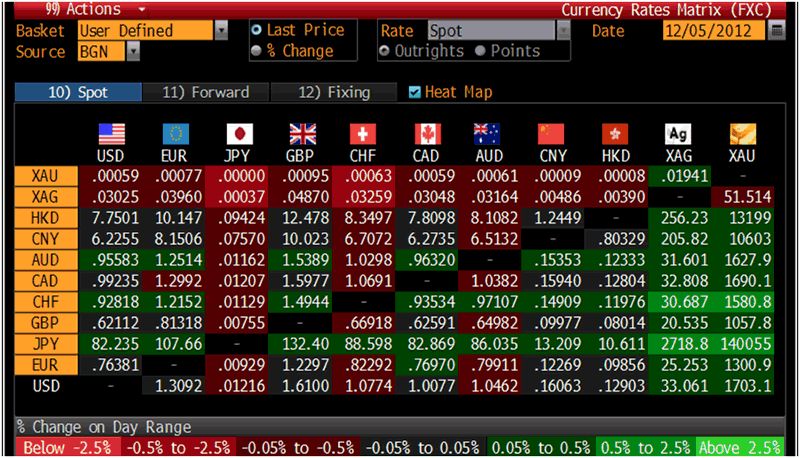

Today’s AM fix was USD 1,703.00, EUR 1,300.79, and GBP 1,057.90 per ounce.

Today’s AM fix was USD 1,703.00, EUR 1,300.79, and GBP 1,057.90 per ounce.

Yesterday’s AM fix was USD 1,706.75, EUR 1,305.35, and GBP 1,058.65 per ounce.

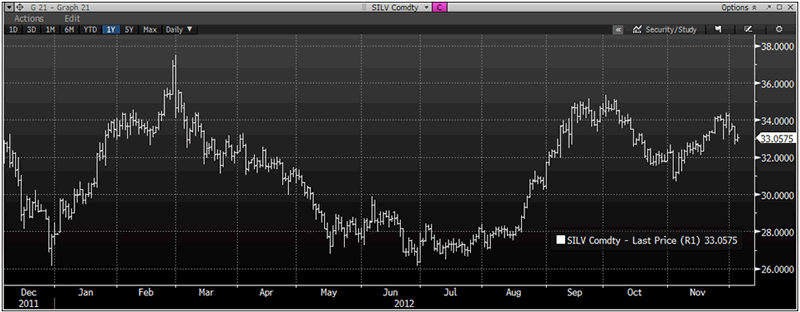

Silver is trading at $33.15/oz, €25.46/oz and £20.67/oz. Platinum is trading at $1,597.00/oz, palladium at $681.00/oz and rhodium at $1,075/oz.

Cross Currency Table – (Bloomberg)

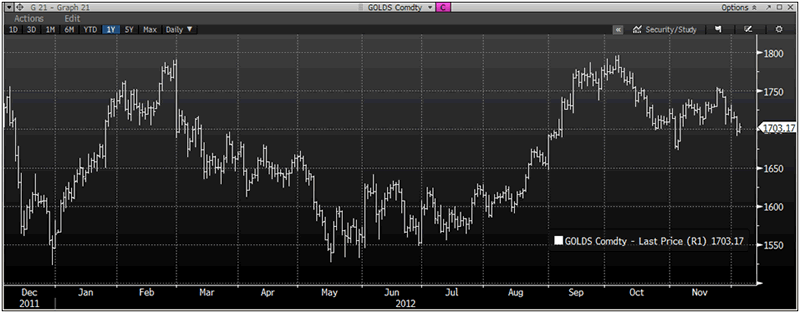

Gold fell $18.50 or 1.08% in New York yesterday and closed at $1,696.70/oz. Silver slid to as low as $32.66 and finished with a loss of 1.88%.

Gold futures selling after midnight in New York, when European and American traders are away and Tokyo's gold trading is quiet after lunch, drove prices down $10/oz in only one minute. More than 3,000 gold-futures contracts changed hands at 12:47 a.m. New York time, and the market's quick slide triggered an automatic, 20-second trading halt in February gold futures, said the operator of the Comex.

According to Dow Jones, preliminary exchange data showed that trading volume from 12 until 1am was over 6 times the average of the last month.

Gold has recovered from the fall yesterday and overnight and is tentatively above $1,700/oz.

There was no fundamental driver of the price falls yesterday or today. It may have been momentum traders selling as the short term trend is now down. Yesterday stop losses were breached at $1,710 & $1,700 which led to further falls.

Support is now at the early November lows of $1,673/oz – seen just before Obama’s election.

The stalemate between the US Congress and the White House has some players waiting on the sidelines.

Important on the horizon is the Fed meeting next week December 11 and 12th, the latter including a summary of economic projections and a press conference by the Chairman. In the minutes released after the last meeting, the US Fed layout a threshold strategy where the Fed would maintain near zero interest rates based on an economic variable such as employment rates at 7.5%.

The crux of the issue FOMC members is deciding whether that variable should be given with numeric or verbal guidance. Since, Operation Twist is expiring at the end of the year; information is necessary as to when it will be replaced with QE4.

The Bank of Korea increased gold reserves 20% last month to diversify investments, boosting holdings for the fourth time since June 2011 and underscoring increased demand by central banks according to Bloomberg.

The bank added 14 metric tons in November, bringing the total to 84.4 tons, the bank said in a statement today. By value, holdings increased about $780 million to $3.76 billion, equivalent to 1.2% of total reserves, the bank said.

“Gold is a physical, safe asset,” the Bank of Korea said in the statement. The precious metal “is a way of diversification, which helps reduce investment risk in terms of foreign-exchange reserves management,” it said.

The Bank of Korea bought 16 tons in July, 15 tons in November 2011 a further 25 tons over a one-month period from June to July last year.

Gold 1 Year – (Bloomberg)

Russia Favors Gold Over Sovereign Bonds

Russian Finance Minister Anton Siluanov speaking to reporters yesterday said that gold is seen by Russia’s central bank as a “rather stable” asset amid global monetary easing.

The world’s biggest energy exporter saw gold and foreign exchange reserves rise to $524.3 billion in the week to Nov. 23 from $522.2 billion a week earlier.

At the end of 2011, Russian foreign exchange reserves (including monetary gold, special drawing rights, reserve position at the IMF and foreign exchange) were at $498.6 billion.

They remain the world’s fourth biggest after China, Japan and Saudi Arabia. More than 41 percent of its currency reserves were in euros as of Sept. 30 but the Russia central bank is gradually reducing its exposure to the dollar and the euro.

Silver 1 Year – (Bloomberg)

Separately, China and Russia pledged to further strengthen their economic and financial cooperation at a bilateral dialogue between the two countries' said finance ministers on Monday.

Chinese Finance Minister Xie Xuren and his Russian counterpart Anton Siluanov co-chaired the Fourth Russia-China Finance Ministerial Dialogue, during which the two sides discussed a number of bilateral and international economic and financial issues, according to Xinhua.

The two sides exchanged views on the global macroeconomic situation, policies and measures to promote sustainable economic growth in both countries, as well as the fiscal regime and tax framework.

The two ministers also discussed how to strengthen international financial cooperation between China and Russia.

Central banks in South Korea, China and Russia realise gold bullion is a safe haven asset.

The majority of retail investors and the general public in the most of the world, and especially the western world do not ... yet.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.