Cisco Represents Rare Investor Opportunity of an Undervalued Dividend Growth

Companies / Tech Stocks Nov 14, 2012 - 12:55 PM GMT We don’t believe that anyone will argue against, or should argue against, the idea that the Internet will continue to grow for many years to come. Cisco Systems (CSCO) is the world’s largest supplier of high performance Internet networking systems and solutions. According to research from Standard & Poor’s Corp., Cisco’s product families are comprised of four segments. Switches represent 32% of fiscal product sales, routers represent 18%, new products (the biggest segment) representing 48%, and the final category is other representing 2% of fiscal sales.

We don’t believe that anyone will argue against, or should argue against, the idea that the Internet will continue to grow for many years to come. Cisco Systems (CSCO) is the world’s largest supplier of high performance Internet networking systems and solutions. According to research from Standard & Poor’s Corp., Cisco’s product families are comprised of four segments. Switches represent 32% of fiscal product sales, routers represent 18%, new products (the biggest segment) representing 48%, and the final category is other representing 2% of fiscal sales.

Cisco reported earnings yesterday and the market seems pleased with what it saw. Earnings, and revenues were both better than forecast (click this link to earnings report supporting slides). We felt that the following quote from CEO John Chambers during their conference call nicely summarized the opportunity in front of Cisco, and frankly, its many competitors:

“In a world of many clouds mobility, bring your own device, and the internet literally connecting everything. The network has never played a more central role, connecting people, the process, data and things, anywhere, anytime, across any device. In this cloud of mobile world, the challenges of scale, agility, security and resilience can only be addressed by an intelligent network, and Cisco is uniquely positioned to help our customers meet business requirements and drive this new growth.”

However, regardless of their good quarter, and the well-defined long-term opportunity in front of them, we believe that Cisco is a very undervalued blue-chip technology stalwart. Furthermore, we believe that there are many reasons that this is the case, but we also believe that none of the reasons are supported by the company’s historically low valuation. In other words, we are suggesting that Cisco’s fundamentals warrant a much higher valuation than they are currently receiving.

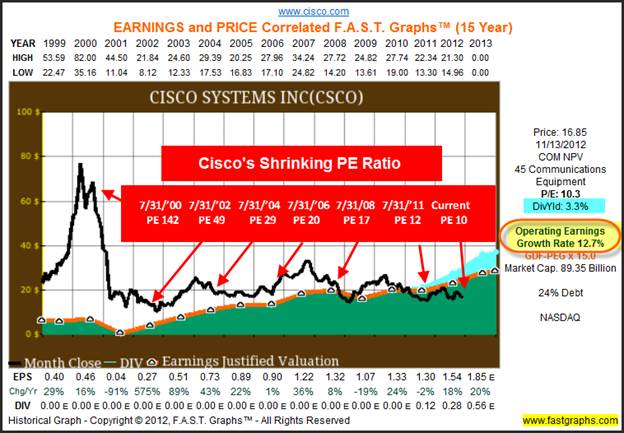

The following historical earnings and price correlated F.A.S.T. Graphs™ tell several interesting stories about this technology bellwether, and perhaps more importantly, the almost bizarre investor psychology that has been applied over the last decade and a half or so. From 1999 until the great recession, investors were willing to price this company at a premium valuation to its earnings justified levels (the orange line on the graph). However, since the fall of 2008, the market has begun valuing Cisco at more realistic earnings justified levels (the price aligned itself with the orange line). However, we believe the pendulum has now swung too far.

To put this into a clear perspective, we can see by looking at the bottom of the graph that Cisco’s earnings continued to grow at above-average rates, indicating that Cisco’s business has not really changed that much. However, by looking at how the market had overpriced Cisco shares for so many years, it becomes readily apparent that what has changed has been investor attitudes towards the company and its perceived value.

