Increased Gold And Silver Storage In Zurich And Asian Capitals

Commodities / Gold and Silver 2012 Nov 08, 2012 - 07:15 AM GMTBy: GoldCore

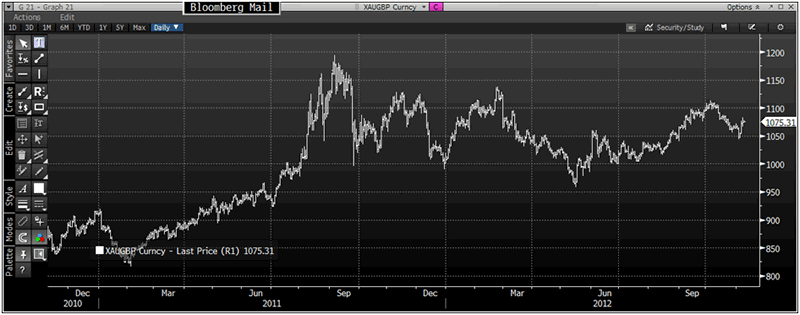

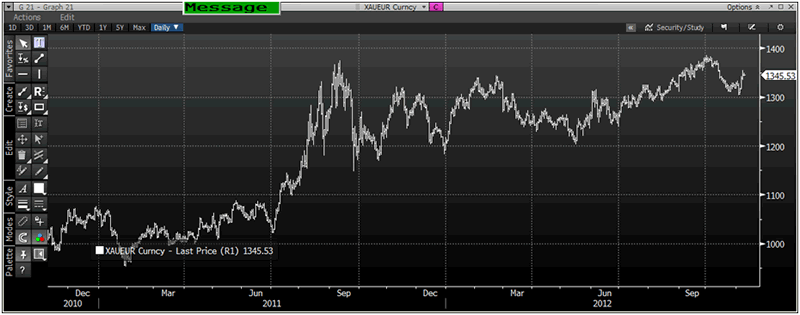

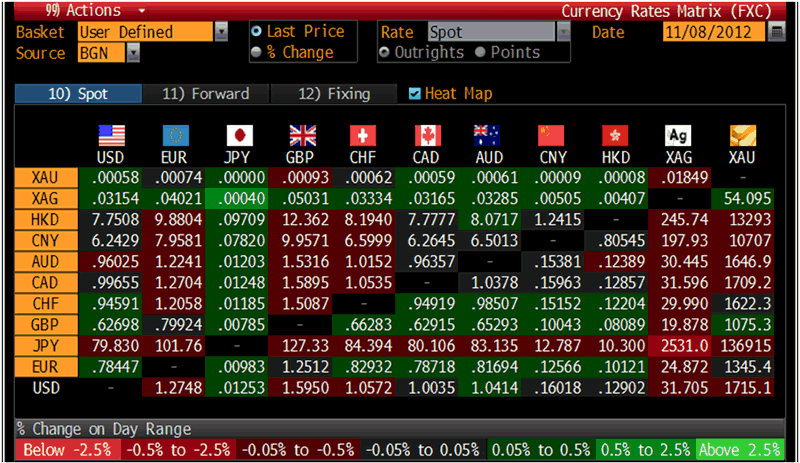

Today’s AM fix was USD 1,715.00, EUR 1,347.42, and 1,075.84 GBP per ounce. Yesterday’s AM fix was USD 1,730.50, EUR 1,345.86, and GBP 1,080.75 per ounce.

Today’s AM fix was USD 1,715.00, EUR 1,347.42, and 1,075.84 GBP per ounce. Yesterday’s AM fix was USD 1,730.50, EUR 1,345.86, and GBP 1,080.75 per ounce.

Silver is trading at $31.85/oz, €25.10/oz and £20.00/oz. Platinum is trading at $1,546.75/oz, palladium at $607.30/oz and rhodium at $1,100/oz.

Gold rose $2.10 or 0.12% in New York yesterday and closed at $1,718.30. Silver hit a low of $31.209 then recovered in late trade but still finished with a loss of 0.56%.

Gold rose for a third day yesterday after confirmation that President Barack Obama won re- election, while stock markets fell sharply and treasuries headed for the biggest advance in 11 weeks.

Robust investment demand continues and may intensify after the election and exchange traded products backed by gold attracted $2.5 billion of inflows in October alone.

Total inflows in commodities ETPs were $3.1 billion last month, taking assets under management to $201.6 billion for Blackrock Inc alone according to Bloomberg.

