Gold and Silver Seasonal Year End Rally Underway

Commodities / Gold and Silver 2012 Nov 09, 2012 - 11:00 AM GMTBy: GoldCore

Today’s AM fix was USD 1,732.75, EUR 1,362.23, and GBP 1,085.55 per ounce. Yesterday’s AM fix was USD 1,715.00, EUR 1,347.42, and GBP 1,075.84 per ounce.

Today’s AM fix was USD 1,732.75, EUR 1,362.23, and GBP 1,085.55 per ounce. Yesterday’s AM fix was USD 1,715.00, EUR 1,347.42, and GBP 1,075.84 per ounce.

Silver is trading at $32.19/oz, €25.42/oz and £20.27/oz. Platinum is trading at $1,560.50/oz, palladium at $613.00/oz and rhodium at $1,100/oz.

Gold rose $14.50 or 0.84% in New York yesterday and closed at $1,732.80. Silver dropped to $31.62 in London, then hit a high of $32.412/oz in New York and finished with a gain of 1.76%.

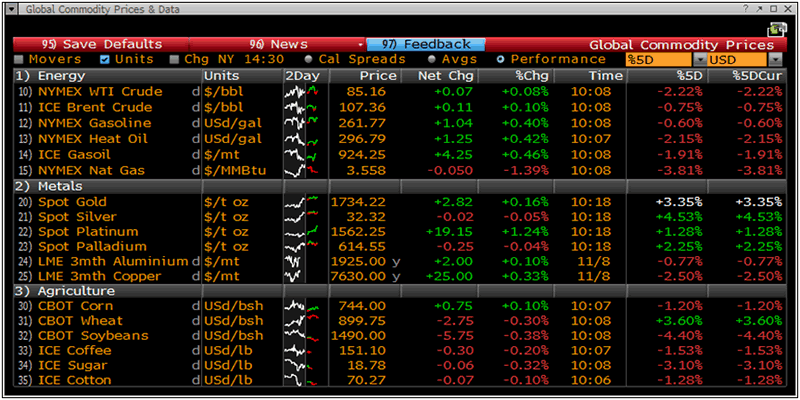

Global Commodities – Prices and Data (5 Day)

Gold is 3.35% higher and silver 4.53% higher this week in US dollars in the aftermath of Obama's re-election.

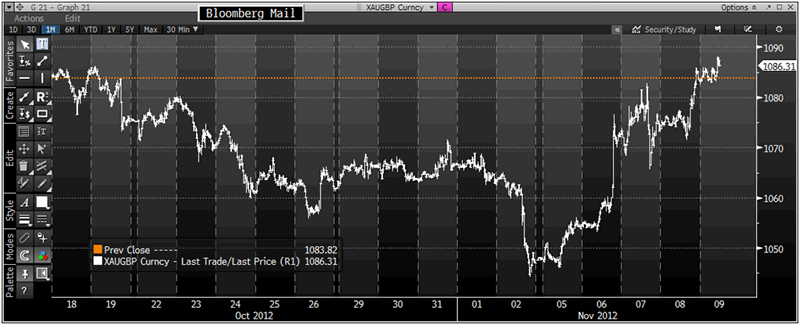

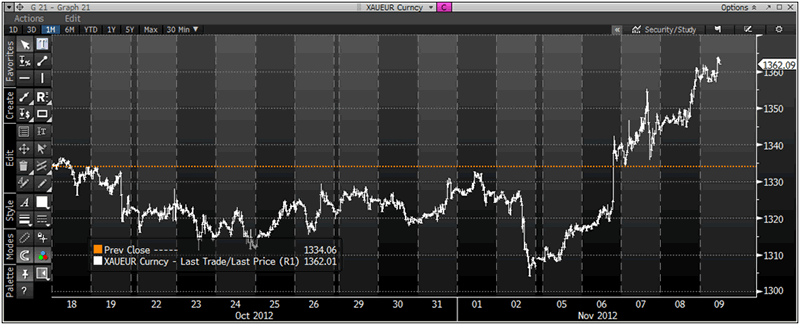

Gold in euros looks set to break out above €1,400/oz and is 4.1% higher and in sterling gold has risen 3.7% so far this week. Silver is 5.25% higher in euros and 4.8% higher in pounds.

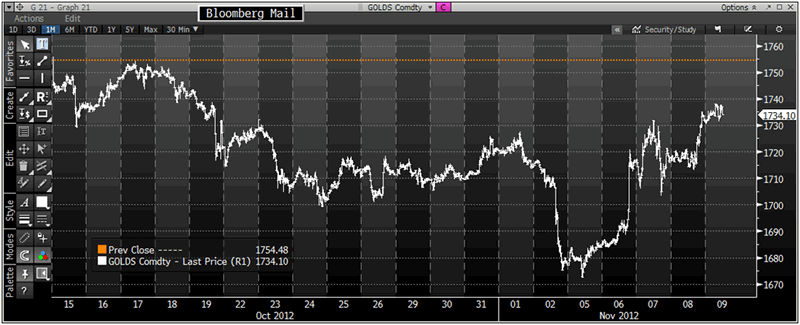

Gold and silver are set for higher weekly closes in all fiat currencies which may negate the recent bearish short term technical picture and set the precious metals up for the traditional yearend rally.

Gold in USD – 4 Weeks (Bloomberg)

The data clearly shows that November is gold's strongest month and one of silver's strongest months. December, January and February are also strong months - prior to a period of weakness is often seen in March.

Gold edged up on Friday heading for its first weekly gain in five weeks as Obama was re-elected with the highest jobless rate since US President FDR in 1936.

The ECB and BOE left interests unchanged as expected. However, Mario Draghi commented that the euro zone economy shows negligible signs of recovering before the year-end despite easing financial market conditions.

The Fed’s ‘QE to infinity’ policy remains and it continues its programme from October 24th to purchase $40 billion per month of mortgage debt and is committed to hold interest rates near zero until mid-2015.

Gold in GBP – 4 Weeks (Bloomberg)

Gold in EUR – 4 Weeks (Bloomberg)

The Bank of Japan on October 30th widened its asset-purchase program for the 2nd time in two months, increasing it by 11 trillion yen to $128 billion.

The US fiscal cliff and geopolitical tensions with Iran (Iranian warplanes fired on US drones last week) only heighten the risk and uncertainty in the markets and are driving safe haven money into gold.

China releases various economic data today starting at 0130 GMT with CPI & PPI for October.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.