Gold Stocks Correction Nearly Done, Forcast 2013

Commodities / Gold & Silver Stocks Nov 19, 2012 - 08:04 AM GMTBy: David_Petch

The past week has been witness to a very sharp decline in energy and commodity stocks, while broad stock markets and related commodities really have not moved. Huge noted gaps were put in place in the HUI which saw an extreme price excursion beyond lower 21 and 34 MA Bollinger bands, indicating that a bottom was likely put in place.

The past week has been witness to a very sharp decline in energy and commodity stocks, while broad stock markets and related commodities really have not moved. Huge noted gaps were put in place in the HUI which saw an extreme price excursion beyond lower 21 and 34 MA Bollinger bands, indicating that a bottom was likely put in place.

Combinations of hedge funds dumping due to computer program stops being triggered, mom and pop investors exercising their tax-loss selling as well as overall fear and uncertainty were the likely causes for the sharp sell-off. One of the large problems in the global economy is the US fiscal cliff...if the US government did nothing, then Prechter would be correct with a 1000 DOW. If this were to happen there would be too much suffering around the globe, so this event, following mass human psychology this situation will likely be cleared up before Christmas. The depth of the correction in all broad markets as well as the HUI has created a situation where there is no where to really go but up over the coming weeks. Building permits are up in many areas of the US as well as Canada, along with the automobile sector starting to show increased sales...these sort of things do not really happen when market crashes occur.

Everything occurring at present is due to positioning of the US Dollar Index within its Contracting Fibonacci Spiral. Cycles (CFS) such as this are smarter than everyone, so it pays heed to observe, respect and thoroughly understand the theory behind the CFS and what it suggests. There are big cuts coming to pension funds, government entitlements across the board, unions etc. etc...if people do not concede, business will be settled in the markets. The latest example of this is Hostess...they are on the verge of bankruptcy and told the union was required to accept deep pay cuts or they were going to fold...the union did not budge and now some 18,500 people are laid off. I was witness to this when a paper mill back in the hometown of my youth threatened to shut down unless workers took a 20% pay cut. They refused and now, only the footprint of the original mill remains...from 1906 until 2003 it survived, but greed forced the closure.

Everything has a cycle and now, unions are on the way out. In order to be competitive with other countries around the globe, prices must be kept in check. If wages are not going to really move, along with global demographic issues and government spending out of control, then unless there is a paradigm shift in repositioning of global currencies, the entire system is done. When 2020 arrives, the can will have been kicked to the end of the road, so instead it will likely be kicked from boat to boat afterwards. How everything exactly unfolds is anyone's guess, but the CFS has provided time posts for expected market tops that have always been followed by an extremely sharp correction, so make sure to know when the expected tops occur.

The updated CFS cycle has broad stock market indices expected anytime between December 27th, 2012 and May 21st, 2013, so chances are that commodity-related stocks top out 2-3 months after, followed by commodities anywhere from 6-8 weeks after. All of the mentioned tops involve the US Dollar expected to top out within the next 1-3 weeks, followed by a decline to 70-72 before the end of August 2013. This will mark the CFS top, with remaining tops due in 2016, 2018, 2019 and 2020. Each of the dates on this cycle are based upon the precise Fib ratios which change going below 8...this is specified within the updated CFS article on the site. Prior CFS time posts were 1966 (34 years), 1987 years (21 years), 2000 (13 years) and 2008 (8 years). Due to the accuracy of this cycle, there is no reason to expect that it will not drive itself to completion.

The following four charts identify all observations that a bottom is looming, followed by an expected rally in the broad stock market indices into early 2013 (January-April 2013). All charts are based upon Elliott Wave analysis. Normally these updates are presented with daily, weekly and monthly charts containing complex Bollinger bands (21, 34 and 55 ) and full stochastics (21, 8, 13; 34, 13,21; and 55, 21 and 34 settings), but due to the main point of this article, understand that these charts along with the CFS cycle do influence the mid-term and Elliott Wave counts presented.

