Student Loans, the Next Debt Bubble

Economics / Global Debt Crisis 2012 Nov 20, 2012 - 05:57 AM GMTBy: John_Mauldin

For the last year, as I travel around, it seems a main topic of conversation is “Where will my kids find jobs?” It is a topic I am all too familiar with. Where indeed? Youth unemployment in the US is 17.1%. If you are in Europe the problem is even more pronounced. The basket case that is Greece has youth unemployment of 58%, and Spain is close at 55%. Portugal is at 36% and in Italy it’s 35%. France is over 25%. Is this just a cyclical symptom of the credit crisis? Much of it clearly is, but I think there is something deeper at work here, an underlying tectonic shift in the foundation of employment. And that means that before we see a true recovery in the unemployment rate, there must be a shift in how we think about work and training for the future of employment. This week is the first of what will be occasional letters over the coming months with an emphasis on employment. (This letter will print a little longer, as there are a lot of charts.)

For the last year, as I travel around, it seems a main topic of conversation is “Where will my kids find jobs?” It is a topic I am all too familiar with. Where indeed? Youth unemployment in the US is 17.1%. If you are in Europe the problem is even more pronounced. The basket case that is Greece has youth unemployment of 58%, and Spain is close at 55%. Portugal is at 36% and in Italy it’s 35%. France is over 25%. Is this just a cyclical symptom of the credit crisis? Much of it clearly is, but I think there is something deeper at work here, an underlying tectonic shift in the foundation of employment. And that means that before we see a true recovery in the unemployment rate, there must be a shift in how we think about work and training for the future of employment. This week is the first of what will be occasional letters over the coming months with an emphasis on employment. (This letter will print a little longer, as there are a lot of charts.)

But first, the staff at Mauldin Economics is furiously putting the finishing touches on your free Post-Election Economic Summit webinar, which will air tomorrow at 2 pm Eastern. They are distilling multiple hours of discussion into a fast-paced, thoughtful (and often lively) conversation about what is in store in our economic future. Panelists and guests include Mohamed El-Erian, James Bianco, Barry Ritholtz, Gary Shilling, Barry Habib, and Rich Yamarone. We also have a truly unique interview with the chiefs of staff of Majority Leader Harry Reid and Senator Rob Portman. While we excerpted part of that interview for the webinar, the entire interview will be made available. If you want to get a true feel for what is going on in Washington, I suggest you listen in. You can sign up to listen here. Now, let’s think about employment.

et’s look at a few facts put forth by the Young Entrepreneur Council from their list of 43 (available here):

· 1 out of 2 college grads – about 1.5 million, or about 53.6 percent, of bachelor’s degree holders age 25 or younger – were unemployed or underemployed in 2011.

· For high school grads (age 17-20), the unemployment rate was 31.1 percent from April 2011-March 2012; underemployment was 54 percent.

· For young college grads (age 21-24), unemployment was 9.4 percent last year, while underemployment was 19.1 percent.

· According to some researchers, up to 95 percent of job positions lost occurred in low-tech, middle-income jobs like bank tellers. Gains in jobs are going to workers at the top or the bottom, not in the middle.

· More college graduates are getting low-level jobs, period. U.S. bachelor’s degree holders are more likely to wait tables, tend bar or become food-service helpers than to be employed as engineers, physicists, chemists or mathematicians combined – 100,000 versus 90,000.

· According to new U.S. government projections, only three of the 30 occupations with the largest projected number of job openings in the next eight years will require a bachelor’s degree or higher. Most job openings by 2020 will be in low-wage professions like retail sales, fast food and truck driving.

While there may not be a bubble in education, there is definitely a growing debt bubble in student loans. More than 1/3 of young Americans of college age went back to school because of the economy, and in doing so have contributed to the $1 trillion in student loans. People are clearly going back to school and taking out loans as a way to make ends meet. The average college graduate has $25,000 in debt. Default rates are up 31% in the last two years. Student loans are relatively easy to get. They are like the old NINJA subprime mortgage loans available toward the end of the housing bubble: “No income, no job, no assets.” And they are just as likely to end up in default. But Congress recently passed new bankruptcy laws, and unlike housing loans, student loans cannot be discharged in a bankruptcy. The law of compound interest means that borrowers, mostly young, will be paying back this debt for many, many years.

We have told our children that education is their ticket to a better life. And the data still shows that there is a clear advantage to having a college degree. But our recent experience suggests that not all college degrees are created equal.

Tom Friedman, writing in this weekend’s New York Times, highlights the problem of education and jobs. He quotes Traci Tapani, who with her sister runs a sheet metal company in Wyoming with 55 employees.

