WTI Crude Oil Price To Test $65 Level in 2013

Commodities / Crude Oil Dec 02, 2012 - 03:09 PM GMTBy: EconMatters

WTI closed November just shy of $89 a barrel on hopes of an improving economy. I think there is an argument for an improving economy in 2013, but it is just too early to tell how things are going to come together with the economy, and all the ramifications of basically an anti-business and social agenda political leadership of the last four years.

WTI closed November just shy of $89 a barrel on hopes of an improving economy. I think there is an argument for an improving economy in 2013, but it is just too early to tell how things are going to come together with the economy, and all the ramifications of basically an anti-business and social agenda political leadership of the last four years.

I am not making a political statement that there aren`t some benefits to be gained by such governmental policies, more to state the fact that with a lot of the legislative and fiscal policies of the last four years we have yet to fully understand some of the costs and unintended consequences of these policies like higher taxes, increased healthcare costs, and increased business regulation costs.

So this is an area that remains to be seen how all this plays out in the economy. Just last year many analysts were expecting 2013 to be an increased chance of a recession, we shall see.

But even with the best case scenario for a stronger 2013 economy in the US, this isn`t going to effectively change the actual demand picture for Petroleum products in a mature market like the US to any significant degree.

In addition, with the latest employment numbers coming out of Europe and the slowdown finally hitting Germany it appears Europe is not going to have a robust 2013. Asia, namely China appears to be coming off the bottom, but the days of 12% economic growth are over for the emerging market, in short, they have finally “emerged”!

China has infrastructure and inflation constraints that hamper growth levels higher than 7% going forward, and real growth may be much less than reported. This economic reality is priced into the Chinese stock market, which has had an abysmal year.

In regard to Japan, they are about to have another leadership change, the 7th one in as many years, and this economy is in a state of perpetual deflationary decline which has lasted for the last twenty years. So despite the new leadership change, Japan has major demographic and anti-competitive businesses constraints that auger more of the same for 2013.

So the US market, which is a mature market may actually have the best economy of the major economies and users of Petroleum products in 2013, and that`s not saying much from the demand side of the equation.

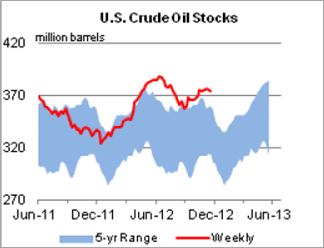

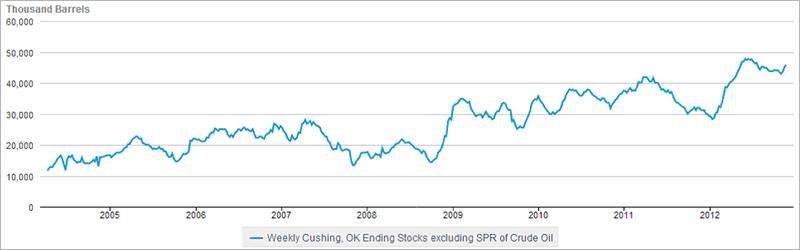

Source: EIA

Now we get to the supply side of the equation, and here is the problem for Oil bulls, and partly the reason so many funds got killed in 2012 trying to aggressively invest in Oil through Futures, ETF`s and the like. No established trends could take hold because the supply levels globally and domestically are well above the five-year average, and at the height of that range. So we have had a drop in WTI from $109 to $78 totaling $31 a barrel, and $100 to $84 totaling $16 a barrel which is not good if you’re a fund manager investing long-term.

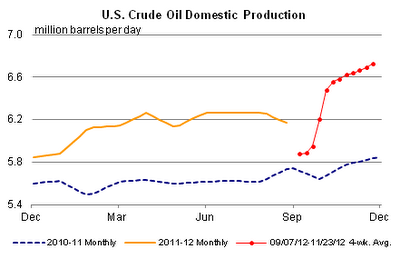

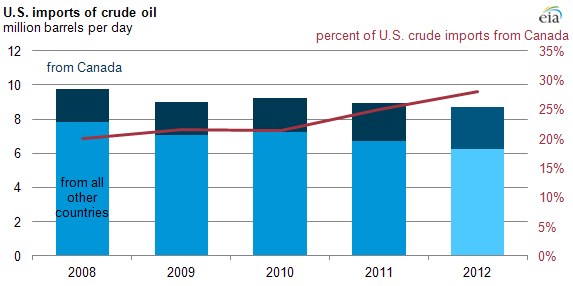

The most noteworthy trend in the Oil markets for 2012 is the increased role of US and Canadian production, and it is only going to get stronger for 2013 and into the future. The trend is definitely not a fluke; we have had a nice run of over a decade of high prices which has spurred a lot of economic investment into new technologies and an increase in smaller, independent operators searching for opportunities to make money by producing oil in North America.

