Carnage at Hewlett-Packard, Autonomy Only Tip of the Iceberg

Companies / Tech Stocks Nov 26, 2012 - 08:07 AM GMTBy: Money_Morning

Michael A. Robinson writes:

If you've been following my advice, you avoided the carnage at the fumbling tech giant, Hewlett-Packard (NYSE:HPQ)

Michael A. Robinson writes:

If you've been following my advice, you avoided the carnage at the fumbling tech giant, Hewlett-Packard (NYSE:HPQ)

In fact, I told my Radical Technology Profits readers on Sept. 18 not to buy into the hype that H-P was becoming a great turnaround story.

That was after I wrote in this Money Morning article from January that H-P was one of the five tech stocks to avoid. It's lost over half of its value since then.

And had you used my Real Demand Tracking System to check out this stock, you would have seen for yourself that H-P was a lousy investment.

No, I didn't have any insider source that warned me about the accounting scandal rocking this Silicon Valley giant.

It runs deeper than that -- the fundamentals and the technicals were just plain horrible for what is clearly a deeply troubled stock.

Hewlett-Packard's Autonomy Problem

In case you missed the news, H-P got crushed last week, falling more than 11% on word that the firm is writing down some $8.8 billion in the most recent quarter.

Honestly, that's an outrage.

I know, the party line is that H-P got hoodwinked when it bought the U.K. software firm Autonomy. Seems a whistle blower has now come forward to say Autonomy's accounting practices made the company a financial house of cards.

But as I see it, there was plenty of reason for HP to have been more cautious.

They were so hell-bent on trying to find new revenues outside of their hardware business they blundered into an ill-fated merger.

This is what happens when you throw spaghetti on the wall to see what sticks. I mean, you have to know a company is confused when it goes through three CEOs in as many years.

Here's a hint for high-tech leaders. When Larry Ellison tells anyone who will listen that a merger candidate is too expensive, heed the advice.

As the CEO of Oracle Corp. (NasdaqGS:ORCL) Ellison is about as good an M&A expert as you'll find anywhere. He's bought dozens of firms over the past decade.

If Ellison can't find a way to make a merger pay off, pretty much nobody can.

Here's the thing. The accounting scandal is a symptom of the problem, not the trouble itself.

Bigger Troubles at Hewlett-Packard (NYSE:HPQ)

Don't get me wrong. I'm not saying these guys are complete idiots. It's just that they focused on computer sales for far too long.

Note to H-P's executive suite -- you missed the mobile wave. Now what?

Just look at these lousy numbers from the quarterly report:

•Industry PC shipments were off 8% for the period, says research firm IDC. But H-P's decline was twice that.

•PC sales to consumers fell 16% as business bought 13% fewer machines

•Printer sales were off 5% while sales for networking and server gear dropped 9%.

So, let me ask you this: Where's the good news?

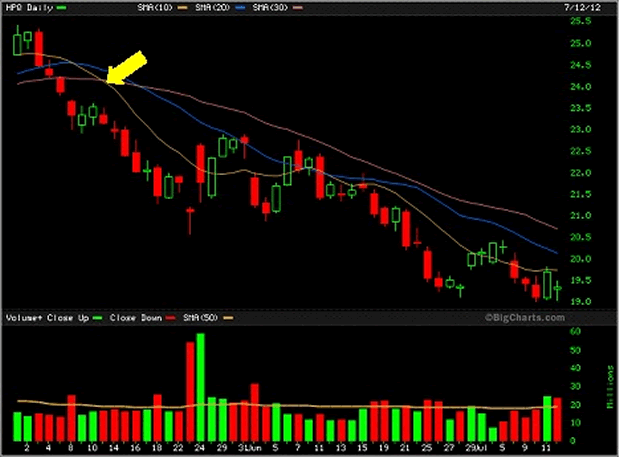

It certainly isn't in the charts. Indeed, in a recent webinar on how to use charts to improve stock profits I gave for Radical Technology Profits subscribers, H-P served as a prime example of the type of stock to avoid.

My system relies on a series of exponential moving averages to show the real demand for a stock. I then add other indicators that I will be talking about in future webinars.

The next webinar is on Wednesday, by the way. It's free and you can sign up for it by clicking here.

For those of you who missed the last session, I've included a chart that shows a pretty clear sell signal back in May as marked by the yellow arrow. The 10-day average falls quickly below the 30-day as volume picks up.

I hope you stayed clear of H-P because we haven't gotten a confirmed buy signal since then.

That's why I say it pays to look for stocks that have a good blend of fundamentals and technicals. As you can see for yourself, H-P had neither.

Let me close by noting that at some point, when it's "stupid cheap," H-P may be a good buy for us. But trust me, now is not the time.

Source :http://moneymorning.com/2012/11/26/how-i-saw-the-carnage-at-hewlett-packard-nyse-hpq/

Money Morning/The Money Map Report

©2012 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.