“About 2009,” she explained, “when the economy was collapsing and there was a lot of unemployment, we were working with a company that got a contract to armor Humvees,” so her 55-person company “had to hire a lot of people. I was in the market looking for 10 welders. I had lots and lots of applicants, but they did not have enough skill to meet the standard for armoring Humvees. Many years ago, people learned to weld in a high school shop class or in a family business or farm, and they came up through the ranks and capped out at a certain skill level. They did not know the science behind welding,” so could not meet the new standards of the U.S. military and aerospace industry.

“They could make beautiful welds,” she said, “but they did not understand metallurgy, modern cleaning and brushing techniques” and how different metals and gases, pressures and temperatures had to be combined. Moreover, in small manufacturing businesses like hers, explained Tapani, “unlike a Chinese firm that does high-volume, low-tech jobs, we do a lot of low-volume, high-tech jobs, and each one has its own design drawings. So a welder has to be able to read and understand five different design drawings in a single day.”

[She ended up training her new potential employees and eventually was able to train someone to train welders.] But even getting the right raw recruits is not easy. Welding “is a $20-an-hour job with health care, paid vacations and full benefits,” said Tapani, “but you have to have science and math. I can’t think of any job in my sheet metal fabrication company where math is not important. If you work in a manufacturing facility, you use math every day; you need to compute angles and understand what happens to a piece of metal when it’s bent to a certain angle.”

Who knew? Welding is now a STEM job – that is, a job that requires knowledge of science, technology, engineering and math.

Employers across America will tell you similar stories. It’s one reason we have three million open jobs around the country but 8 percent unemployment. We’re in the midst of a perfect storm: a Great Recession that has caused a sharp increase in unemployment and a Great Inflection – a merger of the information technology revolution and globalization that is simultaneously wiping out many decent-wage, middle-skilled jobs, which were the foundation of our middle class, and replacing them with decent-wage, high-skilled jobs. Every decent-paying job today takes more skill and more education, but too many Americans aren’t ready. This problem awaits us after the “fiscal cliff.’”

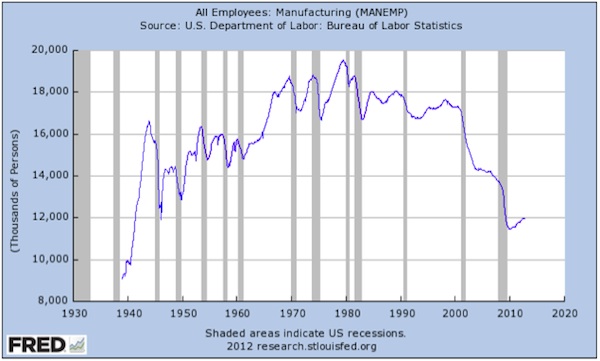

There is a continual complaint that US manufacturing has been “hollowed out.” Where manufacturing jobs once were tickets to the middle-class lifestyle, there are now fewer and fewer such jobs available. Indeed, the next chart shows that manufacturing jobs are down almost 40% from the peak in 1978 and back to roughly where they were during World War II.