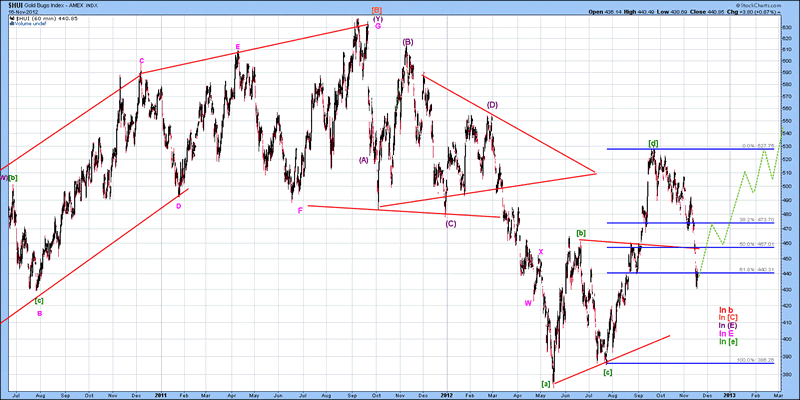

The mid-term Elliott Wave chart of the AMEX Gold BUGS Index (HUI) is shown below, with the thought pattern forming denoted in green. The corrective pattern at present is thought to be completing a contracting triangle with reverse alternation (to end wave [C]). Notice how the huge gaps with a brief penetration to the 61.8% retracement of the most recent advance. Chances are highly probable that another 1-2 weeks are required to put in an Orthodox low to wave [e] in order to complete the entire pattern. Subsequently, wave [D] up is expected to follow with a move up to 800-850 before August 2013, followed by a decline into wave [E]. Please note that the corrective pattern from 2008 until present is part of wave b. The move following the Orthodox low in 2014 will be wave c, which should not top out until around 2020 with the minimum high is expected to be at least 3000...much higher from present levels. As promised, I am not going to be externally posting the US Dollar Index, as it is the pinnacle of everything occurring at present...everything occurring at present is a symptom of the US Dollar and where it is within the present cycle.

Figure 1

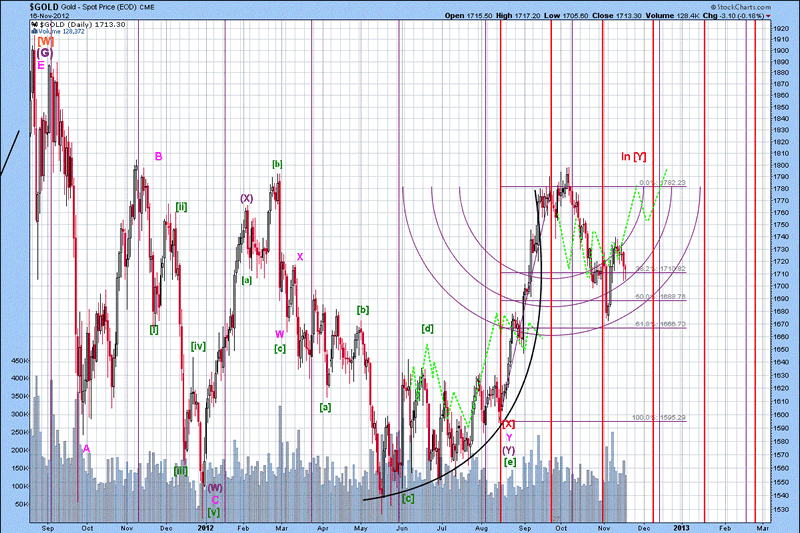

The short-term Elliott Wave count of gold is shown below, with the thought pattern forming denoted in green, with wave [Y] thought to be forming at present...I am expecting to provide lower Degree labelling schemes within 2-3 weeks. Whenever parabolic moves terminate a corrective phase and are not fully retraced, it provides a bullish indication that higher prices are looming. At present, there is a triple top around $1800/ounce, $120/ounce lower than the September 2011 high. When gold takes out $1800/ounce, it will create a move that powers well above the $1900/ounce...this is due to the significant amount of price action and time required to correct the top. Gold is expected to top out anywhere between $2500-3074/ounce before the end of August 2013. If $3000/ounce is hit, then a 61.8% retracement of the move from the end of wave [X] is expected, or $2200/ounce. This move down should occur between Q3 and Q4 2014, which will subsequently see gold go to anywhere from $6000-10,000/ounce. In order to balance all global debts by 2020, I calculated a valuation of $30,000/ounce would be required. I do not think the price will get to this level, but one thing I can guarantee....if gold goes above $7000/ounce, gold should be owned over stocks because most countries will be nationalizing mines for financial security.

