Negative Real Interest Rates Continue To Drive The Gold Price

Commodities / Gold and Silver 2012 Nov 18, 2012 - 12:27 PM GMTBy: GoldSilverWorlds

People tend to focus on the daily “noise” and often forget the long term view. The first point that Ronald Stoeferle made during our discussion, was that the major topics of his first report (from five years ago) are still relevant. In fact, he doesn’t see any fundamental change since then. The only change he noticed is that the figures became bigger, in the first place the debt levels and the amounts of the rescue packages.

People tend to focus on the daily “noise” and often forget the long term view. The first point that Ronald Stoeferle made during our discussion, was that the major topics of his first report (from five years ago) are still relevant. In fact, he doesn’t see any fundamental change since then. The only change he noticed is that the figures became bigger, in the first place the debt levels and the amounts of the rescue packages.

The evil effect of financial repression

Ronald Stoeferle considers financial repression a critical aspect in today’s economic environment. Financial repression is a combination of incentives and restrictions for banks and insurance companies. Capital is channeled away from asset classes and flows into a more liberal environment.

In its essence, it’s a perfidious form of redistribution of wealth, taking it away from the saver. The beneficiary is obviously the debtor (think about the government in the first place). On a short term basis it helps to alleviate the huge debt mountain. Unfortunately, there is a significant long term effect that is not taken into account well enough. As the dependence on financial repression rises, so does the collateral damage that comes on the longer run. It will pave the way for an even bigger crisis in the future.

One of the most important pillars of financial repression is negative real interest rates. With the Fed’s announcement of QE3, negative rates are a sure thing till at least mid 2015. QE3 is the kind of rescue package that “nobody” would have believed to see several years ago, at least not in the current size. More importantly, it shows that the Fed is running out of ammunition. We see the same picture elsewhere in the world, like in Europe, Japan or the UK.

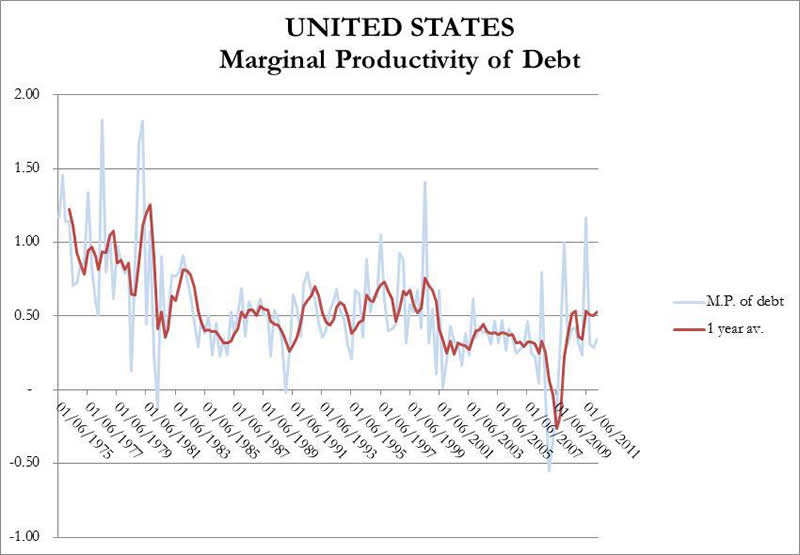

The marginal impact of every new measure is decreasing continuously. Ronald Stoeferle expects more measures and stimulus packages in the future. These types of actions sadly kick the can further down the road.