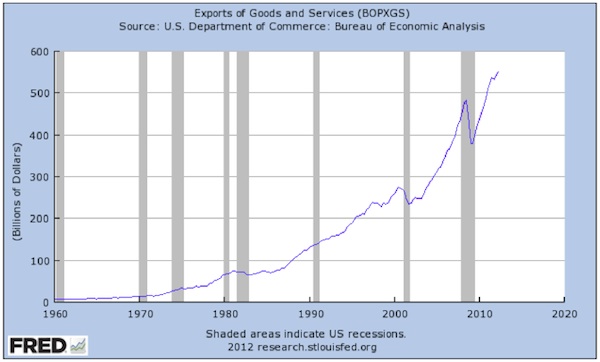

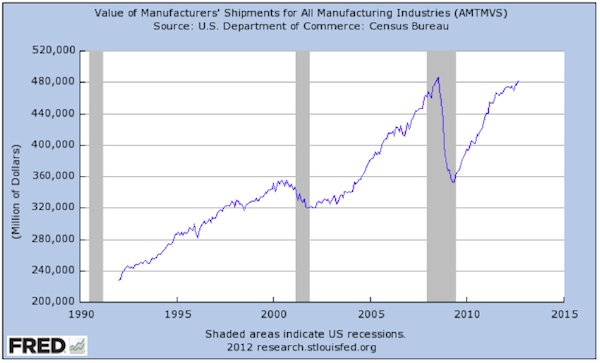

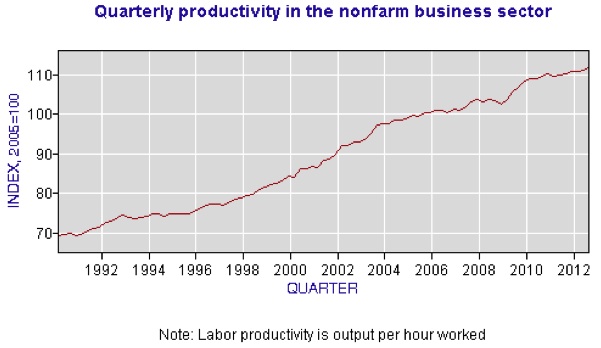

Yet the number of manufacturing employees doesn’t tell the whole story. The US is still the number one manufacturing country in the world. We are an export powerhouse. Indeed, the growth of exports in the last 20 years has been nothing short of phenomenal. Exports have doubled and then doubled again. Total manufacturing in the US has almost come back to where it was prior to the Great Recession. Productivity in the last 20 years is up over 50%. We are producing as much as or more than we did in the past but with far fewer people. Taken alone, US manufacturing would be the ninth largest economy in the world. See the next three charts:

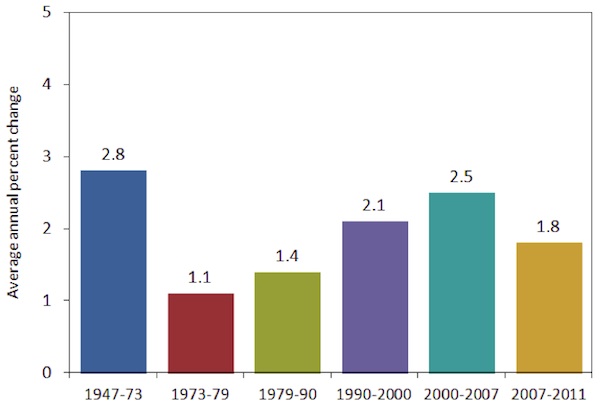

The chart below shows the average growth in productivity over various periods during the last 65 years. Note that after the postwar boom productivity growth fell and then began to increase again, up until the Great Recession. Greenspan was right to call it the Productivity Miracle.

We’ve Seen This (Manufacturing) Movie Before

At the dawn of the 19th century, farmworkers were somewhere between 75% and 80% of the entire labor force (http://www.nber.org/chapters/c8007.pdf). That number was still over 50% in 1860. It was not just the Industrial Revolution that increased the number of manufacturing workers in the US, it was an agricultural productivity revolution that allowed more food to be produced by fewer people. Even so, productivity growth was not all that exceptional in the first 60 years of the 19th century.

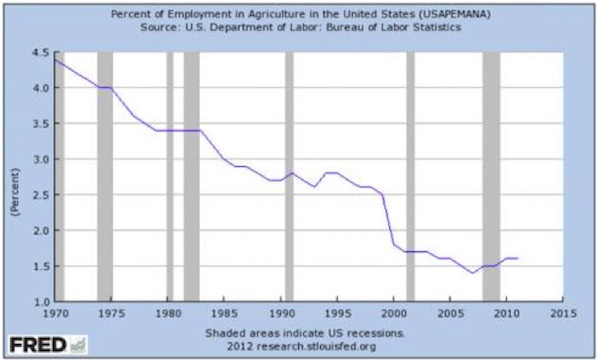

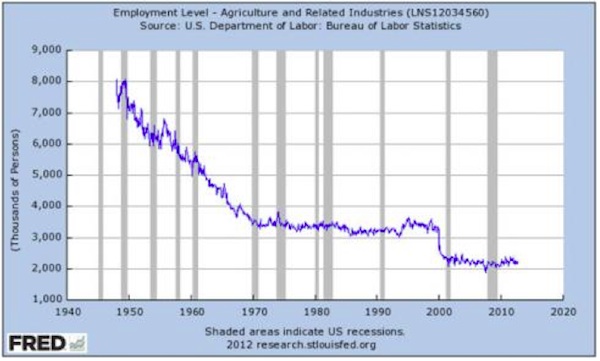

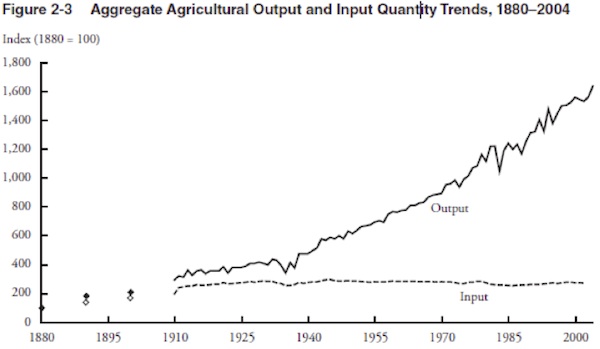

But that was then and this is now. Today the percentage of the labor force employed in agriculture is less than 2%. Agricultural productivity is up some 16 times since 1880, but we barely have more than two million people working on the farm, about the number working in agriculture in 1820. Take a look at the charts below:

