Will President Obama Be Able to Stand Up To China?

Politics / GeoPolitics Nov 09, 2012 - 11:13 AM GMTBy: Money_Morning

Keith Fitz-Gerald writes:

While U.S. Presidential headlines dominate the airwaves this week, there is another "election" under way thousands of miles from our own shores that may be even more important when it comes to your money.

Keith Fitz-Gerald writes:

While U.S. Presidential headlines dominate the airwaves this week, there is another "election" under way thousands of miles from our own shores that may be even more important when it comes to your money.

The 18th National Party Congress is now underway in Beijing. Attendees are girding for a week of symbolic posturing and speeches, the culmination of which will be a new set of Chinese leaders and a new Chinese President for the next 10 years.

While this is a complicated process when things are running smoothly, this particular Congress is really critical. China is a mess. Recent economic challenges and corruption on a scale that has boggled even the most jaded of insiders are at the top of the "fix it" list.

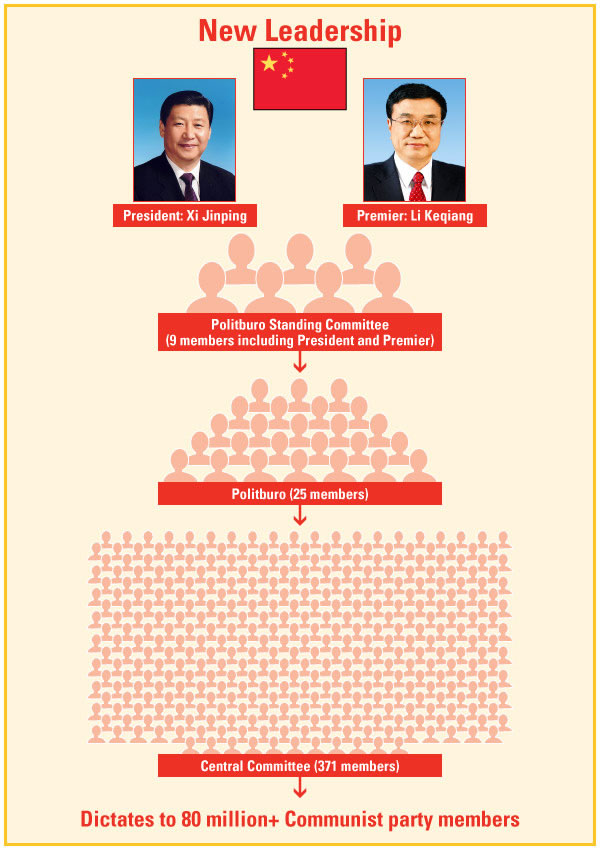

Outgoing Chinese President Hu Jintao's replacement and China's presumptive new leader looks to be a man named Xi Jinping.

At 59 years old, he's a power player with close ties to the People's Liberation Army (PLA).

While he's not a military man per se, as the son of a revolutionary general he currently holds several significant offices that give him wide-ranging and very significant exposure to both the State and Communist Party.

What's significant about this is that there are three parallel strands in Chinese government structure: the Communist Party, State, and Military.

The Party and State are deeply intertwined, but the military is less so, except at the top levels of leadership. Consequently, China's new leader is intimately familiar with the Chinese military and also the likely new head of China's Central Military Commission.

I'm not so sure we've ever seen this exact combination before and I think it's going to challenge President Barack Obama in ways that he hasn't thought through yet.

China's Drive For Respect

China is not only more powerful economically, but the nation has grown significantly more confident in recent years, especially as it fills the tremendous gaps created by the Global Financial Crisis.

China is notoriously secretive about its intentions, but there are a few clues to what President Obama and his advisers will have to contend with.

For example, Mr. Xi spoke in Washington earlier this year at a luncheon for executives and diplomats as part of a five-day tour.

In his remarks, which were viewed as a major policy statement, Xi explicitly said that there should be "respect" for both Chinese and United States interests.

He also noted the need for "increasing mutual understanding and strategic trust."

That sounds innocuous enough if you take his remarks at face value in English. But if you translate them into Chinese diplomatic speak, a very different message was delivered.

I've talked about this before in Money Morning, highlighting the cultural context behind key phrases and language delivered by Chinese and Japanese diplomats for international consumption.

And that's really what Xi's statement was, a carefully worded, exquisitely postured message. His presumptive appointment is also a warning of sorts.

I say this because the words "mutual" and "respect" are about as loaded as they come, especially when they are used in the same sentence.

Mr. Xi was not playing to the American media nor even our leaders. What he was counting on was that his message would be re-translated into Chinese.

He knows that respect in the Chinese sense of the word involves the mutual acknowledgement of position and, more importantly, status.

According to Chuck Gitomer, a policy and political expert who has spent decades studying the Chinese, there's a sense of victimhood that the Party has cultivated over the decades that China was subject to foreign slights and indignities when they were weak.

In conjunction with the nationalist card, which is recently particularly visible in China's irredentist position taken over the Diaoyu/Senkaku Islands, Gitomer notes, "this demand for respect will be reciprocated only when the foreigners meet that demand."

I agree.

So, in as much as Mr. Xi made a statement in Washington, what he really did was put Washington on notice that China expects to be treated as an equal on the world's stage.

