Central Bank Insurance and Agricultural Gold Alchemy

Commodities / Farm Land Nov 13, 2012 - 02:27 AM GMTBy: John_Mauldin

“Without that sense of security which property gives, the land would still be uncultivated.” – Francois Quesnay

“Without that sense of security which property gives, the land would still be uncultivated.” – Francois Quesnay

“There were at least one million people marching in the streets,” said Alejandro.

“No,” said Juan, “it was not anywhere close to that number. I don’t think there were more than 600,000.”

When I had driven past the center of town earlier that afternoon, around five, there were only a few thousand. “Where’s the rest of the demonstration?” I asked.

“Oh,” Enrique replied, “this is Argentina. Everything starts later here. People won’t really start gathering till eight.” Small pockets of people had started gathering on every street corner, banging their pots and gathering their neighbors as they made their way to the center of town. A trickle soon became a large stream and then a massive river. All across Argentina, demonstrations were held protesting the policies of President Cristina Kirchner. The local press proclaimed the crowd in Buenos Aires to be 700,000+, protesting the increased authoritarianism and policies that are clearly hurting the economy.

“As rich as an Argentine” was a saying at the beginning of the last century. And indeed Argentina was one of the richest countries in the world in the early 1900s. It has been a long, slow decay since that time. There have been many upheavals and sea changes. Once, in the early 1990s, Argentina saw hyperinflation, destroying the value of savings. Prices rose by a factor of 20 billion in Argentina from 1975 to 1991. Inflation was eventually contained by fixing the exchange rate, but by 2000 there was serious economic disruption, with bank runs and the eventual collapse of the dollar peg.

Some argue that the economic and political crisis was worse than before the peg was put in place. By the end of 2002, the economy had contracted by 20% since 1998. Over the course of two years, output fell by more than 15%, the Argentine peso lost three-quarters of its value, and registered unemployment exceeded 25%. Income poverty in Argentina grew from an already high 35.4% in October 2001 to a peak of 54.3% in October 2002. To say things were volatile is an understatement: Argentina had five presidents in two weeks.

Chaos? The destruction of wealth? No doubt. But as I sat down in a very fashionable restaurant in the historic and beautiful Recoleta district, in the midst of one of the largest demonstrations in Argentine history, the contrast of the recent past with the wealth I saw around me was thought-provoking. I thought back to my first visit to Argentina, just after their period of hyperinflation in 1992. It’s hard not to notice the impressive buildings that have been erected since then. And I had just come from Salta province, where agriculture holds sway and the commodity price boom is in full force.

For the last two weeks I’ve been in Brazil, Uruguay, and Argentina. In this week’s letter I offer a few impressions gathered on this trip, as we meditate on what French physiocrats have to tell us about true wealth.Central Bank Insurance

“If you want to enjoy life, go to Buenos Aires. If you want to do business, go to Sao Paulo,” the saying goes. It is hard to get an impression of a country by going to a city of 20 million people. It is like visiting New York City and thinking you can understand the United States. But I never fail to enjoy myself in Brazil. While it is clearly a Latin culture, the country has become serious about the business of business. I spoke to a large gathering of financial professionals (the local CFA society). Gustavo Franco, the former Brazilian Central Bank President who orchestrated the Plano Real, which helped save the country from hyperinflation in 1993, spoke before me in a very formal economic presentation. Inflation was running 30% per month in Brazil when his plan was implemented. Here was a man who truly understood the power of a central bank committed to stable monetary policy. I felt like the comic relief act trying to follow him, but his presentation l eft me with a thought.

(Sidebar: There were translators for me, as I know absolutely no Portuguese. And while there were headsets for those who wanted to hear my presentation in Portuguese, I did not see anyone using them. My unofficial survey of the CFA group left me with the impression that the members were fluent in at least three languages each. Serious indeed.)

Both Franco and the CFA society were thinking about monetary policy. And not just Brazilian monetary policy. They were looking around the world, and the massive quantitative easing underway was clearly causing concern. Currency valuations in a country where commodities play such an important role as they do in Brazil can mean the difference between boom and bust. The fact that the central banks of some of their largest customers are seemingly going wild does not make for a stable environment.

I have often said that I do not consider gold as an investment but rather as insurance. But the question is, insurance against what? As I spoke to that audience with their particular concerns, I realized that gold is central bank insurance. Central bankers are quite content to talk about stable monetary conditions, but history has shown all many too times that, under pressure, monetary stability yields to political exigency.

