Buffett’s Gen Re Sees “Tendency To Higher Gold Prices”

Commodities / Gold and Silver 2012 Dec 04, 2012 - 10:23 AM GMTBy: GoldCore

Today’s AM fix was USD 1,706.75, EUR 1,305.35, and GBP 1,058.65 per ounce.

Today’s AM fix was USD 1,706.75, EUR 1,305.35, and GBP 1,058.65 per ounce.

Yesterday’s AM fix was USD 1,718.00, EUR 1,317.59, and GBP 1,069.67 per ounce.

Silver is trading at $33.55/oz, €25.60/oz and £20.77/oz. Platinum is trading at $1,598.50/oz, palladium at $685.10/oz and rhodium at $1,075/oz.

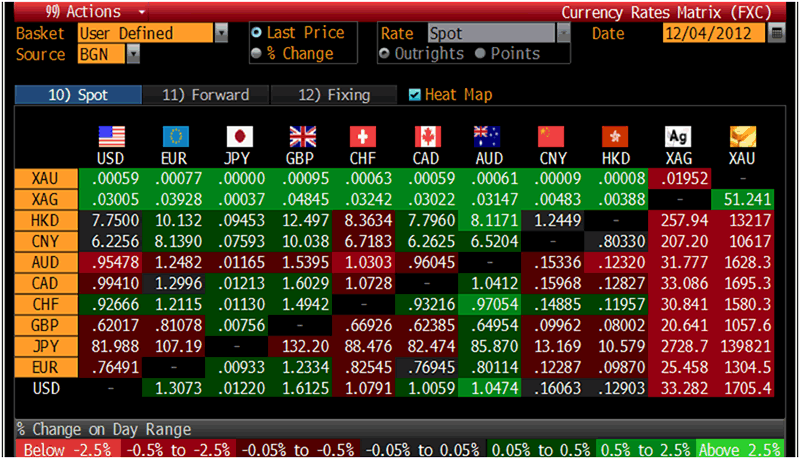

Cross Currency Table – (Bloomberg)

Gold climbed $2.00 or 0.12% in New York yesterday and closed at $1,715.20/oz. Silver dropped to $33.38 then rose to as high as $33.821 and then retreated, but it still finished with a gain of 0.66%.

Gold fell to its lowest point in a month on Tuesday, briefly touching $1,700/oz after a drop below $1,710/oz triggered some technical selling.

Investors with a longer time horizon continue to accumulate on the dip and the uncertainty of shaky sovereign economies will fuel continuing diversification into gold.

Yesterday, Australia’s central bank cut interest rates ¼ point to match a record low. Central banks around the world continue to flood the market with cheap, printed fiat money which will continue to boost gold bullion.

Platinum group metals have see a rise in the past few weeks in tandem with car sales data, as the metals are used in exhaust catalysts.

Warren Buffett’s General Re-New England Asset Management has warned that until central bank monetary policies around the world change “there will be a tendency to higher gold prices.”

General Re-New England Asset Management, a unit of Warren Buffett’s Berkshire Hathaway Inc., said gold may advance as businesses temper spending and central- bank stimulus measures fall short.

Gold’s climb last year to more than $1,900 an ounce was fuelled by the expectation that government spending cuts in Europe would reduce demand for goods and services, GR-NEAM Chief Investment Officer John Gilbert wrote in a newsletter posted on the unit’s website today, as reported by Bloomberg.

“There is growing evidence that the rising price of gold is a statement about the discouraging prospects for returns on productive investments,” Gilbert said.

“We hope that this analysis is wrong. We fear that it is not.”

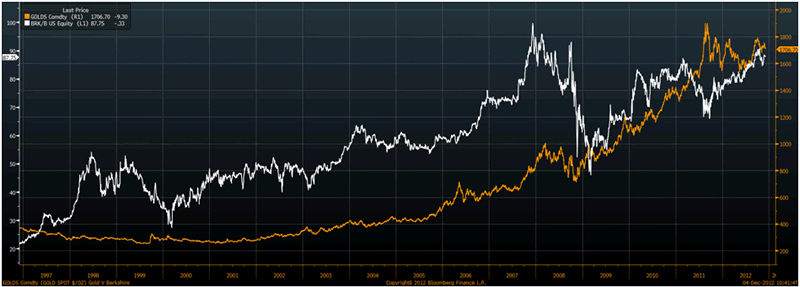

Gold vs Berkshire, from 1997 – (Bloomberg)

Buffett, 82, has said productive assets like farms and companies will outperform gold over the long term.

Gold retains some of its appeal to investors even as central banks around the world implement policies to spur investment, Gilbert said.

“Businesses express caution by not making the investments necessary to improve productivity,” Gilbert wrote. It’s not “clear that activist central banks can repeal gravity by encouraging investors to take risk anyway. There will be a tendency to higher gold prices until that changes.”

GR-NEAM had $64.4 billion in unaffiliated assets under management as of Sept. 30. The investment adviser primarily serves insurers.

The European Central Bank has provided the region’s banks with cheap three-year loans and committed to buy the bonds of distressed nations as long as they fix their budgets and reform their economies. The Federal Reserve has kept borrowing costs near zero and expanded its balance sheet to help stimulate the U.S. economy, the world’s largest.

Buffett said in a February letter to Berkshire shareholders that investors should avoid gold, because its uses are limited and it doesn’t have the potential of farmland or companies to produce new wealth. Achieving a long-term gain on the metal requires an “expanding pool of buyers” who believe the group will increase further, he said.

“What motivates most gold purchasers is their belief that the ranks of the fearful will grow,” he wrote. “During the past decade that belief has proved correct. Beyond that, the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis. As ‘bandwagon’ investors join any party, they create their own truth -- for a while.”

Buffett and his partner Charlie Munger’s lack of appreciation of gold as financial insurance and bias against gold either shows a significant and potentially costly blind spot. Alternatively, there is an element of “talking their own book” as Berkshire is obviously very exposed to the U.S. dollar, U.S. equities and U.S. banks and the pair may realise the threat that gold poses to their lack of diversification.

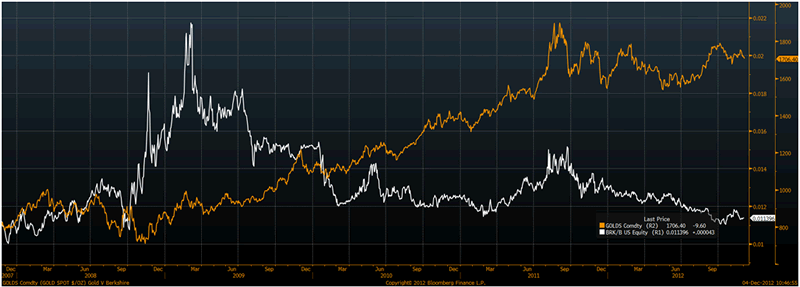

The performance of Berkshire Hathaway versus gold since 1996 and since the outset of the financial crisis five years ago (see charts) shows gold’s importance as a hedging instrument and a safe haven in a portfolio.

Buffett deserves the title ‘Sage of Omaha’ and is to be respected but his failure to appreciate gold’s importance as a diversification in a portfolio and his repeated negativity towards gold, in contrast to his father Howard Buffett, will not be judged kindly in financial history.

Gold vs Berkshire, from 2007 – (Bloomberg)

It is never too late to do the right thing and to ensure his legacy Buffett should acknowledge gold has intrinsic value, has utility as money, as monetary asset, a finite currency and as financial insurance in a portfolio.

By acknowledging the truth he will regain much respect, help protect many investors and he may even manage to protect and grow his own and his shareholders wealth.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.