Credit Default Swaps, the Next Financial Armageddon?

Stock-Markets / Credit Crisis 2008 Feb 22, 2008 - 06:24 AM GMT

Everyone knows that homeowners insurance is designed to insure against fires and floods but few are familiar with credit default swaps, arcane financial instruments invented by Wall Street about ten years ago. Credit default swaps (CDS) were designed as “insurance” to reimburse banks and bondholders when companies failed to pay their debts. Credit default swaps have become so popular among banks that the Comptroller of the Currency (OCC), which regulates banks, reports that they are the fastest growing derivatives product in the market, growing 19% from the second quarter to the third quarter last year to $14 trillion in value.

Everyone knows that homeowners insurance is designed to insure against fires and floods but few are familiar with credit default swaps, arcane financial instruments invented by Wall Street about ten years ago. Credit default swaps (CDS) were designed as “insurance” to reimburse banks and bondholders when companies failed to pay their debts. Credit default swaps have become so popular among banks that the Comptroller of the Currency (OCC), which regulates banks, reports that they are the fastest growing derivatives product in the market, growing 19% from the second quarter to the third quarter last year to $14 trillion in value.

The problem is, they are unregulated. Experts contend that, because credit default swaps have proliferated so rapidly, a hiccup in this market could set off a chain reaction of losses in financial institutions that will virtually dry up the banks' ability to lend. The cost of protecting corporate bonds from default soared to a record as investors purchased credit-default swaps to hedge against mounting losses in the $2 trillion market for collateralized debt obligations.

``The market is full of rumors of unwinding of CDOs, and the price action suggests that people believe the rumors,'' said Peter Duenas-Brckovitch, head of European credit trading at Lehman Brothers Holdings Inc. in London. ``It sort of has that Armageddon feel, and the market is feeding on itself.''

This is more than just a tempest in a teapot. Already AIG , the largest insurer in the United States , has had to deal with pricing and risk issues with its independent auditors on some of the credit default swaps it holds. Societe Generale, the French bank that recently reported losses from a rogue trader, also has problems with CDSs. "The purchase of assets originating from asset-management funds invested in credit-type underlyings could continue in the first quarter and, given the situation in the credit markets, lead to further write-downs," the bank warned. Credit Suisse was forced to raise the coupon on a $2 billion note it was offering after reporting writedowns of $1 billion in the first quarter of 2008 dealing with credit-default swaps.

All of this must be leading to arguments between the boards of directors and their independent auditors at almost every major bank about the true value and risk of their credit-default swaps. The trouble is, they must have their 2008 reports signed off by their auditors and in the hands of the Comptroller of the Currency by February 28th , for the OCC's year-end report. The problem is, practically no one can get a handle on the true value of their credit-default swaps because they are thinly traded, have huge counter-party risk, are unregulated and are difficult to analyze.

Next week I'll talk about how the other side of the swap is treated.

Crash Alert!

Harry Schultz commentary: “Pretend an emergency is coming, because it may be.” Most people will ask, “Why worry about the market? It appears to be recovering.” But Dow Theory states that, once the primary trend is established, it can last from a few months to many years. The rallies that may be touted as recoveries by Wall Street are just secondary movements that act as “release valves” to blow off some pressure in preparation for the next move in the primary trend. Human behavior needs modification at this point from “Buy the dips.” to “Sell the rallies.” The primary trend is now down.

Harry Schultz commentary: “Pretend an emergency is coming, because it may be.” Most people will ask, “Why worry about the market? It appears to be recovering.” But Dow Theory states that, once the primary trend is established, it can last from a few months to many years. The rallies that may be touted as recoveries by Wall Street are just secondary movements that act as “release valves” to blow off some pressure in preparation for the next move in the primary trend. Human behavior needs modification at this point from “Buy the dips.” to “Sell the rallies.” The primary trend is now down.

Higher consumer prices nail bonds.

“The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.5 percent in January before seasonal adjustment, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The January level of 211.080 (1982-84=100) was 4.3 percent higher than in January 2007.”

“The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.5 percent in January before seasonal adjustment, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The January level of 211.080 (1982-84=100) was 4.3 percent higher than in January 2007.”

That's only part of the story. The 3-month increase, compounded annually, was 6.8%. Is it any wonder that long term bonds , whose yields are only 4.55% aren't holding up?

Gold says, “Inflation.” Stocks say, “Deflation.” Which is it?

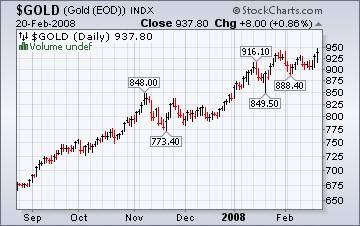

NEW YORK ( MarketWatch ) -- Gold futures closed with gains after soaring to a new record high of $958.40 an ounce Thursday, boosted by weakness in the U.S. dollar and the metal's appeal as a hedge against inflation.

NEW YORK ( MarketWatch ) -- Gold futures closed with gains after soaring to a new record high of $958.40 an ounce Thursday, boosted by weakness in the U.S. dollar and the metal's appeal as a hedge against inflation.

Gold remains in its up-trend, with no apparent letup. When will it stop? Let the market tell us.

Another major decline imminent in the Nikkei.