A Monument for Cristina

I went from Sao Paolo to Montevideo, Uruguay. As I reported last week, Uruguay is booming. Money is pouring into the country from all over the world but especially from Argentina. The country has an essentially open border with Brazil, too. Goods, people, and services travel freely both ways. You can get US dollars as well as Uruguayan pesos from the ATMs.

Around 85% of Uruguay’s land is used for agriculture (77% for pasture, 8% for cultivation, and 9% for forestry), which generates 60% of exports. Cattle and sheep rearing is the main activity. As one might expect, Uruguay has the highest annual consumption of red meat per person in the world – almost 170 pounds (76kgs)! Soybeans, wheat, rice, barley, corn, and sunflower are the most important arable crops, with soybeans the main export. (Hat tip, Vulpes Investment)

The country is a financial center, as it has a well-established rule of law and economic free zones where business can be done tax-free as long as it does not produce income in Uruguay. A large number of international corporations have their Latin American headquarters in Uruguay. From a seriously challenged economic condition ten years ago, the country has grown to full employment and an increasingly diversified economy. Real estate is booming, and not just in agricultural land. Punta del Este is the playground of South America, and one tower after another of vacation condominiums seems to be rising on the beautiful beaches. Condominiums are being built and sold in Montevideo at a rapid clip.

Interestingly, in general the building is being done without debt. Large projects are financed with equity. Clearly, in the current culture there will never be a debt supercycle to blow up, at least not one generated by the private sector. And for now the government is behaving. An interesting sign of the current prosperity is that 50% of children now go to private schools. Evidently, one of the first things that parents do when they get extra income is to put their kids in private schools.

In talking with financial professionals and businessmen in Uruguay, it was clear that there is a large influx of Argentinean money and people, and has been for years. That trend has only increased since the re-election of Cristina Kirchner.

“We should erect a monument to Cristina,” said my partner Enrique Fynn. “Her policies have created an investment boom in Uruguay.”

“Well,” said an Argentinean dinner companion rather sadly, “at least her policies have been good for one country.”

I rode with Enrique through the Uruguayan countryside to the historic and picturesque city of Colonia, where I took a ferry to Buenos Aires. The countryside reminded me of East Texas with palm trees.

Agricultural Alchemy

I flew the following day to Salta province and then drove with my partner Olivier Garret to Cafayate, through one of the most beautiful canyons I’ve ever seen. We eventually rose to a beautiful, broad valley surrounded by Andean foothills. I was told that Cafayate, because of its high altitude, is the only tropical region that grows decent wine grapes. The climate is close to perfect year-round. The small city is captivating and full of energy. Vineyards and farms were everywhere. The city square is alive at night. I was captivated by Cafayate and will go back again, hopefully many times. My partners in Mauldin Economics have created a world-class development there, drawing residents from over 30 countries. Wine production is growing dramatically as more and more acreage is planted. The scenery is just magnificent, with the mountains changing color throughout the day.

I had the privilege of meeting Juan Carlos Romero, the former governor and current senator from the province of Salta, at his local winery. He has run for president and is currently the vice president of the Senate. He is the very image of the classic patron, right from central casting. Athletic and youthful at 62, he was a gracious host. He was somehow able to summon a European nonalcoholic beer in two minutes, when we had been looking for one in town for several days.

He was smiling and pleasant until I began to inquire about Argentinean politics. Then his eyes turned a bit steely as the conversation deepened. His concern for his country was evident. Having been a businessmen and politician through the last two major crises, he clearly disagrees with the current direction of policies, and he left the majority block a few years ago.

I was privileged to have a number of other conversations with leading business and academic figures in Argentina, some quite off the record. It appears a great deal of the opposition to the current president is coming from within her own party. That being said, she took 54% of the last vote and recently was able to get a law through their Congress allowing 16-year-olds the right to vote. She is evidently quite popular among the youth. The concern is that with a two-thirds majority in the Congress she could the override constitutional term limit and be reelected in 2015.

