The Bankers Lost - 2012 Debt Tipping Point Results

Stock-Markets / Credit Crisis 2012 Nov 20, 2012 - 06:23 AM GMTBy: Darryl_R_Schoon

The bankers’ bet that sufficient credit can reverse an economic contraction is no longer on the table. This does not mean central bank credit will tighten. Just the opposite will happen. Monetary easing will continue until the very end. Central bankers are trapped. The end game is now underway.

The bankers’ bet that sufficient credit can reverse an economic contraction is no longer on the table. This does not mean central bank credit will tighten. Just the opposite will happen. Monetary easing will continue until the very end. Central bankers are trapped. The end game is now underway.

It is highly unlikely the Mayan predictions of the end of the world referred to the bankers’ world of credit and debt. Nonetheless, with only one month remaining until December 21, 2012—the end date of the Mayan 5,125 year Mesoamerican calendar—the concomitant end of the bankers’ 300 year ponzi-scheme of credit and debt should not be dismissed as mere coincidence.

The world has entered a paradigm shift of immense proportions; and the collapse of the bankers’ economic world is a part of that shift. The bankers’ credit fueled a 300-year global expansion which transformed the world. The bankers’ credit, however, has now become debt which increasingly cannot be repaid.

Economics is not rocket science although the arcane algorithms used by Wall Street banks to predict capital markets imply that intended conclusion. Modern economics, i.e. capitalism, is merely the current iteration of the supply and demand dynamic distorted by 300 years of credit and debt—a distortion that’s now about to end.

CAPITALISM FOR DUMMIES

Prior to capitalism, the underlying economic dynamic was supply and demand. However, in economies fueled by the bankers’ debt-based banknotes, the relationship between credit and debt becomes equally, if not more, important than supply and demand.

GOLD, MONEY AND CREDIT

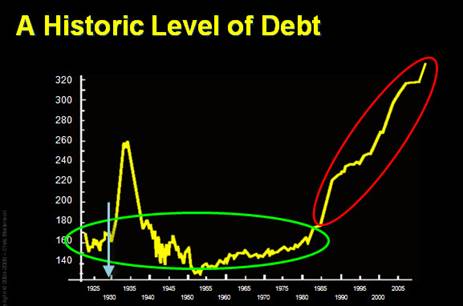

After gold was removed from the global monetary system in 1971 and after initial inflationary concerns were addressed in 1980, embedded constraints on monetary and credit growth no longer existed. The attendant rise in debt is noteworthy—as will be the consequences.

poorrichards-blog.blogspot.com

What central bankers did not anticipate from the explosive growth of credit was the resultant levels of massive debt. Fixated on growth, central bankers miscalculated the inevitable effects of the unrestrained increase in monetary and credit aggregates on their heretofore successful ponzi-scheme of credit and debt.

Credit is the zygote of debt; and since debts constantly compound in capitalist economies, unless controlled, credit will inevitably lead to fatal levels of debt. This is not rocket science. This is common sense.

Prior to the 1980s, central bankers controlled credit growth with central bank credit. After the 1980s, however, the markets, not central bankers, controlled the growth of credit—and markets love credit.

After 1980, credit growth was similar to pouring sugar into petri-dishes where glucose conversion had been previously carefully observed and stabilized. Now, three decades later, the alcoholic fumes from the petri-dishes are obvious to all, even to the central bankers who realized too late what the investment bankers had done with their credit.

The subtext to all central bank maneuverings since 2008 has been the attempts of central bankers to avoid the now inevitable deflationary collapse in demand that will bring their 300-year economic fraud to an end.

In the first edition of my book, Time of the Vulture; How to Survive the Crisis and Profit in the Process (2007), I predicted a deflationary collapse was going to happen. Six years later, that predicted depression is about to make its appearance on the world stage; and, it will be an economic collapse, a depression so deep, that another completely new economic paradigm will take its place.

CAPITALISM FOR DUMMIES

EUPHORIC BUBBLES AND DEPRESSING DEPRESSIONS

Depression, an economically moribund state where credit can no longer induce growth

Depressions are caused when uncontrolled credit growth results in speculative bubbles and runaway markets, e.g. stocks, real estate, etc. When this happens, capitalism’s usual cycles of expansion and contraction are replaced by deflationary depressions where collapsing bubbles result in excessive levels of supply and crippling levels of defaulting debt.