This latter chart is from http://www.springer.com/economics/agricultural+economics/book/9-ï1-4419-0657-1

The Industrial Revolution and the shift to a manufacturing economy was clearly disruptive to employment. Yet who would advocate going back even 40 years to when the farm labor force was three times the relative size it is today? Especially if you had to be the farm labor? Been there, done that. Not interested in hoeing spuds.

Just as agricultural output per worker has increased dramatically over time, I think that in the next 40 to 50 years we will see massive gains in manufacturing output without an accompanying large increase in manufacturing jobs. Companies are beginning to bring manufacturing back to the US because automation, robotics, and other new technology make it cheaper to manufacture products locally than to use inexpensive labor in other countries. I am told that Foxconn (in China) is beginning to use robotic manufacturing lines. When Foxconn is turning to robots rather than cheap labor, you know there is a revolution in the offing.

Yet even the manufacturing jobs that are left will not demand a “college degree.” They will require serious skills and technical know-how, but that is different from the typical college degree. That is not to say college education will not be useful, but it is increasingly going to have to be an education that has a focus and goal of a marketable skill.

What is going to be needed is the creation of brand-new industries, as well as the unleashing of the entrepreneurial skills of the younger generation. Small business is the engine of growth for jobs. It seems that all politicians can do is talk about the need to create jobs, yet the reality is that government doesn’t create jobs. It can create the conditions in which jobs are created, but it is up to the individual businessman (or, increasingly, businesswoman) to make a decision to hire additional workers.

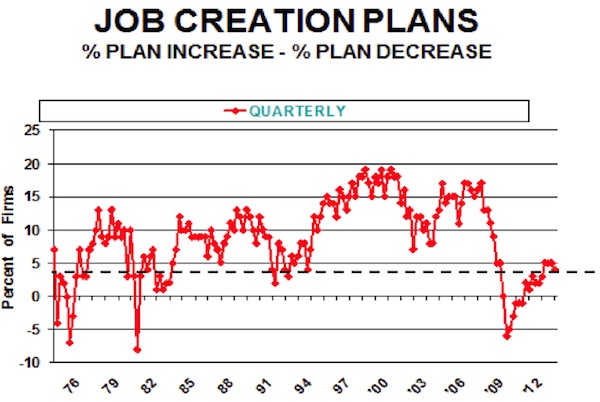

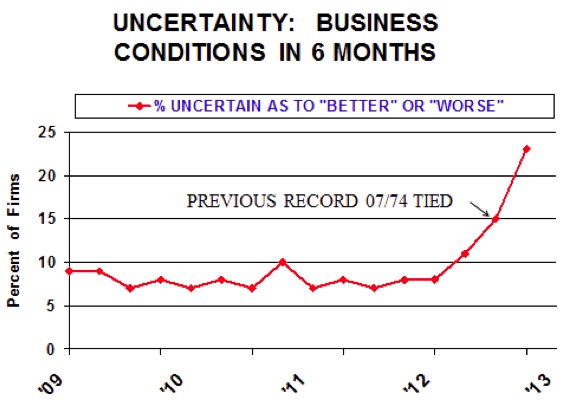

My friend Bill Dunkelberg is the chief economist for the National Federation of Independent Businesses. He’s been doing regular surveys since at least 1974. His latest monthly survey shows that businesses are not terribly optimistic in terms of their plans to increase employment, which should be no surprise. The number one problem? Uncertainty.

Let’s hope that our political leaders can give us a little more certainty and that it will not be the certainty of a recession. David Krone (Senate Majority Leader Reid’s chief of staff) felt, in our interview for the Summit tomorrow, that it was only 50-50 that a deal would be done to avert the fiscal cliff. He was rather adamant that they would rather go over the cliff than kick the can down the road on the deficit. Not that it couldn’t be fixed later – but I suggest you listen to at least that part of the interview we’ll post tomorrow. I should note that both congressional chiefs of staff acknowledged they have been working for weeks prior to the election to come up with solutions to the cliff. These are the guys (along with their counterparts) responsible for much of the detail that will come out of the negotiations. They don’t get interviewed often, and that is a shame. It makes you feel better about the country to know t here are people who care enough about our future to work with each other responsibly, even if they don’t agree on the path we must take.