Very shortly, we're going to see what exactly he meant by that.

On the one hand, Mr. Xi and President Obama have a golden opportunity to put the currently strained relations between the United States and China back on track. His remarks were intended to convey his willingness to work with the United States.

On the other, he's got precisely the wrong background if that's the case. What China needs is a leader with the authority to make great leaps in progress by taking bold chances to move things ahead, rather than risk being trapped in problematic posturing.

In that sense, Obama's not the guy, either. He is woefully unprepared to move away from the heat of politics and engage in true bridge building.

Instead, what China appears to be choosing is a man who spent the bulk of his career in the Zhejiang and Fujian provinces fostering industrial relations with Taiwan before moving for a few years to Shanghai's political structure, then on to Beijing's political "mother hive."

That means he's had very little international exposure until becoming Vice President. Evidently, though, in his defense, he's making the rounds. The New York Times recently reported that Mr. Xi has visited more than 50 countries since becoming Vice President.

Personally speaking, we know relatively little about him.

For example, Mr. Xi apparently loves American movies. He has visited the United States six times. His daughter, Xi Mingze, studies at Harvard under an assumed name. His wife, Peng Liyuan, is a famous folk singer. But that's about it.

So what does all this mean?

Assuming Mr. Xi does, in fact, become China's next leader when the Congress concludes next week, I think we'll see a few things happen.

We will see posturing internally but not a lot of action nor reform. Mr. Xi's status as a "sent-down" youth is extraordinarily important, notes Gitomer. It buys him significant political capital. His past dealings with high-profile corruption scandals gives him the air of an incorruptible official.

Of course, we know that's not true since his family has accumulated multiple billions of euros worth of investment holdings, but it makes a nice story domestically, especially when the great firewall keeps the masses from finding out too much.

Expect China to continue to buy global resources companies. China's growth will continue on a pace that's faster than the United States, Europe and likely Japan combined. And it needs fuel quite literally to pull that off.

Mr. Xi will aggressively encourage offshore globalization. The nation is anxious to flex its economic muscles.

Unfortunately, China is also anxious to flex its military muscles. That means we'll also likely see more nationalistic posturing in international trade and politics. The Diaoyu/Senkaku Islands are but a small insight into how mainland China views the world. Similar disputes with the Philippines, Vietnam and even Korea offer a glimpse into an increasingly hawkish contingent that's coming to the top with Mr. Xi.

Since China believes it is a rising power while the U.S. is a declining power, the danger is growing that China will actually use military force to protect its interests. Taiwan is not the prize, as most Westerners believe; being able to engage American carriers in deep water while forcing them to "stand off" is. Long range weapons systems are a top priority at the moment.

Here in the U.S., this will set off all sorts of alarms in the military industrial complex, not to mention inside the Beltway.

But longer term, it's probably not worth the worry. When China realizes that international behavioral norms are worth more money, they'll come to their senses. They're as pragmatic as any capitalist in that sense.

And finally, pay careful attention to regional economics.

China is openly seeking regional economic domination while courting long- held U.S. alliances with Singapore (wary of the communists), Australia (wary but hopeful of the economic hegemons), and South Korea, (they understand what being forced into vassal state status is about) for example. Even Japan is viewed as a resource behind closed doors, rather than the enemy, as is commonly perceived by citizens around the world.

An Investor's Guide to the New Chinese Leadership

When it comes to your money there are a couple of key takeaways.

First, while investing in China directly can be great if you've got a long enough time horizon and a willingness to tolerate volatility, the better plays are going to be big, state- involved entities, particularly if they're energy related.

CNOOC Ltd. (NYSE ADR: CEO) is a good example. It's China's third- largest energy player and a leading offshore/onshore producer that accounts for nearly a million barrels a day of production. It's got emerging markets exposure and, with close ties to Beijing, is a likely avenue for overseas acquisitions.

Second, U.S. and European defense contractors may pick up significant business if China does, in fact, become more aggressive in the region. I particularly like Raytheon Co. (NYSE: RTN) because of its diverse offerings and advanced weapons platform logistics.

The key here is that investors can play China's emergence while enjoying the benefits of stricter reporting requirements and a greater probability of honest balance sheets.

Third, consider the Chinese Yuan itself. You can open Yuan- denominated savings, time and demand based accounts directly through Bank of China branches in the United States, Canada and Europe. Or, perhaps an investment in the Chinese Renminbi deposit account through Everbank is more your speed. There are also RMB Exchange- Traded Notes.

China wants the Yuan to be a hub for international trade and considers Yuan- denominated accounts an important component of that process.

That's why the nation has already signed 1.3 trillion Yuan of currency swap agreements with 14 nations, including Russia, Japan, Brazil, Australia, and Turkey to name a few, according to Forbes and The Wall Street Journal. These agreements make it increasingly powerful at a time when Western fiat currencies are failing.

In closing, the situation is obviously fluid. However, I'll do my best to update you on what's important and what's new.

I'll also continue to identify what I believe are the best investment opportunities created by circumstances like this that are not yet understood in the Western world.

Source :http://moneymorning.com/2012/11/09/will-president-obama-be-able-to-stand-up-to-china/

Money Morning/The Money Map Report

©2012 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.