RICHARD KOO’S BALANCE SHEET RECESSION, aka THE LAST WALTZ

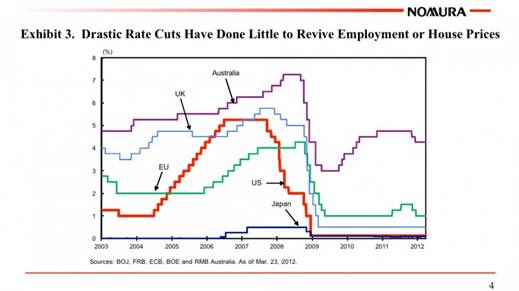

Richard Koo, currently chief economist at Nomura Research Institute, has deservedly carved out a reputation analyzing the current economic malaise. Koo’s term for the downturn is a ‘balance sheet recession’; a term drawing attention to the fact that monetary solutions, i.e. lower interest rates, will not solve the problem; that the problem and solution are found, instead, in the balance sheets of affected nations.

A presentation Koo gave at a gathering of The Institute for New Economic Thinking showed that although Australia, the UK, the EU, the US and Japan have all significantly cut interest rates, the global economy still has not recovered.

Koo’s solution, the substitution of borrowing-based government spending to make up for the loss of private demand, is drawn from the considerable experience of Japan after the spectacular collapse of the Nikkei in 1990.

However, Richard Koo is wrong that Japan’s strategy will also work for the US, the UK, and the EU, etc. Japan’s remarkable record in holding a deflationary depression at bay for over 20 years is not just because of record levels of government borrowing (Japan’s ratio of public debt to GDP is now 204 %, the highest among industrialized nations); but, more importantly, Japan’s struggle against deflation occurred as the largest surge of credit-driven consumer demand in history was in progress

Japan’s struggle against deflation began when the US credit-driven 25-year consumer bubble was just getting underway. Japan’s now prolonged 22-year survival is as much the result of bubble-driven US and global demand which directly benefited Japan as it is due to the ability and tenacity of Japan to draw down and deplete its record levels of domestic savings.

Koo’s solution to survive today’s deflationary crisis will neither work for the US, the UK, or the EU in the future as it did for Japan in the past—and it won’t work for Japan in the future as well; for, today, there is no bubble of excessive global demand to prolong Japan’s now record survival.

The opposite is, in fact, true. Aggregate global demand today is falling and for the first time in decades, Japan’s exports are exceeded by its imports. Today, Japan, as well as the rest of the industrialized, i.e. over-indebted, world stands naked and exposed to deflation’s now imminent assault.

As 2012 ends, all major economic zones are drinking deeply at the well of Richard Koo’s solution, i.e. central bank-based government borrowing. But, in the end, Richard Koo’s proffered well water will be little different than the cyanide-laced kool-aid that Jim Jones offered his ill-fated followers in Jonestown in 1978.

DRINKING POISON TO QUENCH THIRST

飲鴆止渴

Drinking poison to quench thirst is a Chinese saying that describes the eventual consequences of the continued monetary easing of central banks and historic levels of government spending; and, although continued government borrowing and spending may hold deflation at bay, as Koo maintains, it will only do so temporarily and at the potential cost of a someday fatal monetary debasement.

There are only two possibilities left in the bankers’ end game. Either deflation’s growing momentum will pull today’s faltering economies into the ever-growing maw of a deflationary collapse or the continued printing of money to stave off such a collapse will end with the complete debasement of paper currencies in a hyperinflationary blowoff.

I advanced the deflationary scenario in Time of the Vulture; and believe both scenarios are not mutually exclusive. It is indeed possible that a more extreme version of 1970s stagflation is coming; that, in the end game, a deflationary depression and a hyperinflationary crisis could occur simultaneously.

We are in uncharted territory; and, unlike most, I view the collapse of the current economic paradigm as a necessary and ultimately beneficial rite of passage, a prerequisite for the better and more highly evolved paradigm that will follow.

Richard Koo presented his ‘balance sheet recession’ findings at a gathering of the Institute for New Economic Thinking; and while there has been some discussion at the Institute about paradigm change, most of its ‘new economic thinking’ still focuses on the current paradigm, what ails it and what can be done to save it.

As 2012 began, there was still hope that the worst of the 2008/2009 downturn had been averted; that a slow but protracted recovery was underway. There is no such hope today. All central banks are printing money and easing credit; but are no longer doing so in the certainty that such actions will reverse what previous actions did not.

As 2012 ends, there is an underlying acceptance, a resignation that what is being done is being done in the abeyance of any real solution; and that although today’s actions may not be a viable answer, in the end such actions are better than no action at all.

Maybe so, maybe not.

In my current youtube, Fake Gold, Fake Coins, Ralph T. Foster, author of Fiat Paper Money: the History of our Currency discusses fake gold coins and fake gold bars and how customers can protect themselves.

The end game draws near.

Buy gold, buy silver, have faith

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.