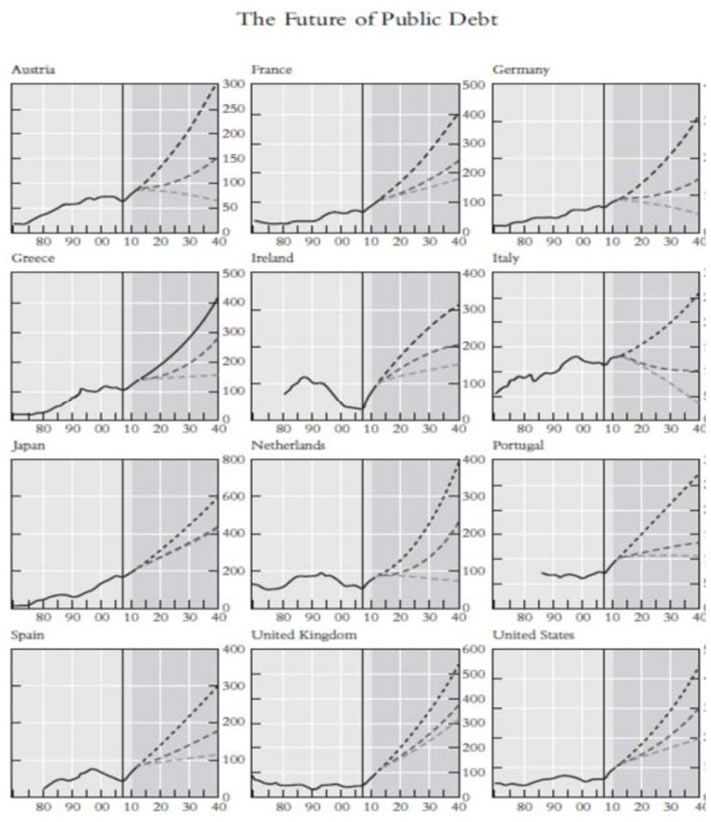

Ronald Stoeferle warns that today’s concerning situation could only be the start. If we look at the future debt projections based on the current evolution, we get the frightening picture that is shown on the following charts. Now in the light of the effect of wealth redistribution caused by financial repression, try to imagine how much wealth could be redistributed if the ongoing trend continues. Chart courtesy: Bank of International Settlements.

Negative interest rates distribute wealth, gold and silver preserve wealth

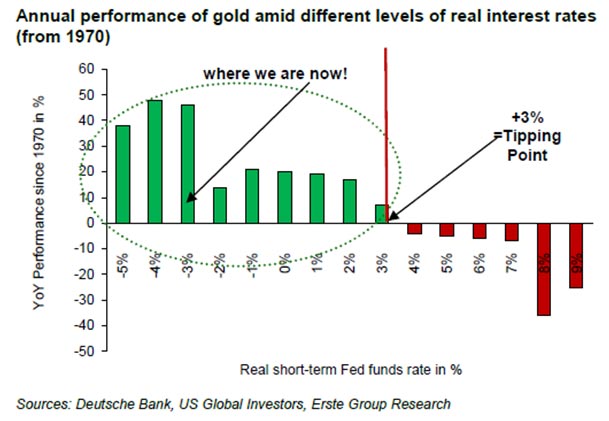

“We should really be confident when it comes to gold and silver”, says Ronald Stoeferle. Negative interest rates have always been the perfect environment for gold and silver, an economic principle that is applicable today as well. Chart courtesy: In Gold We Trust 2012.

One specific quote from Simon Mikhailovich (hedge fund manager in New York) is worth mentioning when it comes to real interest rates and Quantitative Easing:

Zero interest rates are like antibiotics. The effectiveness wares off over time. You need to take more and more to achieve less and less. Eventually they stop working.

In that context, the Cantillon effect is highly relevant today. The Cantillon effect describes that the newly created money is distributed neither equally nor simultaneously among the population. In fact, the users who first receive the newly created money, are benefitting most from it as they will be less affected by price inflation. So the people handling money partially benefit from inflation and partially suffer from it. Note that from an Austrian School of Economics perspective, inflation is the cause of price increases. What we call inflation is only the effect of inflating the monetary base. Because of the Cantillon effect, late money users are transferring wealth to the early money users. This is one of the main reasons for the extreme inequality of wealth distribution and will lead to further social problems like riots on the streets e.a.

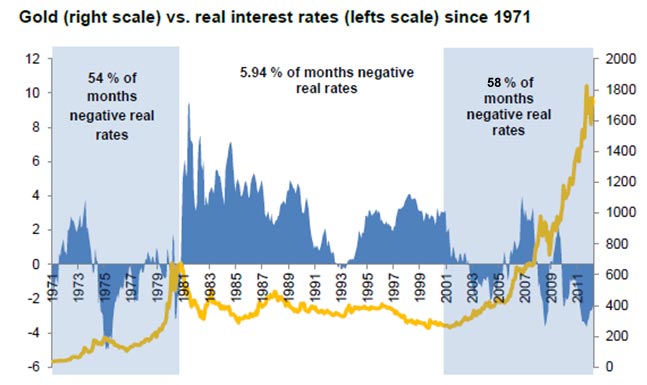

Interest rates in gold’s bear market of 1980 – 2000 stood around 4%. In the 70’s during most of the time there were negative real rates, just like in the current bull market. Between 2001 and November 2012, we saw negative real rates in 58% of the months. That’s already a higher figure than in June when the 2012 edition of “In Gold We Trust” report was published (it stood at 53% at that time). Negative real rates will continue till at least mid 2015, based on the Fed’s recent decisions. We are in the perfect environment for gold and silver. As soon as interest rates pick up to between 3 to 4 percent (which is the tipping point that is indicated on the previous chart), we should sell our gold and silver holdings. Chart courtesy: In Gold We Trust (updated chart).

