Gold Bullion vs. Gold Stocks – Which is the Better Investment?

Commodities / Gold and Silver 2012 Nov 13, 2012 - 03:52 PM GMTBy: Jason_Hamlin

You have probably read in multiple articles that mining stocks offer leverage to the movement of the underlying metal. But this hasn’t been the case over the past several years, which has created some confusion in the precious metals investment community. While the gold price has more than doubled (+110%) in the past five years, the AMEX Gold Bugs Index (HUI) is up only 15% and the Market Vectors Gold Miners ETF (GDX) is up only 7%.

You have probably read in multiple articles that mining stocks offer leverage to the movement of the underlying metal. But this hasn’t been the case over the past several years, which has created some confusion in the precious metals investment community. While the gold price has more than doubled (+110%) in the past five years, the AMEX Gold Bugs Index (HUI) is up only 15% and the Market Vectors Gold Miners ETF (GDX) is up only 7%.

So, why do people keep saying that mining stocks offer leverage? Well, because they do during certain periods of the bull market.

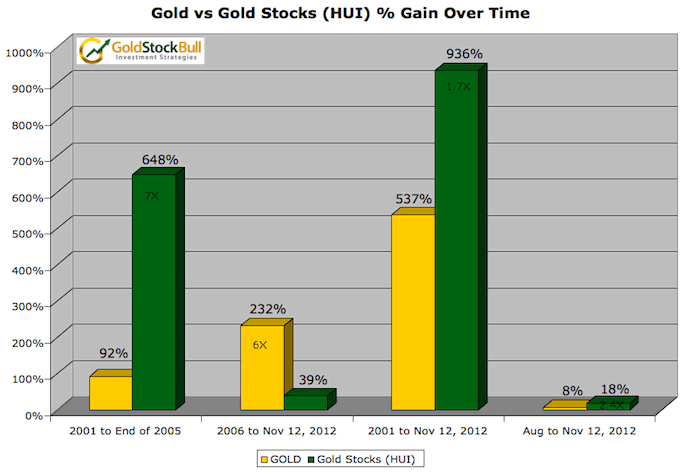

If you have been aboard this bull market since the beginning, you remember the incredible leverage that mining stocks once offered. In fact, during the first five years from 2001 to 2006, gold shot up 92%, but the HUI mining stocks index went up an astounding 648%! Put another way, you would have realized seven times greater returns by investing in mining stocks versus the physical metal during those early years.

But this leverage did not last very long. Following the incredible run for gold stocks, the period from 2006 until present has seen the HUI advance by only 39%, while gold itself has shot up by 232%. In this period, you would have realized six times greater returns by owning physical gold than by investing in mining shares. This is the polar opposite of the relationship witnessed between gold and mining stocks in the previous period.

I know many bullion dealers will be delighted to see the data showing physical metals outperforming the miners as of late, but this is not the whole story. Combining both periods and tracking the performance of gold versus gold stocks for the entirety of the current bull market, we see that gold stocks have still been the better investment.

From 2001 until today (Nov 12, 2012), physical gold has appreciated by 537%, an impressive gain considering that the stock market has only returned 7% in the time period. However, gold stocks have gone up nearly twice the rate of gold, for a gain of 936%! This is the leverage that seasoned gold investors remember and it drives the decision to allocate a significant portion of their portfolios to mining stocks.

This brings us to today and leaves many investors wondering if the leverage experienced in the early years will once again return. One positive sign for those holding mining shares is their recent performance versus bullion in the latest run. Since the start of August, gold is up 8%, but gold stocks are up 18%, for leverage of roughly 2.4X. If this is any indication of what the remainder of this upleg has in store, it appears that gold stocks may once again return to outperforming the underlying metal.

I put together one more chart to help give investors determine whether bullion or mining stocks are the better value at the current time. This chart shows the entirety of the current bull market and charts the relationship between the AMEX Gold Bugs Index (HUI) and the gold price. I’ve added a dividing line at the half-way point to help illustrate when mining stocks are overvalued or undervalued versus gold.

As you can see, we are currently at a point where gold mining stocks are significantly undervalued relative to gold. In fact, this reading has recently dipped to the lowest levels since the depths of the financial crisis or very beginning of the bull market. Of course, it is possible that mining stocks could become even more undervalued versus gold in the near future. However, if this ratio returns towards its historic norm or swings back towards gold being undervalued, then we can expect mining shares to continue their recent run of outperforming gold by 2X or greater.

This is assuming that one were to simply buy the Market Vectors Gold Miners ETF (GDX), which tracks very closely (with some time decay) against the HUI Gold Bugs Index. I believe that by doing your due diligence and researching quality mining stocks, investors can significantly outpace the gains of an index such as this. The Gold Stock Bull model portfolio has been doing exactly that over the past five years and continues to outperform in 2012 year-to-date. But we also realize the importance of physical metals in your possession and advocate a balanced mix of both physical metals and mining stocks. If you would like to view all of the stocks in the GSB model portfolio, receive the monthly newsletter and get email alerts whenever we are buying or selling, click here to sign up for the premium membership.

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. You can try it for just $35/month by clicking here.

Copyright © 2012 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.