The Gold Price Barometer

Commodities / Gold and Silver 2012 Dec 01, 2012 - 12:01 PM GMTBy: Brian_Bloom

There are some very respected technical analysts who are calling for an exploding gold price and there are also a few respected technical analysts who disagree with that view. One analysis that recently arrived in my inbox shows that gold’s On-Balance-Volume chart is giving sell signals.

There are some very respected technical analysts who are calling for an exploding gold price and there are also a few respected technical analysts who disagree with that view. One analysis that recently arrived in my inbox shows that gold’s On-Balance-Volume chart is giving sell signals.

From a technical perspective, if one takes emotion out of the equation, there are three charts that seem to me to be of importance (four if one includes that OBV chart which I am unable to reproduce for copyright reasons. It was produced by Kimble Charting):

The first chart below is a trading chart that shows $1800 is the key resistance level and $1500 is the key support level. (Source of all charts: Stockchart.com)

The formation on this chart reflects investor indecision. On the upside, the indecision will probably be resolved if/when the $1800 level is penetrated. That will happen if perceptions begin to embrace coming inflation

Chart #1 – Daily Chart of Gold with Fibonacci support and resistance levels

The second chart is the “standard” 3 box reversal Point and Figure chart with the scale set at $10.

This chart shows an unresolved target of $1560 and that the only way this $1560 level is going to be negated is a) if it is reached, or b) If the $1790 level is penetrated on the upside.

Chart #2 - $10 X 3 box reversal Point and Figure Chart

Importantly, if the $1560 level is reached then, based on this chart, one still can’t say that the market will be anticipating deflation – because $1560 is still within the trading range of indecision.

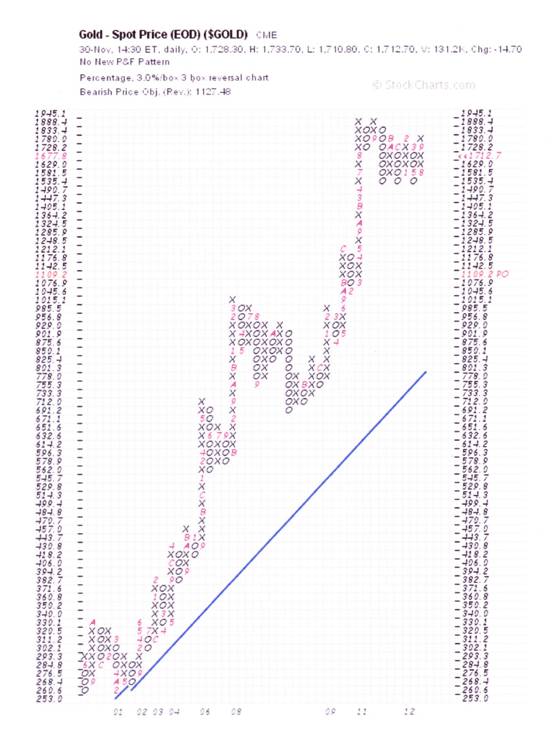

It’s the third chart that seems to me to be the important one:

This chart is calling for a target of $1109 and that the $1109 destination will remain the prevailing target until the price rises above $1880. There is no room for discussion on any of the above. Those are the facts.

Chart #3 – 3% X 3 box reversal P&F Chart

If the market begins to embrace deflation then the $1560 level will be reached and, very likely, the price will continue to fall below $1560.

Fundamentally (in my view) the reason that the gold price is trading between the two extremities is that the debt overhang has one of only two possible outcomes, and it is not yet transparent which outcome will prevail:

- It will be written off in some way (deflationary)

- The central banks throw ALL caution to the winds and man the printing presses (inflationary)

My personal assessment of this is that those who are arguing for inflation are arguing from theory. Theoreticians do not live in the real world. They live in a world of books and media and arguments and cerebral logic – and they often also live in protected environments such as educational institutions and government employment. For example, both Professor Bernanke and Dr Greenspan before him came out of the corner of theory.