The government recently took control of $30 billion in privately managed pensions in order to “protect” the people. The funds were then invested in “safe” government assets. The government has been on a nationalization tear for the last eight years, taking over many large private companies and seizing the oil and gas assets of a company owned by a Spanish firm. Recently, the government instituted currency controls. Inflation is officially 10%, but everyone seems to agree it is closer to 30%. I kept asking, “How do you deal with 30% inflation?” The answer typically came back as a shrug, accompanied by “We’re used to it.”

In such a world, how do Argentinean investors establish long-term wealth? The answer is, they are buying what they know, but in other countries. And what they know is agriculture. An increasing number of farms in Uruguay are owned by Argentinians. And they are buying in Paraguay and Bolivia as well. I met with the Southern Cone Group, who are doing various projects throughout the region in all types of agricultural real estate businesses. I admitted to being quite skeptical about Bolivian farmland from a country-risk perspective, but they argued that the real risk is in getting actual title to the land. If that can be accomplished, it can be said that Bolivian farmland is “dirt cheap.”

But it is not just theArgentineans and not just South America. Farmland all over the world is rising in value, as the case for rising demand for agricultural products is quite solid. I had dinner here in Dallas last night with Grant Williams (who writes things That Make You Go Hmmm…) and his boss, Stephen Diggle of Vulpes Management, who were in from Singapore. They own and run three largish agricultural projects in Illinois, New Zealand, and Uruguay and are looking to acquire more.

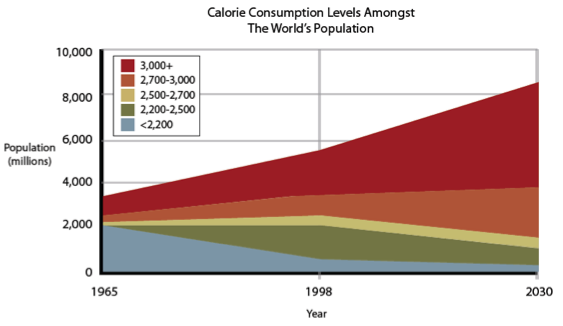

They sent me a few graphs I will share with you on the rising demand for agricultural products. First, calorie consumption is higher than ever and rising rapidly, as the world’s population grows and demands more nutrients.

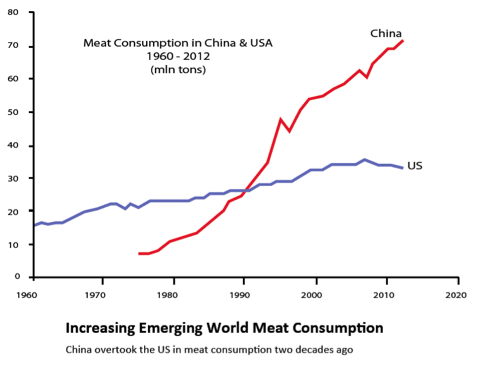

In the cattle-farming industry, it is said that it takes 6 kg of grain to produce 1 kg of meat, so 1.3 billion Mainland Chinese changing their diet to eat much more meat will severely strain the resources of a planet already struggling to feed a growing population. Chinese dairy consumption is rising by 20% compounded per year. That sort of growth requires a lot of feed and land to grow it on.

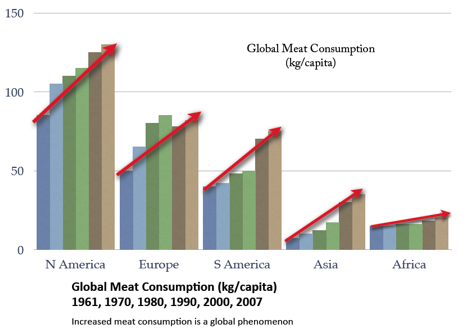

It is not just in China that meat consumption is rising, but throughout the world. And if Asia catches up to Europe and South America, let alone the US, that is a huge increase in the need for grain.

The investment yields on farmland are in general lower than you might think. But properly managed farmland (bought at the right price) can be a nice alternative asset.