A final scheduling note: On December 4 I will be doing a special live conversation with Dr. Lacy Hunt and my partner Jon Sundt of Altegris. Lacy is expecting a recession next year. The question now is how deep a recession – and what can investors do about it? Lacy and I both anticipate a bumpy few years ahead as we stare into the teeth of a rolling global deleveraging recession – the Endgame, as I’ve called it. The decisions that we make in the next couple of years about how to handle our budget deficits – here in the US, in Europe, in China, in Japan, and elsewhere – are going to be absolutely crucial. If you are an accredited investor or a financial professional and have already registered with the Mauldin Circle (and are in the US), you will shortly be receiving an invitation to attend. If you have not, I invite you to go to www.mauldincircle.com and register today, so you can hear Lacy, Jon, and me discuss the direction of the economy, the Endgame, and ways for investors to navigate the landscape in 2013. (In this regard, I am president and a registered representative of Millennium Wave Securities, LLC, member FINRA.) Thanks.

Bismarck, Scandinavia, Greece, Geneva, and Writing Schedule

It is time to hit the send button. It is going to be a busy week, as I have so much stacked up in my “inbox.” And of course Thanksgiving will be here in a few days, and that means an afternoon of going to the local fresh food market to purchase all the needed victuals and spending the next day cooking and getting ready. Thankfully, none of my culinary creations call for Twinkies, so I don’t have to worry about the shelves being empty. It is rather sad to note that 18,000 people will be losing their jobs this season as Hostess shuts down. That means we need to create at least 4,000 new small businesses to make up for those lost jobs.

I have read numerous reports about the bankruptcy of Hostess and was planning to comment on that debacle, but there is not enough space and time. Both sides of that argument can share the blame. One of the ironies is that the unions are vilifying the private-equity company that owned Hostess, and yet the owner of the PE firm is a certified big-time Democrat and sought out opportunities to find unionized companies to buy. And while the unions seemed to have a death wish, management simply had no clue. They were in a shrinking business (even if they made you personally fatter) and did not adapt. Side bet: Someone will buy them, move them to a non-union state, and produce the same amount of goods with fewer workers. Not that the people at Hostess didn’t work hard; they just had crazy rules and hundreds of conflicting contracts no sane business could compete with. Management so loaded the company up with debt that there was no money to advertise or create new (and healthier) product lines. It was truly bizarre.

Note: This was one of those times when a private-equity firm simply lost money. They bought the company out of bankruptcy, and it was already laden with debt. Then commodity prices soared, and unfunded pensions that exceeded the total assets of the company were a drag. Pensions like that cannot possibly make their targets when the Fed is keeping rates so low, and that means companies go deeper in the hole. Now, the pensions of the union members of Hostess will have to be taken over by the Pension Benefit Guaranty Corporation, which is itself massively underfunded. Union members will only get a fraction of what they think they should get. And we taxpayers get to fund the PBGC losses. Sigh.

I do have a few personal flights to make in the next month, but other than a speaking engagement in Bismarck, North Dakota, I will mostly be home until I leave for Copenhagen, Oslo, and Stockholm in early January, to speak for Skagen Funds. I have to be in Geneva a week later, so I will stay in Europe. I plan to visit Greece and perhaps one other country, to try to get a feel for the mood on the ground and what is likely to happen. It was not so long ago when we were “All Greece, All the Time.”

I will be working with Bill Dunkelberg on a book on the future of employment over the next few months, hoping to finish it shortly after the first of the year.

As luck would have it, the Mavericks are playing three games this week while I am home. I really do enjoy watching NBA basketball and have had season tickets for almost 30 years. My first tickets were $2 a game on the very top row in the corner at the old Reunion Arena. It was all we could afford back then. Times have changed, and my seats are now much better, as over the years I have been able to move over and down. Given that the Mavericks are not likely to overawe me this season (though I have this dream that Dirk will come back better than ever), I just enjoy watching B-ball. I will admit to not having the same patience for the Cowboys. If they aren’t winning, I’m not watching.

Have a great week. I will do my own part for the employment numbers this week and make a job offer to a new potential associate.

Your trying hard to imagine the future analyst

By John F. Mauldin

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2012 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.