Figure 2

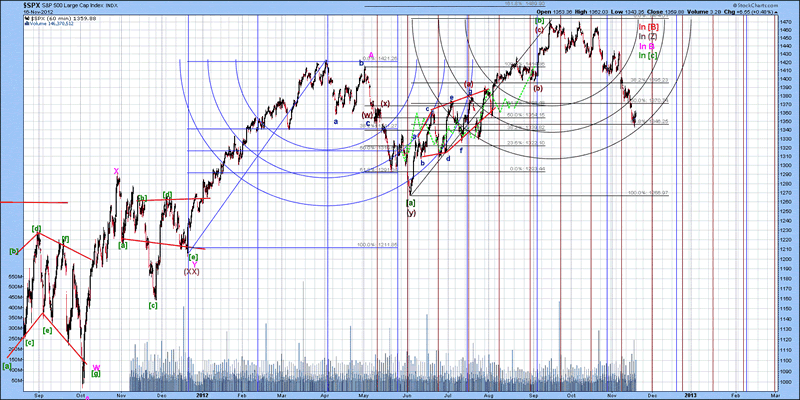

The mid-term Elliott Wave count of the S&P 500 Index is shown below, with wave [c].B thought to be forming at present. Once complete, wave B will be complete, with wave C expected to have at least 2-3 months of sideways to upward price action. The pattern presented represents a complex flat pattern, which has a bullish upward bias. We are expecting a top anywhere between 1600-1650 before the end of May 2013. QE's should be kicking in soon and much of the fear in the market will be released into a sharp upward move. A 250 point move is not out of the realms of probability to hit 1600 before mid 2013. With the CFS time post due anytime between now and the end of May 2013, coupled with the first two years of the US Presidential Cycle to perform their dirty work, the latter half of 2013 into late 2014 is expected to be very weak.

Figure 3

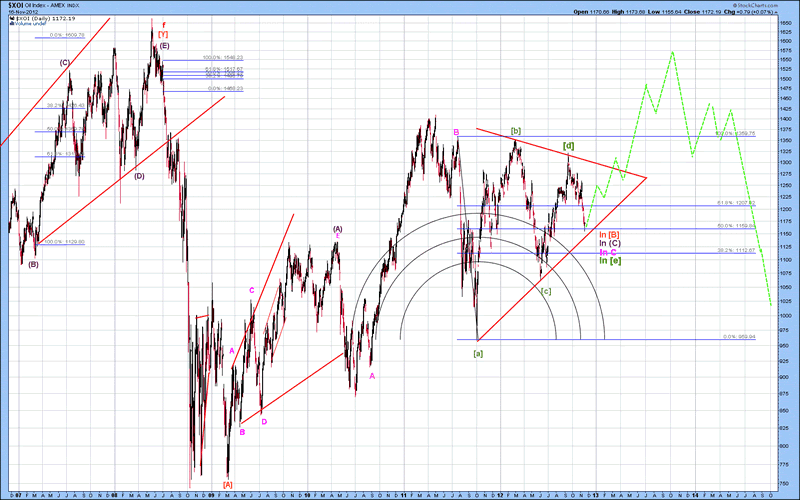

As promised, an updated version of the Elliott Wave count of the AMEX Oil Index (XOI) is shown below, with the thought pattern forming denoted in green. The wave pattern forming is extremely complex and the thought pattern that I had forming (labelled well over 18 months ago...refer to Archives for prior labelling scheme) fell out of favour. With the present wave count, wave C.(C) completing a terminal impulse of an expected flat pattern to complete wave g by late 2014. The wave structure shown below illustrates a two year triangle that will be resolved by a breakout to the upside or downside. Based upon the CFS and everything that I examine, technical analysis strongly suggests a breakout to the upside. One thing that may disappoint the reader is that wave (B) underway at present is only expected to match the 2008 top...not any higher.

Figure 4

Well, that is all for the weekend piece. Back tomorrow AM with an update of various Exchange-traded funds. Have a great day.

Have a great day.

By David Petch

http://www.treasurechests.info

I generally try to write at least one editorial per week, although typically not as long as this one. At www.treasurechests.info , once per week (with updates if required), I track the Amex Gold BUGS Index, AMEX Oil Index, US Dollar Index, 10 Year US Treasury Index and the S&P 500 Index using various forms of technical analysis, including Elliott Wave. Captain Hook the site proprietor writes 2-3 articles per week on the “big picture” by tying in recent market action with numerous index ratios, money supply, COT positions etc. We also cover some 60 plus stocks in the precious metals, energy and base metals categories (with a focus on stocks around our provinces).

With the above being just one example of how we go about identifying value for investors, if this is the kind of analysis you are looking for we invite you to visit our site and discover more about how our service can further aid in achieving your financial goals. In this regard, whether it's top down macro-analysis designed to assist in opinion shaping and investment policy, or analysis on specific opportunities in the precious metals and energy sectors believed to possess exceptional value, like mindedly at Treasure Chests we in turn strive to provide the best value possible. So again, pay us a visit and discover why a small investment on your part could pay you handsome rewards in the not too distant future.

And of course if you have any questions, comments, or criticisms regarding the above, please feel free to drop us a line . We very much enjoy hearing from you on these items.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Comments within the text should not be construed as specific recommendations to buy or sell securities. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities as we are not registered brokers or advisors. Certain statements included herein may constitute "forward-looking statements" with the meaning of certain securities legislative measures. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the above mentioned companies, and / or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Do your own due diligence.

Copyright © 2012 treasurechests.info Inc. All rights reserved.

Unless otherwise indicated, all materials on these pages are copyrighted by treasurechests.info Inc. No part of these pages, either text or image may be used for any purpose other than personal use. Therefore, reproduction, modification, storage in a retrieval system or retransmission, in any form or by any means, electronic, mechanical or otherwise, for reasons other than personal use, is strictly prohibited without prior written permission.

David Petch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.