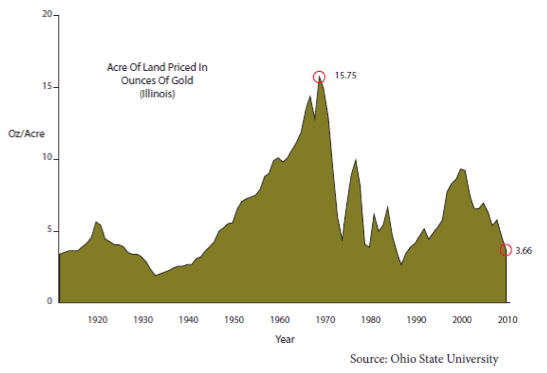

I could make the case that agricultural land is yet another form of gold. It too is central bank insurance. Over the long term, its value will rise in relation to the fiat currency in which it was purchased. It is a question of yield. In place of the old alchemical pursuit of the Philosopher’s Stone, which could change lead into gold, we now have farmland turning dirt into yet another form of real wealth. Diggle makes the case that farmland is rather cheap in terms of gold.

You can buy a bond that will yield 5% for 20 years (or you could a few years back!), but that yield will not change for 20 years. The yield on farmland will change with the price of the crop from year to year and remain subject to the vagaries of weather, pestilence, etc.; but the value of the land will hold its own over time in the face of central banks gone wild. The world will always want more food. Increasingly, agricultural products have become global commodities, with their prices the same from place to place, when transportation costs are factored in.

The French physiocrats of the late 1700s argued that the only true wealth was that associated with land. Manufacturing and the Industrial Revolution had not yet made an impact. Note that Adam Smith met with the physiocrats in France and was influenced by them, though he did not think the only source of wealth was land. They were actually quite cutting edge in their time, because the prevailing wisdom was that wealth inhered in mercantilism and the power of the sovereign. (Some things never seem to change!)

Land has one thing going for it that gold does not, though, and that is yield. Some years the yield might not be much, or even negative, but over time there is a return. And it can be a nice one. Gold with a yield. A bond with built-in central bank insurance. That is a nice combination.

But gold has a few things farmland does not have. It is portable. While farmland is a store of value, it is subject to the policies of local government. You can’t pick up your farm and move. As one of the leading lights of the physiocratic school of thought, Francois Quesnay, said, “Without that sense of security which property gives, the land would still be uncultivated.” But you have to know that the land and its fruits can be securely yours.

(My friend Richard Russell, citing his Jewish heritage, would tell me that diamonds are smaller and a more compact way to get out of town with your money.)

Gold is liquid. While farmland will, in general, readily sell, at the wrong moment the price may not be in your favor.

Gold can be a bridge, a form of crisis insurance. I have a number of friends who bought land quite cheaply during the last crisis in Argentina. In our own crisis of 2008, many people I know were liquid and bought land and other assets at fire-sale prices. People who had overextended themselves or who needed cash to survive had to sell at whatever price they could get.

During the oil bust and the savings and loan crisis in Texas in the late ’80s, you could buy real estate at 15-20 cents on the dollar. Whole portfolios of loans from bankrupt savings and loans were sold at literally pennies on the dollar, and those who bought them made fortunes.

The real crises were soon over, but if you did not have the staying power to make it to the end of the crisis, it made no difference to you that things were getting better.

I buy some gold every month and have for years. I hope the price of gold goes down so I can get more gold for the dollars I spend, as I am hoping I never have to sell my gold. If I ever do, things will not be going well at the Mauldin household.

At some point, I might get interested in going back to my country roots and getting involved in agriculture, if only as an investor. It is another interesting form of real estate and real-asset investing.

I don’t want you to think I am an overly conservative investor. I probably should be, but I’m not. I should note that Stephen Diggle and I share a passion for technology and biotechnology. Gold and farms and real estate are part of a diversified portfolio, but they are typically not the high-growth portion. I have too great a share of my personal assets in small-firm technology, but I can’t help myself. I am actually a big believer in the future and look for things that I think have the potential to “scale” or even to transform society.

And in a Real Emergency

A few weeks ago a husband-and-wife argument turned ugly, and he threatened her. He threw her phone against the wall and it broke, but the violent impact on the wall caused the phone to automatically call 911 and give emergency responders their location. The police responded, and after a shootout in which thankfully no one was killed, the police credited a new phone app with potentially saving the woman’s life. It made the local news, whose reporters called the developer of that application, a tech start-up called My911. Their app was designed to work in all sorts of emergencies.

If you are in a car crash, the My911-equipped phone will “recognize” the impact and automatically call 911 and give them your location, even if you can’t make the call. That has already happened many times. There are many other features that come with the app. You can track your employees’ or children’s whereabouts (for safety reasons!), have a personal SOS button that can notify anyone of your choice in an emergency, receive updates on local emergencies and crimes, and a lot more.