The charts that Ronald Stoeferle is monitoring when it comes to interest rates are the short term Fed rates or shorter term Treasury bond rates.

Redistribution of wealth is going largely unnoticed

From a social point of view, the trend of wealth redistribution should be of major concern for everyone living in the Western society. But people in general remain unaware of this. So the question arises when we will see a tipping point in awareness. Ronald Stoeferle believes that psychological reasons will create such a tipping point but we need to take into account that nobody really knows what the exact reasons are for a tipping point to occur (just like Malcolm Gladwell described in his book “The Tipping Point”).

Although we cannot forecast the timing and precise conditions of a tipping point, we know with a high probability that a very fast turnaround in psychology will take place as soon as we hit that critical moment. It’s obvious that negative interest rates will be one of the important drivers.

In the meanwhile, the large-scale skeptical attitude towards gold is still present. Gold still carries the negative perception that was created in the 80’s and the 90’s. People continue to think that gold is highly speculative and argue that it’s not yielding interests. In his report, Ronald Stoeferle points to cognitive dissonance and normalcy bias as the real issues. Wikipedia describes cognitive dissonance as “a discomfort caused by holding conflicting cognitions (e.g., ideas, beliefs, values, emotional reactions) simultaneously. In a state of dissonance, people may feel surprise, dread, guilt, anger, or embarrassment. The theory of cognitive dissonance in social psychology proposes that people have a motivational drive to reduce dissonance by altering existing cognitions, adding new ones to create a consistent belief system, or alternatively by reducing the importance of any one of the dissonant elements.” It occurs when a decision has been made although the alternative seems also attractive. If people would buy gold now, it would result in a strong dissonance as the environment is not in favor of gold. The second reason is the normalcy bias. It refers to the mental state of distorted perception which people enter when facing a disaster. Simply said, they think that “what must not happen, will not happen” and “what has been that way, will remain that way”.

The sad thing is that people don’t really care about what’s happening on the monetary and economic scene. They are too busy and remain uninterested. They only see that the prices of their daily purchases are increasing (take for instance purchases in the super market or the price at the gas station). Furthermore they tend to blame governments, speculators and “the capitalistic system” with a more or less superficial way of thinking. So people simply aren’t able to see the link between the monetary policy, our over-indebtedness and price inflation. Ronald Stoeferle observes the following: “When talking about the Austrian School of Economics, most people tend to show their disinterest in economics. Economics are nevertheless a key pillar of our society. Ludwig von Mises created his theory in which the economy is inextricably linked with individuals and society.”

Buy gold, buy silver, but not as an investment

Ronald Stoeferle concludes: “I don’t see gold as an investment. It’s a form of money that is around for 5,000 years now. So I look at it as just an alternative form of cash … cash in its hardest form to be precise.” In a normal market process, gold and silver are being considered as money. The latest 41 years (i.e. since Bretton Woods) are a very short period of time when compared to the whole monetary history. Just like 50 or 100 years ago nobody would have believed that there would be one global fiat currency system without any backing of gold, in a similar way people today have difficulties to realize a currency system backed by gold. We will definitely see a paradigm shift. The first signs are there: more and more politicians and economists are talking about a gold standard.

This article is based on a Q&A with Ronald Stoeferle. He is born October 27, 1980 in Vienna, Austria, is a Chartered Market Technician (CMT) and a Certified Financial Technician (CFTe). During his studies in business administration and finance at the Vienna University of Economics and the University of Illinois at Urbana-Champaign, he worked for Raiffeisen Zentralbank (RZB) in the field of Fixed Income/Credit Investments. After graduating from University, Stoeferle joined Vienna based Erste Group Bank, covering International Equities, especially Asia. In 2006 he began writing reports on gold and gained media attention when he expected the price of gold to rise to USD 2,300/ounce when the current price was only at USD 500. His six benchmark reports called “In GOLD we TRUST” drew international coverage on CNBC, Bloomberg, the Wall Street Journal, Economist and the Financial Times. He was awarded “2nd most accurate gold analyst” by Bloomberg in 2011. He also writes reports on crude oil. The latest oil report by Stoeferle, entitled “Nothing to Spare” was published earlier this year. Stoeferle is managing two gold mining funds and one fund with silver mining equities. As of December 2012, Stoeferle will leave Erste Group in order to become partner of Liechtenstein based Incrementum AG.

Contact Ronald Stoeferle at rps@incrementum.info The website of Incrementum AG www.incrementum.li

class="style3">© 2012 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.