Many analysts believe that President Obama’s re-election is the “best- case” scenario for precious metals due to implications for monetary and fiscal policy. Obama faces chronic high unemployment, weak economic growth and the upcoming fiscal cliff, not too mention very difficult geopolitical challenges in the form of Israel, Iran, Russia and China.

Today, The European Central Bank has its rate decision at 1245 GMT and they are expected to leave rates unchanged.

The Bank of England decided to leave its benchmark interest rate at a record low and pause its stimulus plan after the British economy emerged from a double-dip recession in the third quarter.

Investors are now again focussing on the US fiscal cliff which will enact $600 billion in tax hikes and severe budget cuts, if no action is taken by the US Congress, than the US will fall deeper into its recession.

XAU/GBP Currency 2 Years – (Bloomberg)

XAU/EUR Currency 2 Years – (Bloomberg)

Gold bullion is not only supported by the uncertainty of the “fiscal cliff” but the Eurozone debt crisis is set to deepen again.

There remains the real risk of an exit from the single currency by one or more members and of course the risk of a global recession and Depression which will be responded to by more loose monetary policies by various central governments.

More of the world's rich are moving their gold, silver and other valuables away from the economic turmoil in the West to the Asian capitals of Singapore and Hong Kong according to Reuters (see commentary).

This is prompting vaulting and storage specialists in the increasingly prosperous region to increase their capacity by creating extra vaulting space.

Depositories in Asia report that there are a lot of enquiries from European banks, not because the banks themselves necessarily want to move the assets to Asia, but because their clients are asking them to.

These clients include rich Asians who want their valuables closer to home as well as Westerners.

Singapore and Hong Kong are two of the favoured destinations. Both have seen a significant increase in gold importations in 2012.

With Chinese demand for gold and silver surging depositories are looking to cater to the huge growing swathe of wealthy Chinese and this is leading to increasing vaulting services being offered in Singapore, Hong Kong and now even Shanghai.

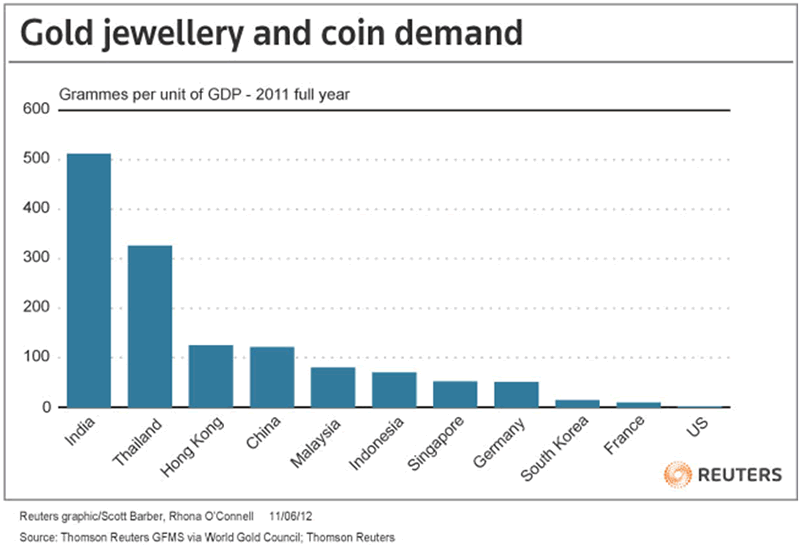

China is on its way to overtake India as the world's biggest gold consumer this year, as India's gold demand has taken a blow on record rupee prices and higher import tax while Chinese consumers' appetite for gold remains resilient.

We have firsthand experience of this increasing preference for secure bullion storage as we have seen an increased preference for storage in Zurich and Hong Kong.

Zurich remains the preferred destination for most western investors and of investors internationally but we and other bullion providers are seeing some western clients opt for secure storage in Asia.

There is a definite sense amongst some of our American and European clients that storing gold in Zurich and Asia is safer than in London, New York, Delaware or elsewhere in U.S. and this trend is set to continue.

Throughout history capital has flowed to where it is most favourably treated and today there is a definite move to own capital and assets outside of massively indebted and near insolvent western democracies.

Obama’s second term is likely to see Ben Bernanke continue to devalue and debase the dollar which will lead to increased investment demand and store of wealth demand for gold and to investors seeking storage in Zurich, Singapore and Hong Kong.

Cross Currency Table – (Bloomberg)

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.