On Thursday Japanese shares rose 2.84%. Lest you think that a new bull market has begun, I might add that the rallied followed a 3.25% decline the day before. The trend is still decidedly negative, and may give way to yet another major sell-off before its troubles are over. Japanese shares are expected to open lower on Friday following the report on the Philadelphia Fed February Manufacturing Index, which fell to –24.0 from –20.9 in January.

On Thursday Japanese shares rose 2.84%. Lest you think that a new bull market has begun, I might add that the rallied followed a 3.25% decline the day before. The trend is still decidedly negative, and may give way to yet another major sell-off before its troubles are over. Japanese shares are expected to open lower on Friday following the report on the Philadelphia Fed February Manufacturing Index, which fell to –24.0 from –20.9 in January.

The Shanghai Composite poised...for what?

Banks were on the mind of Chinese investors as their market sold off today. A steep fall among lenders dragged Shanghai 's key stock index lower this morning. Shanghai Pudong Development Bank Co led the drop on speculation that the bank may raise as much as 46 billion yuan (6.4 billion U.S. dollars) from an additional share sale. The Bank of China tried to reassure investors that their exposure to sub-prime debt was minimal.

Banks were on the mind of Chinese investors as their market sold off today. A steep fall among lenders dragged Shanghai 's key stock index lower this morning. Shanghai Pudong Development Bank Co led the drop on speculation that the bank may raise as much as 46 billion yuan (6.4 billion U.S. dollars) from an additional share sale. The Bank of China tried to reassure investors that their exposure to sub-prime debt was minimal.

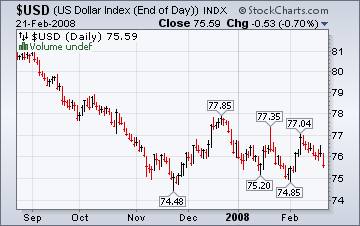

The U.S. Dollar is in a trading range.

NEW YORK (AP) — The dollar slumped Thursday as disheartening economic data poured in, while the European Union gave an outlook that would show the euro zone growing faster than the U.S. economy. What didn't help was that European and Asian stock indexes had a good day while the U.S. stock indexes declined. The Labor Department reported a slight drop in the number of people filing for unemployment benefits for the past week, but the four-week average rose to 360,500 — its worst level in more than two years.

NEW YORK (AP) — The dollar slumped Thursday as disheartening economic data poured in, while the European Union gave an outlook that would show the euro zone growing faster than the U.S. economy. What didn't help was that European and Asian stock indexes had a good day while the U.S. stock indexes declined. The Labor Department reported a slight drop in the number of people filing for unemployment benefits for the past week, but the four-week average rose to 360,500 — its worst level in more than two years.

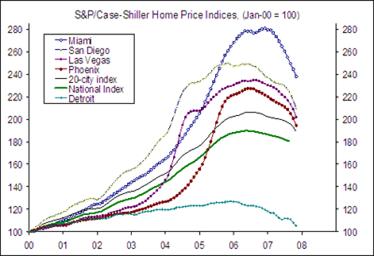

Falling satellites meet falling home prices.

While many have fretted over the upcoming resets of adjustable-rate mortgages, falling home prices are a much more important concern. Home price declines threaten to turn many recent homebuyers upside down – that is, owing more than the home is worth. Falling home prices and tighter mortgage credit in turn lead to even weaker housing conditions, further home price declines and even tighter mortgage credit, and so on. Is there a missile for falling home prices?

Plan for seasonal gasoline shortages.

The Energy Information Administration's This Week In Petroleum suggests that both planned and unplanned refinery outages will have a very large impact on gasoline prices in 2008. EIA expects (planned) refinery outages in late spring and early fall, since that is the time between peak heating and driving seasons when refiners typically do most of their planned maintenance. Expect the unexpected outages, too.

In a word, “Frigid” in the Midwest .

The Natural Gas Weekly Update reports, “ Spot prices increased this week as space-heating demand remained strong in large population centers in the Midwest and Northeast. Continued cold temperatures and increased crude oil prices, which rose to more than $100 per barrel yesterday (February 20), contributed to increases in natural gas prices.”

The Natural Gas Weekly Update reports, “ Spot prices increased this week as space-heating demand remained strong in large population centers in the Midwest and Northeast. Continued cold temperatures and increased crude oil prices, which rose to more than $100 per barrel yesterday (February 20), contributed to increases in natural gas prices.”

Meanwhile, natural gas in storage fell last week, but remained 5.8% above its 5-year average.

Dr. Housing Bubble meets Mish…

…and a good interview results. As you know, Mish (Michael Shedlock) is very opinionated about all things economic. The problem is, he's done his homework and goes far behind the headlines to arrive at his conclusions. So when strong opinion is backed by unassailable logic, the fur really flies. So read his interview to find out how changing attitudes will be changing the financial landscape.

Some places like Florida (which was ground zero of the housing bust) may bottom earlier. Areas that didn't experiences a boom like Detroit may just flat line for a few years. Places in small town USA may flatline as well. Vast areas in this country where there isn't much real estate wealth may stay flat for a few years. But everywhere else there was a major bubble (all the major population centers), the bottom is still many years

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are back in our weekly session on the markets. This week should be fascinating. You will be able to access the interview by clicking here .

New IPTV program starting in March.

I will be a regular guest on www.yorba.tv starting on Thursday, March 6 th at 4:00 pm EDT . Stay tuned for news and views!

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.