The following fiscal year-end PE ratios that were applied to the company during various fiscal year-ends tells the story. At fiscal year-end July 31, 2000, Cisco’s PE ratio was 142, by fiscal year 2002 the PE ratio had fallen to 49, by 2004 Cisco’s PE was 29, by 2006 it was 20, by 2008 Cisco’s PE ratio was 17 and by fiscal year-end 2011 the PE had fallen to just above 12. Currently, Cisco’s blended PE ratio hovers around 10. This seems like an awful low valuation for a company that has grown earnings growth of 12.7% per annum.

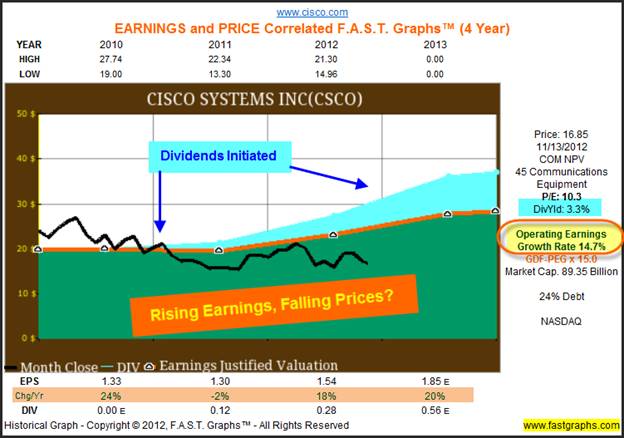

Cisco’s valuation story becomes even more confusing when you evaluate the company over its more recent history. Since calendar year 2010, the following earnings and price correlating graph shows that Cisco’s stock price has steadily fallen, in spite of the fact that their earnings growth post recession has actually accelerated to 14.7% per annum. Moreover, Cisco has sweetened the pot by initiating a dividend that has grown very rapidly since it was first started.

Follow this link for a FAST Graphs™ video analysis of Cisco Systems Inc.

Summary and Conclusions

As this article is being written, Cisco shares are trading up over 6%, so perhaps the market is beginning to recognize the value in this blue-chip technology bellwether. However, even after a 6% increase, we believe that Cisco remains a very undervalued blue-chip technology stalwart. Longer-term, we are confident that the company will continue to deliver above-average earnings growth and with approximately $49 billion in cash, the company’s financial profile is impeccable. Consequently, we expect to see a continuing dividend increase in the future.

We believe there are many drivers fueling the opportunity for Cisco’s continued growth going forward. These include more sophisticated utilization of the Internet requiring capacity that Cisco is well positioned to supply. Although Cisco is facing more competition as many startups are bringing innovative new offerings to the market place, Cisco’s management appears to be on top of the situation. Consequently, we share the view that Cisco’s new product segment will be the primary driver of future growth. Furthermore, we believe there is no other company in the industry that possesses the size and scale that Cisco does to continue to serve its ever expanding market.

Consequently, we believe that Cisco represents an excellent opportunity for investors seeking a high-quality stock with above-average growth potential and an above-average and growing dividend yield. We see Cisco shares as undervalued relative to their current fundamentals, an even more importantly, relative to their well-defined continued long-term growth potential. Therefore, we believe that the opportunity to find such a high-quality company trading at such a low valuation as Cisco currently is represents a rare opportunity that should not be overlooked.

Disclosure: Long CSCO at the time of writing.By Chuck Carnevale

Charles (Chuck) C. Carnevale is the creator of F.A.S.T. Graphs™. Chuck is also co-founder of an investment management firm. He has been working in the securities industry since 1970: he has been a partner with a private NYSE member firm, the President of a NASD firm, Vice President and Regional Marketing Director for a major AMEX listed company, and an Associate Vice President and Investment Consulting Services Coordinator for a major NYSE member firm.

Prior to forming his own investment firm, he was a partner in a 30-year-old established registered investment advisory in Tampa, Florida. Chuck holds a Bachelor of Science in Economics and Finance from the University of Tampa. Chuck is a sought-after public speaker who is very passionate about spreading the critical message of prudence in money management. Chuck is a Veteran of the Vietnam War and was awarded both the Bronze Star and the Vietnam Honor Medal.

© 2012 Copyright Charles (Chuck) C. Carnevale - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.