In the real world of kill or be killed, people don’t behave rationally in a manner that the text books describe. They lie and cheat and manipulate (at one end of the spectrum) or they turn openly vicious and just take what they want (at the other end of the spectrum). If the question ever devolves to survival and it becomes every-man-for-himself, then the system will break down. There is no way of “protecting” against that – which, incidentally, will be viciously deflationary. Therefore, the goal of the authorities should be to avoid a situation where people begin to perceive that their own survival will be a function of every man for himself.

The end game has to be that we must work out a way to keep the system from breaking down. Even a child can see now that printing money will just postpone the day. The central bankers are running fools errands because they don’t know what to do and the politicians are so self centred that they are not thinking of protecting the system. They are thinking of protecting their hides (and maybe personally benefiting in some way). What is needed is a total restructure of the way we conduct our affairs and the longer we leave that “for tomorrow” the closer we will edge towards collapse.

At the end of the day, what is needed is ethical behaviour and leaders of society possessed of personal integrity. What are the chances of that happening? Well, you can form your own view. My two factional novels suggest that this outcome is possible and makes some concrete suggestions regarding how this might be achieved. Many will regard them as “impractical”. I would disagree with that view. From my perspective, it is the central bankers and the so-called hard-nosed realists who are living in a world of fantasy. The old system has passed its use-by date. It’s just that many of those who live at the coal-face are so close to the action of the waves that they can’t see the direction of the tide.

So let’s put it this way: The longer the market dickers about which way the gold price is going to “finally” break, the longer people are going to be hiding from the reality of the situation we face, and the more difficult it will become to resolve it.

Here’s a little anecdote:

After World War II, the United Nations took a decision (supported by the vast majority of members) to allow the Jews a “homeland”. The Arabs (in particular, the Palestinians) rejected that decision in 1948 and have been at war ever since with the Israelis. What has ebbed and flowed is the intensity of hostility as opposed the existence of that hostility. Now the Palestinians are rejoicing because the vast majority of the members of the United Nations have voted to recognise Palestine as a “state”. So, this is the situation: “We will rejoice the decisions of the majority when it suits our agenda and we will reject the decisions of the majority when it does not.” That, in my book, is the definition of anarchy. The recent vote by the UN was the first solid evidence that the Rule of International Law is indeed breaking down. A vote of expediency was taken that paid no heed to an existing law and the refusal of Arab nations in general and the Palestinian people in particular to abide by that law.

The world’s challenges do not only exist at the level of economics. More importantly, they exist at the level of “power” politics and the planet is also suffering from ecological degradation.

As mentioned earlier, most people are so concerned about their day-to-day survival that they lose sight of the Big Picture. In my view, the gold price is symptomatic of what’s happening at the Big Picture level. For the world’s economic system to survive unscathed, the gold price needs to remain in its trading range. If we want a good outcome then that’s the only “good” outcome I can see. A “bad” outcome would be a break below $1500 and a “catastrophic” outcome would be a break above $1800.

In my view, we need to stop worrying about the gold price and start worrying about rebuilding the world’s economic and social systems from their foundation upwards. The economic foundation is not based on gold or any other “form” of monetary exchange. It is based on energy. The legal system is not based on Shariah “Law” or Biblical “Law”, it is based on Ethics, which is the foundation of all laws. We have been drifting away from ethical behaviour and the Rule of Law has been eroding.

If you want do something “practical” about this then I suggest that you read my two novels and that you recommend to all your friends and acquaintances that they do the same. Those two books were intended to form a point of departure to more serious discussion along constructive lines, and you can read about them at my website from the link below.Author, Beyond Neanderthal and The Last Finesse

Beyond Neanderthal and The Last Finesse are now available to purchase in e-book format, at under US$10 a copy, via almost 60 web based book retailers across the globe. In addition to Kindle, the entertaining, easy-to-read fact based adventure novels may also be downloaded on Kindle for PC, iPhone, iPod Touch, Blackberry, Nook, iPad and Adobe Digital Editions. Together, these two books offer a holistic right brain/left brain view of the current human condition, and of possibilities for a more positive future for humanity.

Copyright © 2012 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.