I think someday this app will be on all phones as a standard feature, like maps or texting. Safety and emergency help is a critical app when you need it. But right now the My911 app is being marketed primarily through security services and businesses (think insurance: someone can literally be there in the case of a problem). And yes, I am an investor. And yes, it does scale. This investment is part of my incurable addiction to cool new technology. And no, we are not looking for additional money. It appears a merger is in the offering. We will see.

My911 is something you should have on your phone. Like my gold, I hope to never use it. If you or your loved ones are in a car wreck, this app can be a true life saver. While I still have some influence, I have persuaded the CEO to offer the app at $1.99 to my readers instead of the $27.99 on the website. This offer will only last for 30 days. You can check the application out and see the news video at the company website below.

Take the next few minutes and put the app on your phone. Go to iTunes (if you have an iPhone) or to the website (www.my-911.com) and use code 125 if you have a phone with the Android or Blackberry operating system. The cost is $1.99 and not the $27.99 on the website. Just click on the discount button on the order form. The direct link to the order form is https://secure.my-911.com/order/.

Money for Nothing

My friend and documentary film producer Jim Bruce is introducing what I think is going to be a very important documentary on the Federal Reserve. The movie, Money for Nothing: Inside the Federal Reserve, will have its world premiere at the International Documentary Film Festival in Amsterdam, on Nov. 15. After that, the plan is to screen the movie in US theaters in 2013, then release it on television and DVD.

Money for Nothing is an independent, nonpartisan, feature-length documentary film. There are appearances in the film by former Fed Chairman Paul Volcker; investor Jeremy Grantham; former Vice Chairman of the Fed Alan Blinder; Peter Fisher, former Under Secretary of the Treasury for Domestic Finance; Philadelphia Fed President Charles Plosser; Richmond Fed President Jeffrey Lacker; Vice Chair of the Fed Board of Governors Janet Yellen; prominent Fed watcher James Grant of Grant's Interest Rate Observer; Barry Ritholtz; Dr. Gary Shilling; and your humble analyst.

The film questions the rationale behind today's Fed actions and calls for better policies in the future. The producers need a few more dollars to finish everything, so please join me in getting out a really valuable tool in the effort to educate America about the Federal Reserve. You can pledge on Kickstarter and receive cool gifts in exchange for helping the film the last few steps to the finish line: http://kck.st/Tf9RuT.

Chicago, Washington DC, New York, North Dakota, and Scandinavia

I am off to Chicago tomorrow for an event with my partners at Altegris, and I will meet with old friend Don Coxe as well, before dashing off to Washington DC on Wednesday for meetings on Capitol Hill on Thursday, before catching the evening train to NYC. Whew! Even for me, that’s fast. It all makes sense; it just gets stacked up.

I will be home for Thanksgiving and then off to North Dakota for a few days to speak for BNC National Bank. I will be bringing my middle son, Chad, with me. He usually doesn’t like to do this type of thing but is interested in maybe moving to North Dakota. Go figure.

I have perhaps a few personal trips to make in December but will be mostly at home for the holidays before I take off to Oslo, Stockholm, and Copenhagen for Skagen Funds in January. And perhaps there will be a side trip to Greece to see Ground Zero and compare it with Argentina.

I know I have said it, but I really did enjoy Cafayate. Doug Casey, David Galland, and the rest of the investors there have created a “libertarian” retreat. The people who are there are so diverse but all were fun to talk with. The ambience is phenomenal, the spa is world-class, and I actually did slow down a little. I am already thinking of going back in March for a longer visit.

I really want to thank my South American partner, Enrique Fynn, who made all those events and meetings possible. He and his assistant Agustina really worked hard. And my deep appreciation goes to the hosts of all the CFA events.

Oh, and before I go, I recently sat down in the studio for a discussion with Ed D'Agostino about my book Endgame, and about where the world is at in the debt supercycle. In 25 minutes we discussed Europe, Japan, and the US and how our newsletter, Yield Shark, can help investors navigate the challenges posed by the market today. You can see the interview here.

It is once again time to hit the send button. I hope my meandering thoughts on gold, agriculture, and real wealth had something close to the impact for you that they had when they first occurred to me.

Your really needing to cut back on red meat again analyst,

By John F. Mauldin

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2012 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.