Source: EIA

Well, we are finally starting to see the results of the increased capital investments, and just like Shale Natural Gas, these projects once they get going stay online, even as prices drop substantially. Expect the same for Oil, as frankly, there just aren`t a lot of areas where you can make the kind of margins that are attainable in the Oil market. It is a good business to be in versus many other industries vying for capital resources.

Source: EIA

Just to give the reader an idea of some of this dynamic change in US production numbers alone, the United States is on track for a 7% increase in oil production this year to an average of 10.9 million barrels per day. Furthermore, The U.S. Department of Energy is forecasting that U.S. production of crude and other liquid hydrocarbons will average 11.4 million barrels per day in 2013. For comparison sake Saudi Arabia's output is approximately 11.6 million barrels per day.

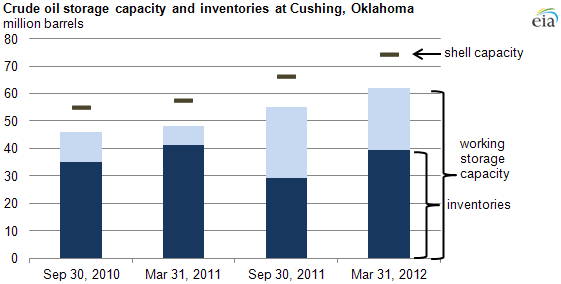

The only reason Oil isn`t much lower currently is that there has been a lot of increased Oil storage for newly built capacity in China and the US. For example, Cushing Oklahoma which is the location that the WTI Futures contract is based upon, had a storage capacity of approximately 47 million barrels in March 2011, with increased Capacity upgrades it stands just above 60 million barrels as of March of 2012.

Source: EIA

But here is the kicker, on September 30, 2011 Cushing had just under 30 million barrels in storage, as of last week Cushing has 46 million barrels stored at this location, this is an increase of 16 million barrels in one year, if we have a repeat in 2013, which all signs point to as the trend is getting stronger not weaker, than Cushing will be running out of working storage capacity of just over 60 million barrels. I am sure Cushing is building more workable storage capacity as we speak, but at some level what is the point, 2013 is when WTI starts really pricing in some of this supply glut that comes from increased US and Canadian production.

The supply glut just isn`t in WTI it is felt in total US inventory levels which to quote directly from the EIA Report: “At 374.1 million barrels, U.S. crude oil inventories are well above the upper limit of the average range for this time of year.” The US Inventory level will probably bust through the 400 million level in 2013 for the first time in history.

Source: EIA

Prices have also been supported by international cases of many supply disruptions during the past two years, but slowly but surely, this oil is coming back online, and expect more output internationally.

Libyan oil is now up to full speed, Iraq output had been greater than expected, and is the real wildcard because they are just now starting to hit their stride, and have the potential for much more on the upside if all those new projects start producing, not only for 2013, but for the next decade plus, it all depends upon political stability in the country.

But here is the thing you have to remember about international Oil, everybody needs money, regardless if your extremist, Islamic fundamentalist, Democratic it still all applies to the need for money, and whomever is in charge, is going to need to monetize their resources, and these countries have very little competitive options other than oil for generating revenue, one way or another this Oil finds its way to the market.

As it happens, many of the international countries robust in Oil resources need to generate Oil revenues because a large portion of their respective populations is subsidized through Oil exports, this trend will continue as it has for the last 30 years with no major supply disruptions.

In fact, I expect OPEC will need to start entertaining supply cutbacks in 2013 to address swelling inventory levels globally, but again here is the irony, they may talk up the market with production cuts, but the fact remains, the incentive is even greater for cheating on quotas the lower the price goes, because the governments still have budgets based upon the same level of revenue, and the only way to get the same revenue with lower prices is to pump more oil.

Moreover, since a lot more capacity is capable of coming online in 2013 globally, and all these governments from Iraq to Sudan need money, expect greater achievement towards capacity which is bearish for Brent Oil prices as well, i.e., expect Brent to test the $85 level sometime in 2013.

The last decade has been exemplified by higher energy prices, and with this came increased CAP EX investment, new technologies were refined, and North America has seen a rebirth in energy activity. It all started with natural gas, and now we are starting to experience this sea change in the Oil market.

Prices in 2012 started addressing this dynamic change, but the real effects of this trend will start taking shape in 2013 as storage constraints start kicking in, demanding a re-pricing of the commodity.

After all, no matter how much the Fed devalues the dollar, unlike Gold or Silver, you can only store so much Crude Oil, and with 700 million in the Strategic Reserves, another 400 million in US Reserves, how much do we really need to store in an increasingly energy independent North American Region?

Economics will dictate that you can only build so much storage to avert the price drop from continual over supply, and right now the world produces more Oil than it consumes each day, and it has for the past 16 months, this trend will only get worse in 2013. So expect prices to finally start to address this over supply issue in the Oil Markets in 2013.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2012 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.